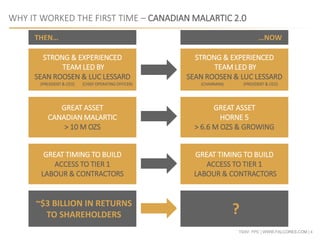

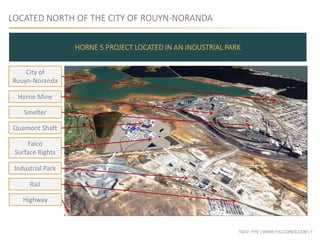

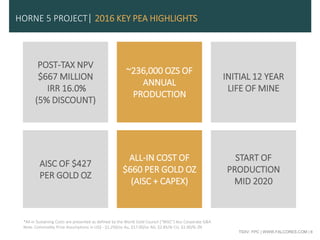

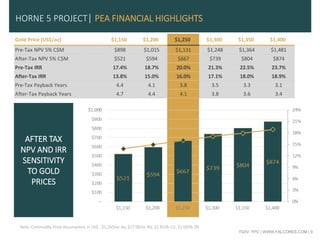

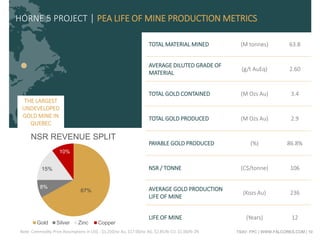

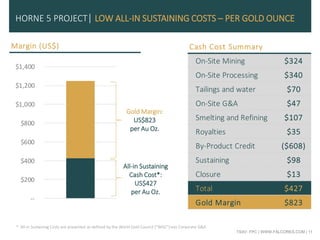

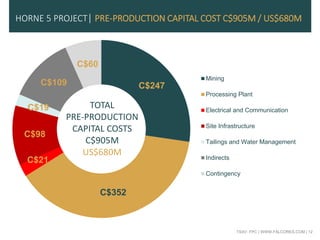

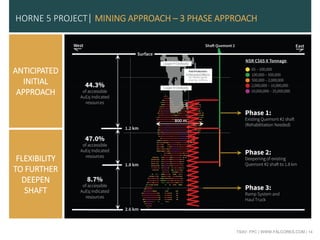

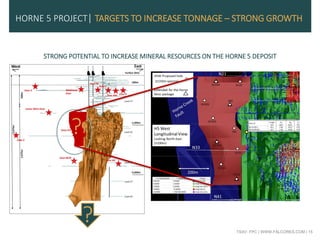

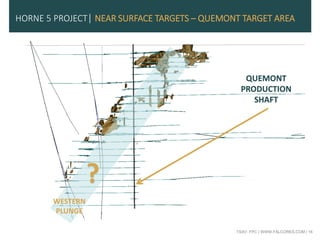

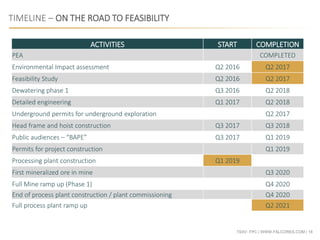

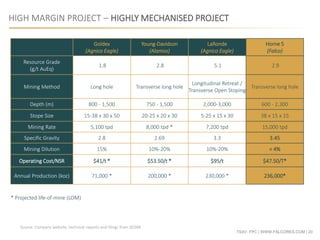

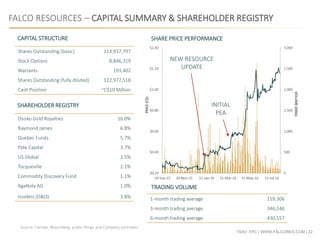

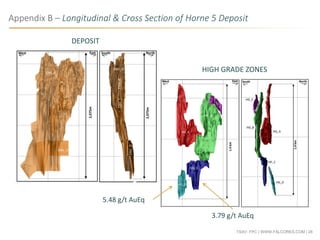

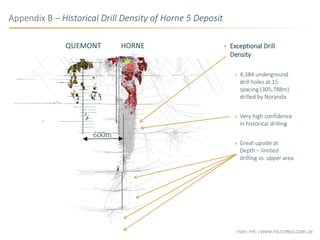

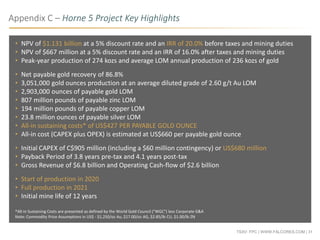

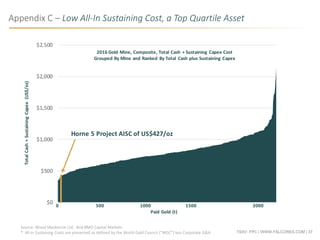

Falco Resources is a Canadian gold developer with its primary asset being the Horne 5 Project located in Rouyn-Noranda, Quebec. The project is targeting annual gold production of 236,000 ounces over an initial 12 year mine life with low all-in sustaining costs of US$427 per ounce and a post-tax NPV of C$667 million at a 5% discount rate. Falco Resources has an experienced management team and is advancing the project towards feasibility and permitting with the goal of beginning production in mid-2020.