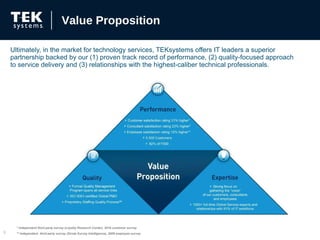

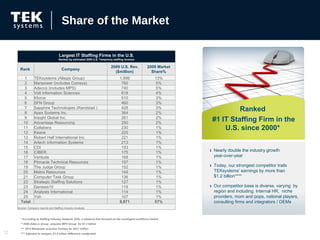

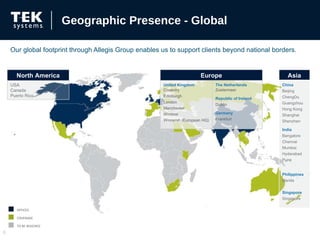

TEKsystems is the largest technology staffing and services company in North America, with $2.3 billion in annual revenue. It has over 26 years of experience in the industry and serves over 82% of Fortune 500 companies. TEKsystems provides a wide range of IT staffing, consulting, and outsourcing services through over 90 offices across the US, Canada, and globally. It has over 70,000 annual placements and maintains high customer, employee, and consultant satisfaction ratings.

![We tailored our value proposition to meet the most pressing needs of our customers. Customer Alignment * Independent third party survey (Loyalty Research Center), 2010 customer survey Rated 37% higher in “maintaining continuous contact throughout engagements” What Customers Say ... What We Offer ... How We Perform * ... Rated 25% higher in “range of service capabilities” Rated 27% higher in “understanding local labor market” Rated 29% higher in “knowledge of my business / company” Rated 22% higher in “quality consultants” Rated 30% higher in “having a tangible screening process” Rated 37% higher in “maintaining continuous contact throughout engagements” Rated 25% higher in “geographic reach” “ Help me onboard, manage and retain high performers.” “ Don’t waste my time with random resumes.” “ Connect me with experts who can help me accomplish my goals.” “ Understand my business and culture.” “ Give me what I need, not what you sell.” “ Be where I am and where I need you.” “ Help me to navigate the hiring complexities in my area.” Breadth of Services Geographic Reach Local Labor Market Expertise Customer Centric Approach Sourcing Expertise Thorough Screening Post-Placement Support [ ]](https://image.slidesharecdn.com/companyoverview-12863890268854-phpapp02/85/Company-Overview-8-320.jpg)