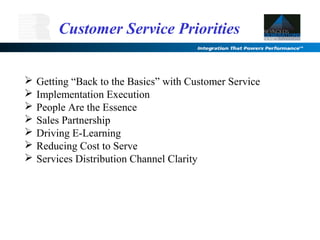

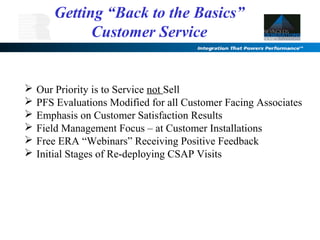

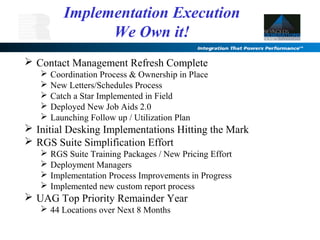

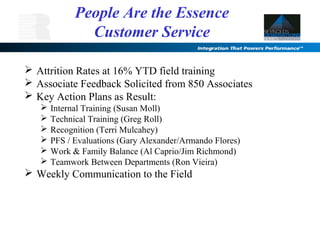

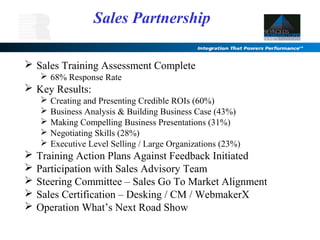

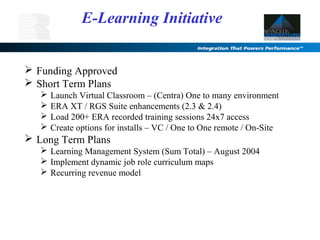

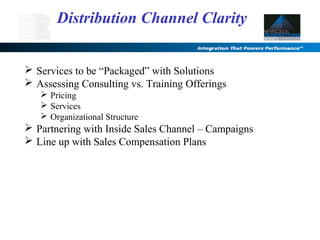

This document summarizes customer service updates from an April 2004 sales summit. It discusses priorities like emphasizing customer satisfaction and service over sales. It also outlines efforts to get back to basics in customer service like refreshing contact management and deploying new job aids. Additionally, it summarizes initiatives around people, partnerships with sales, driving e-learning forward, and bringing clarity to the services distribution channel.