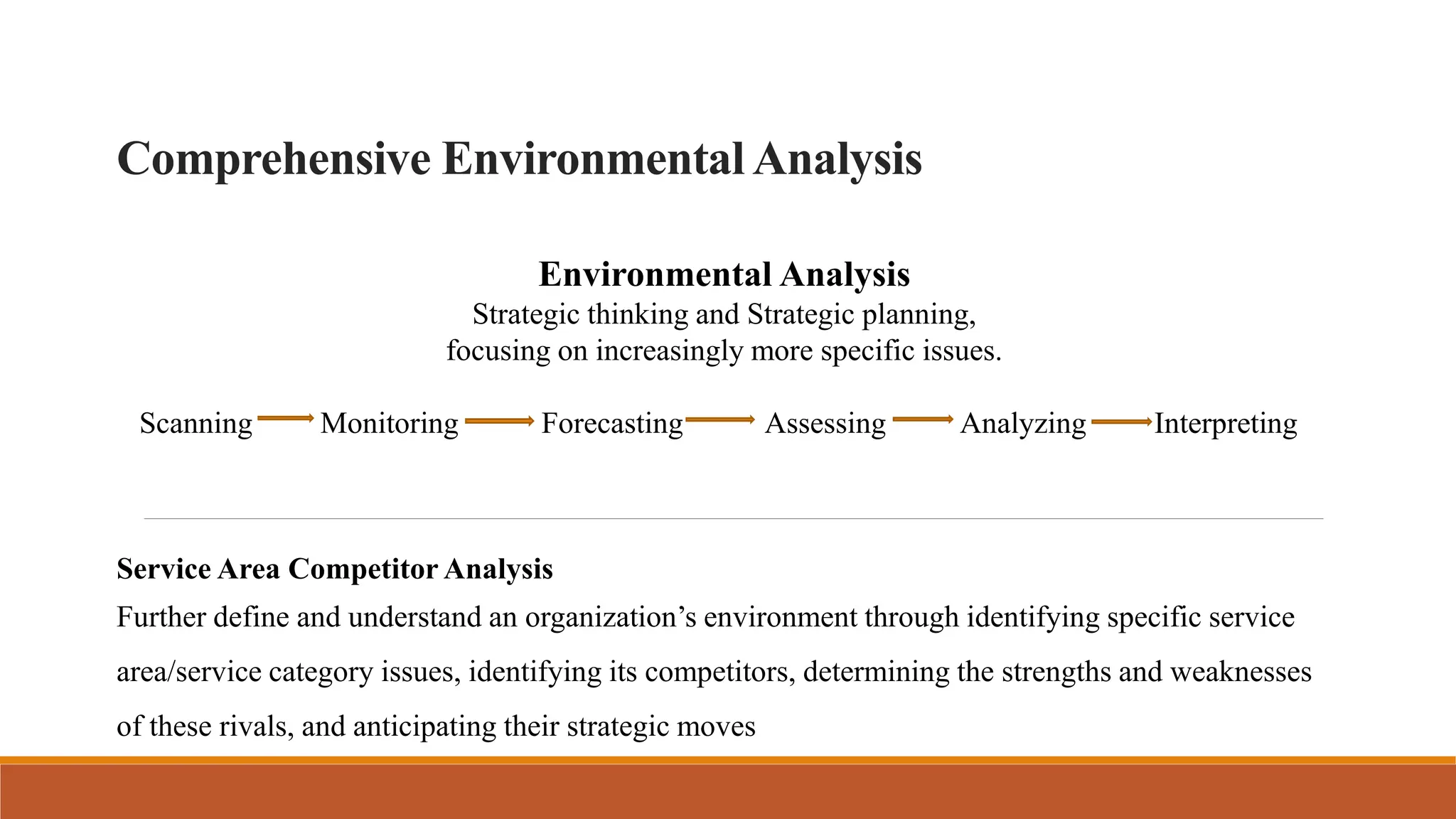

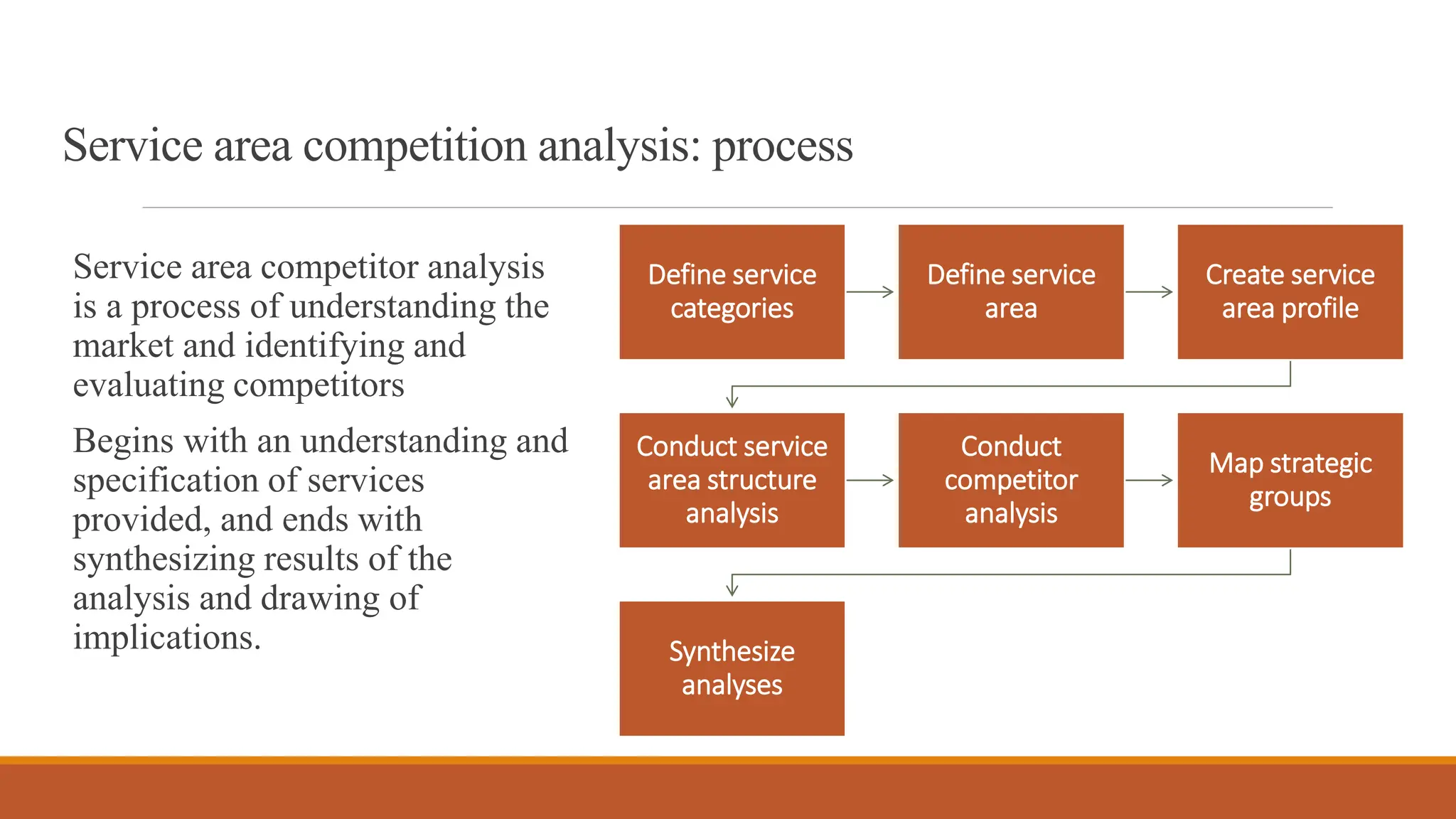

This document provides an overview of service area competition analysis. It discusses how analyzing competitors within a service area emerged as healthcare became more competitive. It defines a service area and lists the objectives of service area analysis. The document outlines the process of conducting service area analysis, including defining service categories and area boundaries, profiling the area, analyzing industry forces, conducting competitor evaluations, and mapping strategic groups. The goal is to understand the competitive landscape to inform strategic decision making.