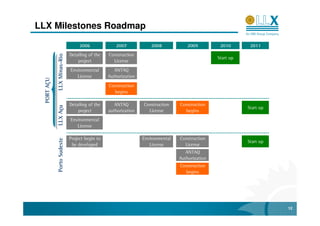

1) The document is a disclaimer and presentation by LLX Logística S.A. about the company and contains forward-looking statements that require caution.

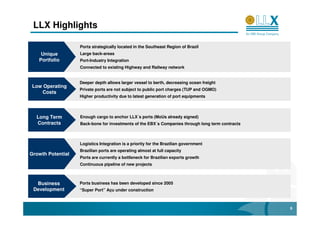

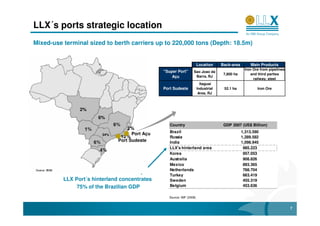

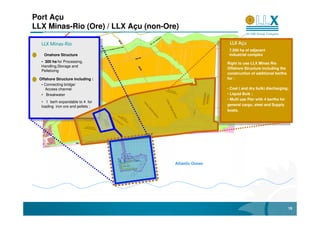

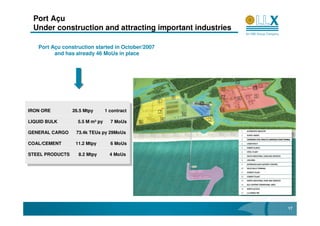

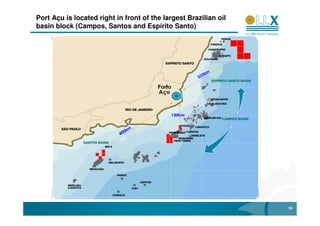

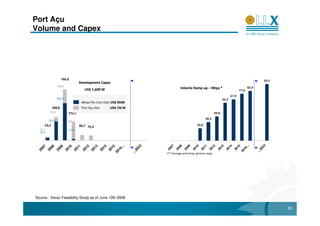

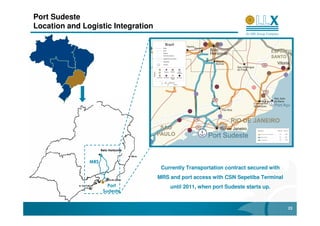

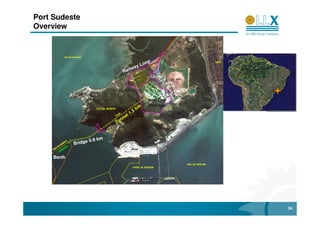

2) LLX operates ports strategically located in southeast Brazil with large back-areas and infrastructure to support cargo from EBX companies through long-term contracts.

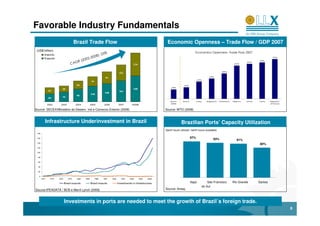

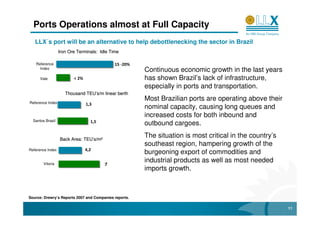

3) The ports have competitive advantages like deep water access and integrated logistics that support Brazil's export growth needs as ports near capacity.