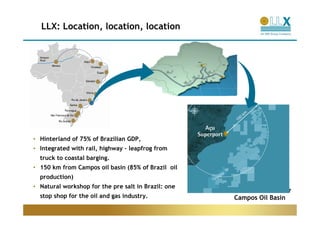

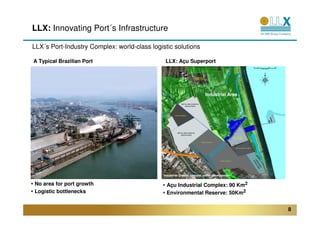

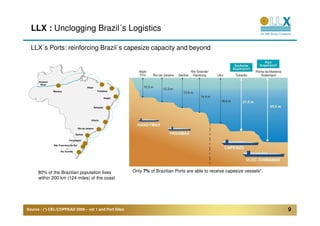

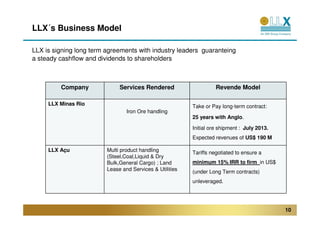

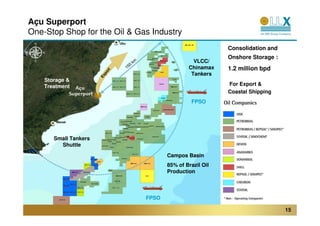

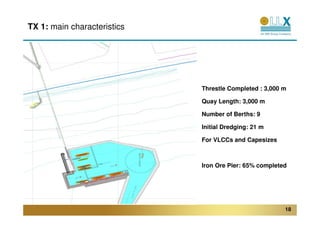

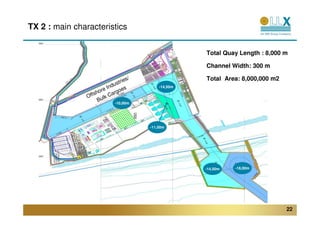

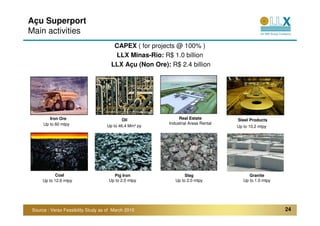

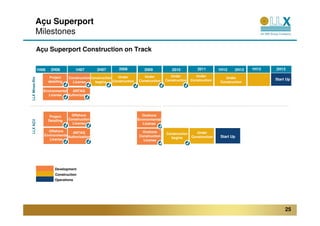

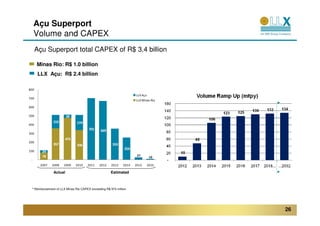

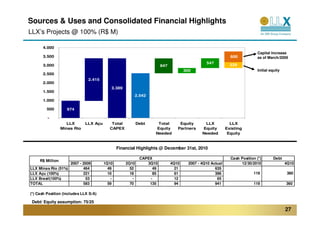

LLX Logística is developing two major port terminals, LLX Minas Rio and LLX Açu, with over $3 billion in total planned investments. LLX Minas Rio will handle iron ore and begin shipments in 2013, while the larger LLX Açu terminal will handle multiple dry and liquid bulk cargos for industries located in its industrial complex. LLX has signed numerous long-term contracts to ensure steady cash flow and dividends for shareholders from its port operations and industrial services.