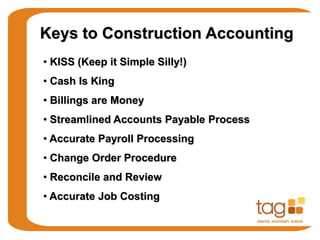

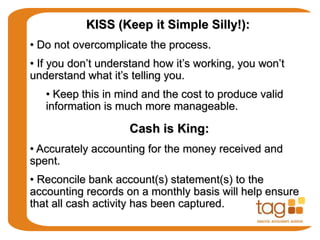

Olivia Roemer from Construction Technology Insider discusses keys to effective construction accounting. TAG provides outsourced accounting, bookkeeping, and CFO services to construction companies to improve efficiency. Some keys include keeping processes simple, ensuring cash flow is accurately tracked, timely billing and accounts payable, accurate job costing through proper payroll and change order tracking, and regular reconciliation and review of financial reports. Accurate accounting provides valuable information for decision making.