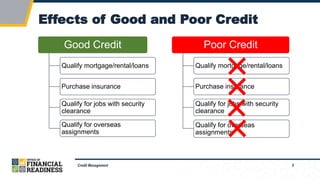

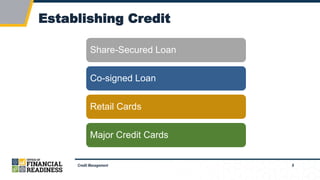

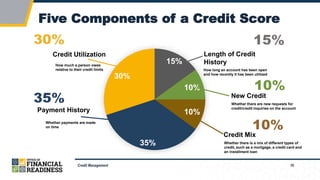

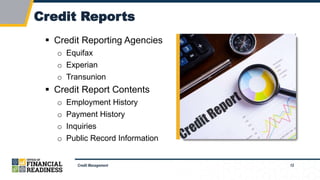

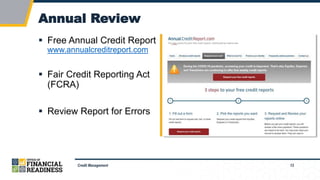

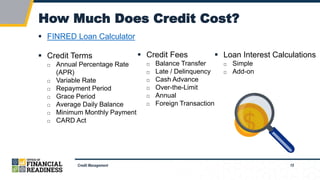

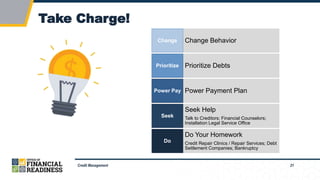

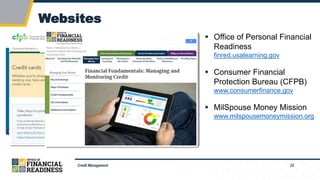

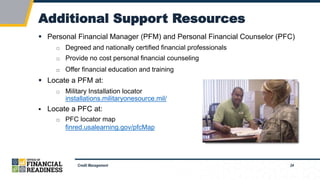

The document covers essential aspects of credit management including the impact of credit, building credit, and understanding credit scores and reports. It discusses wise and unwise uses of credit, costs associated with credit, and strategies for recovering from debt. Additionally, it provides resources for personal financial management and emphasizes the importance of credit health.