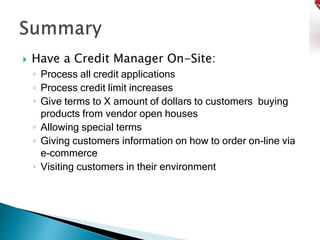

This document discusses the benefits of having a credit manager available on-site at new locations, open houses, and underperforming locations. It suggests that this can enhance revenue growth by allowing for faster credit decisions and customer satisfaction. It also notes that a credit manager can inform customers of their credit limits, increase limits for qualified customers, and offer special financial terms during vendor events to targeted products. Having a credit manager on-site can improve the customer experience and allow store managers to focus on relationships without credit stresses.