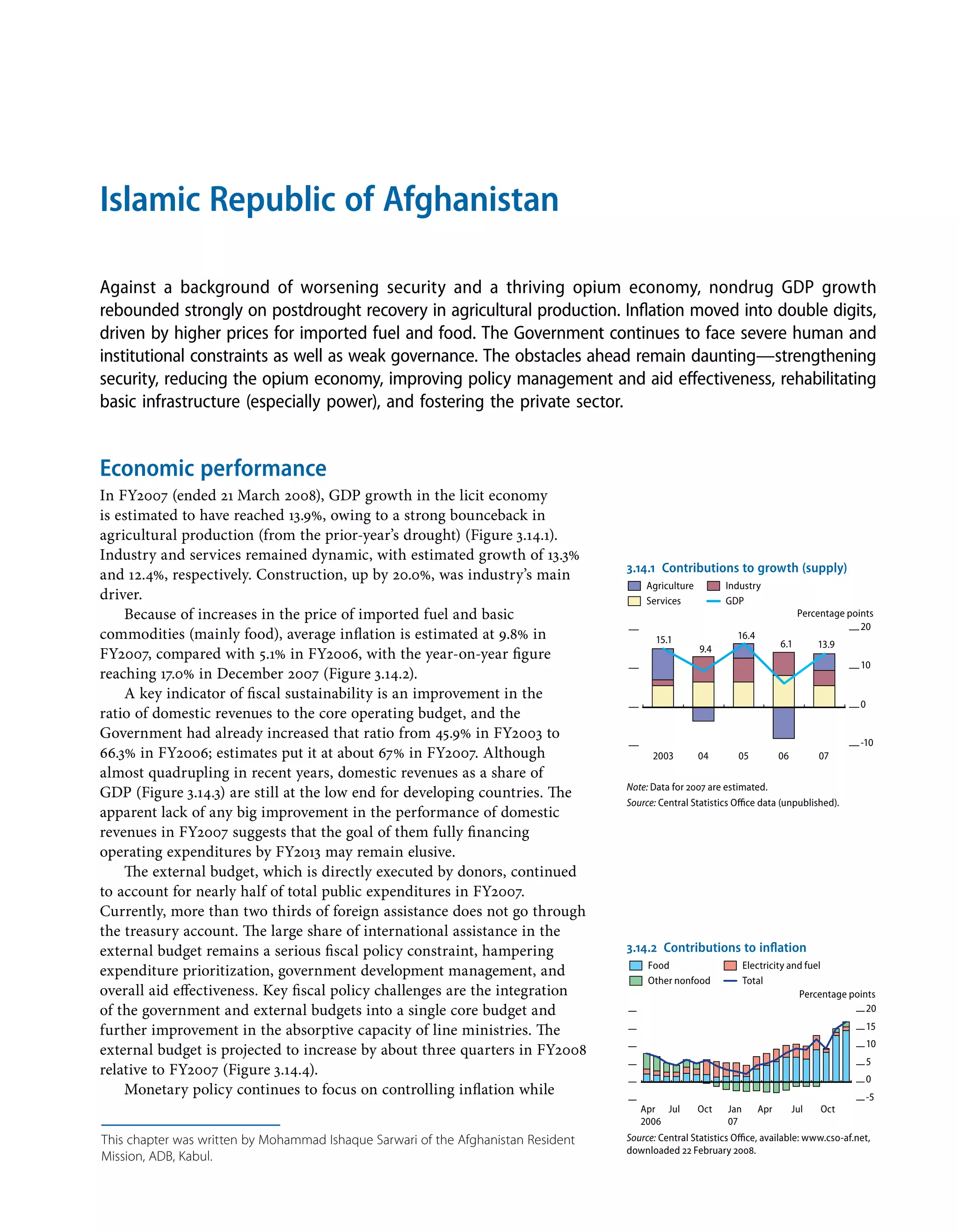

- Afghanistan experienced strong GDP growth of 13.9% in FY2007 due to recovery in agricultural production after drought, while inflation rose to double digits due to higher fuel and food prices.

- The government continues to face challenges of weak governance, security issues, and a thriving opium economy.

- Future growth depends on structural reforms, improved infrastructure like power and transport, and sustained international assistance; GDP growth is forecast at 9% for FY2008-FY2009 if conditions remain stable.