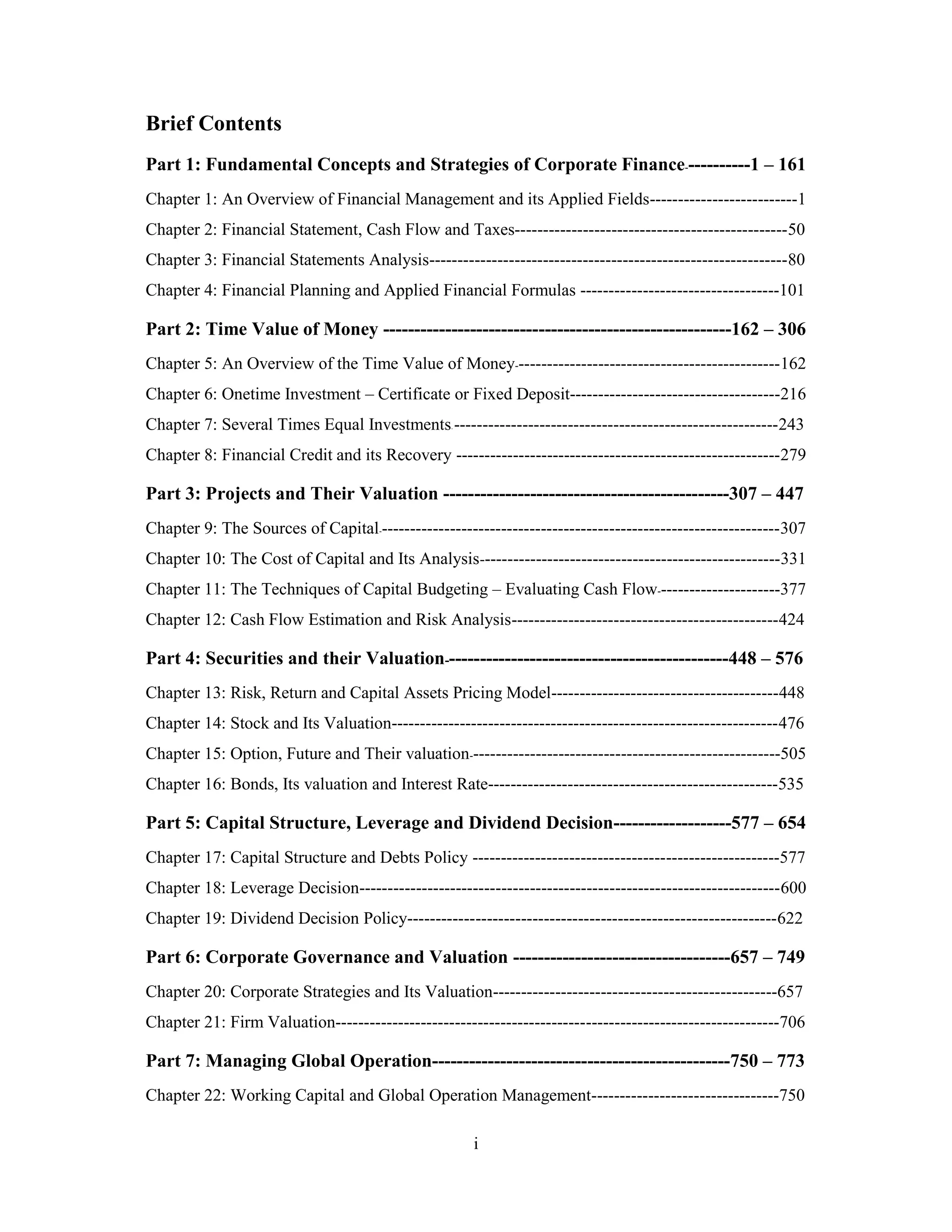

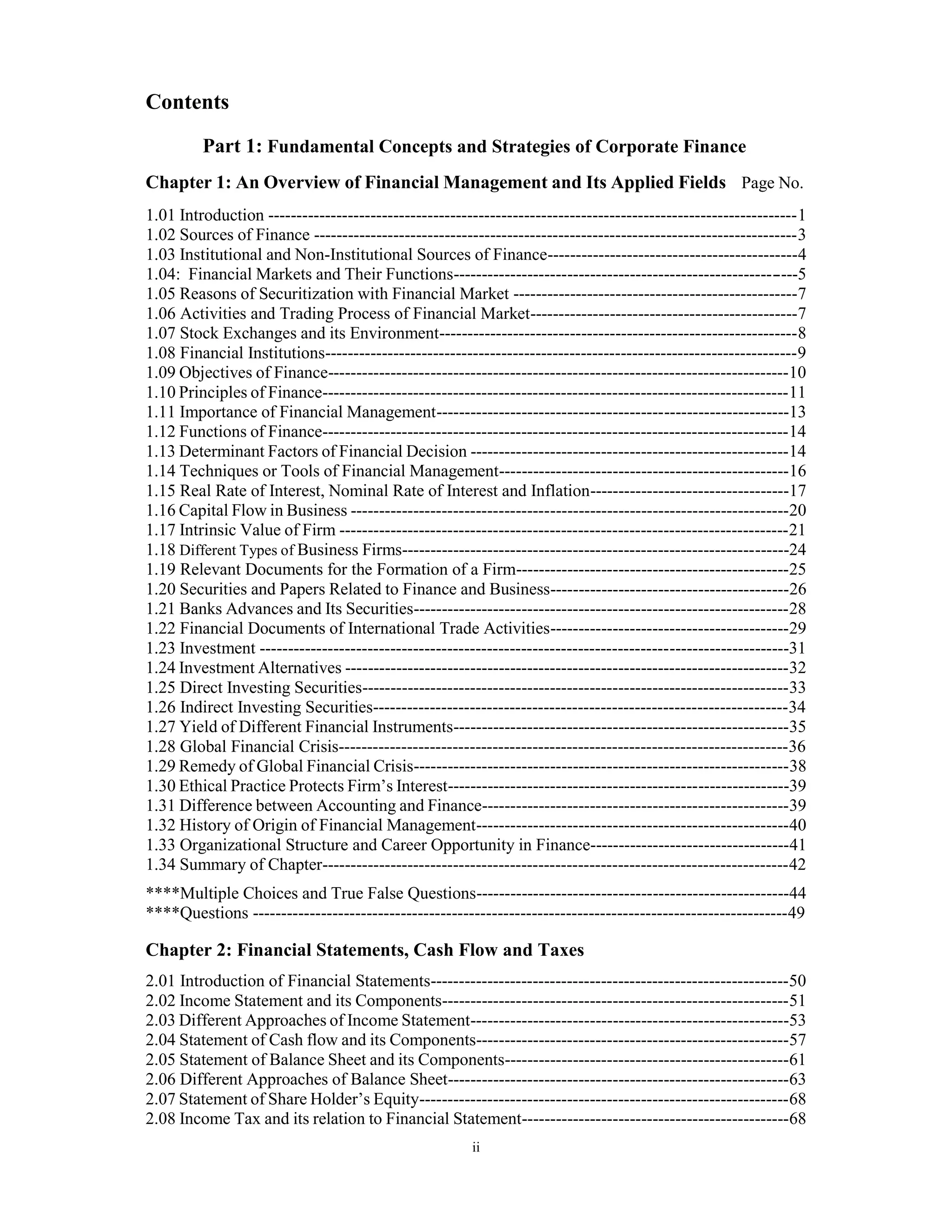

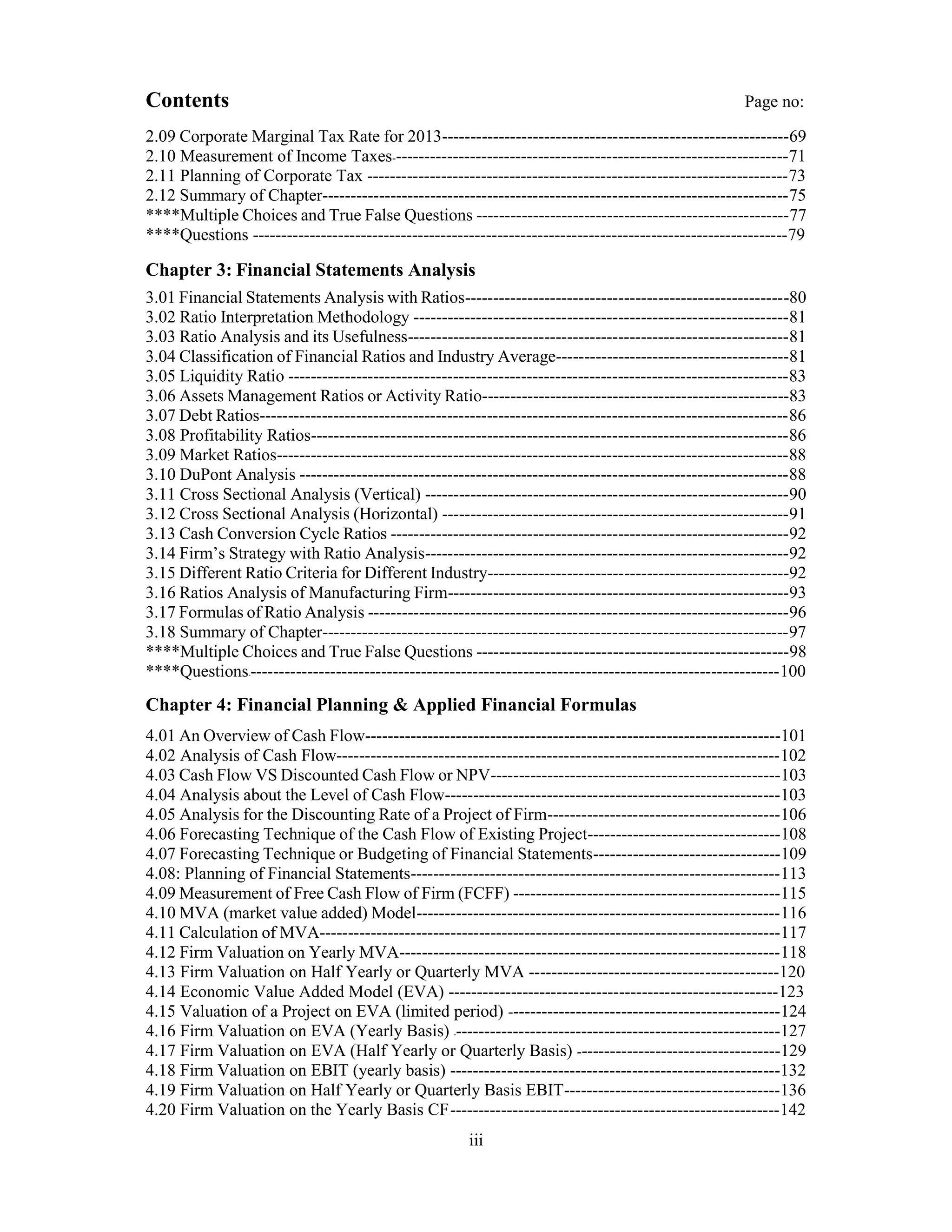

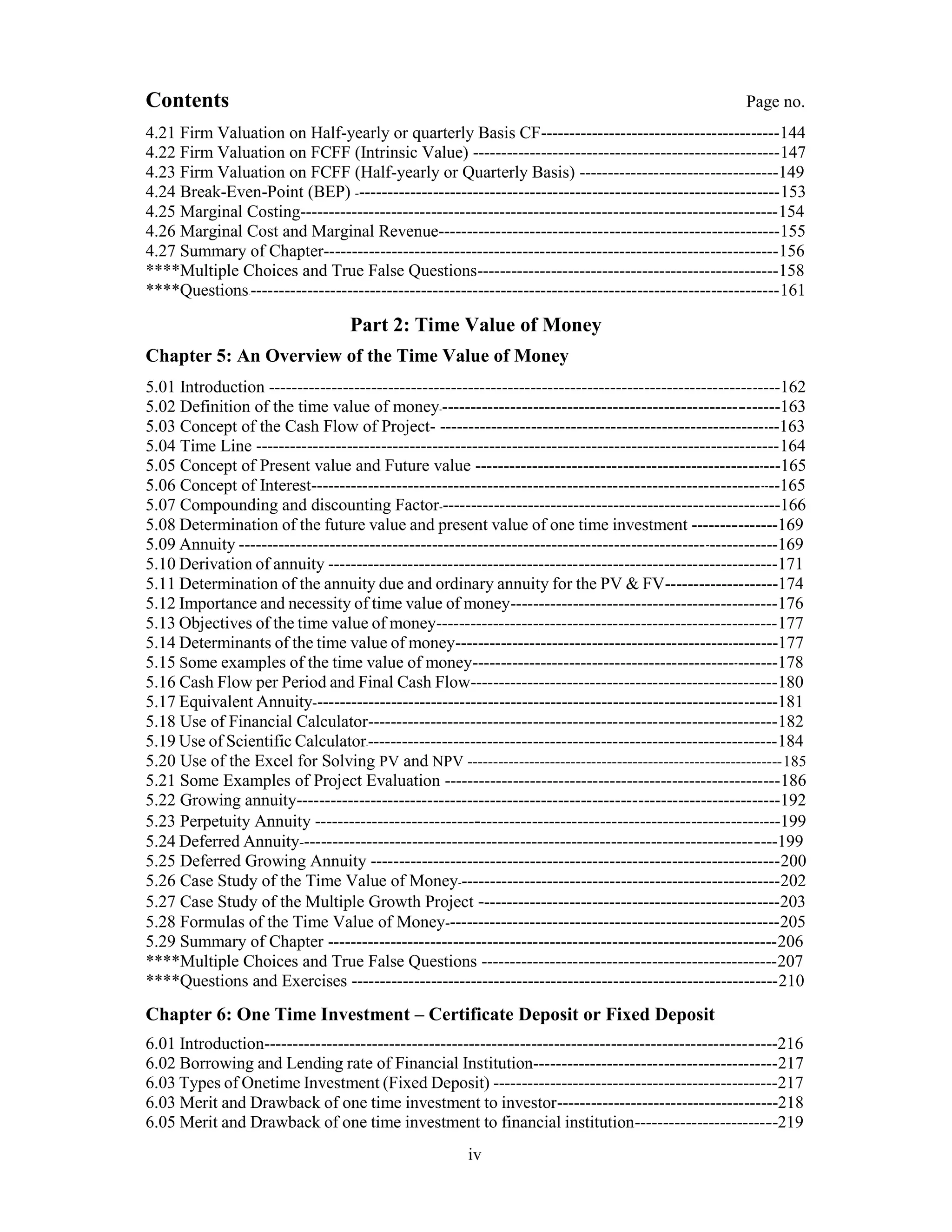

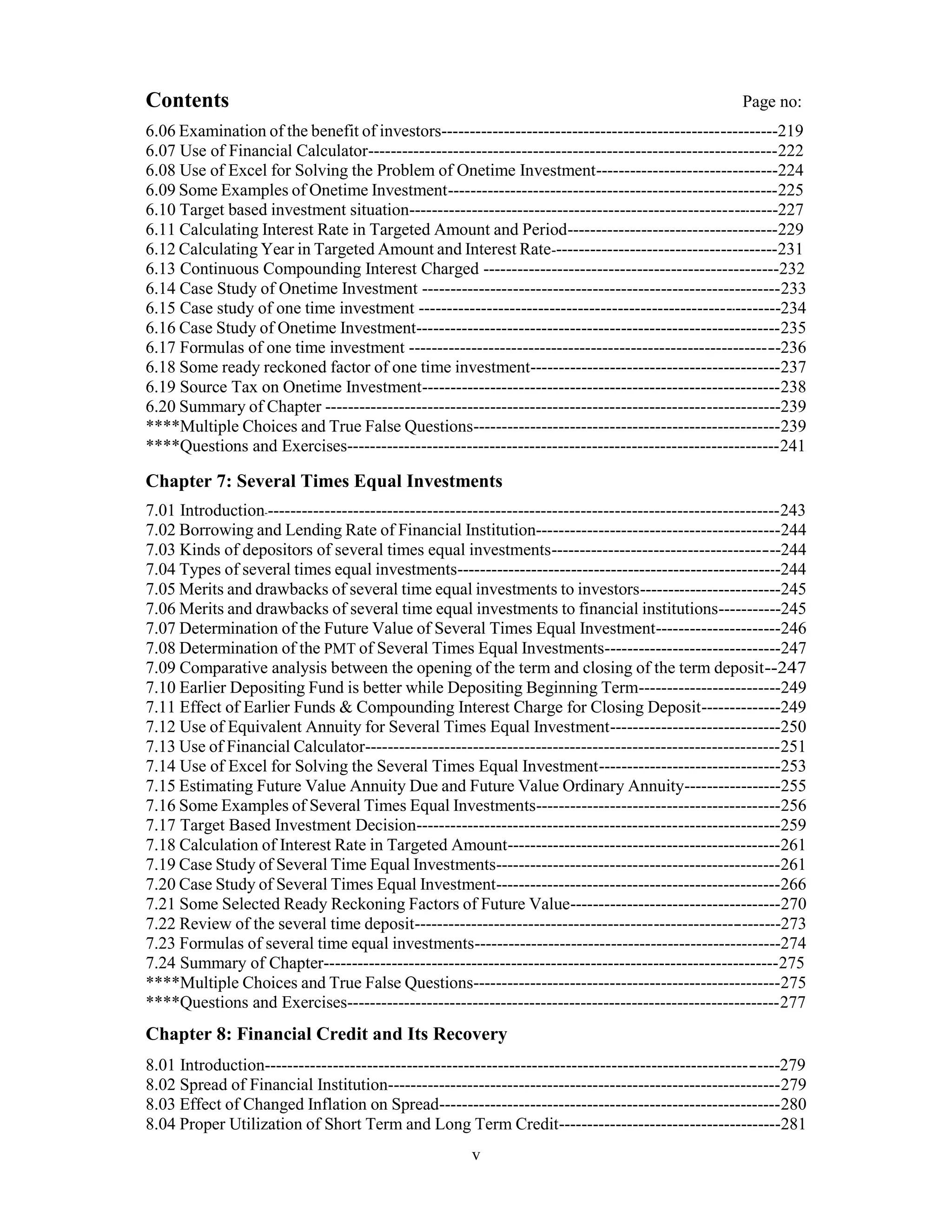

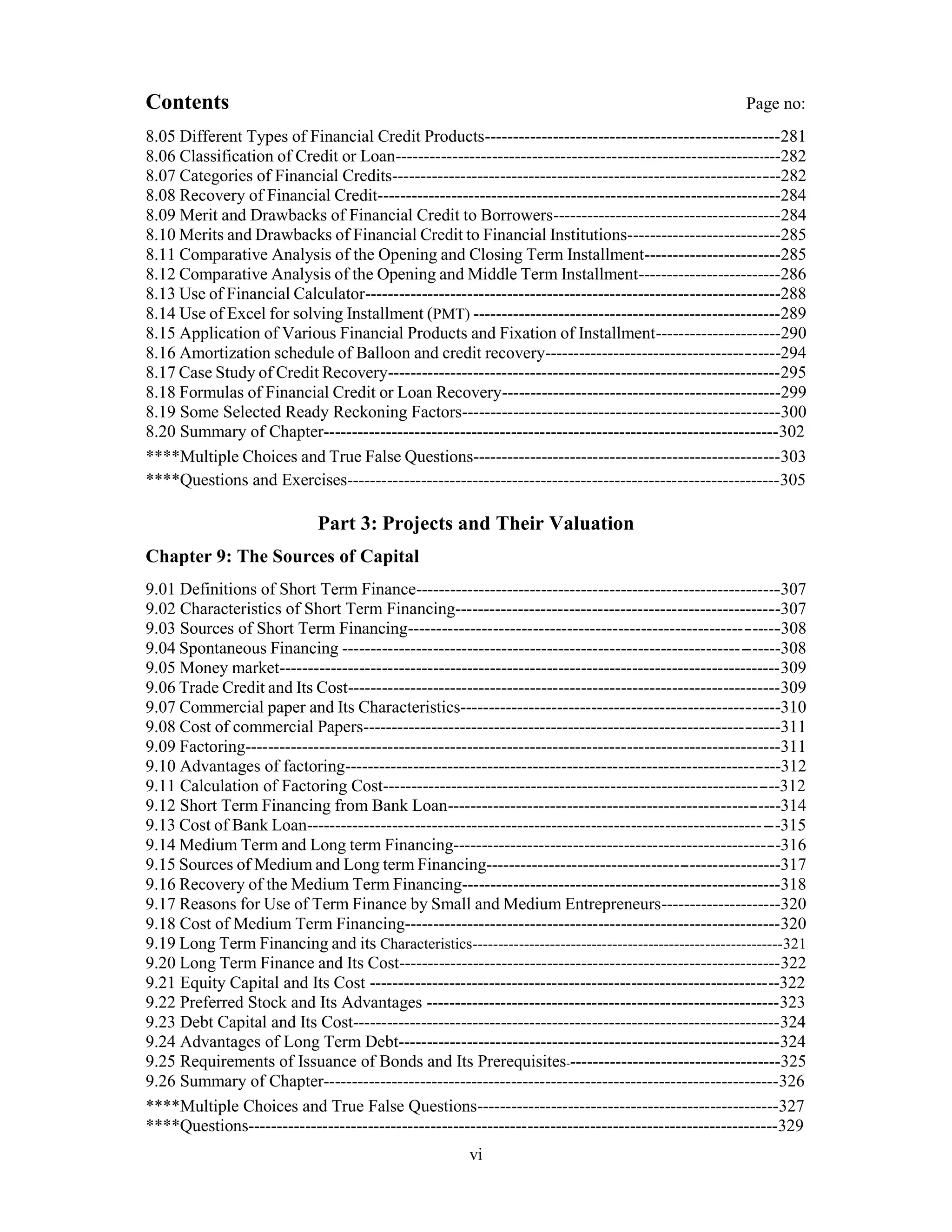

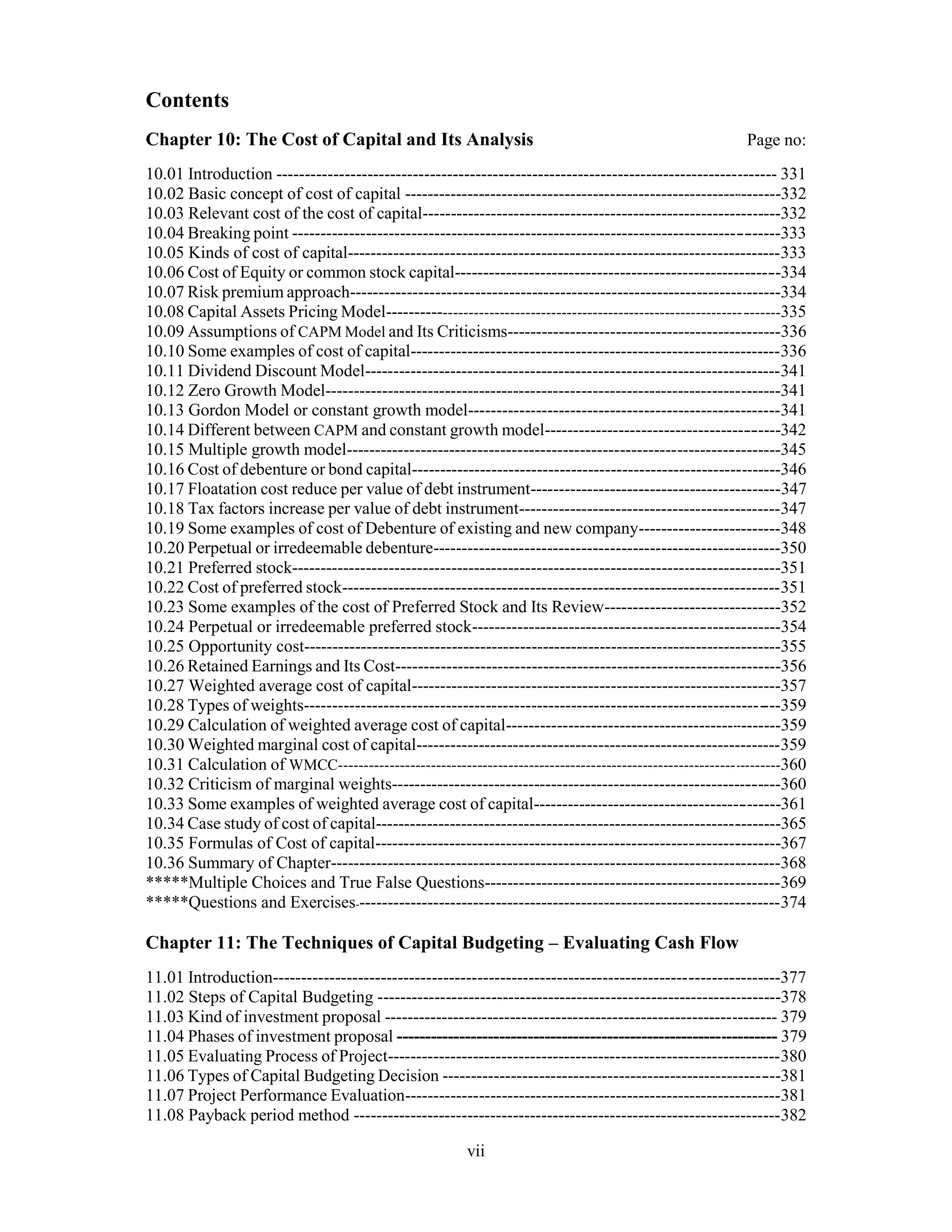

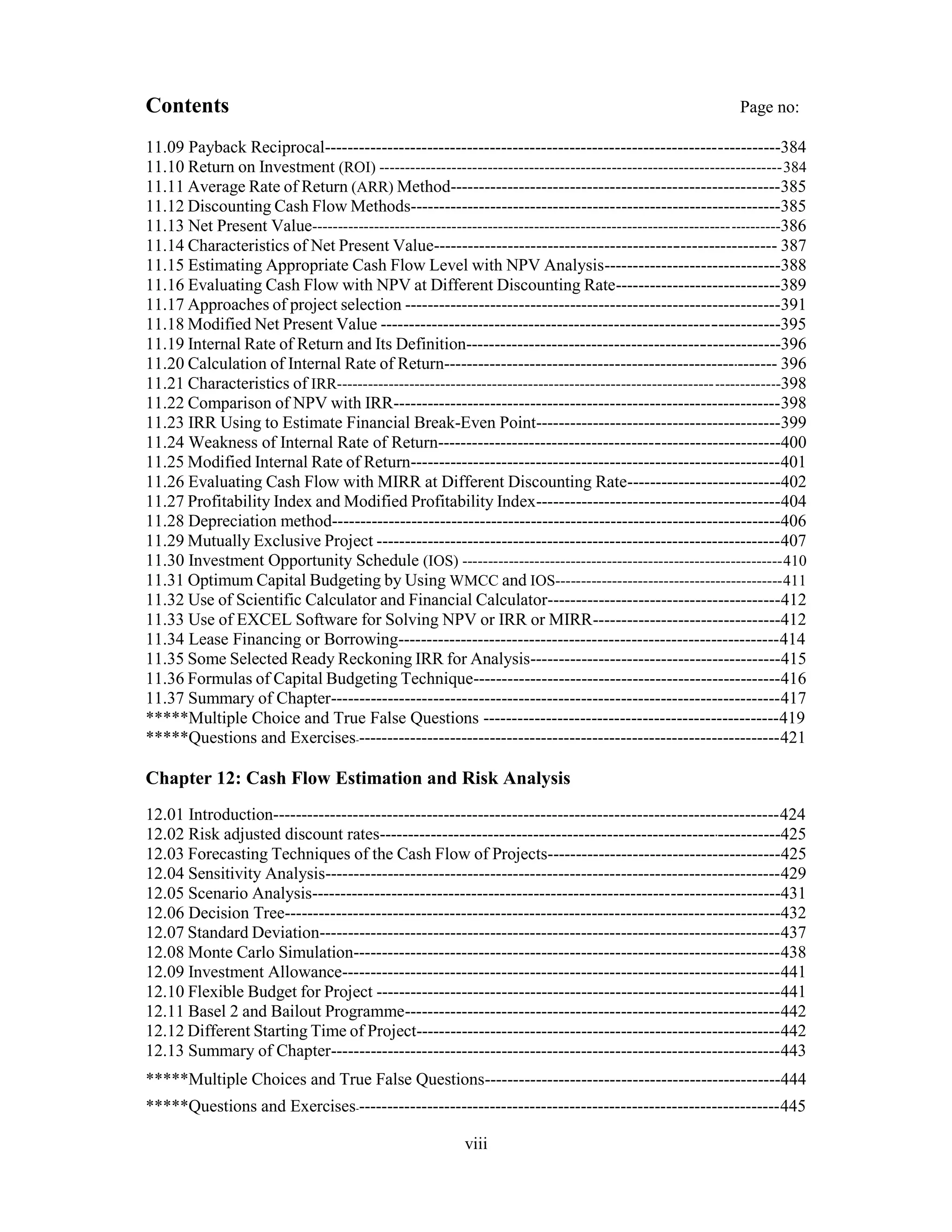

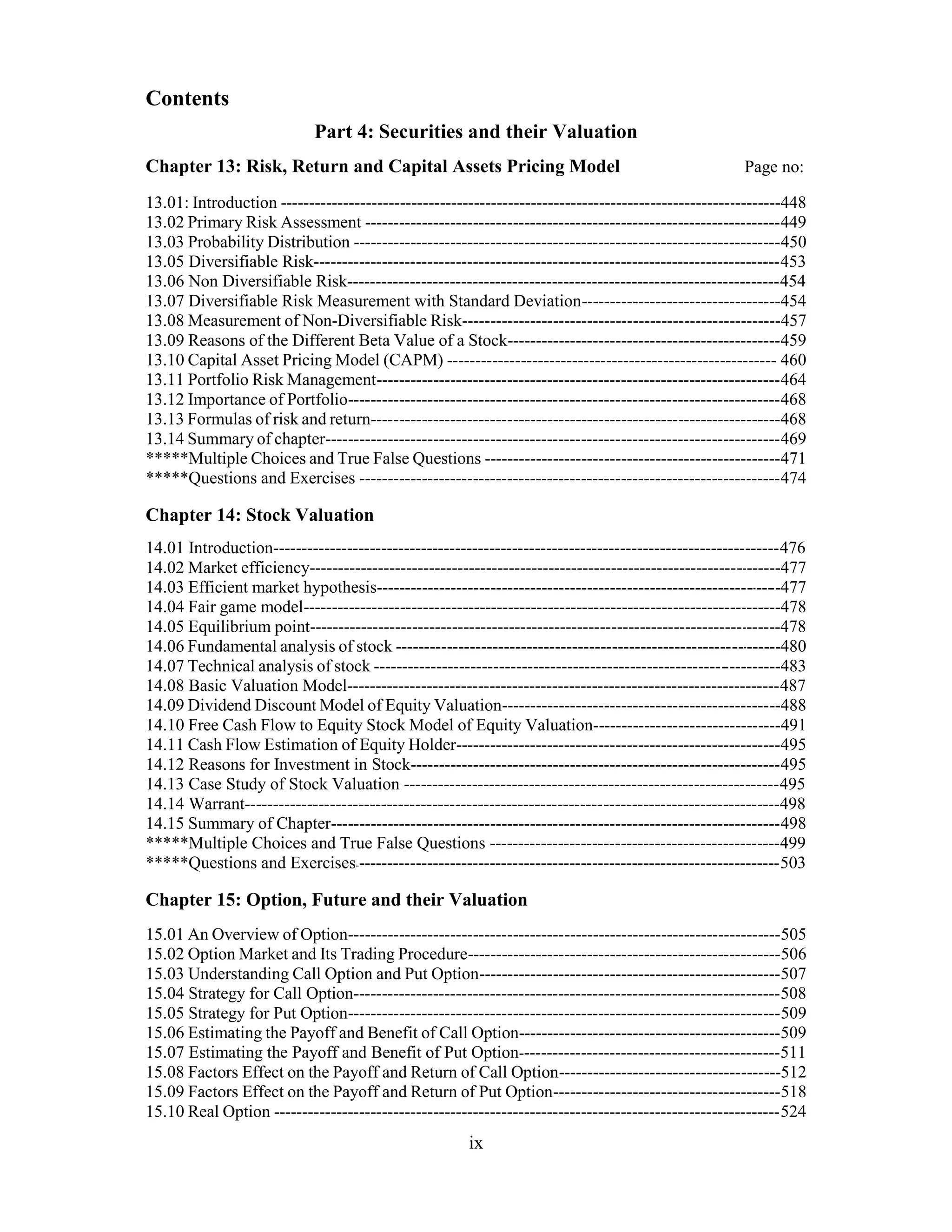

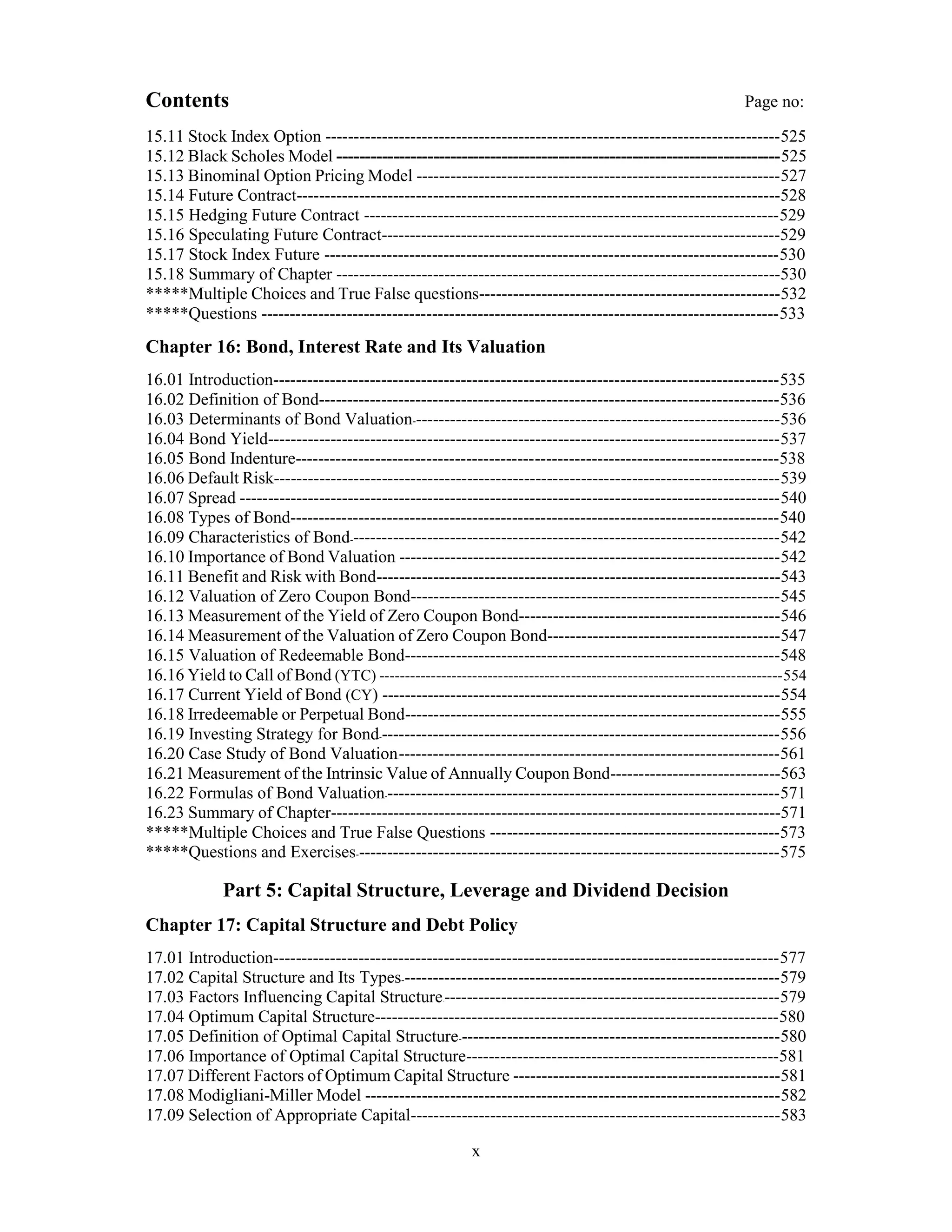

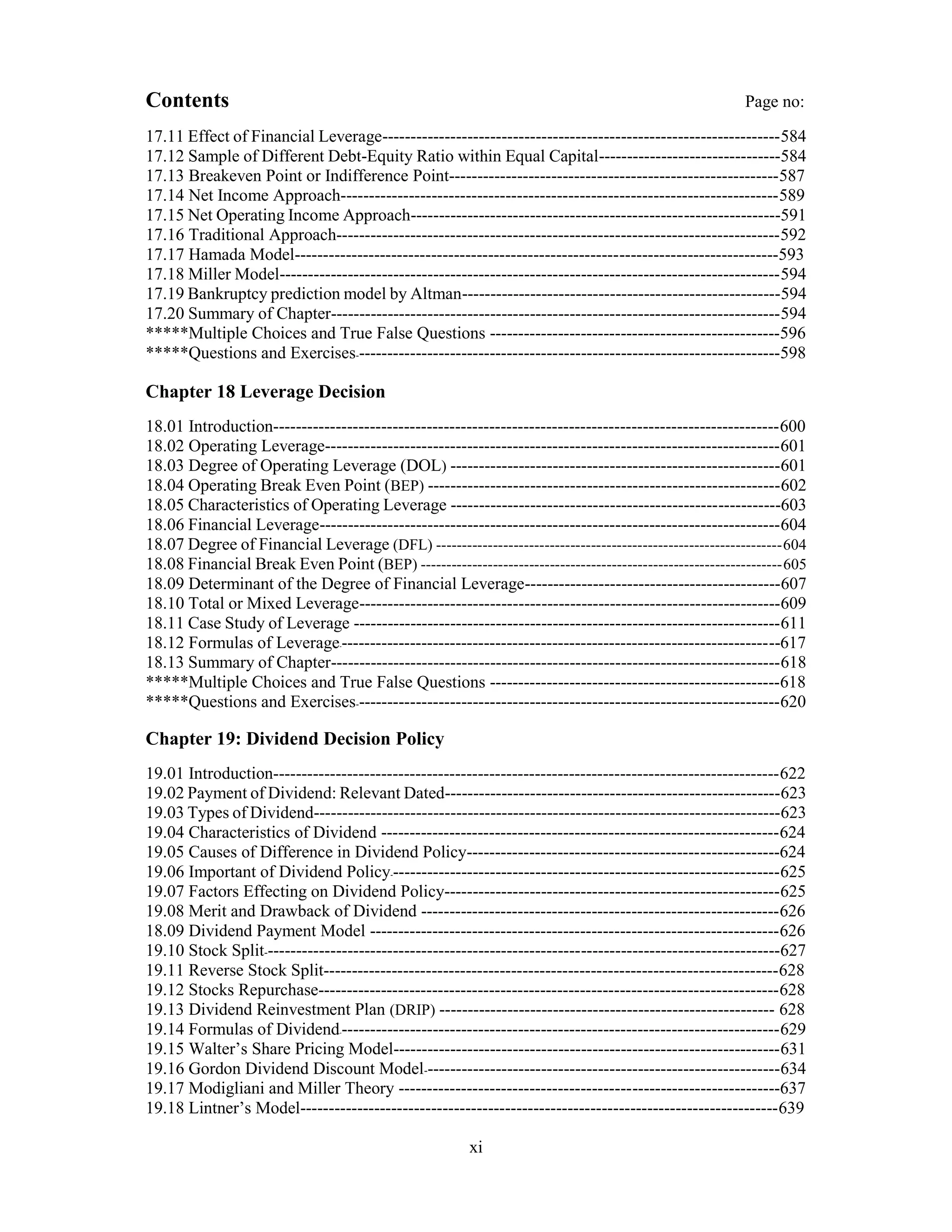

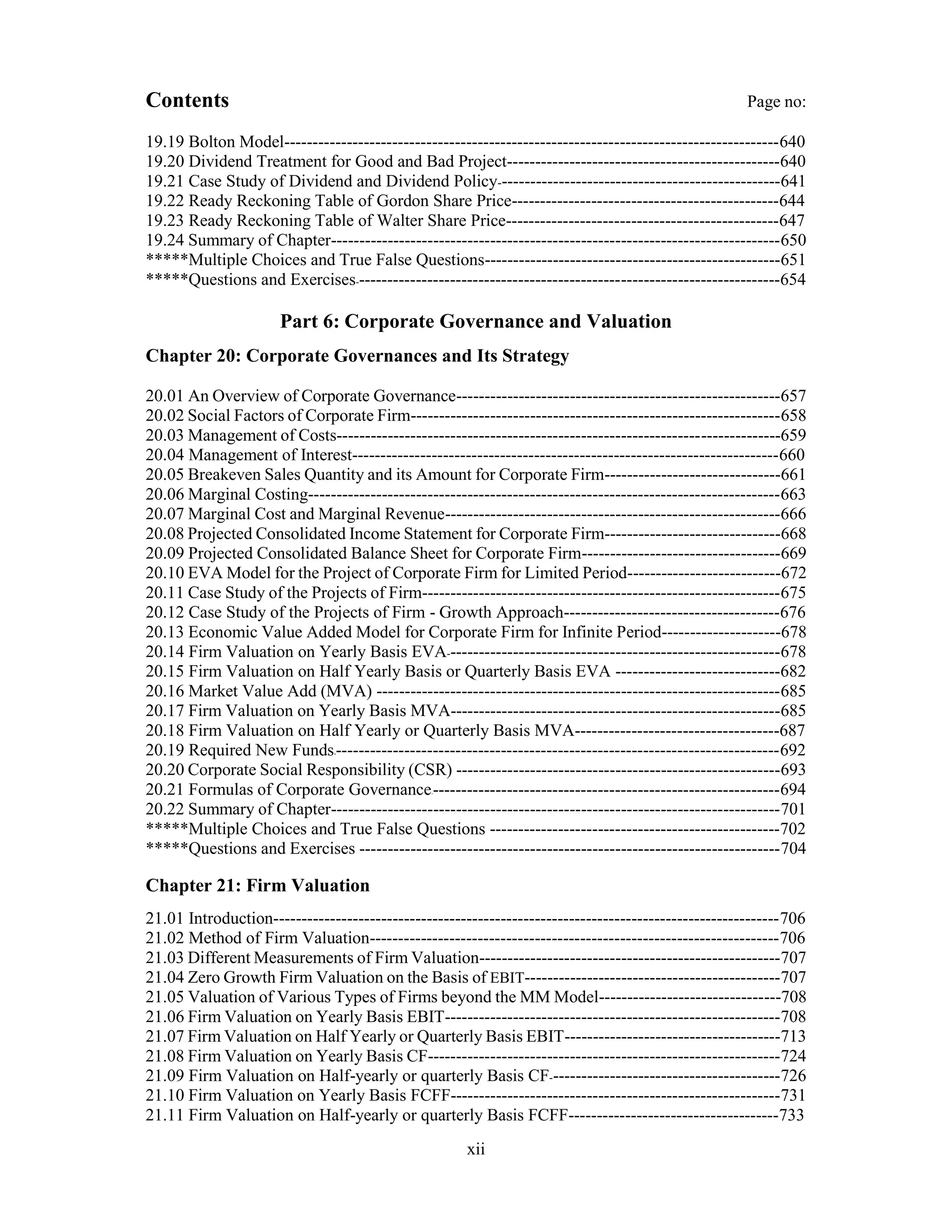

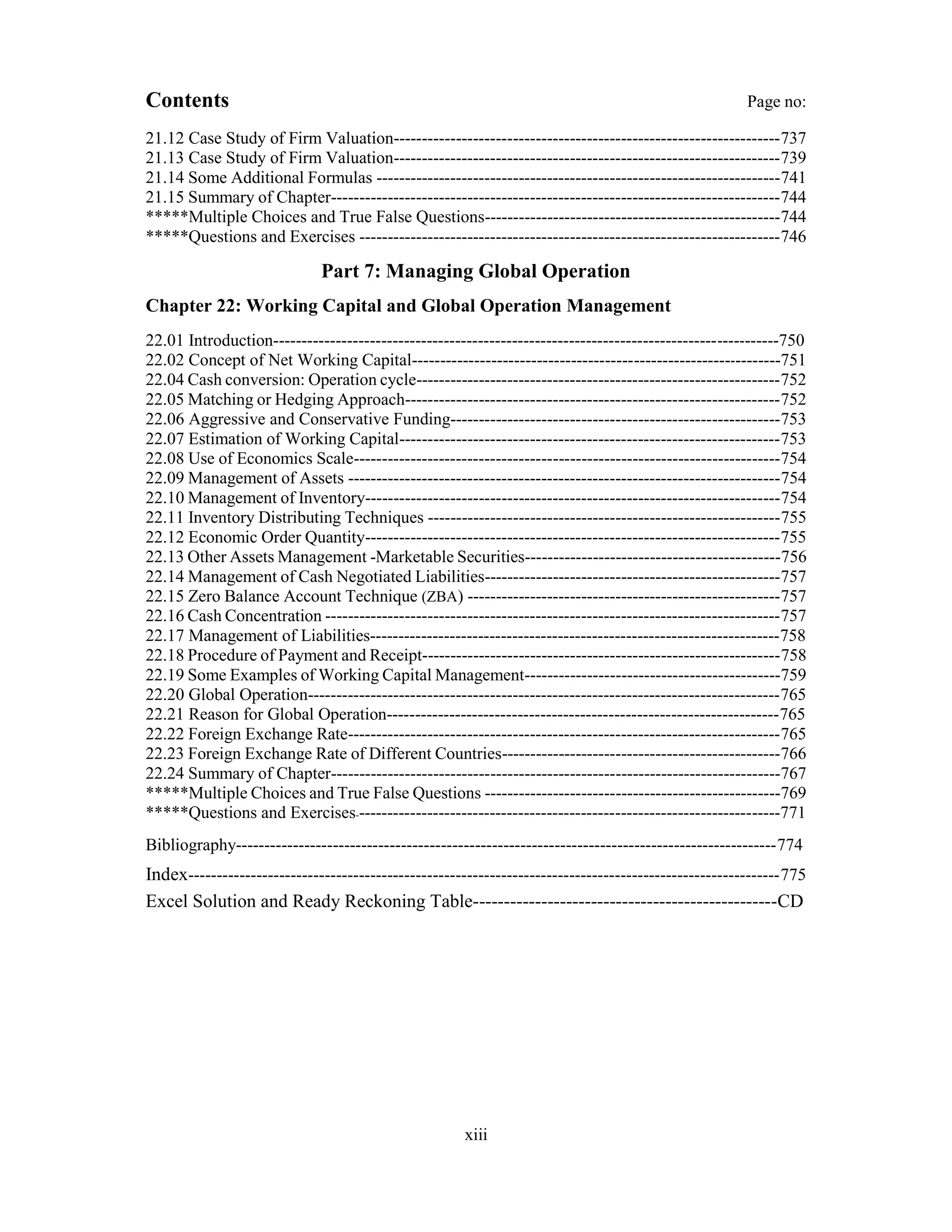

This document contains an overview of 22 chapters across 7 parts on the topic of corporate finance. It covers fundamental concepts, time value of money, project valuation, security valuation, capital structure, corporate governance, and global operations. Some key areas discussed include financial statements, ratio analysis, sources of capital, cost of capital, capital budgeting techniques, risk and return models, stock and bond valuation, and capital structure decisions. The document provides a detailed table of contents outlining the topics covered in each chapter.