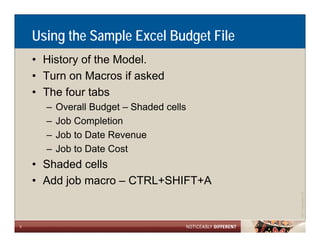

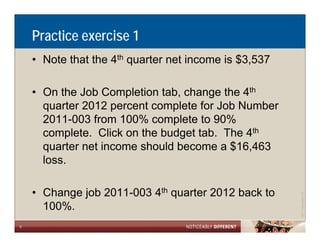

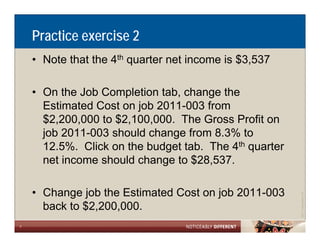

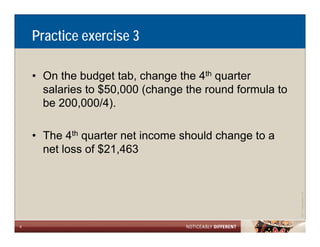

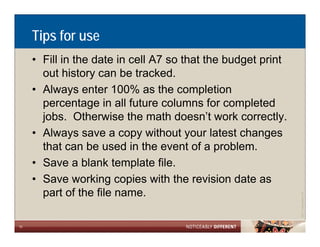

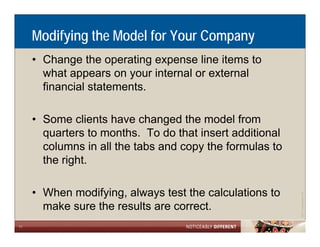

The document is a presentation about creating a working financial plan and budget for a company. It discusses the objectives of creating a budget, key factors that determine profitability like gross profit and overhead, and how to use the sample budget Excel file provided. The presentation demonstrates how to modify data in the sample file and see the impact on financial metrics. It also provides tips for customizing the file template for a company's specific needs.