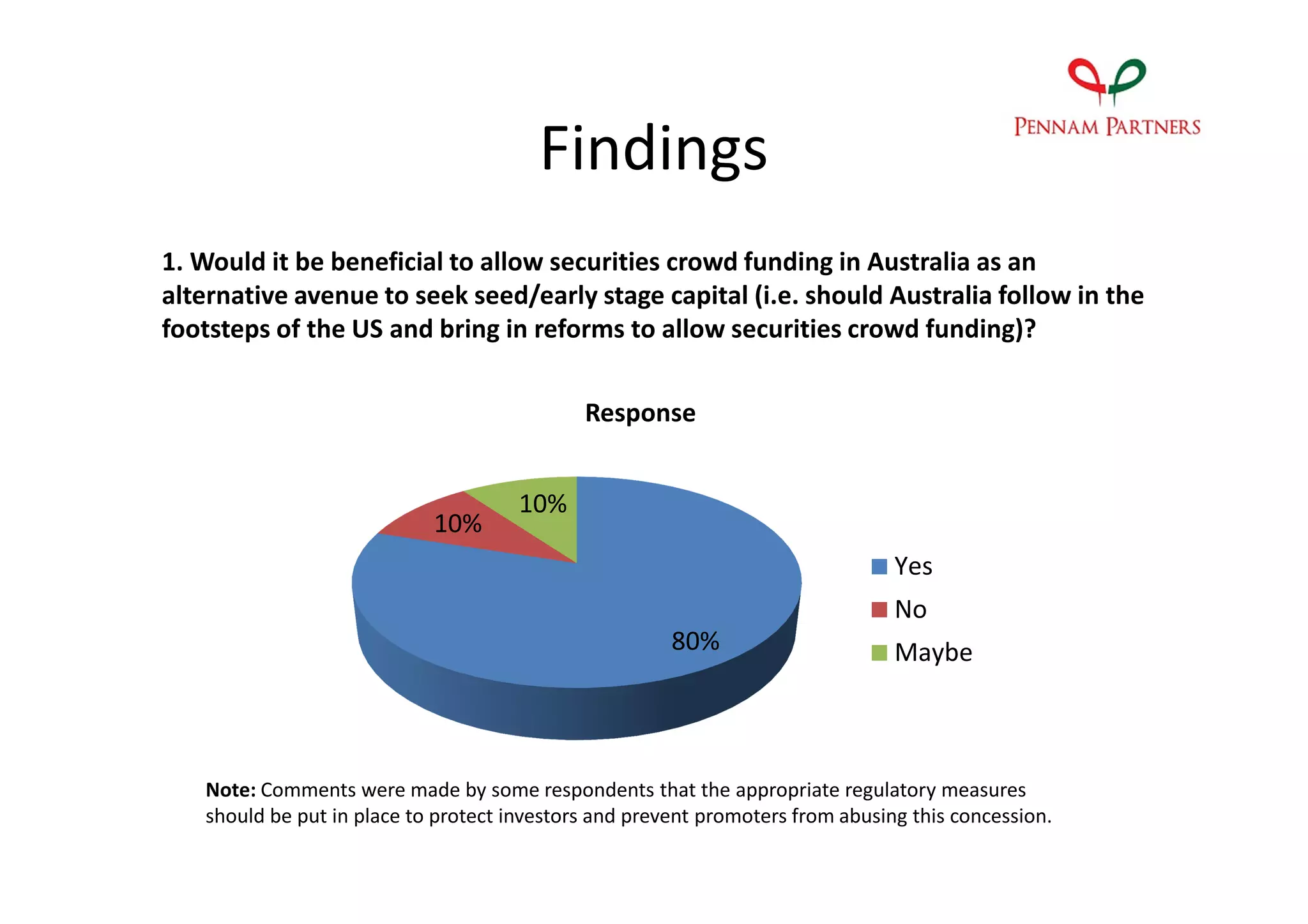

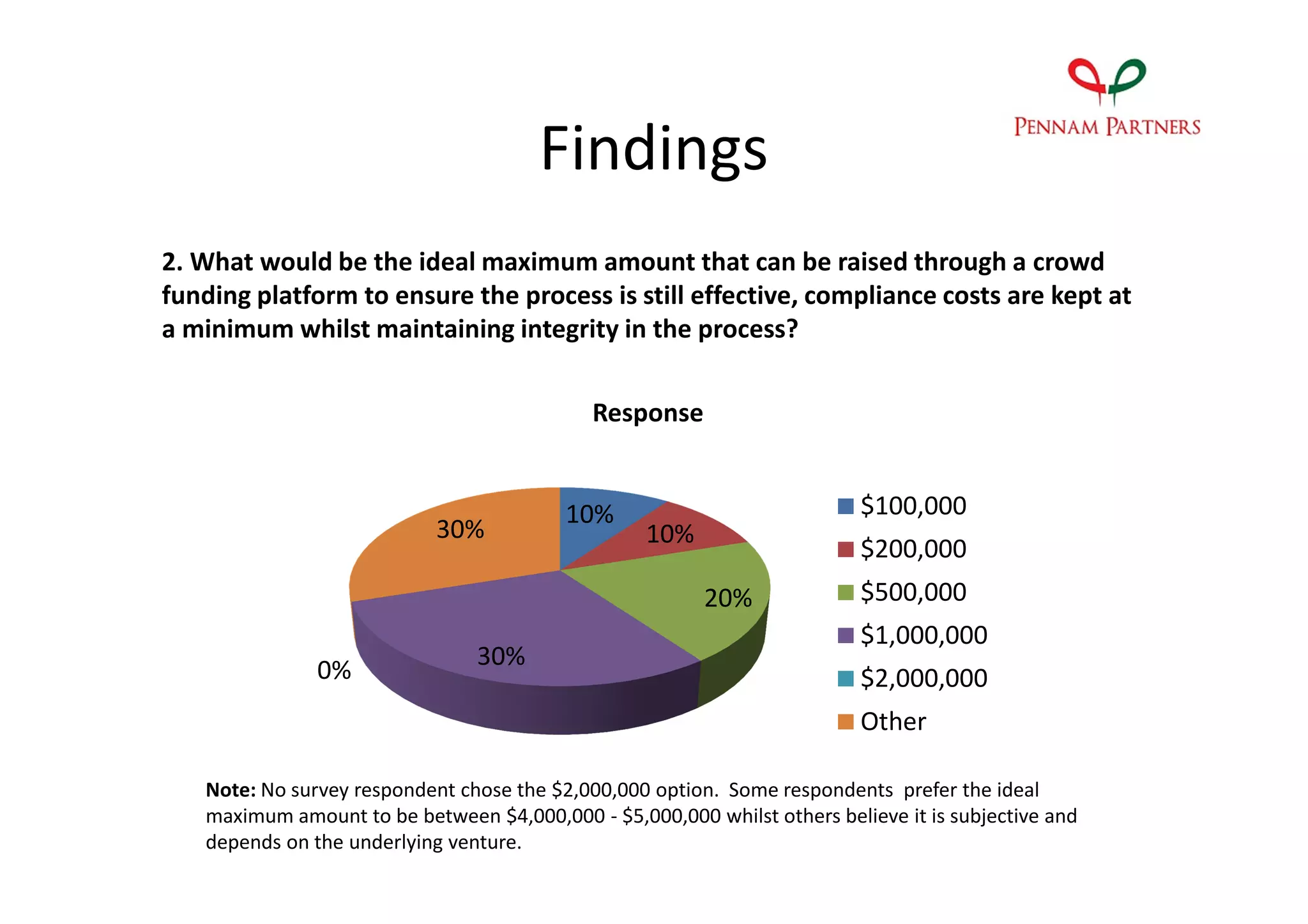

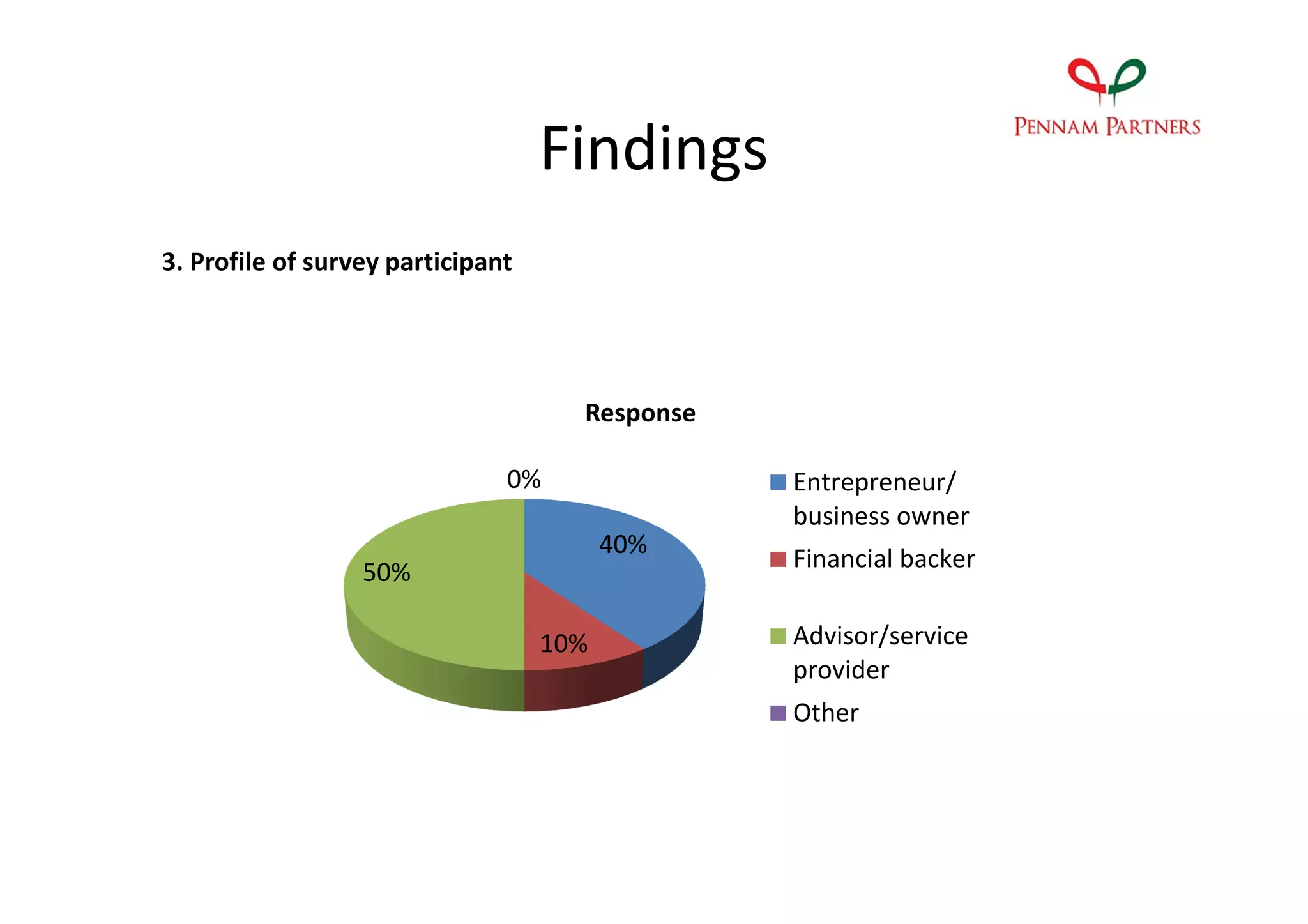

The document summarizes the findings of a survey on crowd funding in Australia. 80% of respondents were receptive to allowing securities crowd funding as an alternative for startups to raise capital, as long as proper regulatory measures are in place. The majority believed the ideal maximum amount raised through a crowd funding platform is $1,000,000, to keep costs low while maintaining integrity. Most survey participants were entrepreneurs or business owners. The conclusion reflects on additional points to consider regarding crowd funding regulations.