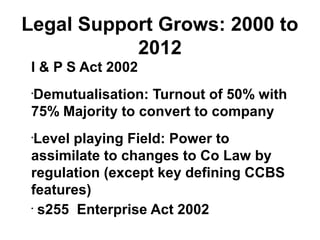

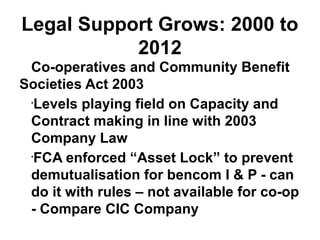

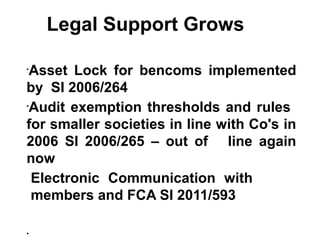

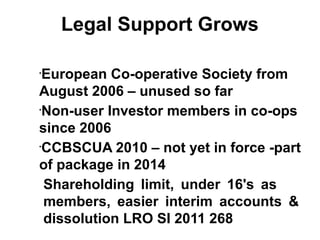

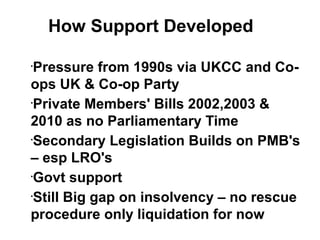

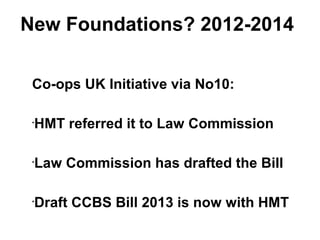

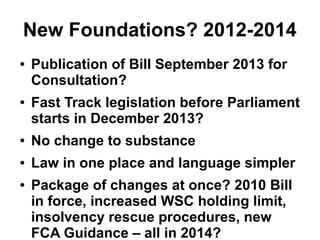

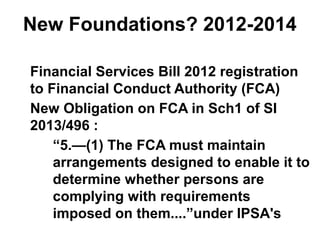

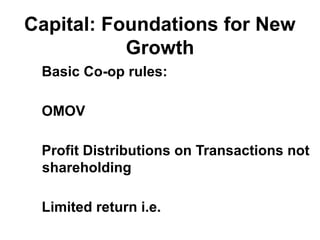

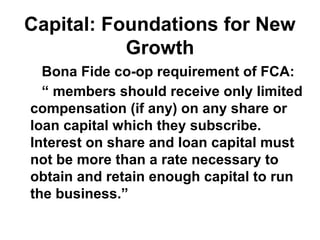

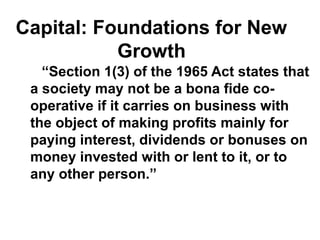

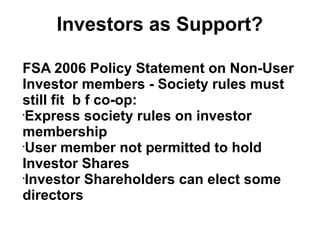

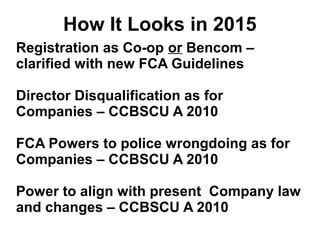

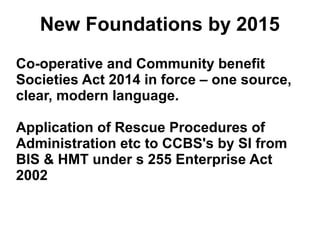

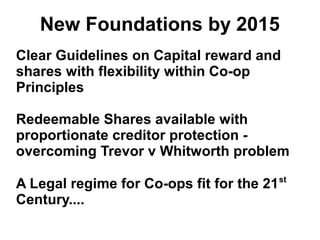

The document outlines the evolution of legal support for co-operatives in the UK from before 2000 to recent developments, highlighting legislation like the Co-operatives and Community Benefit Societies Act 2003 and the 2014 Co-operative and Community Benefit Societies Act. It discusses challenges such as outdated laws and the ease of demutualization, while emphasizing improvements in legal frameworks to better support co-operatives and community benefit societies. The conclusion points to a more modern legal regime tailored for co-operatives that addresses their unique needs and encourages growth.