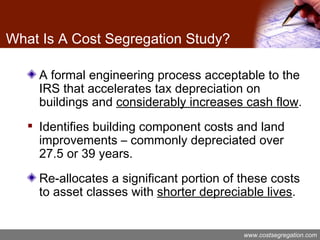

A cost segregation study is an engineering process that accelerates tax depreciation on buildings, improving cash flow by reallocating building component costs and land improvements to shorter depreciable lives. This can lead to significant tax savings and cash flow increases, with a potential net present value benefit of $0.12 to $0.23 for each dollar reclassified. For example, in an auto dealership case, cost segregation resulted in increased depreciation expense and significant deferred taxes.

![Questions… KBKG, INC. COST SEGREGATION SPECIALISTS Contact Information Mitchell Lardner Director, Business Development 626.449.4225 x506 [email_address] www.kbkg.com www.costsegregation.com](https://image.slidesharecdn.com/7-slide-110304125723-phpapp02/85/Cost-Segregation-Studies-8-320.jpg)