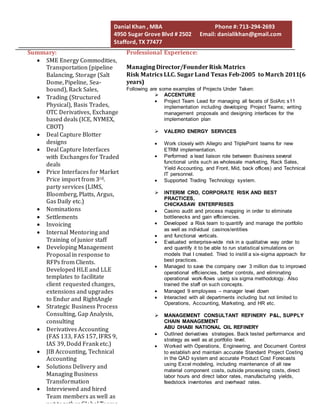

This document contains a summary and details of Danial Khan's professional experience and qualifications. It lists his 18+ years of experience in accounting, auditing, risk management, and energy commodity trading. It also provides details of his past roles as Director of Professional Services, Managing Director of a risk consulting firm, and manager roles in structured products trading and risk management at large energy companies.