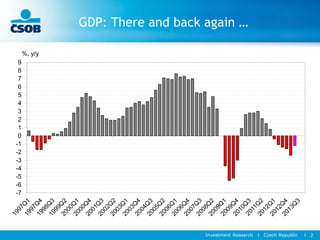

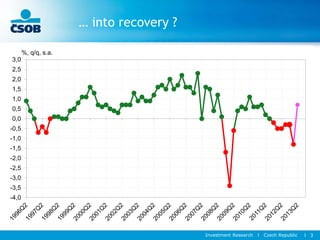

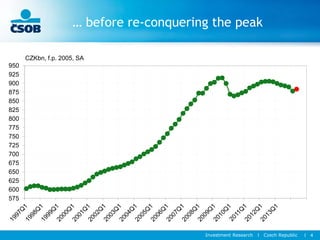

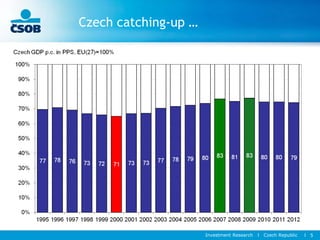

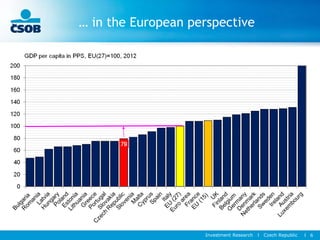

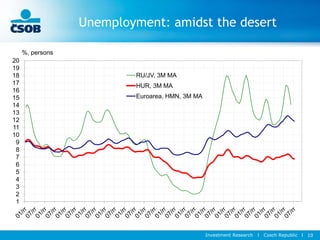

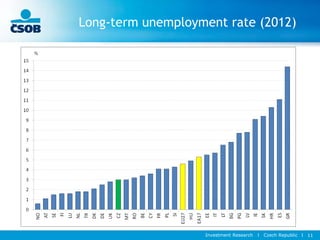

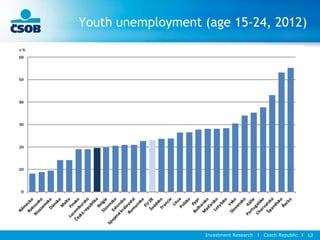

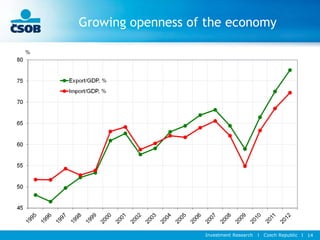

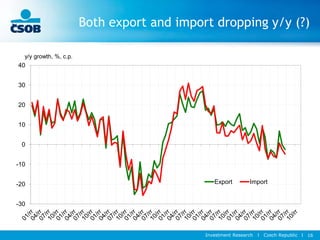

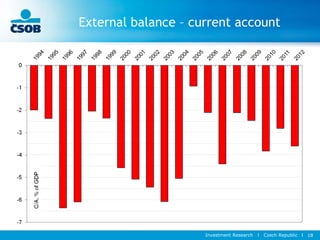

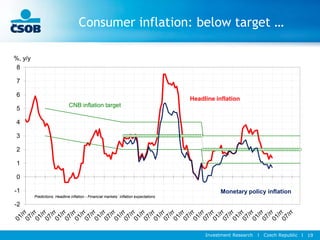

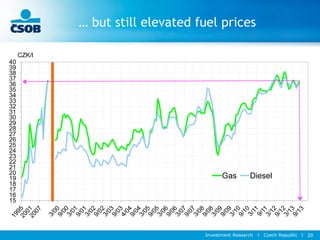

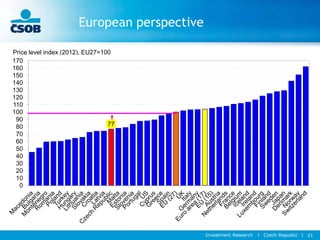

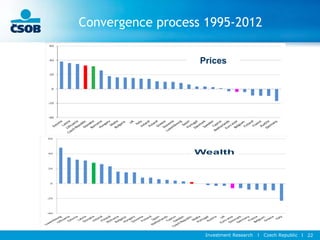

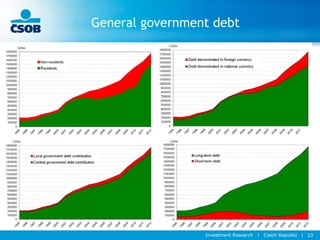

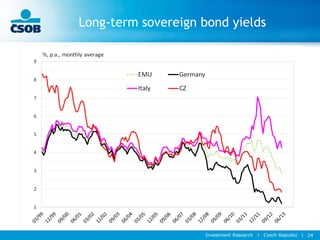

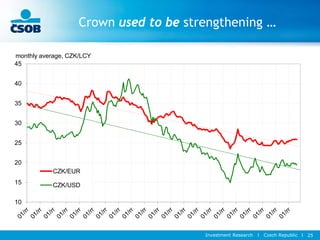

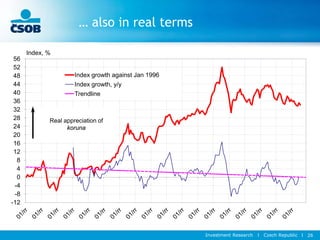

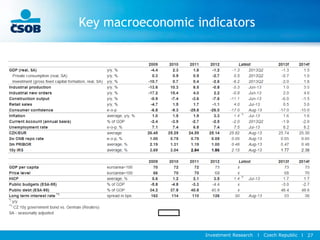

The document is an economic report on the Czech Republic from the third quarter of 2013. It analyzes key indicators of the Czech economy such as GDP, industrial output, construction, retail sales, unemployment, trade, inflation, interest rates, and currency exchange rates. The report finds that while the Czech economy recovered in 2013 after declining previously, growth remained modest and inflation was still elevated compared to the central bank's target. Unemployment levels differed across regions of the country.