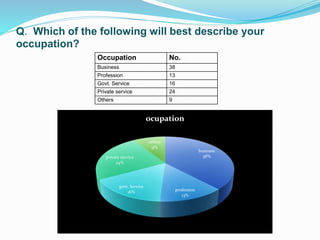

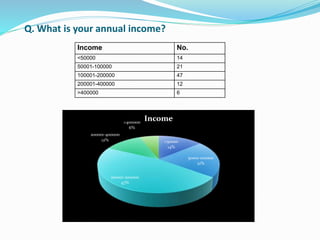

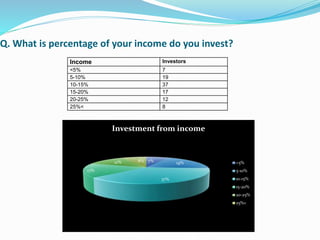

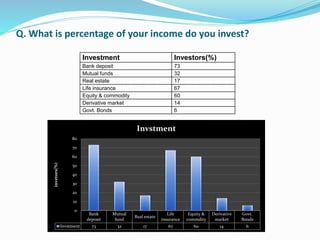

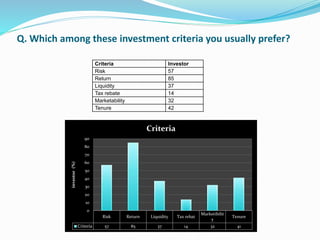

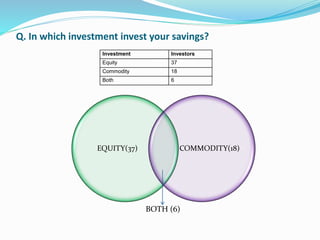

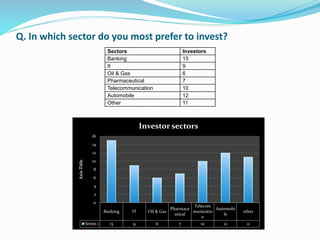

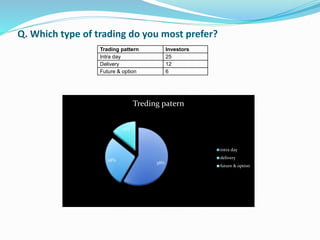

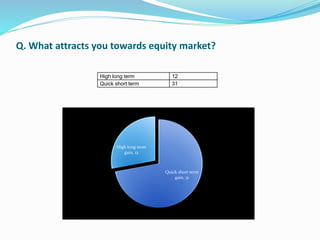

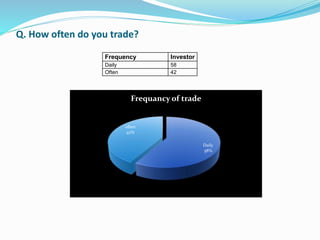

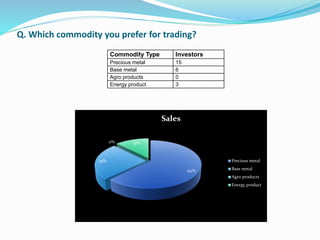

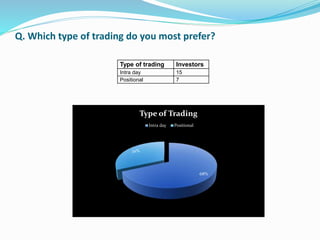

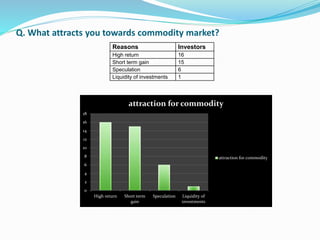

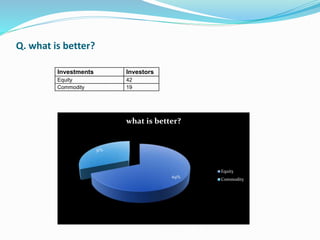

A brokerage firm facilitates buying and selling of financial securities between buyers and sellers. It researches markets to provide recommendations and offers margin loans to approved clients. The document discusses a broking firm established in 1996 that operates in stock and commodity broking. It presents results of a survey of 100 investors that found most prefer investing in equities over commodities on the NSE for long term gains and intraday trading.