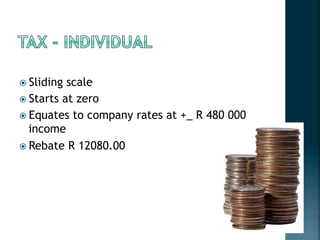

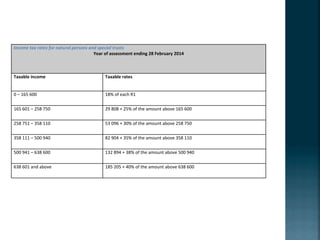

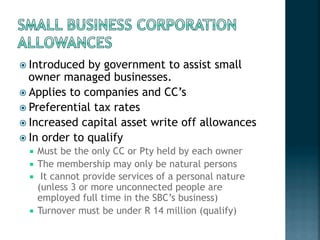

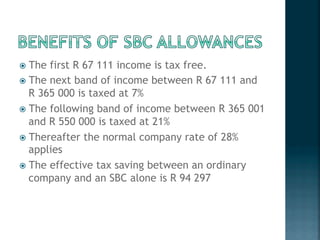

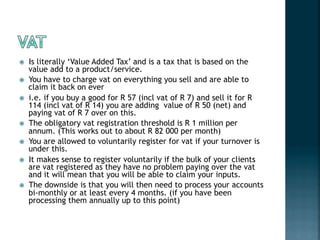

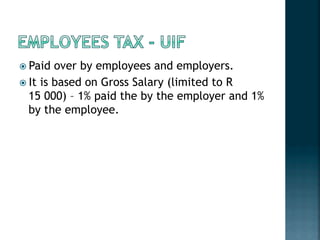

The document outlines a tax structure for small owner-managed businesses in South Africa, including a two-tiered tax system and effective rates based on income brackets. It explains the preferential tax rates, VAT implications, and requirements for qualifying as a small business corporation (SBC). Additionally, it covers employee payroll taxes and training costs associated with industry SETAs.