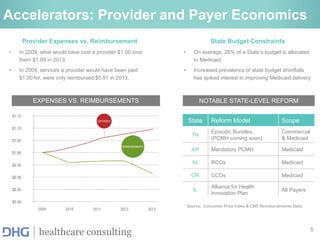

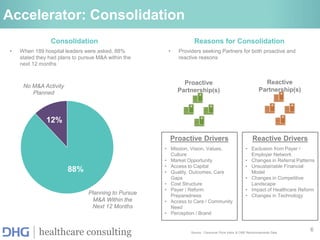

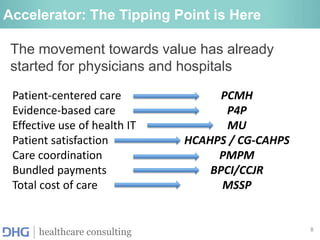

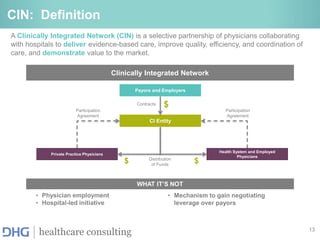

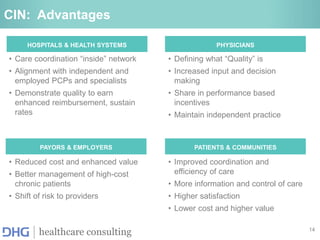

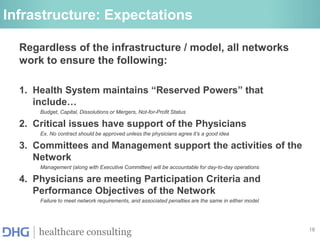

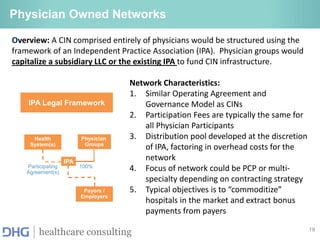

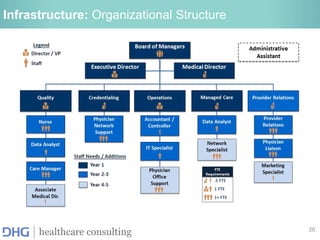

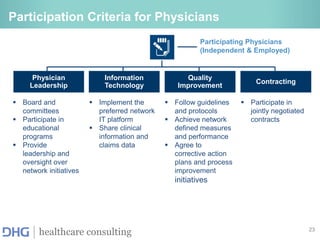

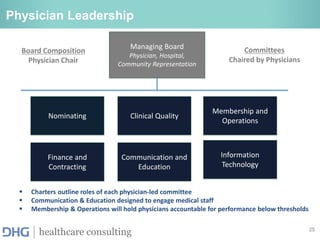

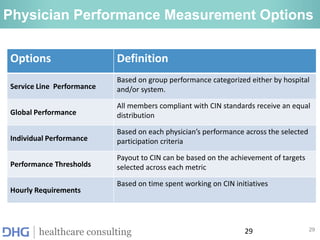

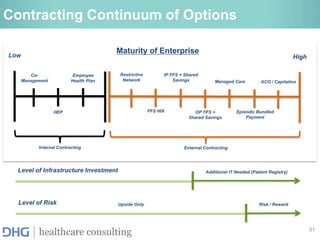

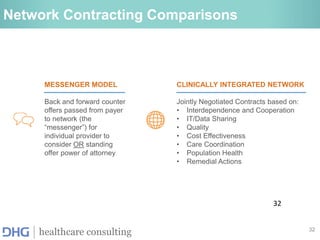

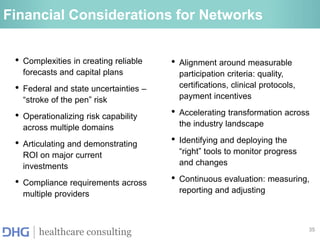

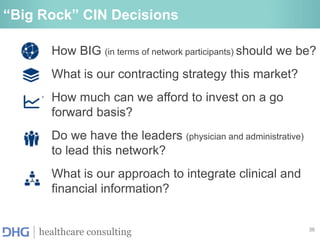

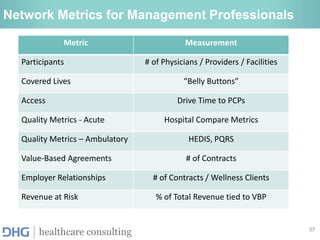

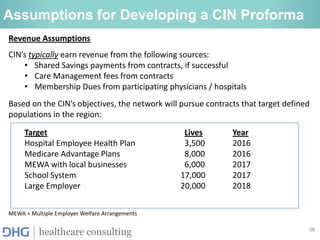

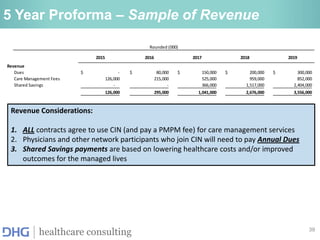

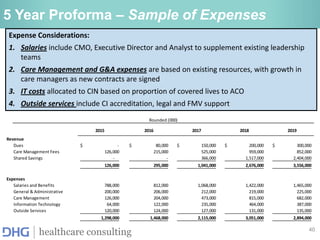

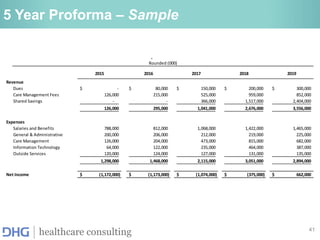

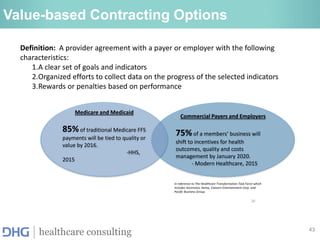

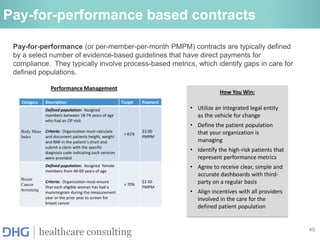

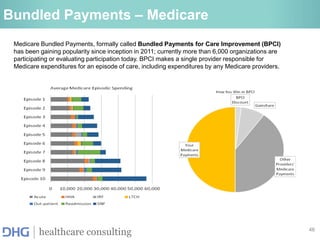

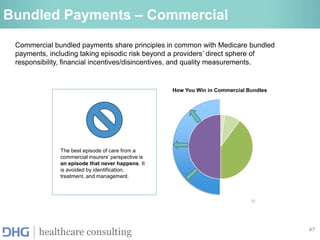

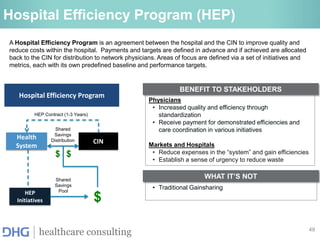

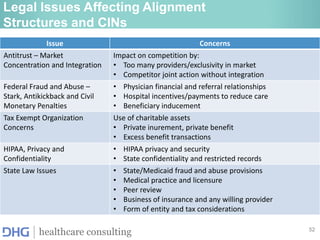

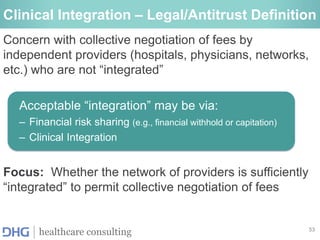

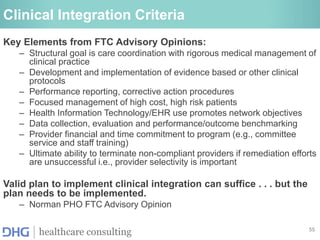

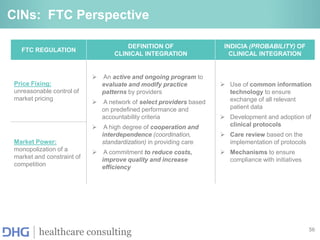

The document discusses the development and financial considerations of Clinically Integrated Networks (CINs) in healthcare, emphasizing the shift from volume-based to value-based care models. It outlines the primary goals and operational structures for CINs, including enhancements in care coordination, quality improvement, and financial integration among healthcare providers. Key components include risk management strategies, various contracting options, and the importance of physician engagement to achieve optimal patient outcomes and cost efficiencies.