This document discusses ideas for improving corporate reporting to better meet stakeholder needs. It proposes:

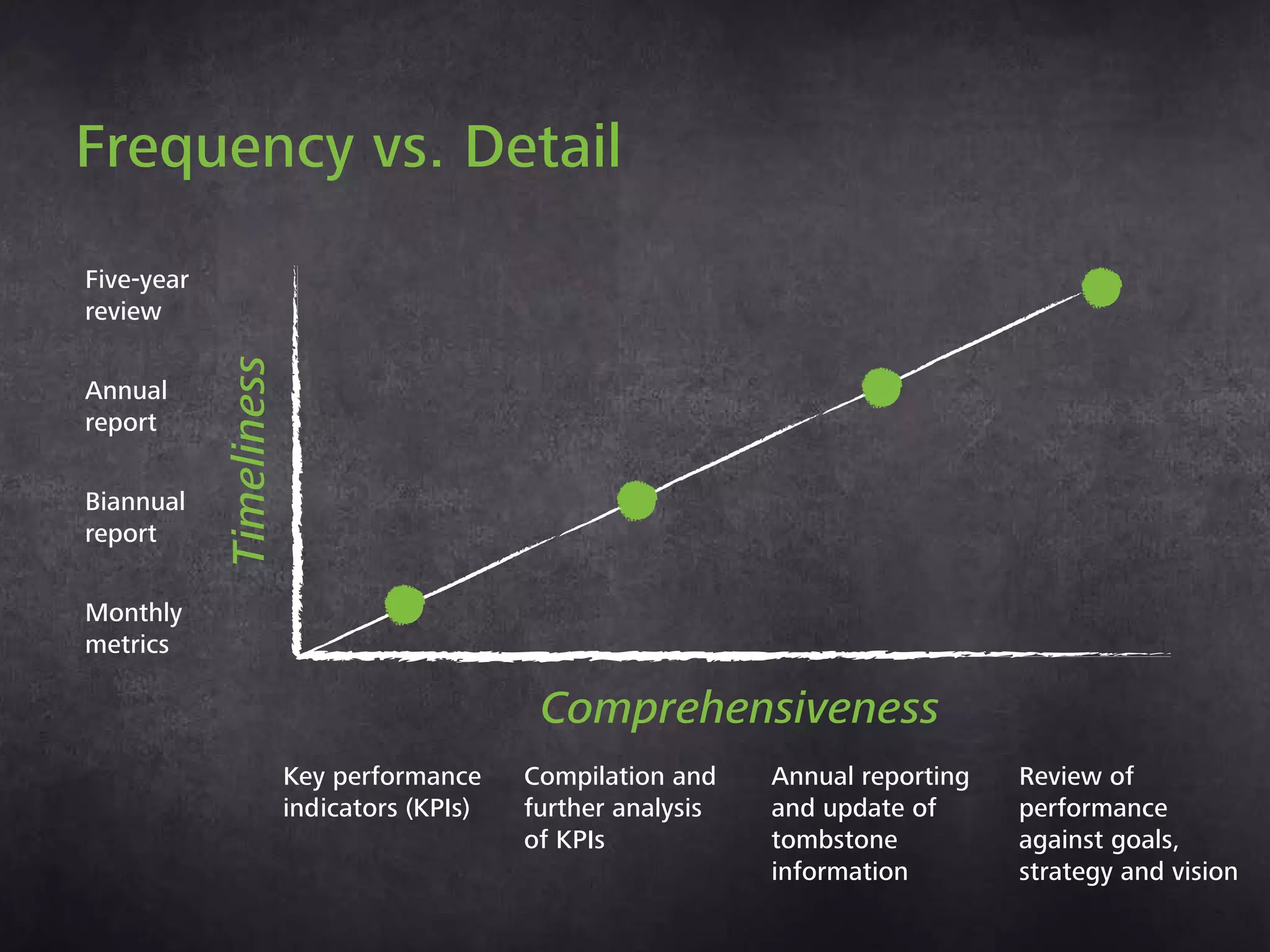

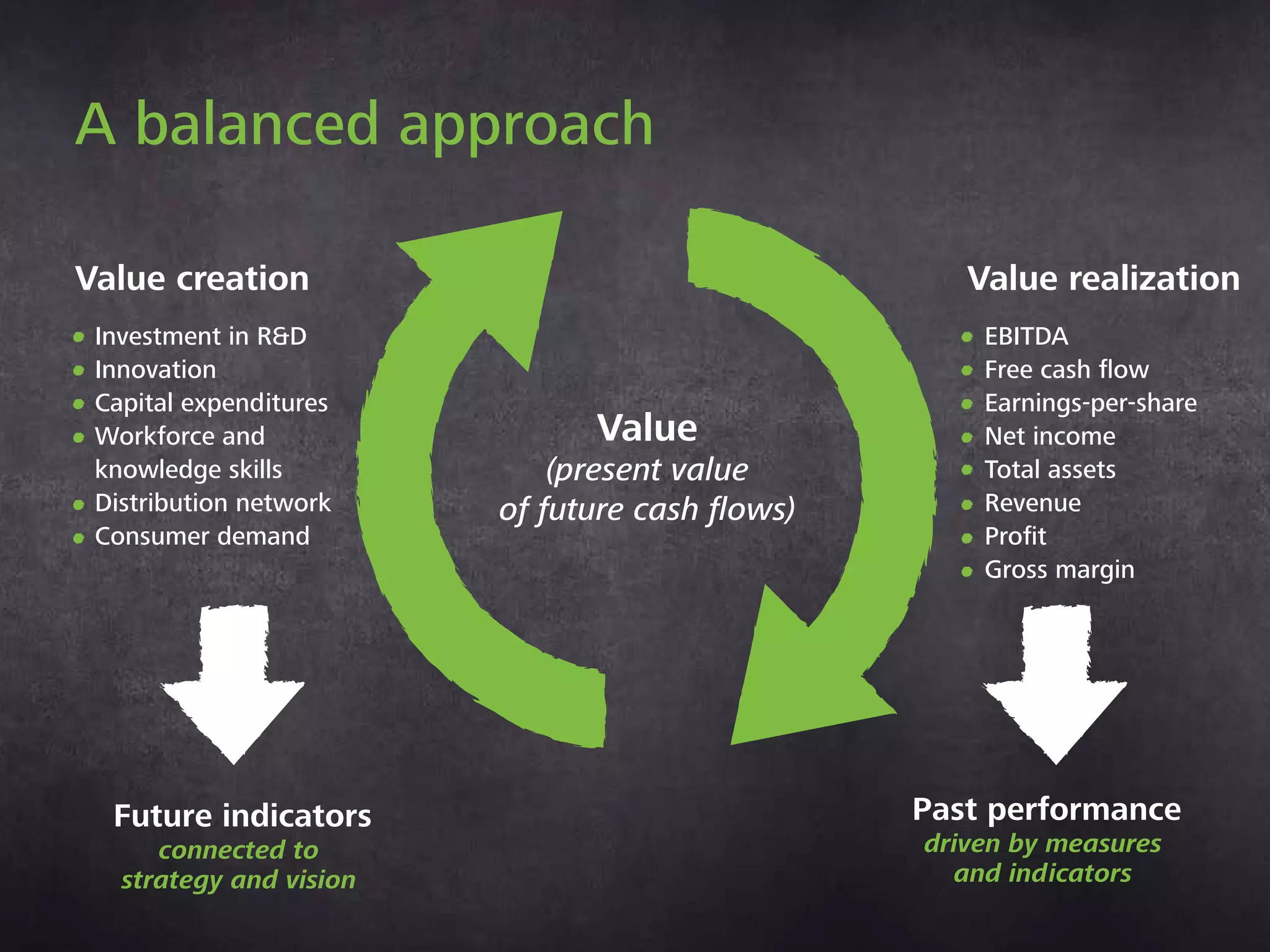

1) Less frequent but more comprehensive reporting (annual/biannual instead of quarterly), focused on long-term value creation metrics in addition to past financial performance.

2) Releasing key performance indicators monthly through social media to provide timely updates between comprehensive reports.

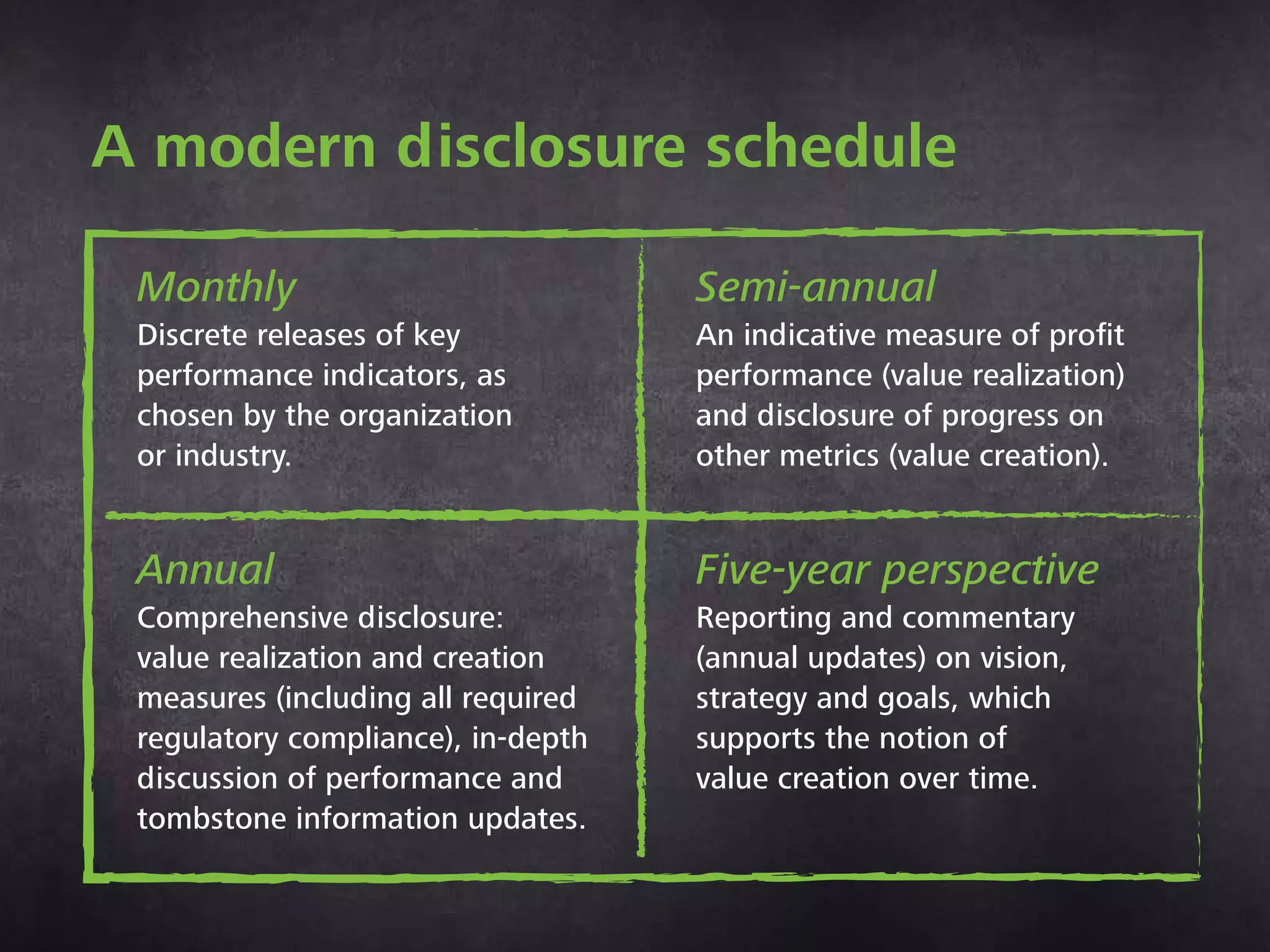

3) A modern disclosure schedule including monthly indicators, biannual reports, annual comprehensive reports, and five-year perspectives on vision and strategy.

4) Integrated reporting comes closest to existing frameworks in emphasizing long-term value creation, but does not fully address issues like standardization and technology that could further modernize reporting.