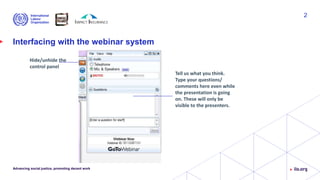

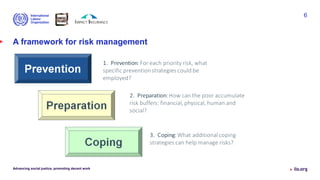

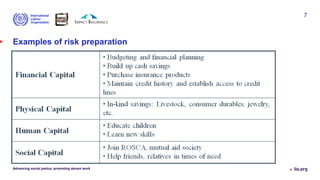

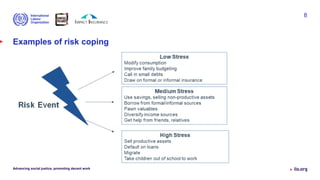

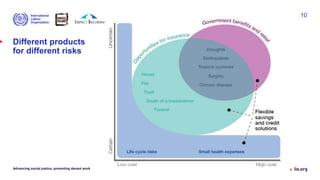

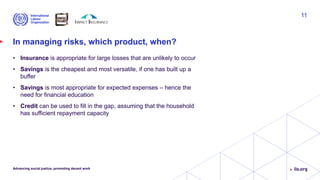

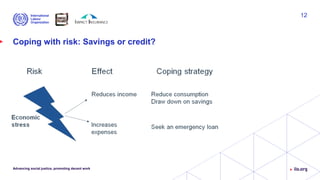

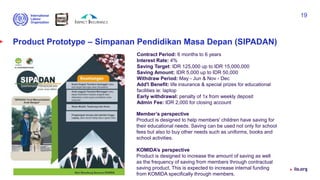

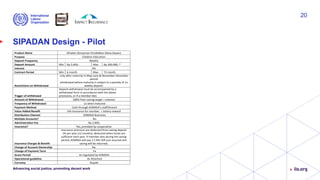

The document discusses integrated risk management solutions aimed at advancing social justice and promoting decent work, featuring a webinar with expert panelists from social finance programs. It emphasizes the importance of managing risks, especially for low-income households, and presents various financial products such as savings and insurance tailored for education and health needs. Key takeaways include the significance of understanding customer preferences and the need for continuous market research in product design to address the financial capacities and expectations of members.