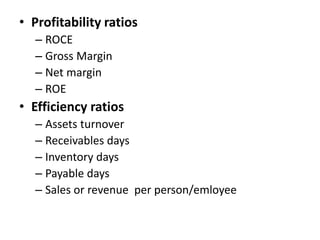

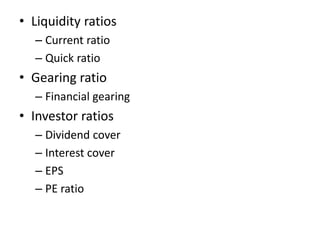

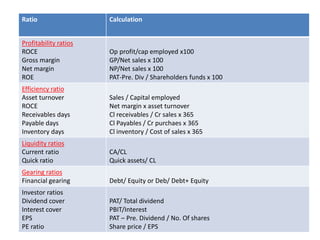

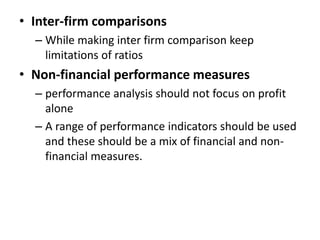

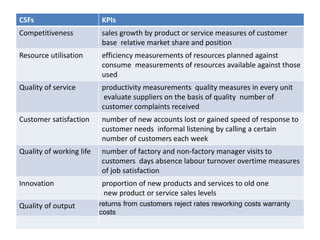

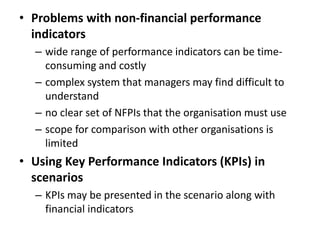

This chapter covers quantitative analysis, financial analysis, benchmarking, and the Baldrige model for performance analysis. It discusses key ratios to analyze including profitability, efficiency, liquidity, and gearing ratios. It also covers the use of non-financial performance indicators and key performance indicators. Benchmarking is defined as the systematic comparison of practices to provide targets for improvement. The chapter outlines the Baldrige performance excellence model which assesses organizations across seven categories including leadership, strategy, customers, and results.