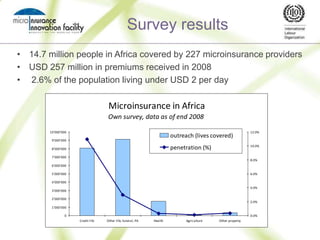

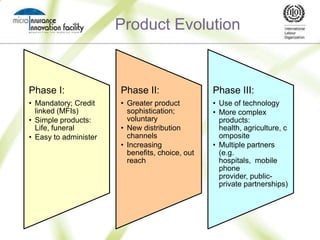

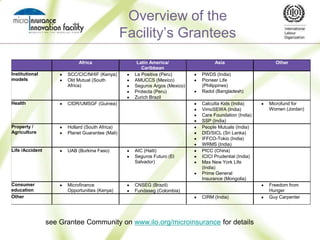

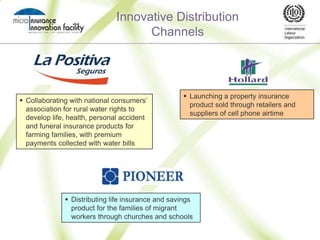

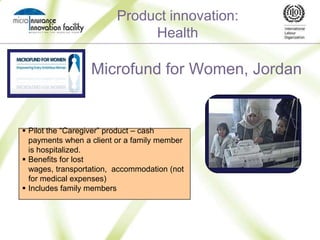

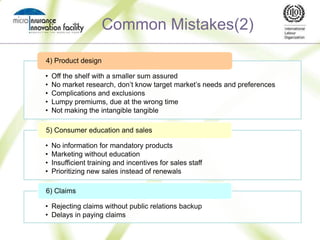

The document provides an overview of microinsurance, highlighting statistics and trends, with 14.7 million people in Africa covered by 227 providers and premiums totaling USD 257 million in 2008. It discusses innovative products and distribution channels targeting low-income households, such as life, health, and agriculture insurance, while emphasizing the importance of consumer education and collaboration with local organizations. The presentation also addresses common mistakes and the increasing interest from policymakers and regulators in promoting access to insurance.