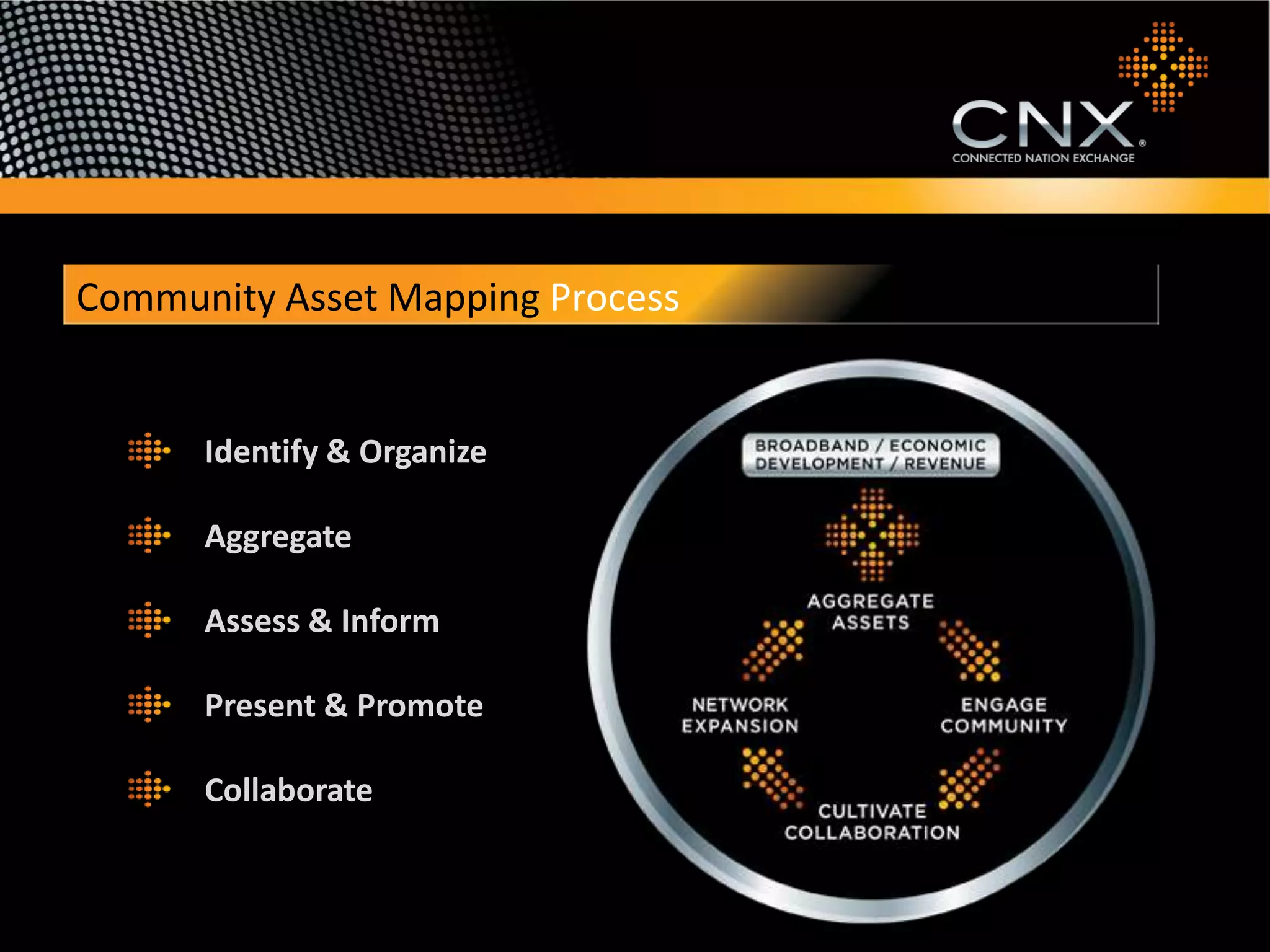

This document discusses how communities can collaborate with technology companies by mapping and aggregating their digital assets. It provides examples of assets like rights of way, dark fiber, and pole attachments that communities control. By organizing these assets and partnering with tech companies, communities can help drive broadband investment and local economic growth. The document also discusses how CNX Advantage can help communities broadly organize their assets through tools like Instalytics to facilitate partnerships between communities and providers for faster and more cost-effective network deployments.