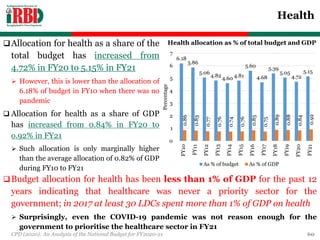

এই প্রতিবেদনটি 2020-21 অর্থবছরের জন্য বাংলাদেশের জাতীয় বাজেটের বিশ্লেষণ করে, যা করোনা ভাইরাসের মহামারীর কারণে অর্থনীতির উপর গভীর প্রভাব ফেলেছে। সেন্টার ফর পলিসি ডায়ালগ (সিপিডি) বাজেটের বাস্তবসম্মততা এবং স্বাস্থ্য, মানবিক ও সামাজিক দৃষ্টিকোণ থেকে তার কার্যকারিতা নিয়ে উদ্বেগ প্রকাশ করেছে। প্রতিবেদনে বাজেটের প্রস্তাবিত লক্ষ্যগুলোর সাথে বাস্তবতার মধ্যে বড় পার্থক্য রয়েছে এবং ধনী-গরিবের মধ্যে বৈষম্য ও দারণতার বৃদ্ধি নিয়ে উদ্বেগ রয়েছে।

![II. MACROECONOMIC PERSPECTIVES

Growth target for export has been set at 15.0% in FY21

Up to May FY20, total export growth was a dismal (-)18.0% with both RMG

[(-)19.0% growth] and non-RMG [(-)12.7% growth] export in hot waters

Growth target for import has been set at 10.0% in FY21

Up to Apr FY20, total import growth was negative (-)8.8%. Particularly alarming

is the slowdown in capital machineries import [(-)33.5%]

Up to Feb FY20, total L/C opening exhibited a growth of negative (-)1.0% while

that of capital machineries recorded a decrease by 0.6%

CPD (2020): An Analysis of the National Budget for FY2020-21 14

Indicator

Actual Budget Revised

budget

Projection

FY19 FY20 FY20 FY21 FY22 FY23

Export (growth in %) 10.5 12.0 -10.0 15.0 10.8 11.0

Import (growth in %) 1.8 10.0 -10.0 10.0 8.0 7.0

Remittance (growth in %) 9.6 13.0 5.0 15.0 10.0 10.0

Source: MTMPS

External sector](https://image.slidesharecdn.com/cpdbudgetanalysisfy2021-200613083757/85/CPD-Budget-Analysis-FY2021-14-320.jpg)

![II. MACROECONOMIC PERSPECTIVES

Remittance growth target for FY21 has been set at 15.0%. However, overall

outlook on outward migration was somewhat bleak in the MTMPS [outward

migration growth was negative (-)11.6% during Jul-May FY20 as per MTMPS]

Up to May FY20, remittance inflow posted a rise of 8.7% over corresponding figure.

However, this dynamic might soon change due to job losses in the host countries,

lower outbound remittance from GCC countries due to COVID-19 and oil price slump,

various restrictive measures and stringent health related conditionalities in host

countries

Exchange rate is expected to be stable – reaching Tk. 84.0/USD on an average

in FY21, but pressure on Taka may increase if current account falters

It appears that the disquieting trends in external sector are either not

recognised or projected to recover

Currently Tk. 84.95/USD – the budgetary framework predicted BDT to appreciate

against USD – CPD proposed a gradual depreciation to aid export and remittance

inflow!

CPD (2020): An Analysis of the National Budget for FY2020-21 15](https://image.slidesharecdn.com/cpdbudgetanalysisfy2021-200613083757/85/CPD-Budget-Analysis-FY2021-15-320.jpg)