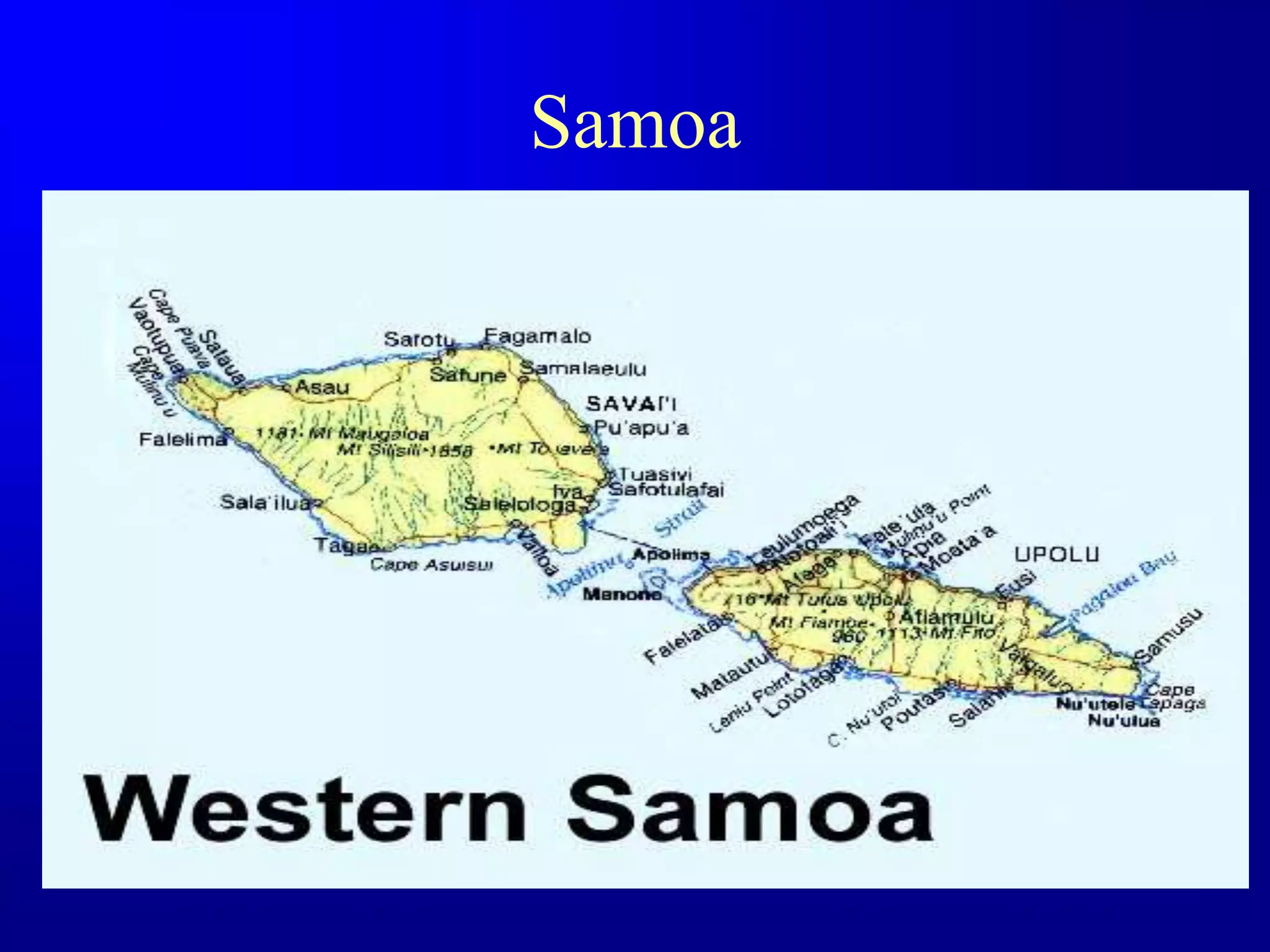

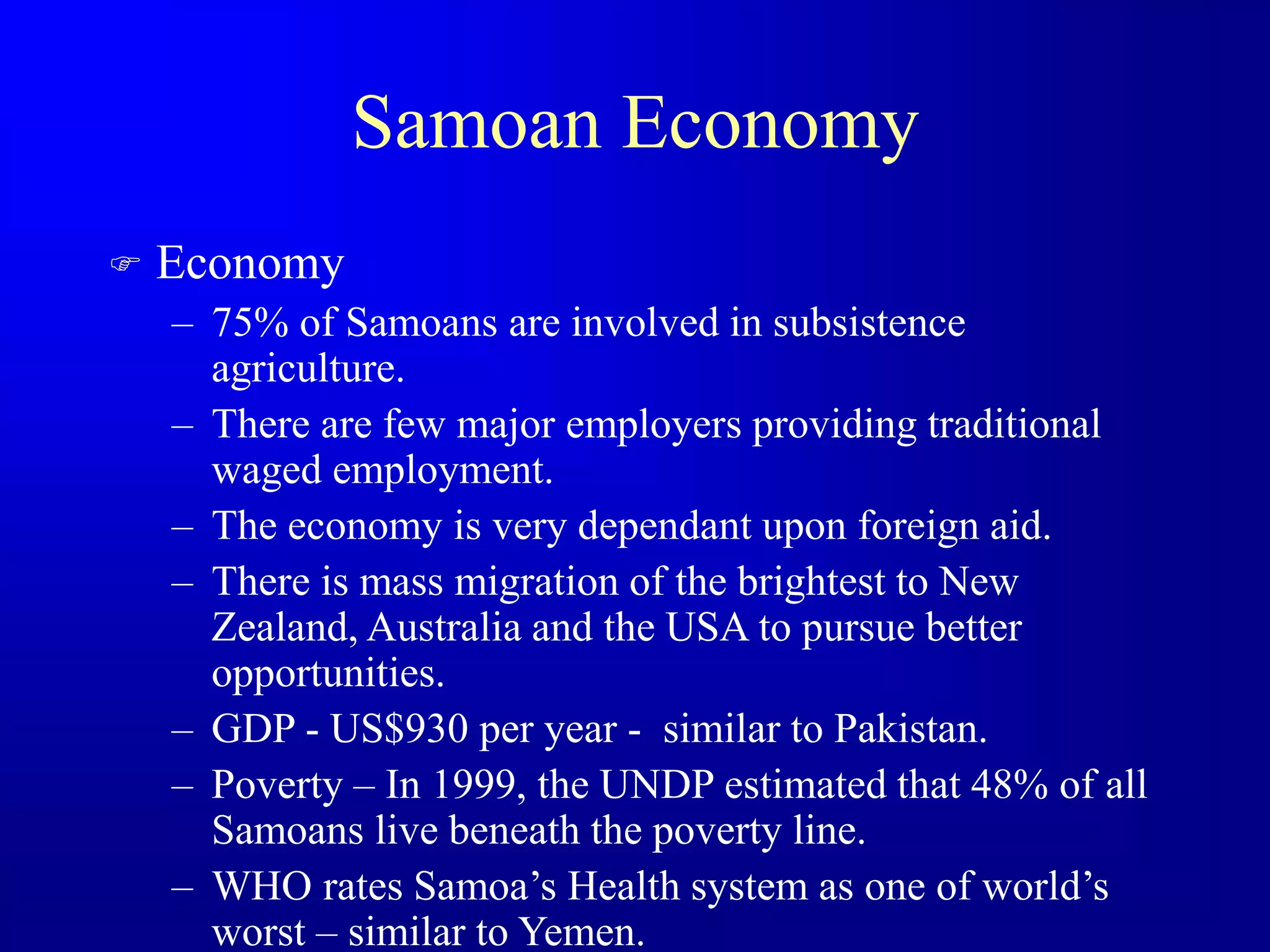

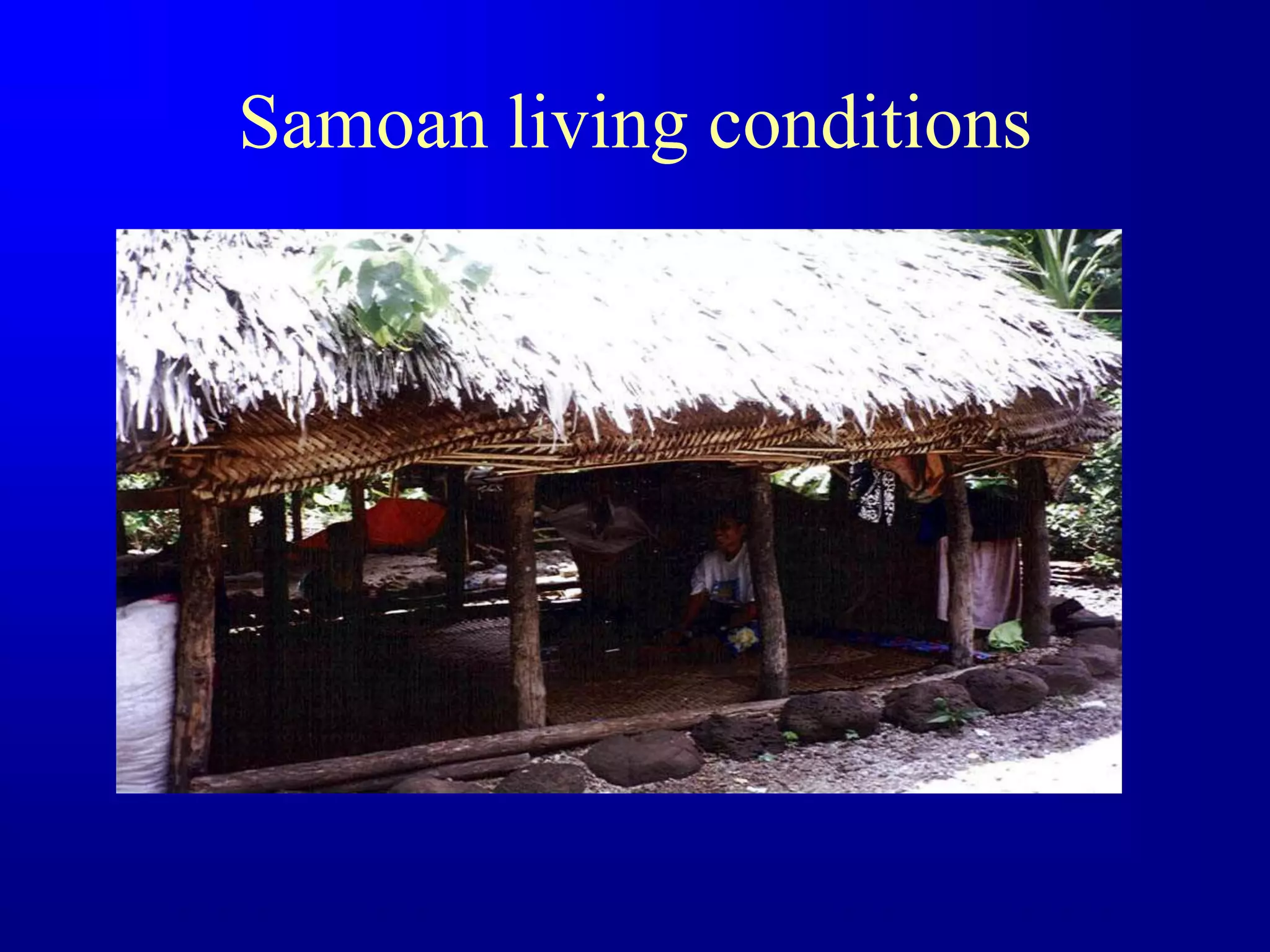

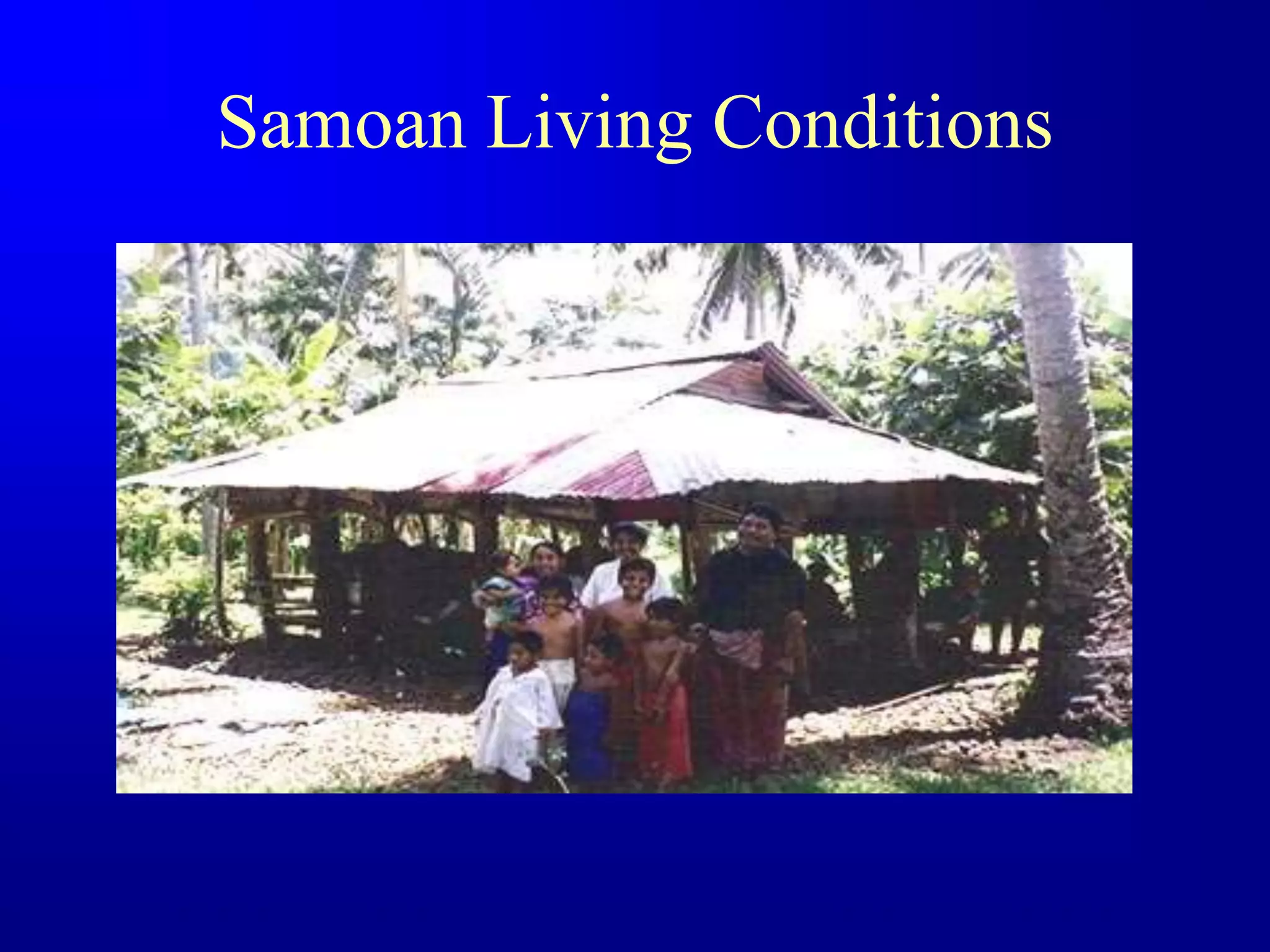

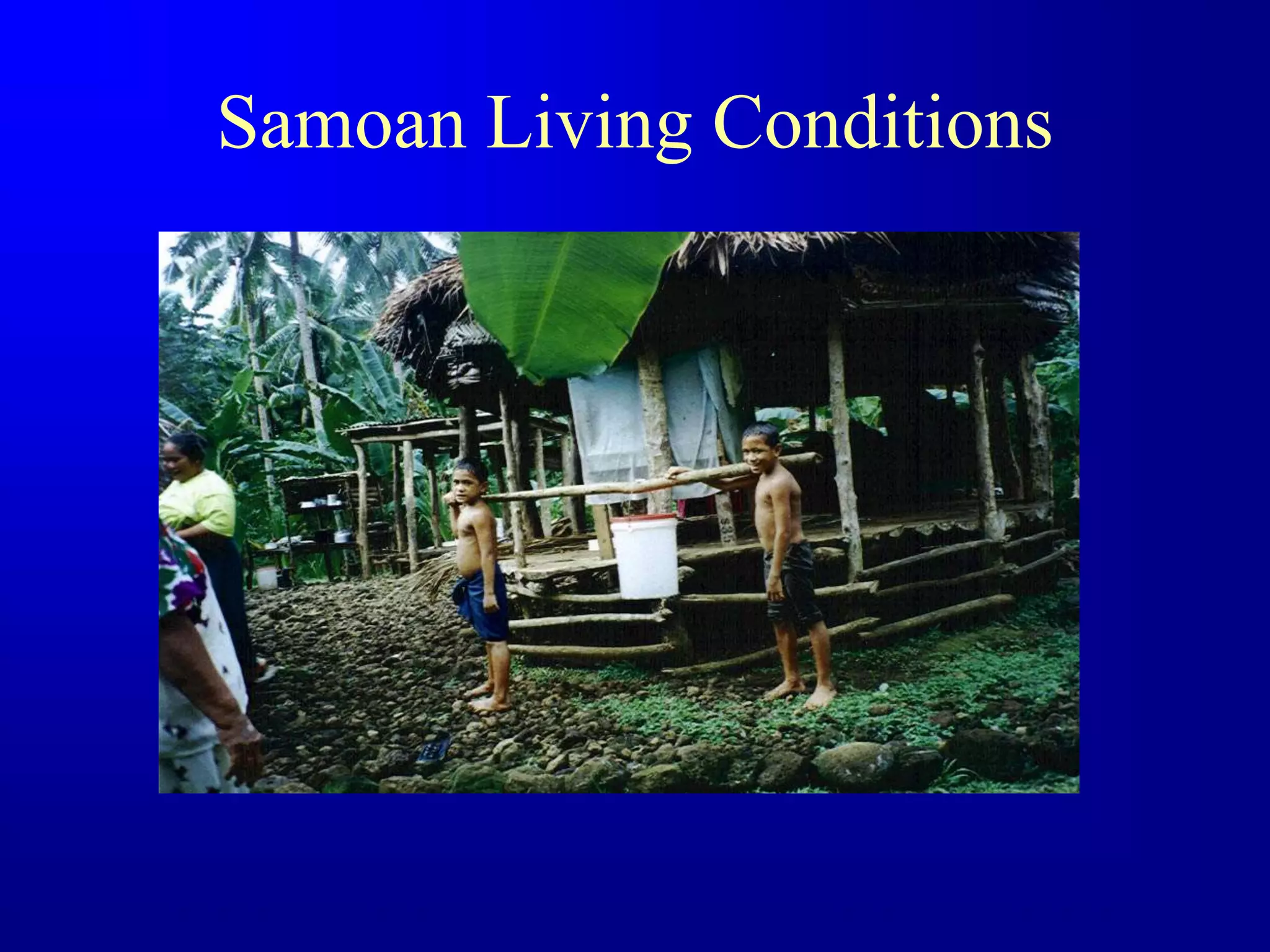

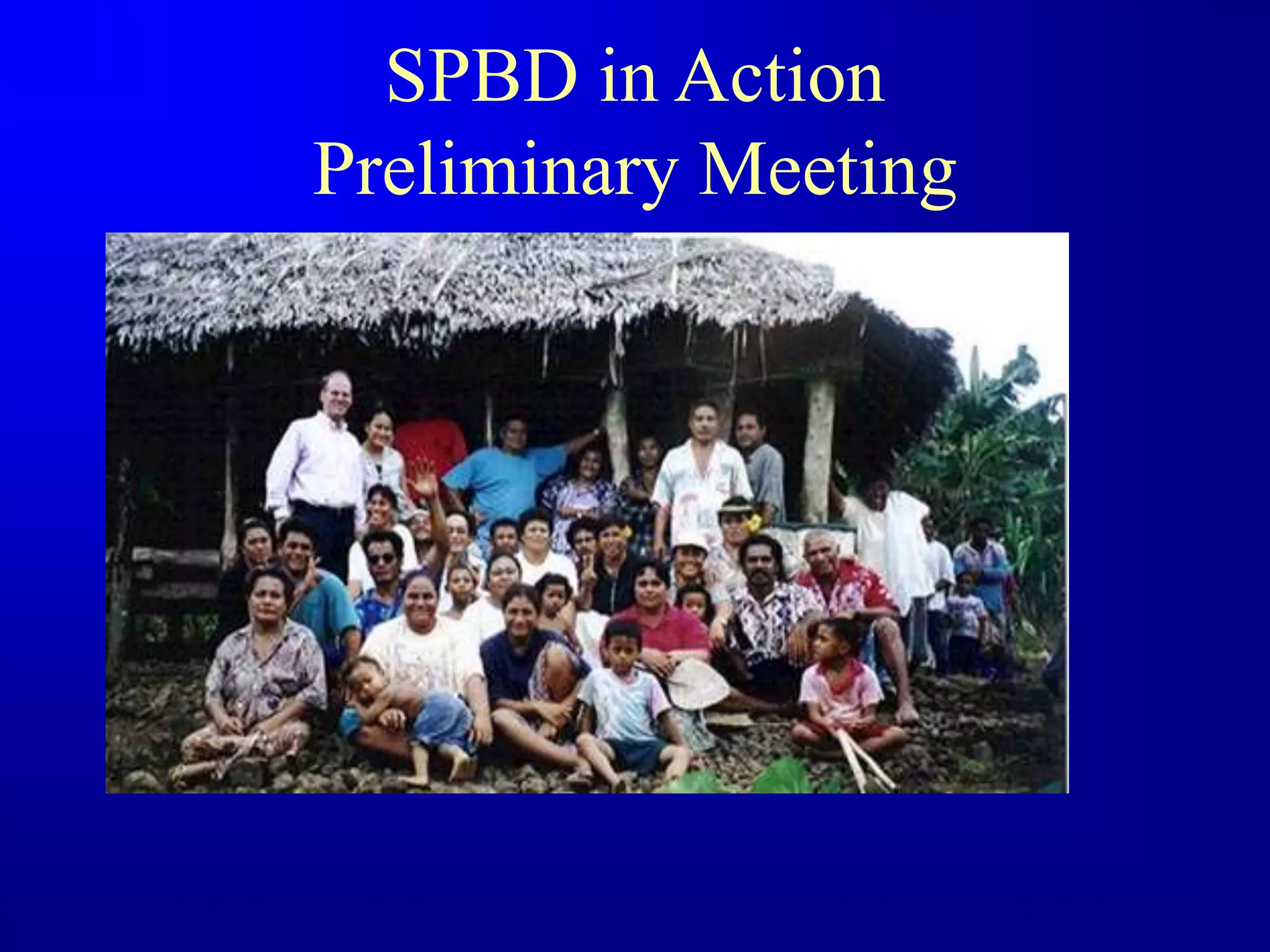

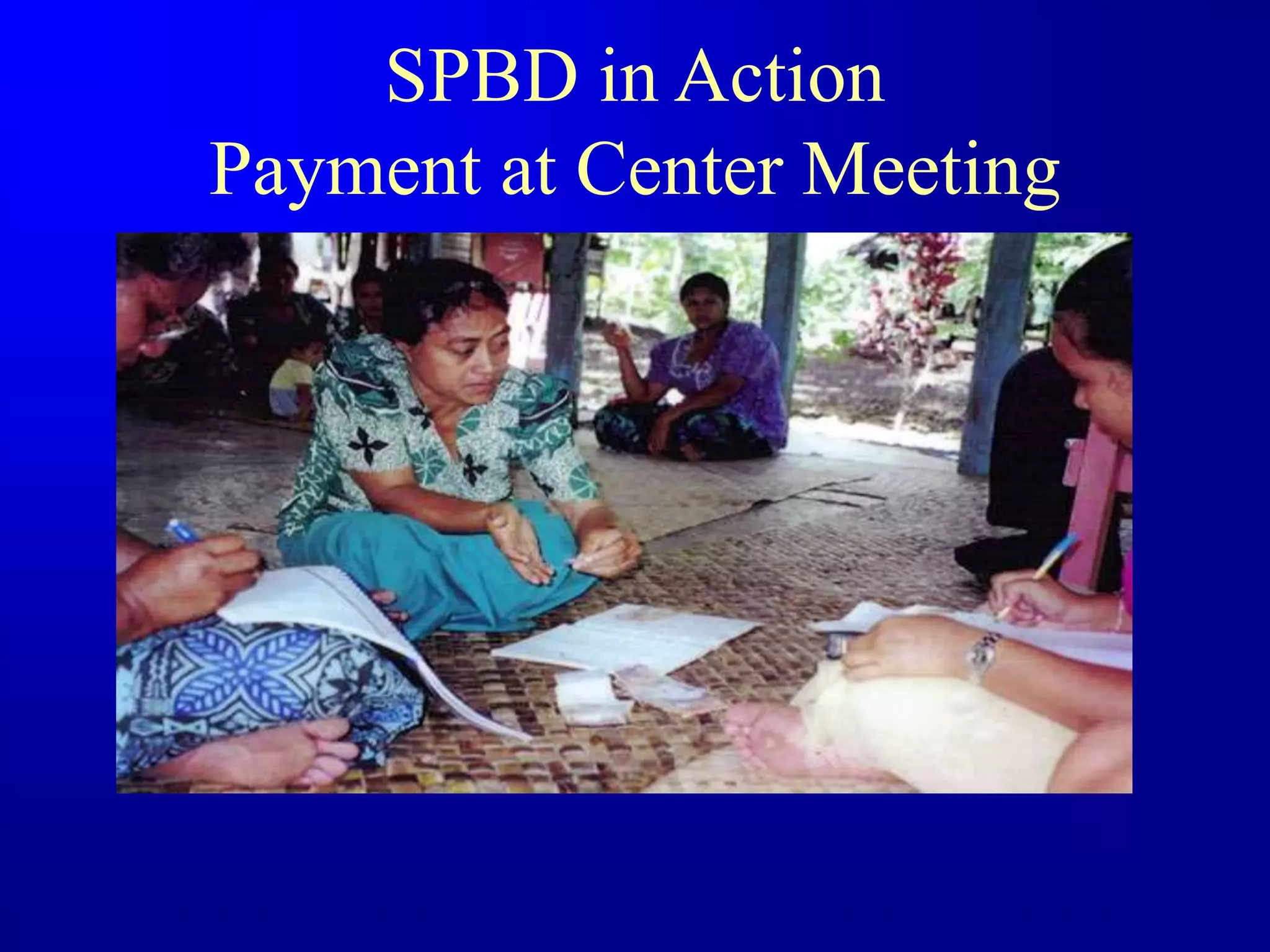

SPBD is a Samoan NGO that provides microcredit to the poor on the island of Samoa using the Grameen Bank methodology. It aims to eliminate poverty in the South Pacific region. Most people in the South Pacific, including Samoa, live in rural poverty with GDP per capita under $2,000. SPBD fills an important need by being the only organization that provides unsecured microloans to the poor in Samoa. It has grown to serve over 2,100 clients across 60 villages. SPBD follows best practices and has achieved a high repayment rate, demonstrating that the poor can be creditworthy. Its loans have helped many start successful small businesses and improve living conditions.