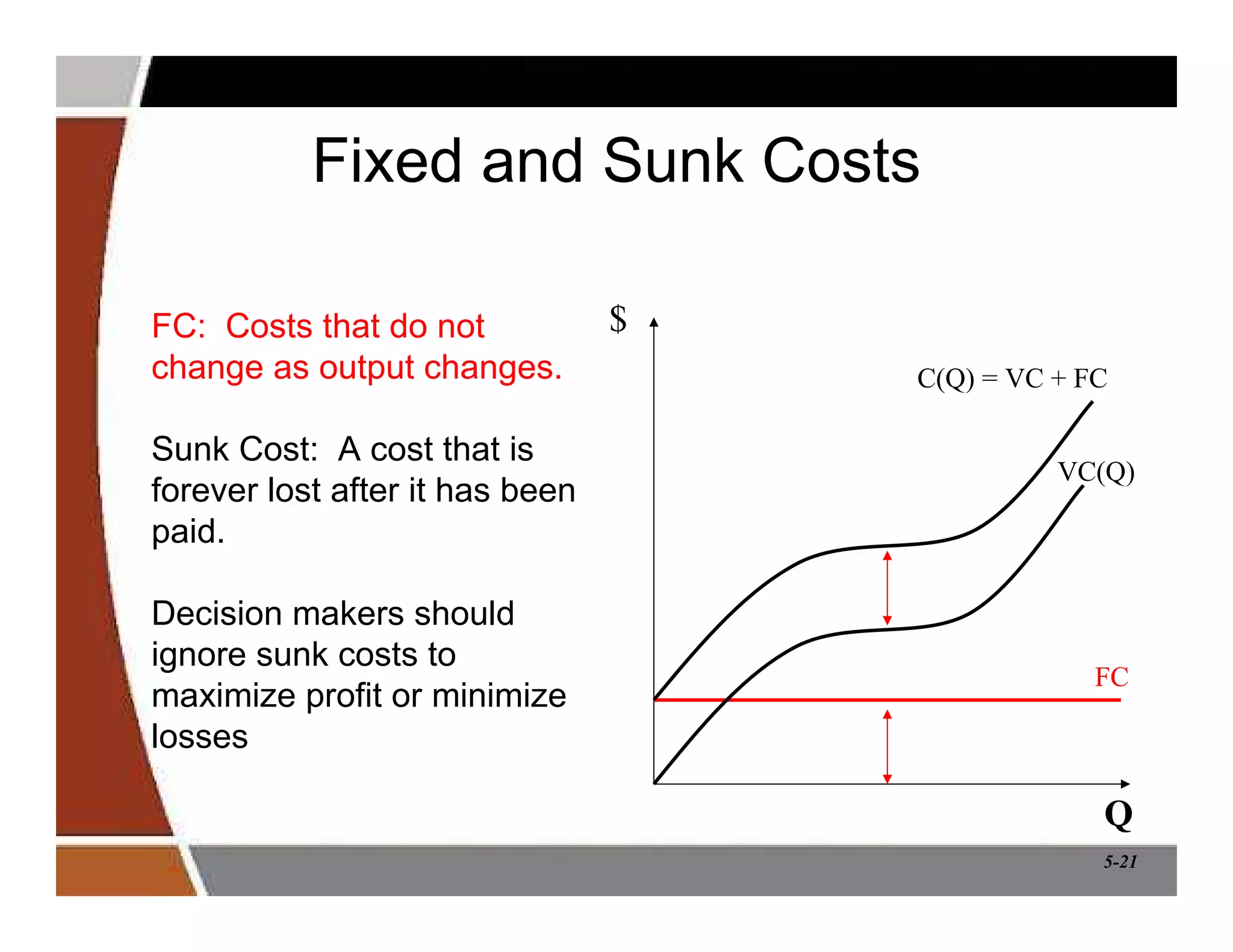

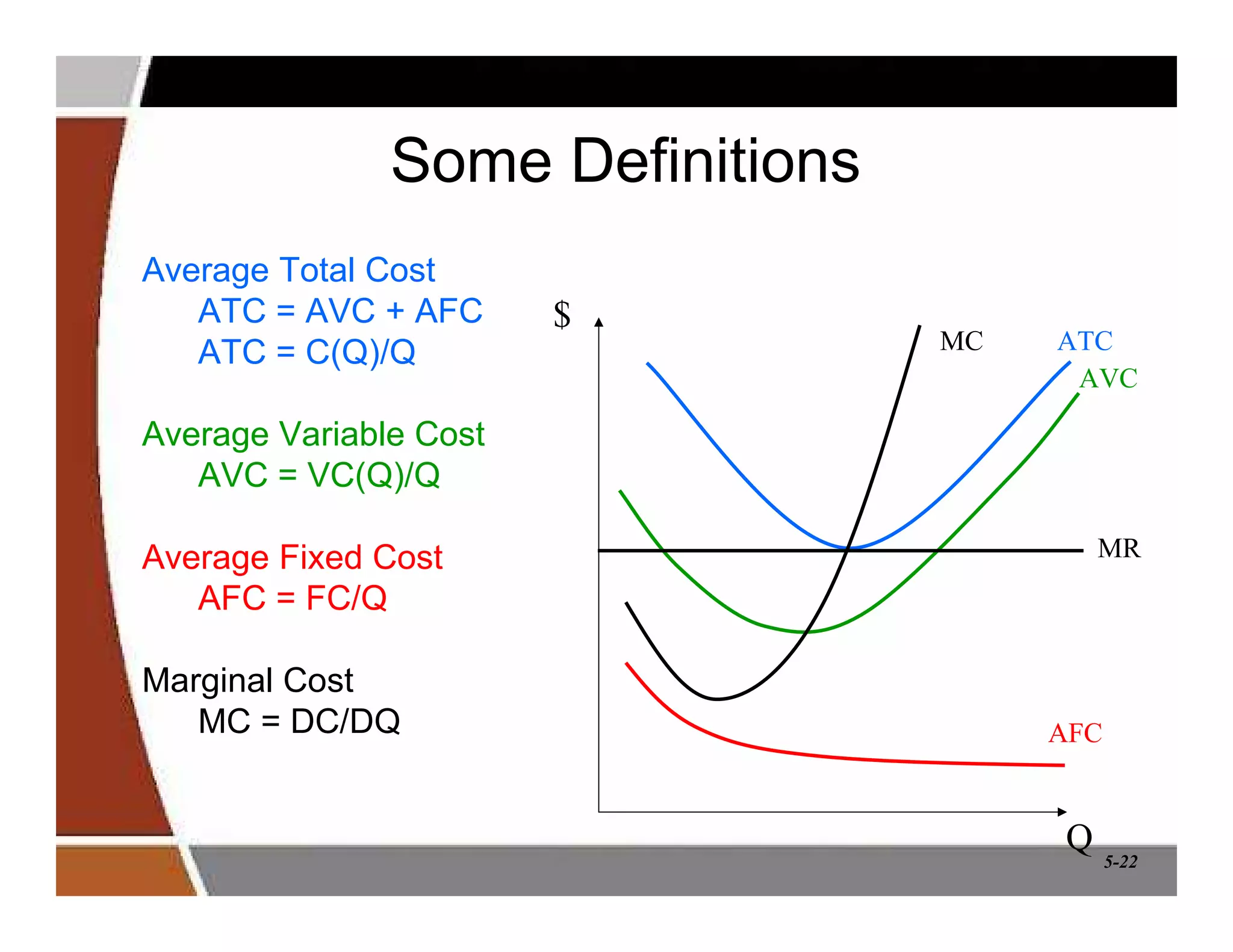

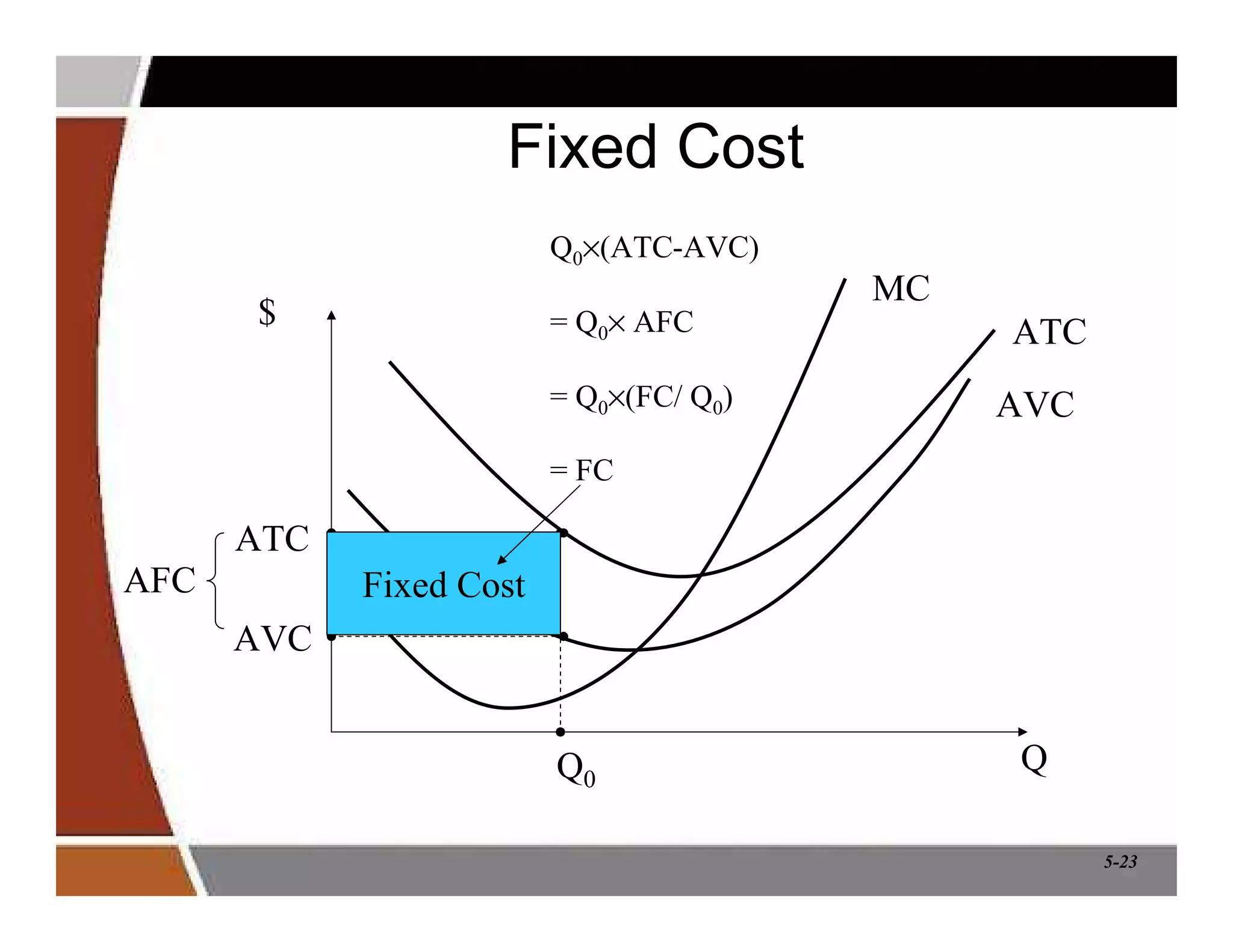

This document discusses production and cost analysis concepts from a managerial economics textbook chapter. It defines key terms like total, average and marginal product, isoquants, isocosts, and different cost functions. It explains how firms determine optimal input levels by equalizing the value of marginal products with input prices to minimize costs. Firms produce at the point where the marginal rate of technical substitution equals the input price ratio. Cost functions are important for analyzing profit-maximizing behavior.

![5-6

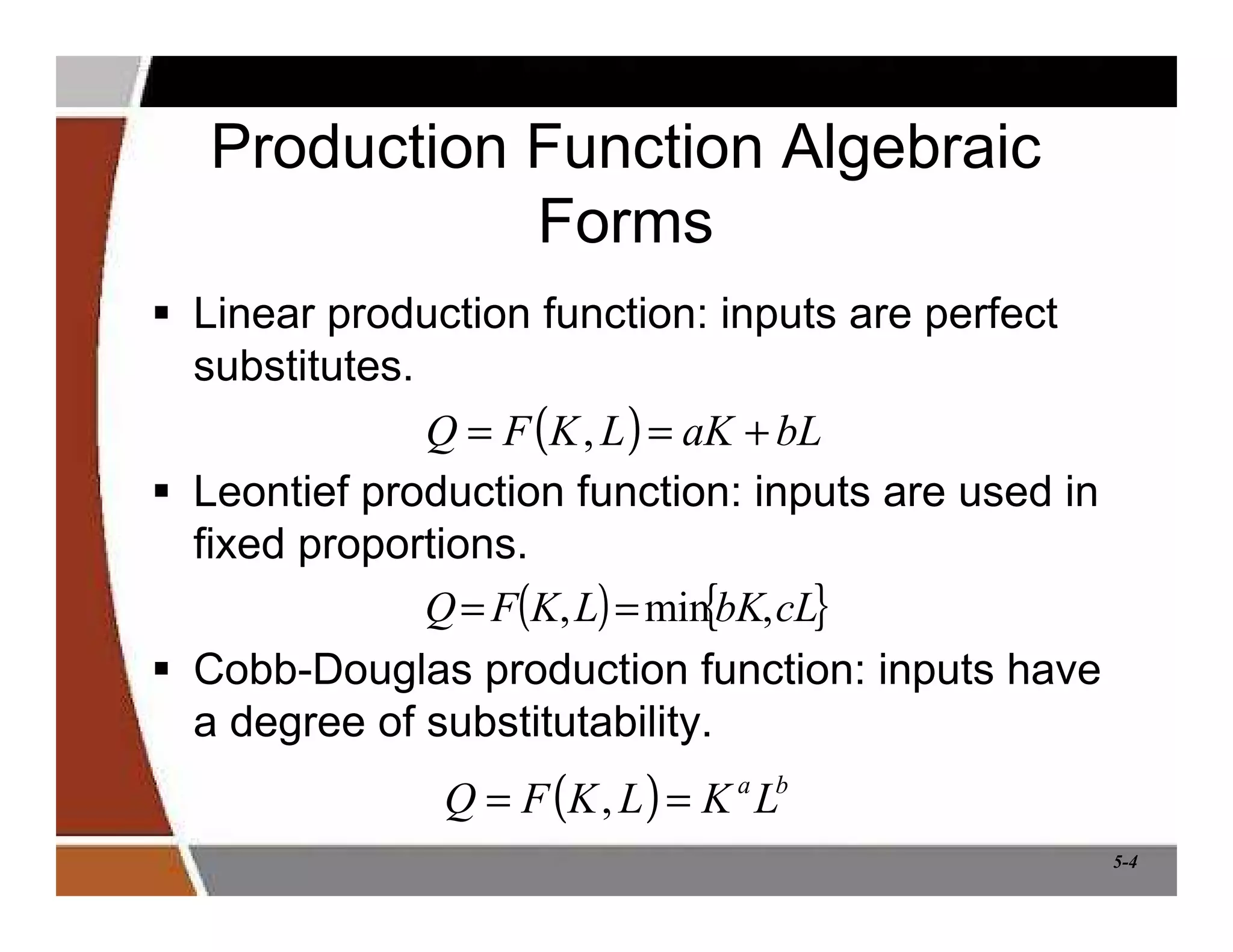

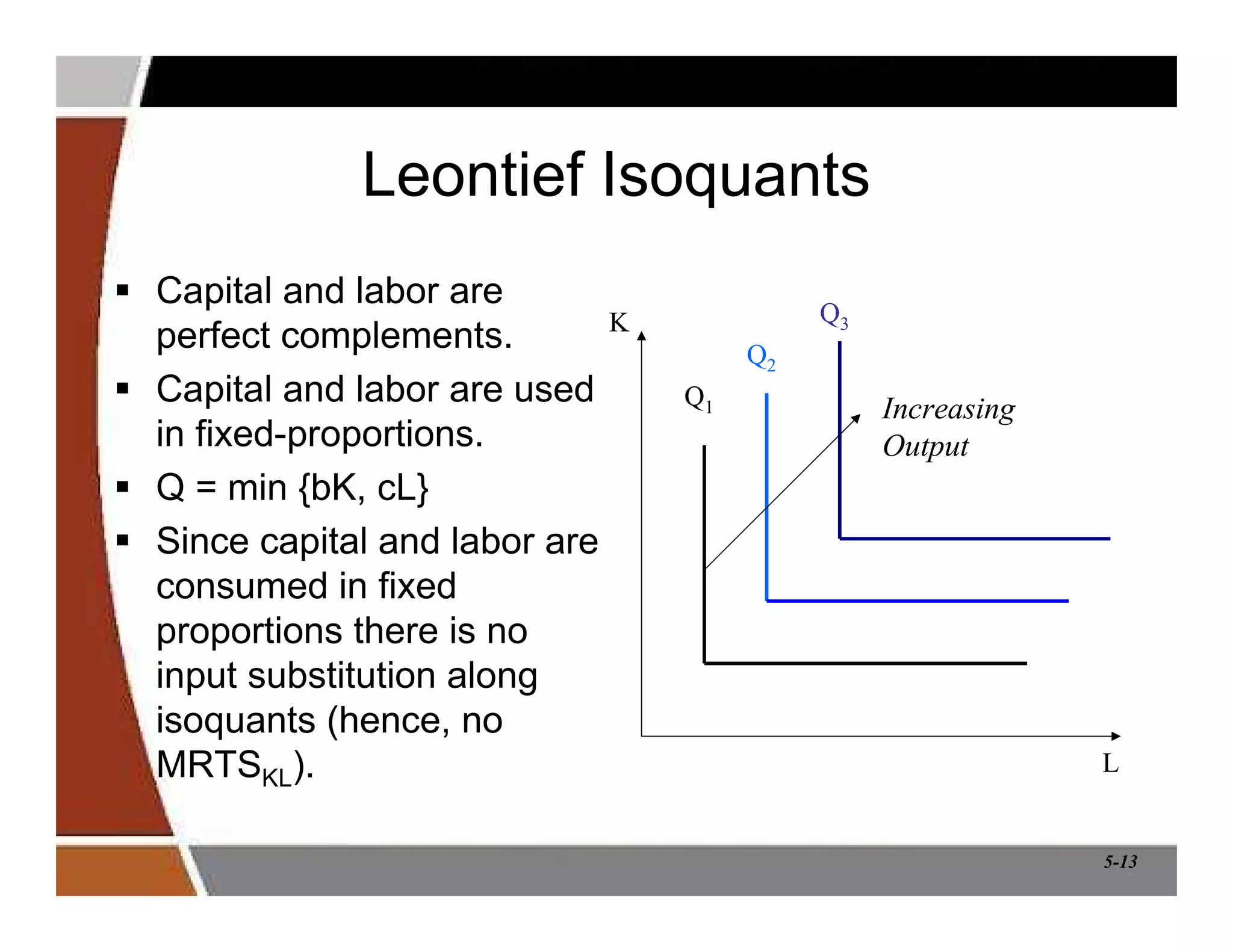

Productivity Measures: Average

Product of an Input

Average Product of an Input: measure of output

produced per unit of input.

– Average Product of Labor: APL = Q/L.

• Measures the output of an “average” worker.

• Example: Q = F(K,L) = K.5 L.5

If the inputs are K = 16 and L = 16, then the average product of

labor is APL = [(16) 0.5(16)0.5]/16 = 1.

– Average Product of Capital: APK = Q/K.

• Measures the output of an “average” unit of capital.

• Example: Q = F(K,L) = K.5 L.5

If the inputs are K = 16 and L = 16, then the average product of

capital is APK = [(16)0.5(16)0.5]/16 = 1.](https://image.slidesharecdn.com/chapter5productionprocessandcost-220316012556/75/Chapter-5-production-process-and-cost-6-2048.jpg)

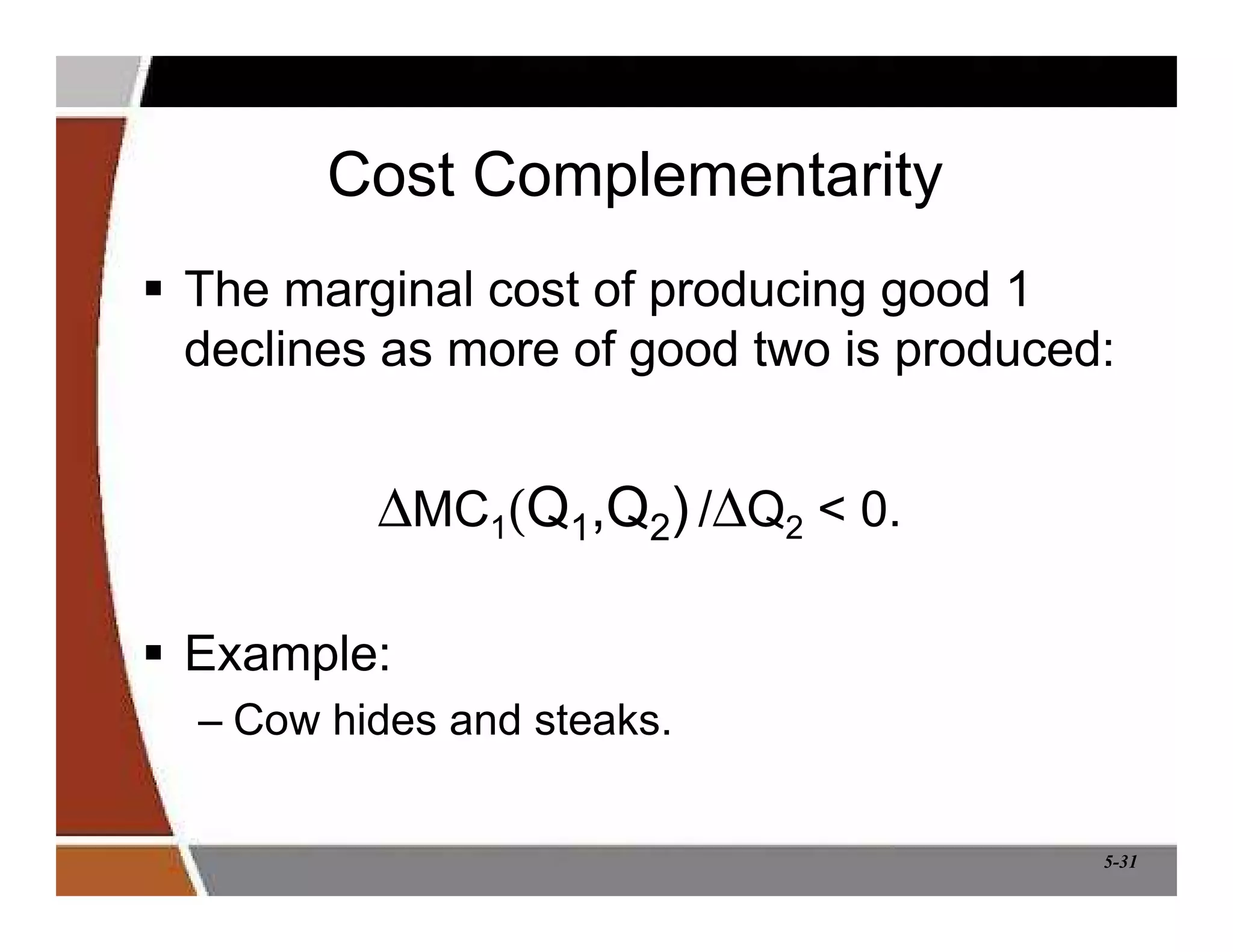

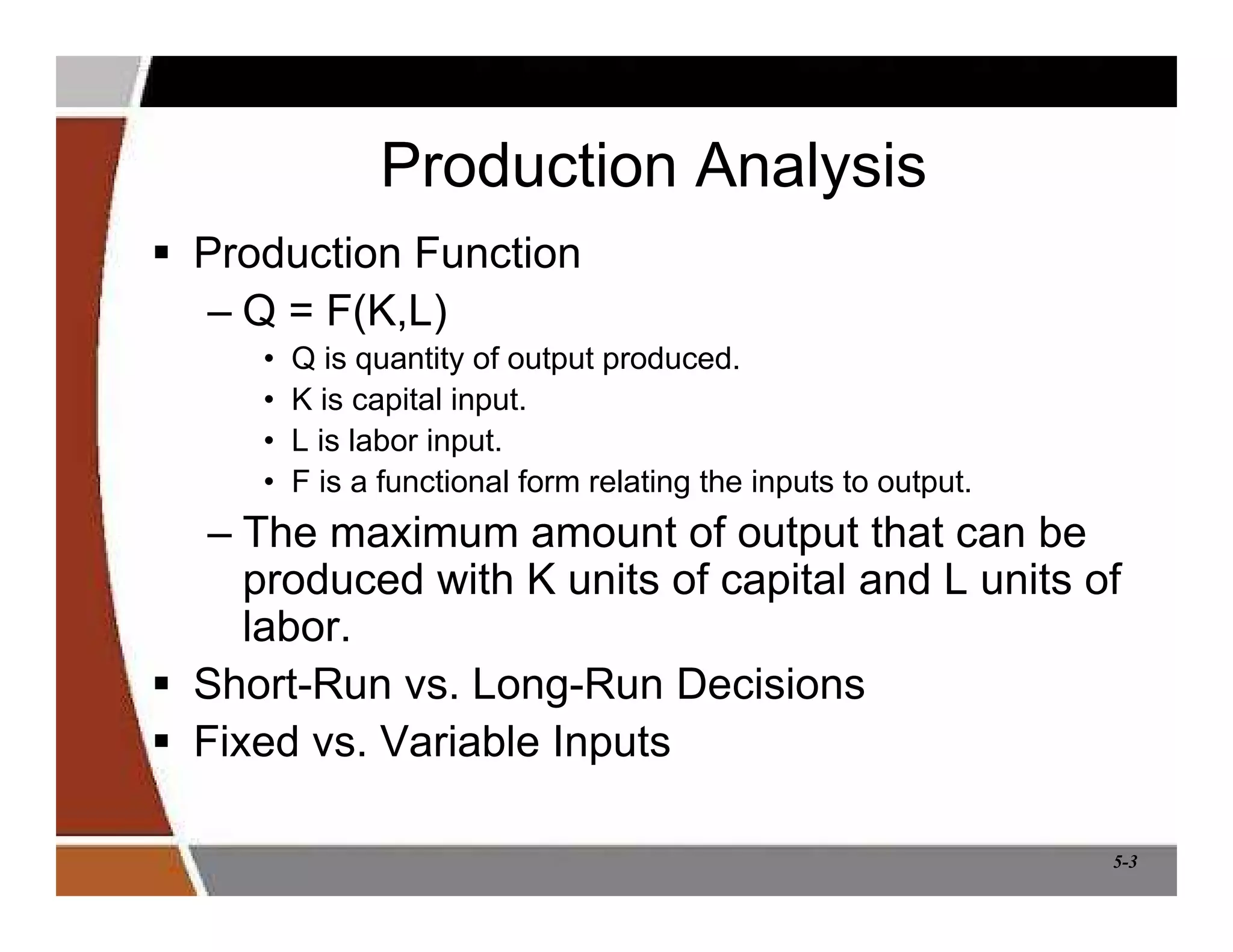

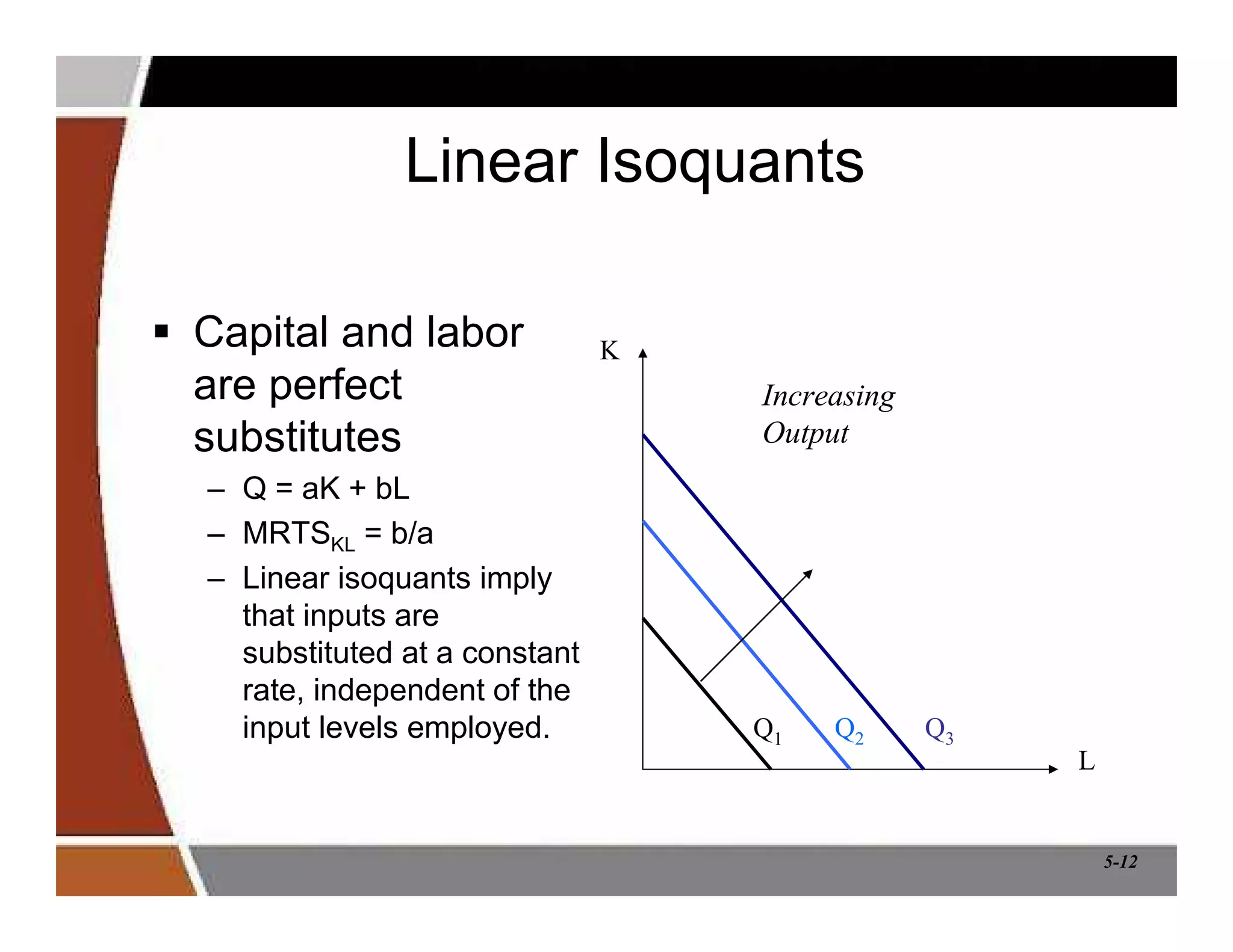

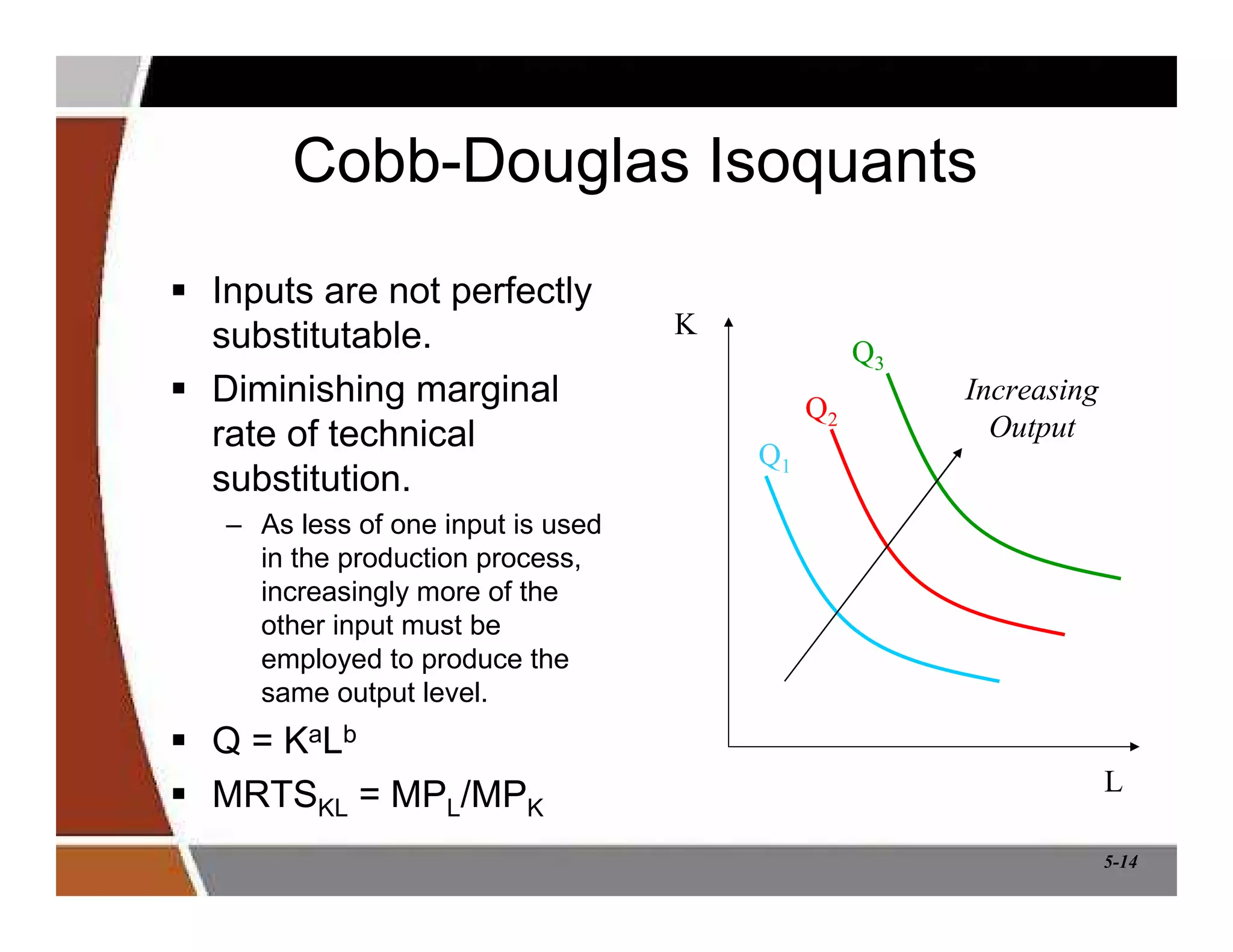

![5-24

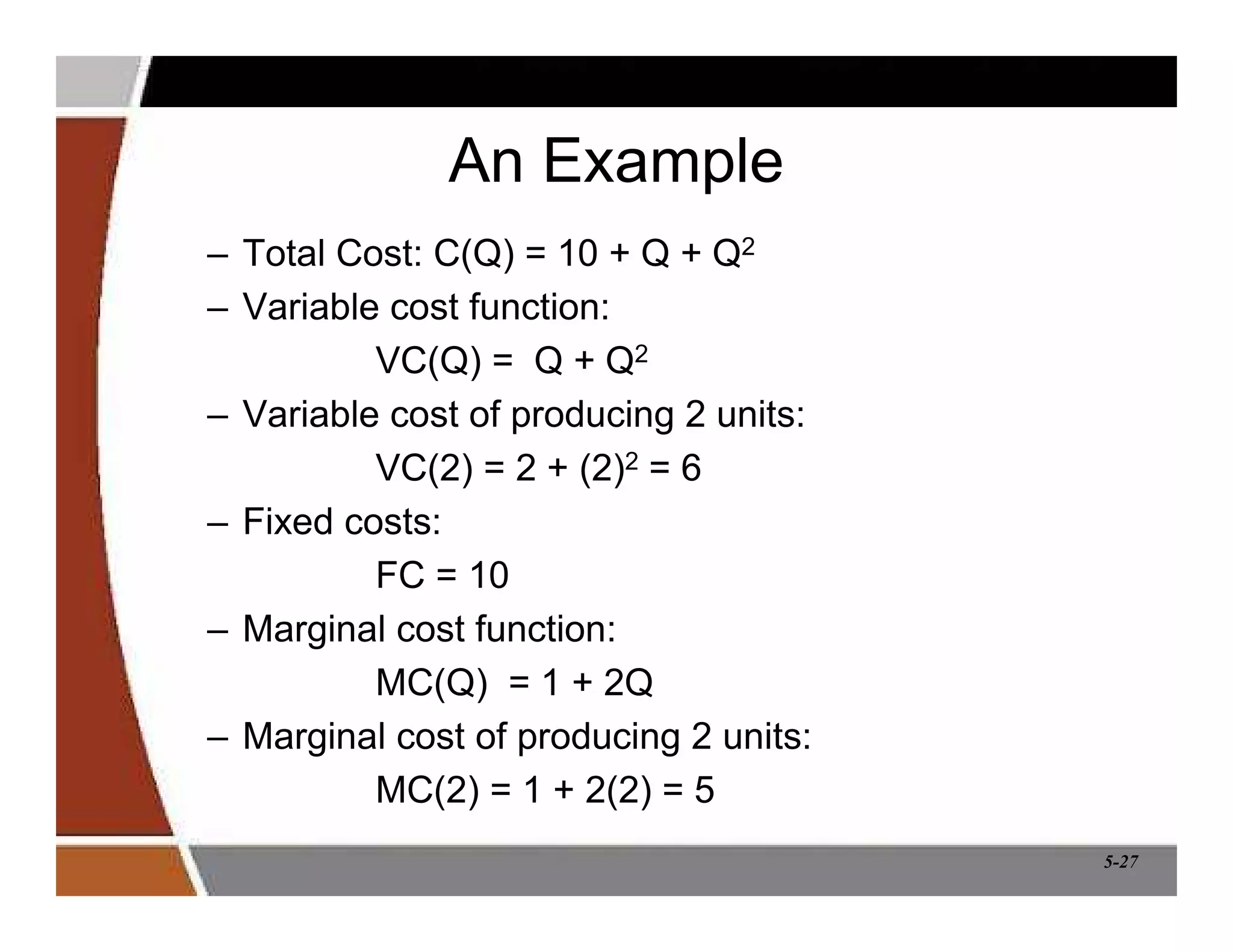

Variable Cost

$

Q

ATC

AVC

MC

AVC

Variable Cost

Q0

Q0×AVC

= Q0×[VC(Q0)/ Q0]

= VC(Q0)

Minimum of AVC](https://image.slidesharecdn.com/chapter5productionprocessandcost-220316012556/75/Chapter-5-production-process-and-cost-24-2048.jpg)

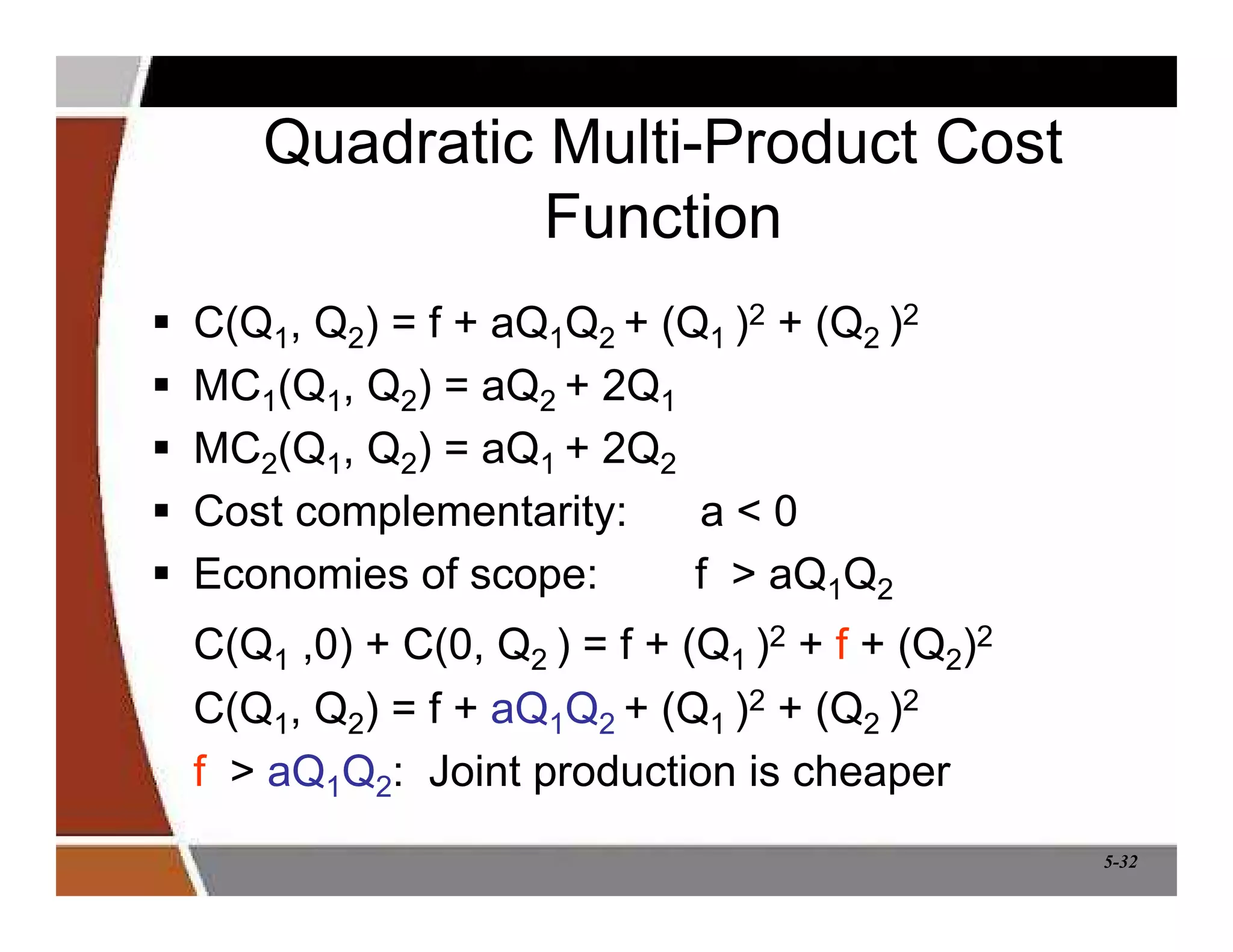

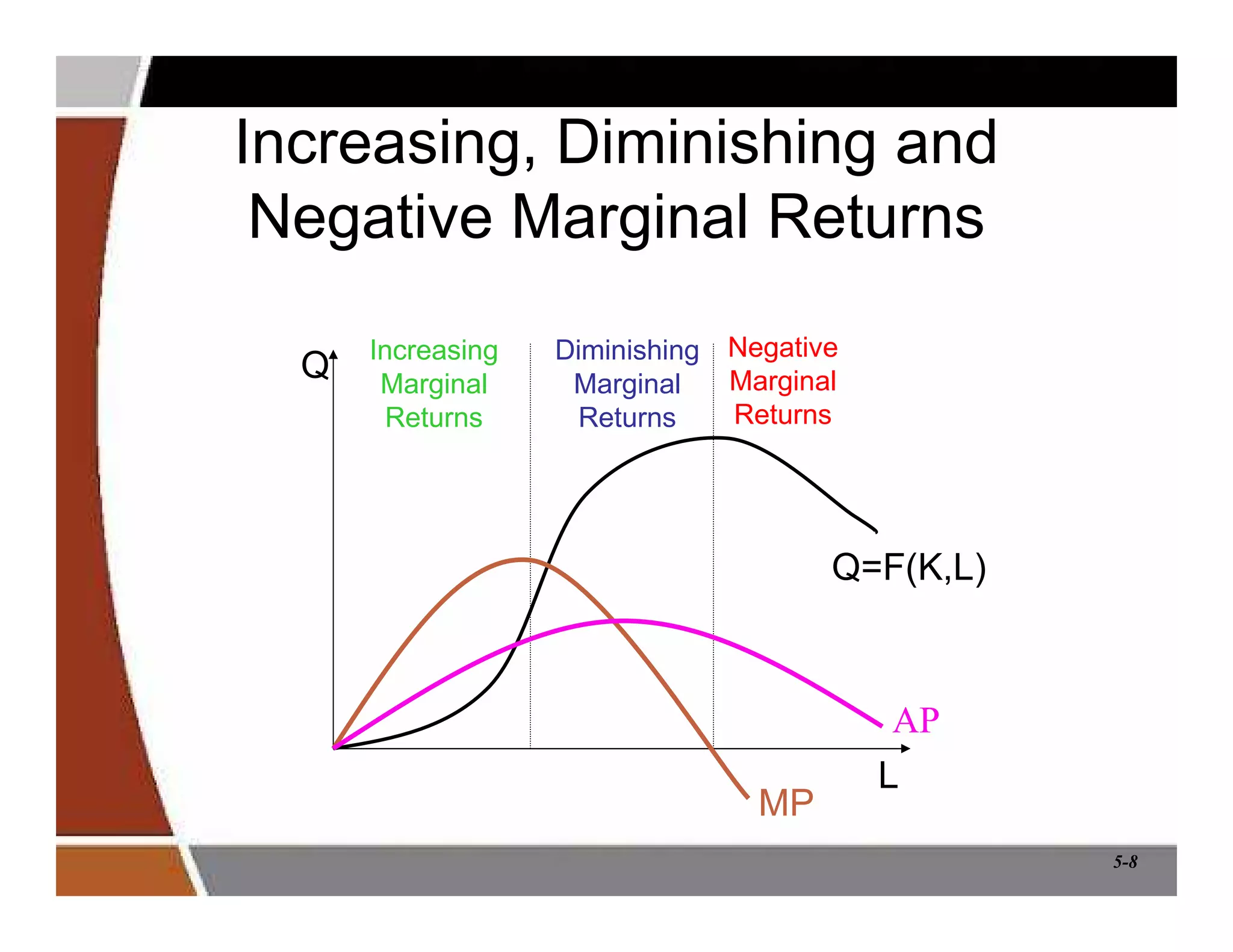

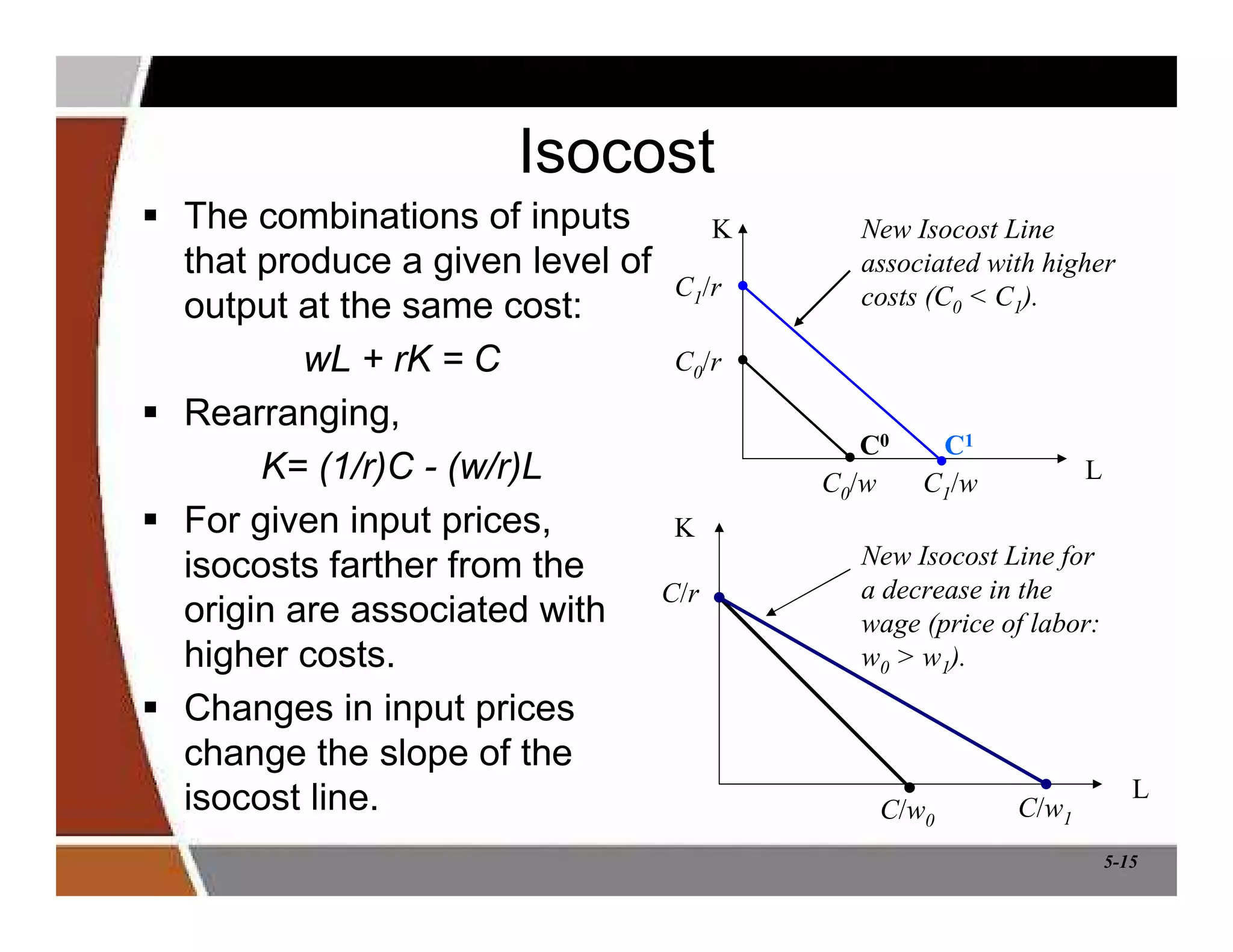

![5-25

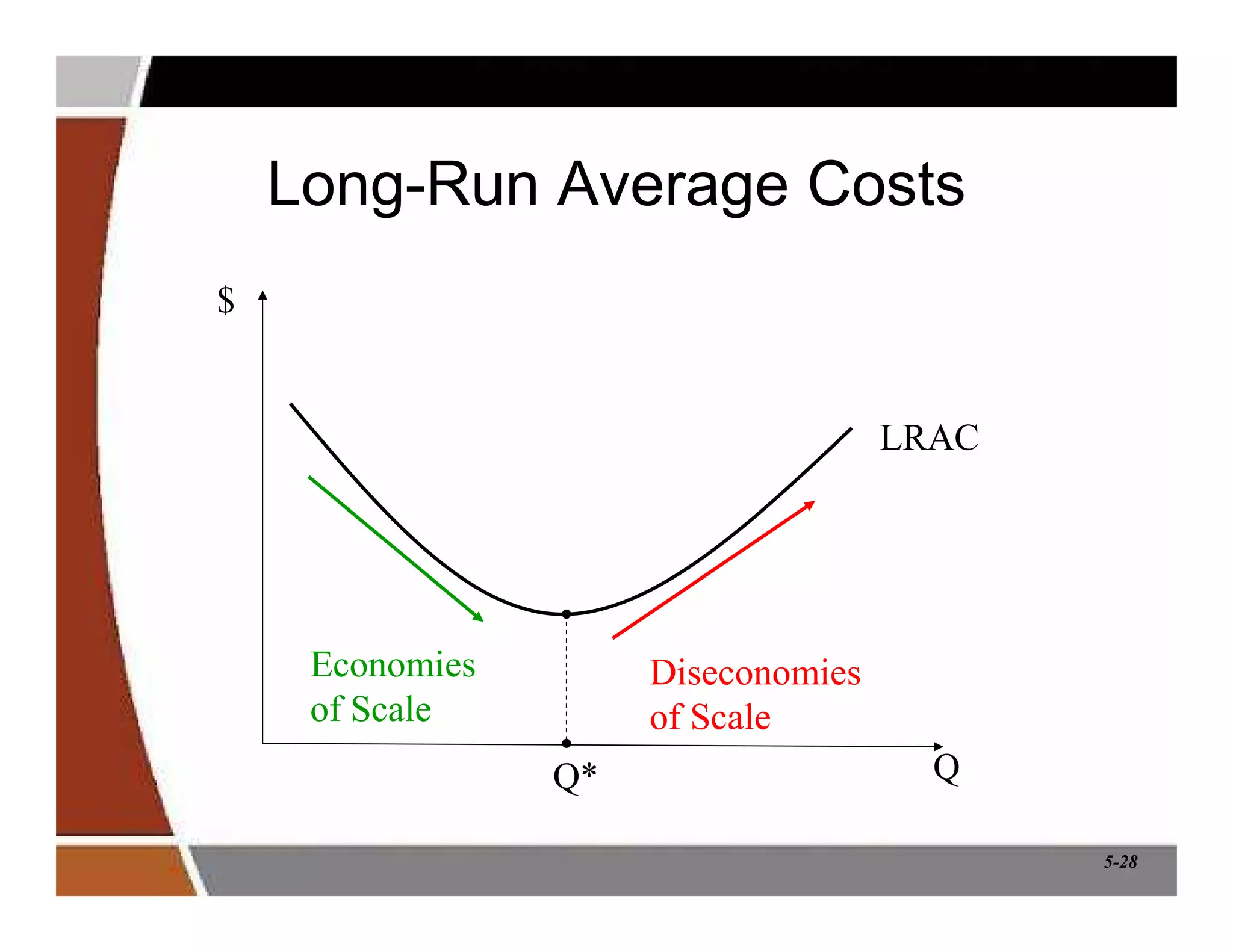

$

Q

ATC

AVC

MC

ATC

Total Cost

Q0

Q0×ATC

= Q0×[C(Q0)/ Q0]

= C(Q0)

Total Cost

Minimum of ATC](https://image.slidesharecdn.com/chapter5productionprocessandcost-220316012556/75/Chapter-5-production-process-and-cost-25-2048.jpg)