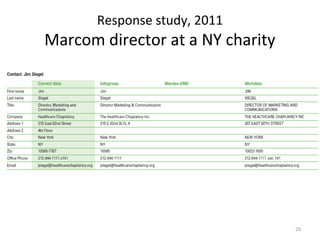

This document provides a comparative analysis of the quality of compiled and response databases used by business marketers, particularly focusing on completeness and accuracy. It outlines the methodologies used in two studies conducted in 2010 and 2011, detailing the participating vendors and the criteria for assessing data quality. The conclusions emphasize the variability in data coverage and accuracy across vendors, recommending thorough investigation and pre-testing of data before use.