Embed presentation

Download to read offline

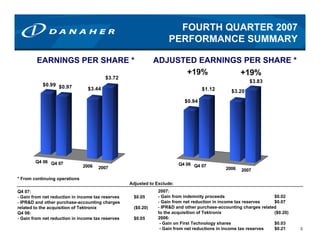

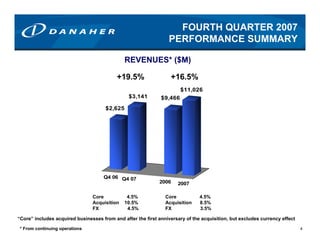

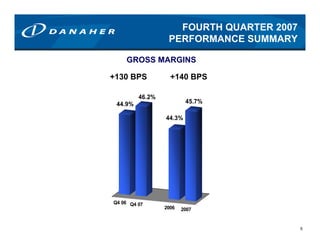

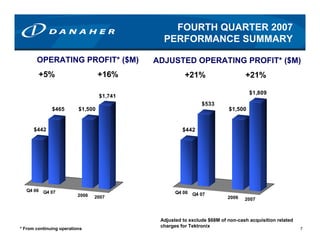

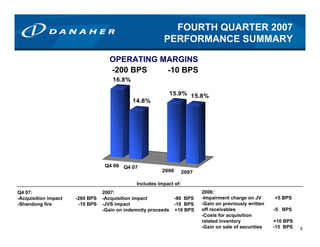

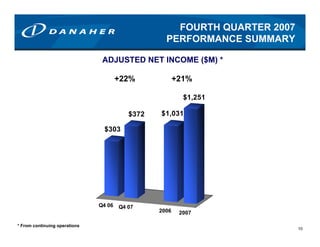

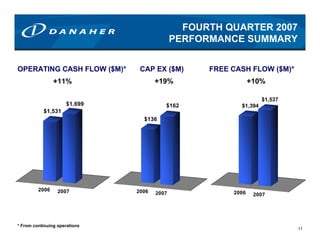

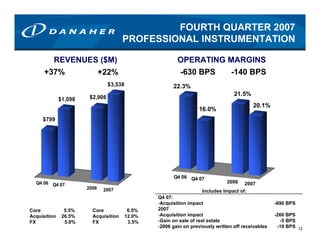

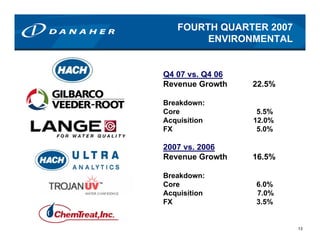

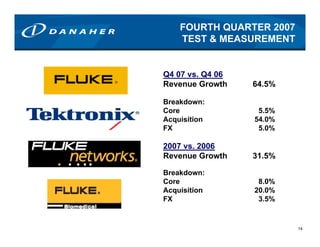

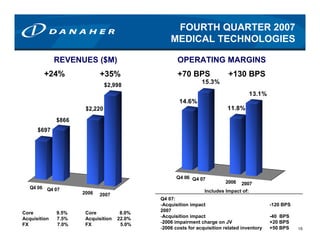

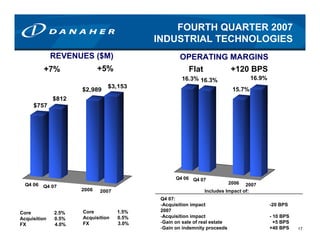

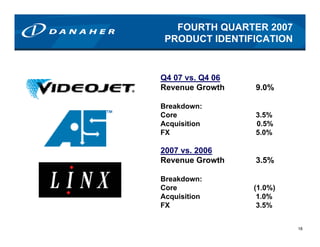

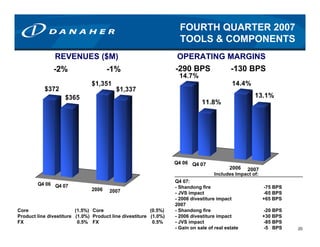

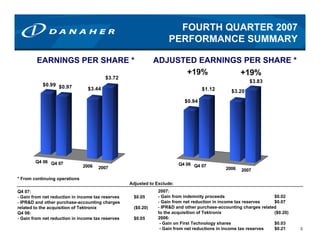

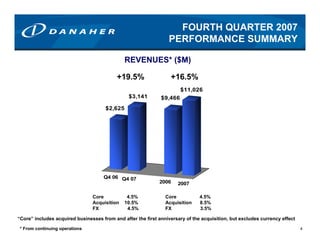

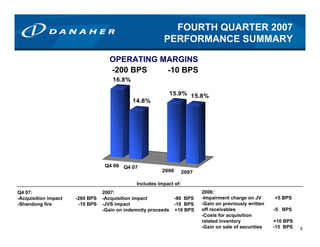

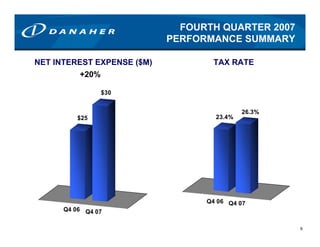

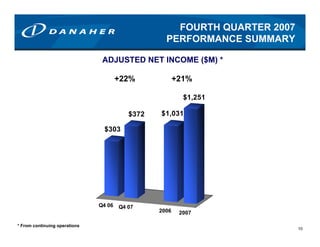

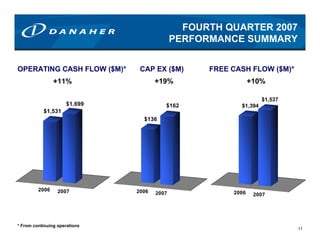

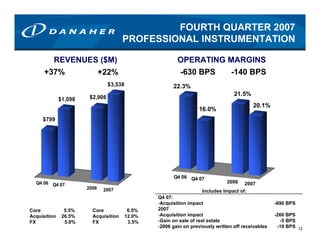

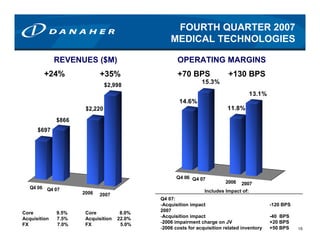

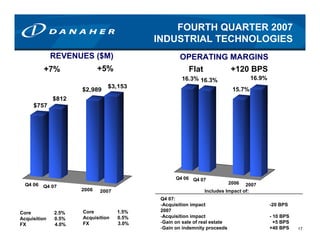

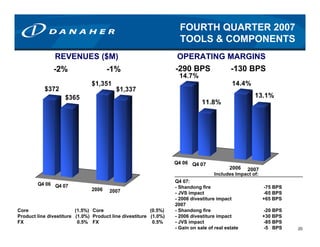

The document provides a summary of a company's fourth quarter 2007 earnings release. Key points include: - Revenues increased 19.5% to $11.026 billion compared to the fourth quarter of 2006. - Adjusted earnings per share increased 19% to $3.83 from $3.20 in the prior year. - Operating margins declined 200 basis points to 15.8% due to acquisition impacts and a factory fire. - Cash flow from operations increased 11% to $1.699 billion.