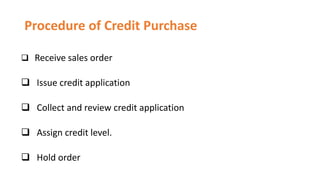

The document outlines the credit granting decision process utilized by credit managers, involving the assessment of individuals' demographics, financial situations, and credit histories to predict repayment behavior. It details the steps involved in credit purchasing and highlights banks' cautious approach in lending, emphasizing the necessity of assurance on borrowers' repayment capabilities. Additionally, it mentions the 'five C's of credit' which include character, capacity to repay, collateral, capital, and conditions.