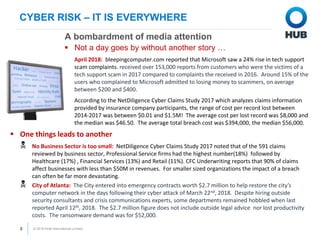

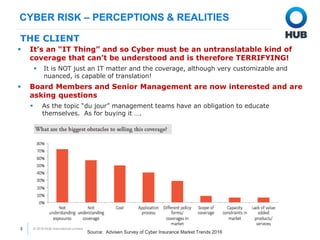

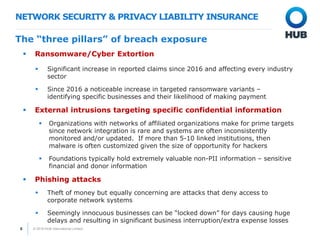

The document discusses the growing prevalence and impact of cyber risks on businesses, emphasizing the need for appropriate cyber liability insurance. It highlights various claims trends, the financial burdens of breaches, and the necessity of organizations understanding their exposure and risk management responsibilities. Additionally, it outlines what underwriters look for in risk assessments and the specific components of network security and privacy liability insurance.