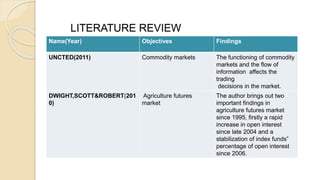

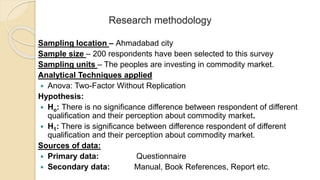

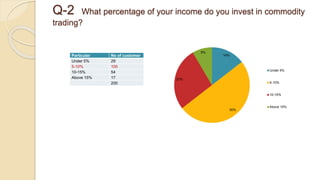

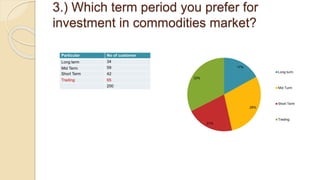

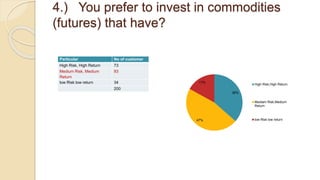

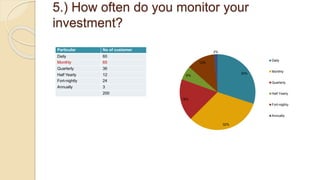

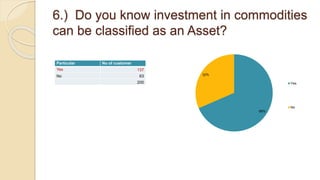

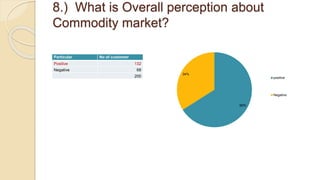

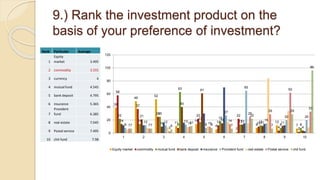

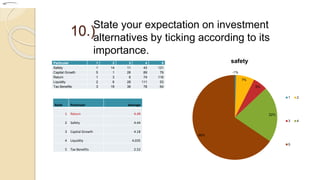

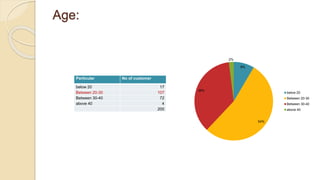

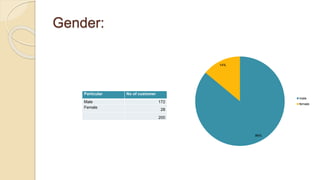

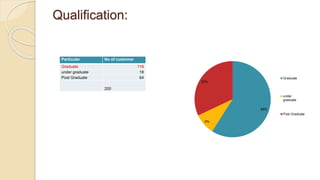

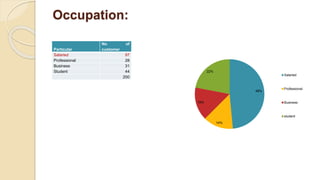

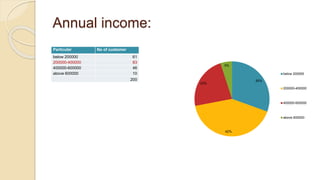

This document is a presentation on a study of the commodity market in Arihant Capital Market Ltd. It includes an introduction to financial markets and commodities. It discusses the objectives of studying customers' perceptions of commodity trading. Research methodology included a survey of 200 respondents in Ahmedabad on their commodity investment habits and preferences. Key findings were that most monitor investments monthly/daily, prefer short-term trading, and invest between Rs. 200,000-400,000 income. Most respondents had a graduate degree. In conclusion, commodity investing provides higher returns than banking but is also higher risk.

![SUMMER PROJECT PRESENTATION

ON

“A STUDY ON Commodity market in Arihant capital

market Ltd.’’

SUBMITTED TO

(Oakbrook Business School)

GUJARAT TECHNOLOGICAL UNIVERSITY

(MBA PROGRAMME)

SUBMITTED BY

Rajdeep Butani [ ENROLLMENT NO.: 148320592004]

Janki Patel [ENROLLMENT NO.: 148320592070]](https://image.slidesharecdn.com/finalppt-151028104318-lva1-app6892/75/commodity-market-1-2048.jpg)