Commercial Tenant's Lease Insider Compendium 2016

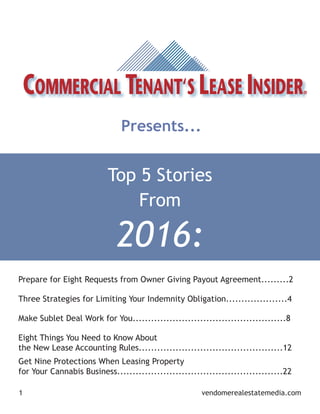

- 1. 2016: Top 5 Stories From 1 vendomerealestatemedia.com Presents... Prepare for Eight Requests from Owner Giving Payout Agreement.........2 Three Strategies for Limiting Your Indemnity Obligation....................4 Make Sublet Deal Work for You..................................................8 Eight Things You Need to Know About the New Lease Accounting Rules...............................................12 Get Nine Protections When Leasing Property for Your Cannabis Business......................................................22

- 2. Prepare for Eight Requests from Owner Giving Payout Agreement Q: My business is located in an area where the local economy hasn’t been doing well. As a result, my sales have been slow—and now I’m dealing with unexpected increases in year-end operating expenses, which are more painful than usual. The center has become a bit neglected and other tenants suspect that the owner is also feeling the financial pinch. Can you suggest a solution that would work for both of us? A: If you’re struggling to pay the rent, chances are, the center’s owner would rather work with you than have to evict you. One option that has consistently worked for both tenants and owners in this situation is the “payout agreement.” Commercial Tenant’s Law Insider Top Stories Know What You’ll Go Up Against 2 vendomerealestatemedia.com Under this type of agreement, you, the tenant, agree to pay the increased operating expenses with scheduled payments over a designated period of time. The agreement outlines the amount and due date of each payment. While the payout agreement has been a successful solution for owners and tenants, owners are not obligated to grant your request for one. Because the owner has the upper hand, it will expect you to agree to its terms. Before deciding whether the payout option is right for you, consider what the owner is likely to want in exchange for granting you a payout agreement. Your owner will probably want you to agree to the following requests: Request #1: Produce financial statements. When you request a payout agreement, the owner will first want to see a copy of your financial statements. Make sure these statements are detailed, accurate, and up to date, as you’re going to have to prove that you need the payout arrangement. Request #2: Put agreement in writing. If the owner grants the request for a payout agreement, it will want the agreement in writing. As a tenant, you might think that an oral agreement is sufficient. But most owners will

- 3. 3 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories disagree because oral agreements tend to turn into expensive, drawn-out disputes that can’t be easily settled in court. Request #3: Acknowledge you have no defenses or claims. The owner will ask you to acknowledge in the agreement that you have no defenses or claims under the lease for not making payout payments. If at some point after the inception of the agreement the owner needs to sue you for nonpayment, it wants to make sure you’ve agreed in writing not to claim that you refused to pay because the owner violated the lease. Request #4: Continue to pay rent. Regardless of the agreement you make, the owner is more than likely going to require you to continue to make regular monthly payments of rent, operating expenses, and other amounts due under your lease. Request #5: Pay accelerated rent for missed payment. To protect itself, the owner will want the right to accelerate the debt for any payments you miss. That means that if you miss a payment, the owner has the right to make all outstanding and future payments become due. Request #6: Concede certain lease rights. When you ask for a payout agreement, a savvy owner might take the opportunity to get you to agree to some concessions. For example, the owner might say, “In exchange for your giving up your right to expand your space, I’ll grant your request for a payout agreement.” Request #7: Apply payments to current charges first. The owner will be adamant that any payments that you make will be applied to your current charges due under the lease, such as operating expenses or rent, and then to the amount you owe under the payout agreement. Request #8: Acknowledge owner’s right to sue. To keep its options open, the owner will want to add a clause in the agreement that preserves its right to sue you for past and future lease defaults, including failure to pay the amount due under the payout agreement. Owners add this clause to prevent tenants that violate the payout agreement from arguing that by entering into the agreement, they’ve waived their right under the lease to sue you for not making the required payments. Commercial Tenant’s Law Insider Top Stories

- 4. 4 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Three Strategies for Limiting Your Indemnity Obligation Virtually every commercial lease includes a provision requiring the tenant to indemnify the owner for damages caused by the tenant and the tenant’s guests. Some indemnity provisions require the tenant to indemnify the owner for damages caused through no fault of the tenant. Many owners are reluctant to compromise when it comes to indemnity, but an overly broad indemnity provision can lead to significant exposure for a commercial tenant. The Colorado Supreme Court’s 2011 decision in Constable v. Northglenn, LLC illustrates why careful attention must be paid to the precise language used in an indemnity provision. In Constable a shopping center owner was named as a defendant in a lawsuit filed by a woman who slipped on ice in the shopping center’s parking lot. The shopping center owner sought indemnity from a tenant who operated a flower shop in the shopping center because the woman was at the shopping center to visit the tenant’s business. The owner relied on the following provision in its lease: “Tenant agrees to exonerate, hold harmless, protect and indemnity [sic] Landlord from and against any and all losses, damages, liability, claims, suits or actions, judgments, costs and expenses which may arise as a result of any bodily injury, personal injury, loss of life or property damage sustained during the term of this lease by any person or entity ... in the Premises, or elsewhere in the Center if present in order to visit the Premises, or as a result of Tenant’s business....” Both the lease and Colorado law required the owner to maintain the parking lot. The tenant argued the indemnity provision was unenforceable because it purported to require it to indemnify the owner against liability for its own negligence. The Colorado Supreme Court disagreed, and held the lease reflected the parties’ mutual intent that the tenant indemnify the owner for injuries sustained in the community areas by her customers, whether or not the owner exercised exclusive control over those areas and whether or not those injuries resulted from the owner’s own negligence. According to the Colorado Supreme Court, “…an agreement purporting to indemnify a party against liability for its own negligence will be enforced as written as long as it contains a clear and unequivocal expression that the parties intended that result.” By Alan M. Cohen, Esq. Commercial Tenant’s Law Insider Top Stories

- 5. Assisted Housing Management Insider Top Stories Compendium 5 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Thus, even though the shopper’s injuries may have resulted from the owner’s failure to comply with its obligation to maintain the parking lot, the tenant was obligated to indemnify the owner with respect to the shopper’s damages. The outcome of Constable may have been different had the lease been governed by the law of a state other than Colorado. For instance, under New York law any lease provision that purports to exempt an owner from liability for its own acts of negligence is void and unenforceable. Because state laws vary with respect to indemnity, careful attention should be paid to the precise language used in the lease. Consider using the following three strategies to mitigate the risks associated with most indemnity agreements included in owner lease forms. Strategy #1: Never Agree to Indemnify Owner for Damages Caused Through Its Fault Many indemnity provisions include an express obligation on the part of the tenant to indemnify the owner for damages caused by the owner’s fault. Any language that explicitly requires the tenant to indemnify the owner for damages caused by the owner’s negligence, gross negligence, or intentional misconduct should be deleted. In Constable, even though the Colorado Supreme Court held that an agreement whereby one party agrees to indemnify another for its own negligence is enforceable, the court recognized that an agreement whereby one party indemnifies another for its own intentional or wrongful acts is unenforceable. Nevertheless, a tenant should never accept language requiring it to indemnify the owner for damages caused by the owner’s own acts or omissions, whether negligent, grossly negligent, or intentional. Instead, your indemnity provision, like our Model Lease Clause: Draft Airtight Indemnity Clause, should explicitly state that under no circumstances will you be obligated to indemnify any party to the extent that the injury, loss, or damage was caused by the negligence or willful misconduct of that party. Although certain states will not enforce an agreement whereby one party agrees to indemnify another for its own negligent or intentional misconduct, it’s always better to address the issue in the lease than to rely on state law. Most reasonable owners, when presented with a controlling anti-indemnity statute or judicial opinion, will concede and delete any requirement inconsistent with state law. Commercial Tenant’s Law Insider Top Stories

- 6. Assisted Housing Management Insider Top Stories Compendium 6 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesAssisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Strategy #2: Limit Indemnity to Your Proportionate Fault Owners frequently seek broad indemnity with respect to any injuries or damages in any way attributable to a tenant or the lease, no matter how attenuated the connection between the tenant and the loss. A tenant’s indemnity obligation should be limited “to the extent” of the tenant’s negligent or intentional misconduct. The insertion of the words “to the extent” is critical because it introduces the concept of proportionate responsibility or comparative fault to an indemnity provision, if used properly, as in our Model Lease Clause. In other words, to the extent damages are caused by your conduct, you are responsible, but to the extent damages are caused by the conduct of a party other than you, you should owe no indemnity. Under many leases the indemnity obligation is not tied to conduct, but rather to the lease itself, or to the tenant’s occupancy of the leased premises. Every effort should be made to tie your indemnity obligation to your negligent or intentional misconduct, but even if you must agree to indemnify the owner against risks arising from the lease or your occupancy, insertion of the words “to the extent” can narrow the scope of the indemnity agreement. By limiting your indemnity obligation “to the extent” of damages arising from the lease or your occupancy, you disclaim responsibility for damages arising from something other than the lease, such as the owner’s failure to maintain the building’s parking lot. Damages and injuries occurring during a lease often result from more than one cause. It is reasonable to require a tenant to indemnify an owner with respect to losses that are the fault of the tenant, but if losses result from the fault of the tenant and the fault of the owner, the tenant’s indemnity obligation should be limited to the tenant’s percentage of fault. Commercial Tenant’s Law Insider Top Stories

- 7. 7 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Strategy #3: Delete Any Duty to Defend Many indemnity provisions require the tenant not only to indemnify the owner, but also to defend the owner against any claims for which the tenant owes an indemnity obligation. The duty to defend generally obligates the tenant to pay to defend the owner against claims made against it that fit within the scope of the indemnity set forth in the lease. That said, the duty to defend is generally broader than the duty to indemnify because the duty to defend generally is triggered by allegations alone. A duty to defend may be owed with respect to a claim in which no damages are ultimately awarded. So even though a claim against an owner may be completely frivolous, if the tenant agreed to defend the owner against the claim, the tenant might be obligated to hire an attorney to defend the owner at the tenant’s expense. If the claim ultimately is dismissed, no indemnity will be owed by the tenant to the owner, but the expenses of defending the lawsuit against the owner may be the tenant’s responsibility. In many instances the expenses of defending a lawsuit, which typically include attorneys’ fees, expert witness fees, deposition expenses, and court costs, far exceed the actual amount in controversy. If both the tenant and owner were named as defendants in the lawsuit, the tenant might be required to pay for two lawyers, one to defend it, and one to defend the owner. Accordingly, you should delete any duty to defend from the general indemnity provisions in your lease. In the absence of a duty to defend you still may be liable for the owner’s legal costs and fees if you owe indemnity and the underlying claim has merit, but deleting the duty to defend should limit your obligation to only those claims found to have merit. Incorporate Three Strategies in Clause Much like insurance policies, contractual indemnity provisions transfer risk. An overly broad indemnity provision could require you to insure the owner against damages resulting from the owner’s fault. Thus, efforts should be made to limit your indemnity obligation to damages resulting from your negligence or intentional misconduct, and to delete any requirement that Commercial Tenant’s Law Insider Top Stories

- 8. 8 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top Stories Alan M. Cohen, Esq. is in-house counsel for URS Corporation in its Austin, Texas, office. His practice focuses on real estate, construction, and government contracts. He is admitted to practice law in Texas and Louisiana, and is an Insider board member. About the Author Commercial Lease Law Insider Top Stories you defend the owner against any claims. If the defense obligation cannot be deleted entirely, the duty to defend should be limited to those claims resulting from your negligent or intentional misconduct. Make Sublet Deal Work for You Subletting your space can be a good option under a variety of circumstances: A better location for your business has popped up before your current lease will come to an end; your sales are suffering and you need to downsize; or your business model is shifting from a retail storefront to primarily online sales. Your lease provisions regarding subletting will determine if and how you can sublet. And you’ll want to be sure that the arrangement with the replacement business for your space doesn’t conflict with your rights and responsibilities to the shopping center’s owner. Here’s what savvy tenants need to know before negotiating and then exercising their sublet rights. Understand Transformation Some tenants, and especially those running a business for the first time, don’t fully understand how a sublet works. Once you understand the nature of the new relationship, you’ll be able to navigate it successfully. Subletting puts you in the role of a landlord—a “sublandlord”—but at the same time that doesn’t mean you can set aside your obligations as a tenant, with respect to the subleased space. Your arrangement is now among three parties with varied interests. Because each party has obligations and rights, each will want protections. Commercial Tenant’s Law Insider Top Stories

- 9. 9 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Ensure that Permission Is Possible Before making plans to sublet, the very first thing you should do is check your lease with the owner to ensure that you have the right to sublet at all. Depending on the terms of the “master lease,” the owner might require prior notice or consent, or may have the right to recapture that space—that is, take it back. But what if the master lease says nothing about subletting? If the lease is silent on the subject, you can assume that you can sublet without owner consent. However, you should always notify the owner of your intent to sublet, even if the lease says nothing on the subject. If you anticipate that there could be a problem, be proactive in communicating your plans to prevent unexpected conflicts down the road and unfulfilled promises to a prospective new tenant that thought it would be able to use the space. Remember that your subtenant will want your owner to know, for its own practical purposes. If you, as the tenant, default on your lease, your subtenant may want the right to cure your default or protect its interest under the sublease even though there is no relationship directly between the subtenant and your owner. Don’t Assume Rent Profit The issue of rent when subletting can be complex, and you should be prepared to negotiate with the subtenant. The subtenant could suggest paying a rent rate that’s lower than yours if it doesn’t have as many rights as you have in the master lease. In addition to any rent issues you’ll have with the subtenant, the language of the master lease also can affect rent. If you’re subletting in part because you think you’ll make a profit, don’t let that be a deciding factor. That’s because often an owner won’t let you make money on subletting its space. If what you collect in rent is in excess of what you already pay in rent, you may be bound to give all or a percentage of that excess to the owner. Commercial Tenant’s Law Insider Top Stories

- 10. 10 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Protect Your Right to Remedies Typically a sublandlord wants to retain a self-help right. If the subtenant defaults on the sublease and doesn’t cure the problem, the self-help right allows the sublandlord to do what needs to be done. It also gives the sublandlord the right to be compensated for doing what the subtenant should have done. Common remedies for such a situation give the sublandlord the option to terminate the sublease, enter and repossess the space, and sue the subtenant for damages. These are the same kinds of remedies the owner would seek from you as the original tenant should you default on your lease obligations. Ensure Other Rights as Landlord In your sublease, you should ensure that you have the same rights and remedies that the master lease gives the owner. If your subtenant causes a problem, the owner is likely to expect you to handle and remedy the problem. Tenants sometimes look for a release from the owner for such obligations, but rarely get it. So be cautious in this scenario—you don’t want to be liable, in the subtenant’s view, for things the owner should have done. For example, you’ve paid your pro rata share of common utilities, but the owner has failed to pay and utility service is cut off. Your subtenant would probably look to you to remedy the situation. So don’t put yourself in a position where your subtenant would have a claim against you for providing services that the owner is required to provide. Instead make sure that your sublease is clear that your aren’t liable to the subtenant for things that are the owner’s obligations. Some things, if not spelled out in a lease, are nonetheless legally implied obligations for a landlord, such as maintaining a habitable space. This implied warranty could include providing utility service for which tenants have paid. Commercial Tenant’s Law Insider Top Stories

- 11. 11 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Correlate Expiration Dates Be sure the term of the sublease expires with, or earlier than, the term of the master lease. The sublease should be written so that it automatically terminates in the event your lease terminates. If you go bankrupt, for example, you don’t want a situation where your subtenant files a claim against you, saying you owe him for the loss of the sublet space. Seek Pre-Approval for Modifications The earlier you know what improvements or modifications (if any) your subtenant wants to make to the space, the better. Your master lease most likely addresses the issue of space modifications, and your subtenant’s plans will be bound by the master lease requirements. Any plans for interior construction or design will be subject to any pre- approval requirements of your master lease. It’s best to work this out in advance and attach the general design sketches or specifications directly to the sublease. Practical Pointer: Don’t forget to address the issue of signage. Expect the owner to have a say in this. Signage is most likely addressed in the master lease. It may say that you, as the tenant, get a sign based on the square footage of your leased space. Your subtenant may want to and expect to be able to put up signage. That’s something you’ll need to agree upon and clear with the owner and then make clear to the subtenant. Create Identical Sublease Make sure that your sublease says the subtenant is bound by all the terms of the master lease as it relates to the subleased space. Be sure to cover: • Maintenance; • Pro rata share of common expenses, such as utilities and janitorial services; and • Reconstruction or removal of improvements at the term’s end. Commercial Tenant’s Law Insider Top Stories

- 12. 12 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories All the provisions related to you as a tenant should apply to your subtenant and be spelled out in the sublease. The biggest mistake in subletting is that the sublease doesn’t mirror the provisions of the master lease. In order to have a good sublease, you have to do a full review and have a full understanding of the master lease. Be aware that you can add any other control you want as a sublandlord, like having the right to approve space modifications along with your owner’s approval. Just be sure the sublease specifies the items that are sticking points for you. While you can negotiate provisions with the subtenant, if the sublease terms are not aligned with the master lease, both you and your subtenant could cause a default under your original lease. Eight Things You Need to Know About the New Lease Accounting Rules You don’t need us to tell you that big changes in lease accounting rules are afoot. And if you’re looking for technical analysis of the new rules, you’ll find tons of it online. The problem is that without an accounting background, you’ll have a hard time digesting it. And what you won’t find on the Internet is a plain English explanation for non-accountants. So we decided to create one. Here are the eight things that tenants of commercial real estate need to know about the proposed new accounting rules and their impact on leasing. Create Identical Sublease 1. What’s at Stake Accounting rules require companies to keep two basic financial statements: • A balance sheet listing assets and liabilities showing what the company owns and owes, with recorded assets equaling, or “balancing,” recorded liabilities plus equity; and • An income statement (a.k.a. P&L) listing the company’s revenues and expenses, which makes it possible to calculate the company’s profits and losses. Commercial Tenant’s Law Insider Top Stories

- 13. 13 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories These financial statements aren’t just a technical exercise in bean counting. They directly affect a company’s ability to attract investors and get bank loans, and even affect how much it pays in taxes. Commercial Lease Law Insider Top Stories 2. How Current Lease Accounting Rules Work A lease is one of the transactions that a company must account for on its financial statements. How the company does that depends on the kind of lease. There are two possibilities: Operating leases are transactions in which the owner (a.k.a. “lessor”) gives the tenant (a.k.a. “lessee”) a right to use land or another asset. The tenant doesn’t own the asset and must return it to the owner after the lease ends. Most standard commercial real estate leases are operating leases. Capital leases are essentially purchases in which the tenant acquires an ownership interest in the leased asset. Examples include leases that transfer ownership of the property to the tenant at term’s end, give the tenant an option to purchase the property at less than its fair value and/or last for as long as the asset’s remaining economic life. Accounting-wise, the most important difference between the two kinds of leases is that tenants aren’t required to record operating leases on their balance sheet. The chart below summarizes the rules: Commercial Tenant’s Law Insider Top Stories

- 14. 14 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Notes: (1) Rent income/expense is shown as a straight line even though most leases provide for higher rent over each year of the lease. Capital leases are treated like purchases in which the tenant acquires an ownership interest that’s recognized on the balance sheet and P&L. Summary: 3. Why the Rules Are Changing The new accounting rules propose to change how leases must be recorded on the balance sheet and P&L. The biggest change: elimination of the rule that tenants don’t have to list operating leases on their balance sheet. From now on, all leases will have to be shown on the balance sheet. Explanation: The point of accounting rules and financial statements is ensuring that investors, banks, regulators, and other stakeholders in the financial system get the information they need to make sound judgments about a company’s financial condition. The boards that make the accounting Commercial Tenant’s Law Insider Top Stories

- 15. 15 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories standards [like the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB)] felt that letting tenants keep operating leases off their balance sheets was creating too big a blind spot in the system. According to one government report, off-balance sheet leasing commitments total approximately $1.25 trillion—and that’s only among publicly registered companies. 4. When the New Rules Will Take Effect FASB and IASB are still working on the rules (which are contained in a 343- page document called the “Revised Exposure Draft,” published on May 16, 2013). And experts say the rules probably won’t take effect until Jan. 1, 2017, at the earliest. That sounds like a long time. But like objects in the passenger-side rearview mirror, 2017 is closer than it appears. For one thing, there’ll be no “grandfathering” of existing leases. All leases will have to be accounted for in accordance with the new rules on the effective date no matter when they were signed or took effect. Result: Owners and tenants will have to revise their balance sheet and P&L before the rules actually take effect so they comply on day one of the new regime. And if your company is required to provide a three-year comparison in its financial statements, once the final rules come out, you’ll have to revise your 2015 and 2016 financial statements. 5. The Four Things You’ll Have to Do to Comply Under the proposed rules, companies will have to record all leases longer than 12 months on their balance sheet and follow new rules for calculating and recording leases on their financial statements. Compliance will be a four-step process: Step 1: Determine if your lease is covered. Remember that the rules apply only to leases that last 12 months or more. Most commercial real estate leases will satisfy the 12-month rule, explains Indianapolis CPA Ron Smith, including leases of less than 12 months: • That give the tenant an option to renew the lease or purchase the property; and • Where the tenant is “reasonably certain” to exercise the option in light of all the economic factors. Commercial Tenant’s Law Insider Top Stories

- 16. 16 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Step 2: Classify the lease as Type A or B. Once you determine that the lease is covered, you must figure out what type of lease it is. “Operating” and “capital leases” are going away. Under the new rules, leases will be classified as either: • Type A leases, which are effectively a sale or financing; or • • Type B leases, which are essentially the same as operating leases under the current rules. Smith’s recommendation: In making the classification, tenants should ask this question: Is the lease effectively an installment purchase of the property? If so, the lease is a Type A; if not, the lease is a Type B. • Rule of thumb: Office building, retail, and other standard commercial real estate leases classified as operating leases under current rules are likely to be Type B leases under the new rules; leases currently classified as capital leases are likely to be Type A leases. Step 3: Properly account for the lease on your balance sheet. You must record Type A and B leases on the balance sheet—both at inception and on a subsequent basis in response to significant economic changes: First Phase: Initial Recognition. To recognize a Type A or B lease when the lease begins, list: 1. A new asset representing the value of your right to use the property (ROU asset). Formula: The ROU asset’s value is the present value (that is, a dollar value that’s discounted to reflect the fact that a dollar in the future is worth less than a dollar right now) of future lease payments over the lease term. Include your initial direct costs in relation to the ROU asset, Smith advises. Also make sure you know what future lease payments do and don’t count: Commercial Tenant’s Law Insider Top Stories

- 17. 17 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Notes (1) Residual value guarantees are amounts the tenant promises to pay the owner at the end of the lease to protect the owner against excessive depreciation of the property over the lease term. Once you total up future lease payments, discount them to get their present value. The discount rate is the rate your owner charges its tenants. If you can’t determine that rate, use your incremental borrowing rate—that is, the interest rate you’d have to pay to borrow an asset of similar value to the ROU asset. If your company is a nonpublic entity, you can make an election to use the risk-free rate as your discount rate, Smith adds. 2. A lease liability. Formula: Remember that under accounting rules, the value of the liability must be the same as the corresponding asset. You must present your Type A and Type B lease ROU assets and liabilities as separate line items on your balance sheet or in the notes to your balance sheet. Second Phase: Reassessment. Over the course of the lease, you’ll have to reassess the value of lease payments you reported as well as the discount rate you used to calculate their present value to reflect lease modifications and other important changes affecting: • The term of the lease caused by a significant event or change in circumstances that are within your control; • Variable lease payments based on an index or rate to the extent you decide to re-measure the ROU liability for other reasons; and/or • The discount rate you used to calculate the ROU asset in response to changes in the lease term or your option to purchase the property. Step 4: Properly account for lease expenses on your P&L. As under current rules, you’ll have to account for all lease-related expenses on your Commercial Tenant’s Law Insider Top Stories

- 18. 18 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories P&L. You must recognize two lease-related expenses on the P&L: • Amortization of the ROU asset—that is, the amount by which the asset’s value is reduced as it’s consumed over the lease term. The ROU asset is amortized on a straight-line basis over the term of the lease. For example, an ROU asset recorded at $1 million for a 10-year lease is amortized at $100,000 per year; and • Interest expense related to the lease liability. While the lease-related expenses are the same for both types of leases, there are important differences in the method you use to recognize them on the P&L: • Type B lease: Combine the amortization and interest on a Type B lease into a single lease expense that you recognize on a straight-line basis over the course of the lease. • Type A lease: Treat amortization and interest on a Type A lease as separate costs. That’s a big deal because while amortization costs are straight-line, interest expenses are higher in the early years of the lease and decrease over time. The result of this “front-loading” is that you’ll have to recognize significant interest costs on your P&L when you enter into a Type A lease. Those added P&L expenses could affect your paper profitability and harm your standing with investors and creditors. Click here for a visual comparison of the impact of the different expense recognition rules for Type A and B leases over a 10-year lease term. 6. How the New Rules Will Affect You The P&L accounting rules for Type A lease expenses are like the current rules for capital leases (although Type A leases are defined more broadly than capital leases under current rules and may sweep in some leases that are today classified as operating leases). But the real impact of the new rules is that you will no longer be able to keep leases off your balance sheet by structuring them as operating leases. The scary part of the new rules isn’t just that you have to list leases on the balance sheet, it’s how you have to do that. You must record your total lease payment obligations over the course of the lease as an up- front liability at the start of the lease. And that’s not chump change: Total payments due under a commercial lease can run into six, seven, and eight figures. Commercial Tenant’s Law Insider Top Stories

- 19. 19 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Adding a massive new liability to the balance sheet each time you enter into a lease may do at least some harm to your company’s financial position. The more leases you make, the more your financial statements and ratios will suffer, and the harder it will be to lure new investment and loans. The added liabilities may even cause you to default on your current loans. Consider the following example: Example of Proposed New Rules’ Impact on Existing Bank Loans Tenant leases 15,000 square feet of retail space for seven years for $32 per square foot on a triple net basis for total rent of $3.36 million. Tenant’s bank loan agreement requires tenant to have a debt-to-equity ratio of below 1.0:1.0. Before entering the lease, tenant has total debt of $5 million and total equity of $7 million, for a ratio of 0.71:1. Current Rules: Tenant doesn’t have to list the lease on its balance sheet, so its ratio remains at 0.71:1. Proposed New Rules: Tenant must record the new lease on its balance sheet at the start of the lease by listing an asset (right to occupy the space) of $3.36 million and a corresponding liability (total rent due) of $3.36 million, and reduce them both over the lease term. (For simplicity, the total lease payments will be used and not the net present value of the total lease payments.) Result: At lease start, assets and liabilities increase by $3.36 million. So the tenant’s liabilities are now $8.36 million. (There’s no change to equity). This changes the tenant’s ratio to 1.19:1. By going above 1.0:1.0, the tenant is in default under the loan. Commercial Tenant’s Law Insider Top Stories

- 20. 20 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories 7. Why Shorter Term Leases May Not Be the Best Answer It’s imperative that you factor the new balance sheet reporting requirements into your lease negotiations. You need to consider whether the lease you’re negotiating is a Type A or Type B and how the lease’s economic terms will be reflected as assets, liabilities, revenues, and costs on your financial statements. One possibility is to negotiate for shorter lease terms and renewal options. After all, the shorter the lease term, the smaller the ROU asset and future lease payment liability you’ll have to initially recognize on your balance sheet at the start of the lease. Caveat: The short-term lease strategy won’t work for all tenants. You shouldn’t use it if significant construction is planned for the space since any reductions in the ROU asset are likely to be wiped out by higher amortization costs over the initial lease term. Explanation: Regardless of who pays them, construction costs must be amortized over the lease. The shorter the lease, the higher the amortization rate (for example, $10,000 is amortized at $2,000 per year in a five-year lease and $5,000 per year in a two-year lease). Getting a renewal option to extend the amortization period won’t solve the problem. That’s because extending the amortization period gives you “a significant economic incentive” (see the chart on counting future lease expenses above) to exercise the option. Result: You have to count future lease payments during the renewal period in calculating the ROU asset. In essence, the renewal option plus incentive to exercise turns the lease into a longer term lease, effectively undoing the short-term lease strategy. And, of course, there’s more to leasing than accounting. Thus, if you’re in retail or another business where staying in one location is crucial, minimizing the ROU asset may be less significant than the stability of a long- term lease. 8. Four Leasing Strategies You Can Use to Protect Your Company Leasing strategies for tenants that do make sense in a balance-sheet reporting world include: Commercial Tenant’s Law Insider Top Stories

- 21. 21 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Strategy 1: Shift costs to non-reportable expenses. Remember that the value of the ROU asset recognized on the balance sheet is the present value of future lease payments, including fixed rent, variable lease payments pegged to an index or rate, and residual value guarantee payments. Result: You can reduce the value of the ROU asset by shifting payment obligations to payments that don’t count, like variable payments based on sales, performance, or usage of the asset such as CAM, and other operational expenses. Strategy 2: Make leases triple net. One of the best ways to shift future lease payments to non-reportable operating costs is via a triple net lease in which you agree to pay fixed rent and a pro rata share of CAM, insurance, and taxes. You also want to make sure that operating cost payments are based on actual costs rather than adjustments against a base year since lease payments become reportable when they’re tied to an index or rate. Strategy 3: Make owner commit to financial transparency. Remember that new rules require you—and the owner—not only to recognize the initial value of the ROU asset but reassess it to reflect significant economic changes. So require the owner to: • Monitor the relevant variables, such as the index or rate to which a particular lease payment is pegged; • Notify you of changes; and • Provide the data you need to make your own reassessments. Strategy 4: Structure leases as Type B, not Type A. Although both types of leases must be recognized on the balance sheet in the form of the bloated ROU asset, the P&L recognition rules for Type Bs are kinder and gentler because they let you combine amortization and interest expense as a single lease cost on a straight-line basis. So structuring leases as Type Bs enables you to avoid the dreaded front-loaded, downhill interest expense slope that must be shown on the Type A P&L. Commercial Tenant’s Law Insider Top Stories

- 22. 22 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Glenn S. Demby is a corporate attorney and award-winning legal journalist who specializes in explaining the law in plain English and helping business leaders overcome their regulatory challenges. He can be contacted at glennsdemby@gmail.com. Insider Source Ron Smith, CPA: Partner, Katz, Sapper & Miller, 800 East 96 St., Ste. 500, Indianapolis, IN 46240, rsmith@ksmcpa.com Get Nine Protections When Leasing Property for Your Cannabis Business Finally found an owner willing to lease commercial property to your legal cannabis business? Congratulations! But while securing a lease is a major accomplishment, you still have work to do. Now you have to negotiate the terms of the lease. If your owner doesn’t have a lot of experience leasing to cannabis businesses, it will probably ask you to sign the same standard form commercial lease it uses with its other tenants. Don’t do it! You’re not like the owner’s other tenants, and you can’t use the same lease they do. As a purveyor of cannabis, your business poses unique legal challenges, and you need special lease provisions to deal with them. So, you need to get your owner to revise the boilerplate lease to make it work for cannabis. Here’s how. By Glenn S. Demby, Esq. Context: The Contradictory & Confusing Cannabis Laws Never for an instant forget that your owner is taking enormous legal risks by leasing to you. Cannabis laws are complex and incredibly confusing. Here’s a quick rundown of the key facts you need to appreciate when leasing commercial property for your cannabis business. Commercial Tenant’s Law Insider Top Stories

- 23. 23 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Fact 1: Cannabis is currently illegal in most states—of course, that’s changing fast. Fact 2: Twenty-three states (and the District of Columbia) have laws allowing doctors to recommend and patients to use cannabis for specific medical conditions. In all but two of these states, licensed businesses can grow and sell the medical cannabis patients need. Presumably, you’re licensed or are seeking such a license in one of these states. Of course, you could be in one of the two states—Colorado and Washington—that have also legalized adult-use cannabis. Several other states are considering legalizing medical or adult-use cannabis. (See below for a state-by-state survey of cannabis laws.) Fact 3: Selling and growing cannabis is illegal under federal law. Leasing to you makes your owner part of a criminal enterprise and a potential target for the local U.S. attorney, the U.S. Drug Enforcement Agency (DEA), and other federal agencies, including the IRS. It can also get the bank that holds the owner’s mortgage into trouble with federal banking regulators. Fact 4: The federal government can enforce its anti-cannabis laws anywhere in the U.S., including within states that have adopted cannabis laws. In other words, the fact that a cannabis business is legal under the laws of your state is no defense against a federal charge. In fact, U.S. attorneys have gone after owners and tenants alike for entering into commercial leases in medical cannabis states like Montana and California. Question: Given these facts, why would any owner ever lease to a cannabis business? For the answer, see Fact 5. Fact 5: Current federal policy is to live and let live and not carry out enforcement activities against cannabis businesses in states where those activities are legal under state laws, provided that the state takes effective action to keep legal cannabis out of the hands of kids and neighboring states where it’s illegal. Congress is also trying to cut off DEA funding for federal raids in cannabis states. Commercial Tenant’s Law Insider Top Stories

- 24. 24 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories THE NINE LEASE PROTECTIONS YOU NEED The current dormant state of federal enforcement makes it possible for owners in cannabis states to lease to cannabis businesses; and the fact that they can collect premium rents for taking these risks makes it profitable. But while they have the potential to help both sides, cannabis leases can also backfire if they’re not done right. Over the decades, the commercial real estate industry has developed standard lease forms addressing the different legal issues that arise between owners and tenants. Although it provides the framework for a cannabis lease, the standard commercial lease form wasn’t created with cannabis in mind. You need to rework certain parts of the lease so it works for cannabis. Specifically, there are nine clauses that need to be revised. We’ll review them below and give you Model Lease Clauses: Make Sure Your Cannabis Lease Protects You from Legal Risks. 1. Permitted Use Problem: Every lease has a clause that lists the activities the tenant can conduct on the premises. Normally, both sides are scrupulous about nailing down these details. But when it comes to cannabis, owners and tenants sometimes get skittish and prefer to gloss over the specifics. That’s a big problem because if the permitted use isn’t clear, you run the risk of accidentally breaking the lease by conducting an activity not permitted. Solution: Don’t be cute and try to cover up what you’ll be doing with the property. Indicate that you’ll be conducting a cannabis business and list the cannabis-related activities that you’re allowed to conduct on the premises, including: • Prescription sale—list product form, e.g., bud, leaf, edible, drinkable; • Recreational sale (if you’re in Colorado or Washington)—list product form; • Cultivation—list maximum number of plants; • Processing of plant parts and resin into products; and • Storage for transport [Clause, Sec. 2]. Commercial Tenant’s Law Insider Top Stories

- 25. 25 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories 2. Covenant to Comply with All Laws Problem: Because cannabis is illegal under federal law, boilerplate clauses requiring tenants to comply with all laws and making any illegal activity a default of the lease won’t work. Solution: The covenant needs to be modified to deal with the weird legal dynamics of cannabis: • You should be required to comply with all applicable state and local laws, including but not limited to the state cannabis licensing and program rules; • Since compliance with all federal laws is impossible, you should only have to comply with all applicable federal laws to the extent they’re not inconsistent with your right to use the premises to run a cannabis business; and • It’s okay to leave in the parts of the boilerplate that require you to comply with other federal laws that are not directly related to the growth, storage, and sale of cannabis—for instance, the duty to make reasonable accommodations for the disabled under the ADA [Clause, Secs. 5.1 and 5.2]. 3. Owner’s Early Termination Rights Problem: The ever-looming threat of federal intervention makes cannabis more volatile than other businesses and places an imperative on flexibility not typically found in boilerplate leases. Solution: The lease should include an exit clause that allows for both sides to terminate the lease immediately and without further obligation to the other if specified deal-breaking legal developments take place after the lease is signed. The biggest challenge is defining the triggers. Tenant triggers: You should be able to terminate early if new regulations, fees, taxes, or other laws are adopted that make it illegal or commercially impracticable to run your business. Expect owners to require specific, detailed notice; they might even want a “rescue” option like cutting your rent so that you can continue the lease. Owner triggers: Your owner will probably want early termination rights in the event that leasing to you results in federal criminal prosecution, seizure of the property under federal forfeiture laws, “nuisance” prosecutions or lawsuits, foreclosure by the owner’s bank, and/or tenant rebellions. Be Commercial Tenant’s Law Insider Top Stories

- 26. 26 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories prepared to accept these triggers, but you may also want to make your owner fight back and not simply roll over in the face of legal proceedings. Thus, for example, the owner’s right to terminate could kick in upon not the filing of but conviction for criminal charges [Clause, Secs. 1.1 and 1.2]. 4. Mode of Lease Payments Problem: Boilerplate leases typically require tenants to pay rent by check or other financial instrument from a bank. Of course, banks are federally regulated and thus not allowed to offer loans, checking, credit cards, and other financial services to cannabis businesses. Even though the Obama administration has loosened the restrictions, many cannabis businesses are still having trouble getting access to financial services. Solution: If you can’t get a checking account or credit card services, make sure the lease gives you the right to make payments in cash. 5. Warranty of Suitability Problem: Many standard leases include an owner warranty that the premises are suitable for the tenant’s proposed use. Don’t expect your owner to offer you such a warranty. Keep in mind that making premises suitable for a cannabis tenant may require significant alterations, as well as approval under building codes, zoning, state licensing, and other regulations. Solution: List the improvements necessary to make the premises suitable for your cannabis business. Be prepared to accept sole responsibility for securing any necessary permits, licenses, and other approvals, but require the owner to take all reasonable actions to cooperate with and support your efforts, including providing information to state licensing and other regulatory authorities. If you have the leverage, you might even try to negotiate to have the owner pay part of the costs of securing the necessary approvals [Clause, Sec. 3]. Commercial Tenant’s Law Insider Top Stories

- 27. 27 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories 6. Tenant Improvements Like casinos, cannabis establishments must meet elaborate security requirements to get (and keep) an operating license. We’re talking exterior walls, access barriers, wall-to-wall surveillance camera systems, exterior lighting, etc. And if you intend to grow cannabis on the property, you’ll also need to install special lighting, heat lamps, and other elaborate environmental systems. Solution: Make sure your lease specifically deals with responsibility for improvements and alterations. Key questions to negotiate: • Who’s financially responsible for making the necessary improvements? • If you pay costs out-of-pocket, how much, if anything, will the owner reimburse you for improvements that will remain part of the premises after the lease ends? • Which, if any, improvements need to be dismantled at the end of the lease and at whose financial expense? [Clause, Secs. 3, and 7.1 to 7.3] 7. Owner’s Right to Inspect Problem: Standard leases give owners the right to enter and inspect the premises to ensure that the tenant is complying with all lease requirements. But state security rules require cannabis establishments to limit access to storage, sales, and other sensitive areas. Result: You may not be allowed to let the owner enter and inspect the way it does with its other tenants. Solution: Establish a procedure that enables the owner to inspect but that doesn’t force you to violate your duty to limit access to limited access areas. One possible solution is to require the owner to be accompanied by your own authorized employees—that is, employees or security guards who are allowed to access limited access areas. If the owner wants the right to take photos and video during inspection, make it promise to keep your trade secrets and patient records confidential as required by HIPAA and other privacy laws [Clause, Sec. 4]. Commercial Tenant’s Law Insider Top Stories

- 28. 28 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories 8. Utilities & Other Operating Expenses Problem: Indoor growing and storage of cannabis consumes copious amounts of water and energy. According to Forbes, an indoor module for handling four cannabis plants uses as much electricity as 29 standard refrigerators. So don’t be surprised if the owner expects you to pay for excessive consumption of water and electricity. Solution: Although it’s fair and reasonable to pay for any excessive utilities you consume, make sure you require the owner to: • Disclose the building’s overall electric and water costs; • Tell you what the baseline rate is for tenant consumption of water and electricity; • Set out a clear and fair formula for allocating excessive costs to you based on your actual consumption; and • Let you review utility bills to verify allocated charges [Clause, Sec. 6]. 9. Common Areas Problem: Owners typically worry that cannabis establishments will cause smoke, odors, loitering, and excessive demands on parking facilities. As a result, you may be asked to take measures to minimize risk of collateral damage to common areas, including: • Preventing employees and customers from consuming cannabis anywhere in the premises or common areas; • Using ventilation or other mechanical devices or systems to minimize odors and keep them out of shared air circulating systems; • Implementing measures to prevent loitering; and • Appropriately disposing of waste products. Solution: Although they may be more than the owner asks of its other tenants, these measures are typically things you need to do anyway under the cannabis program rules of your state. But if the owner asks you to do more than the state requires, such as deploy 24/7/365 security guards, you should probably negotiate for some kind of cost-sharing arrangement. Commercial Tenant’s Law Insider Top Stories

- 29. 29 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Glenn S. Demby is a corporate attorney and award-winning legal journalist who specializes in explaining the law in plain English and helping business leaders overcome their regulatory challenges. He can be contacted at glennsdemby@gmail.com. He thanks Professor Michael N. Widener, of Bonnett, Fairbourn, Friedman & Balint, P.C., in Phoenix, Ariz., for his help in preparing this article. About the Author States Where Cannabis Businesses Are and Aren’t Legal Property owners can’t lease to a cannabis business unless growing and selling cannabis is legal under your state’s laws. Nearly half of the states allow this—in most states, medical is the only form of legal cannabis. Here’s a look at the current legal landscape: Legal to grow and sell medical and recreational cannabis: Colorado Washington Legal to grow and sell medical cannabis: Arizona California Connecticut Delaware Illinois Maine Maryland Massachusetts Michigan Minnesota Nevada New Hampshire New Jersey New Mexico New York Oregon Rhode Island Vermont Commercial Tenant’s Law Insider Top Stories

- 30. 30 vendomerealestatemedia.com Assisted Housing Management Insider Top StoriesCommercial Lease Law Insider Top StoriesCommercial Lease Law Insider Top Stories Legal to use but not sell and grow medical cannabis: Illegal to grow and sell cannabis: Alabama Arkansas Florida Georgia Idaho Indiana Iowa Kansas Kentucky Louisiana Mississippi Missouri Nebraska North Carolina Notes: • It’s legal to sell and grow medical cannabis in Washington, D.C. • Florida and Pennsylvania are considering medical cannabis. • California, Arizona, and Oregon are considering recreational cannabis. Alaska Hawaii Montana North Dakota Ohio Oklahoma Pennsylvania South Carolina South Dakota Tennessee Texas Utah Virginia West Virginia Wisconsin Wyoming Commercial Tenant’s Law Insider Top Stories