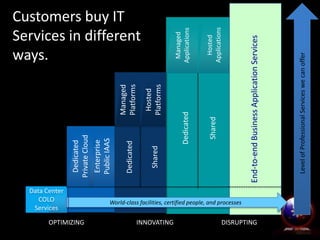

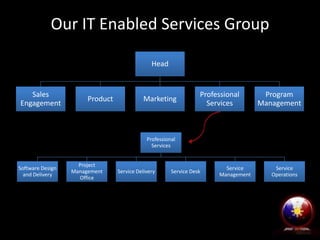

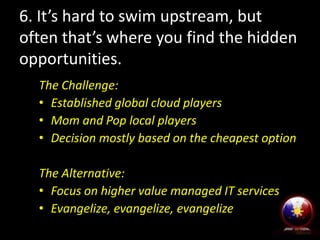

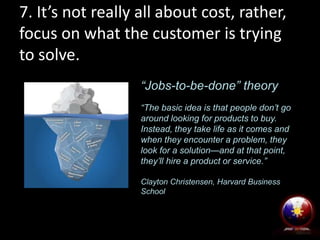

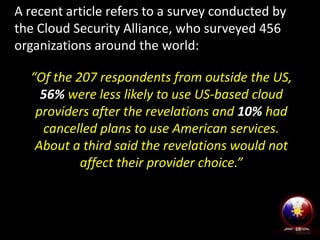

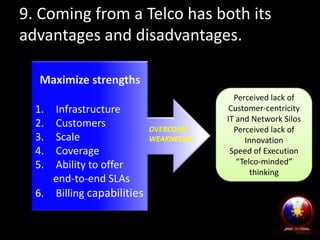

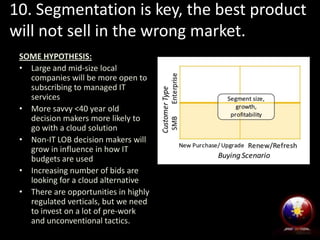

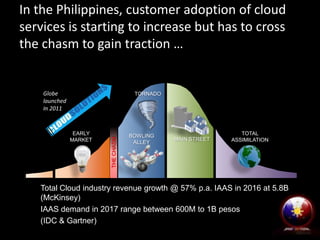

The document outlines ten key lessons learned from deploying public and private cloud services in the telecom sector, emphasizing the importance of strategic partnerships, customer-centric solutions, and effective marketing. It highlights the growing demand for managed IT services amidst competitive pressures and the need for organizations to adapt to changing market dynamics. Notable focus areas include infrastructure investment, customer engagement, and targeting specific market segments for cloud service growth.