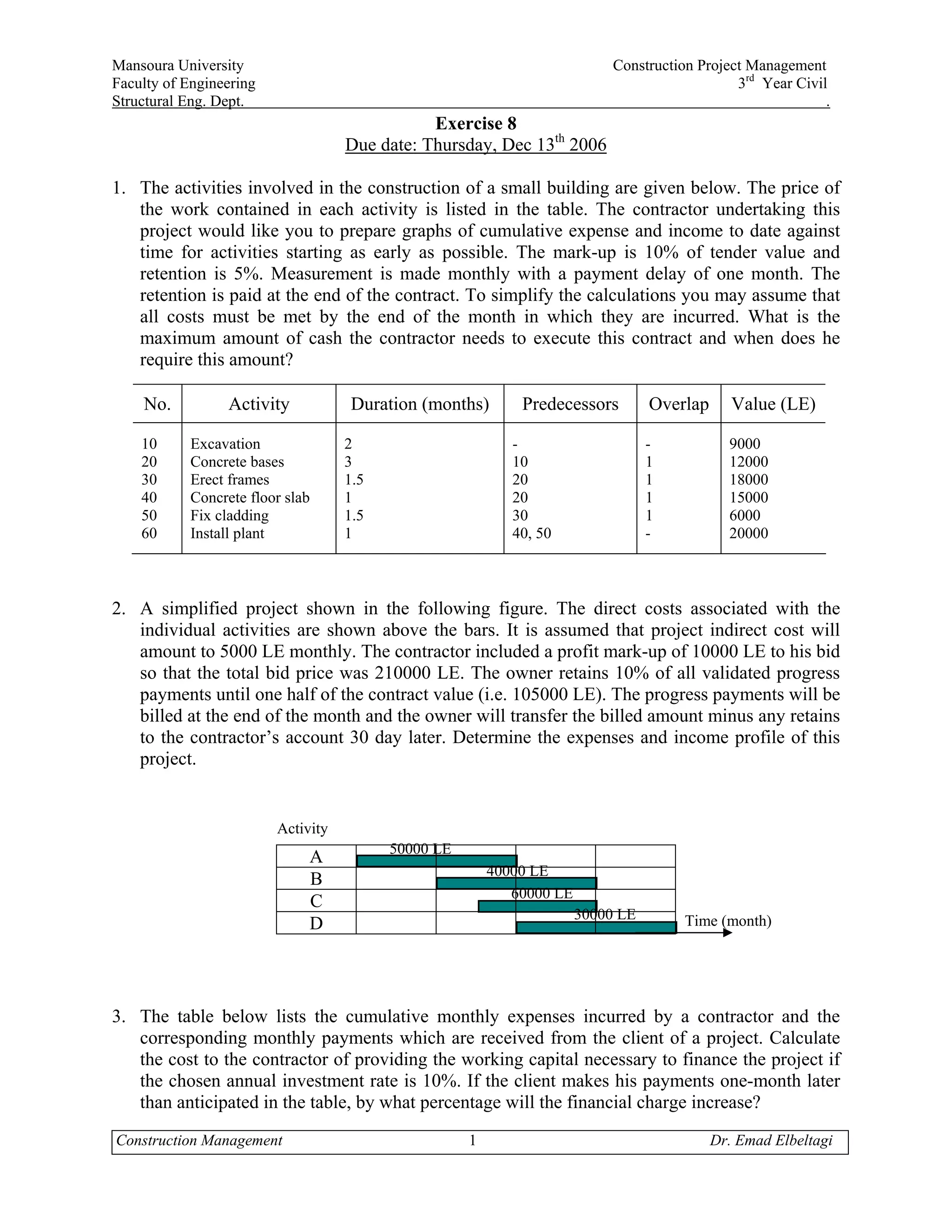

This document contains instructions and information for six exercises related to construction project management. It provides details on activities, costs, schedules, cash flows, and calculations to determine things like maximum cash needs, financial charges, profit margins, and rates of return for several small building and infrastructure projects.