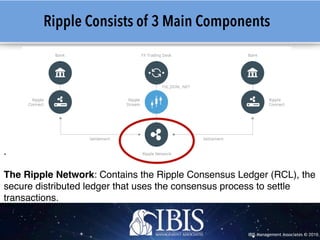

The document discusses advancements in cross-border payment processing for Caribbean banks through the use of Ripple's distributed financial technology. It highlights the inefficiencies of traditional payment systems and presents Ripple as a solution for real-time transactions, improved operational efficiency, and reduced costs. The presentation outlines the benefits of integrating Ripple's services, such as increased profitability and enhanced compliance with regulatory standards.