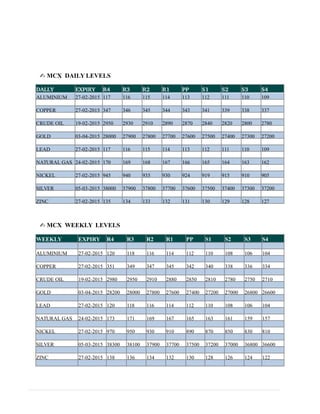

The document provides daily and weekly levels for various commodities on the NCDEX and MCX exchanges, including price points for soybean, mustard seed, and gold, among others. It also reports on economic indicators such as unemployment claims, inflation rates, and natural gas storage in the U.S., alongside market trends influenced by weather conditions and international demand. Additionally, it highlights India's agricultural output forecasts and the implications of adverse weather on crop performance and exports.