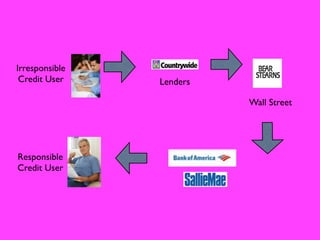

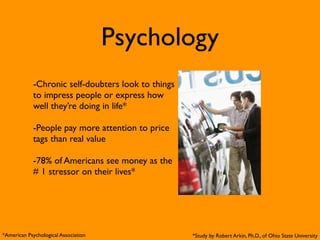

The document discusses various perspectives on money and credit use. It includes hypotheses that increasing access to credit has made it more difficult to talk about debt. Several sections discuss the American Dream and how it has long involved using debt to achieve goals like home ownership. Current events notes that consumer spending drives 2/3 of the economy and credit card use has greatly increased. Lessons learned are usually from parents' relationship with money. Relationships with money can impact romantic relationships if debts are hidden. Psychology shows money impacts emotions and self-image. Habits like overspending and under-saving are common issues. Recommendations include becoming conscious spenders and openly discussing financial matters.