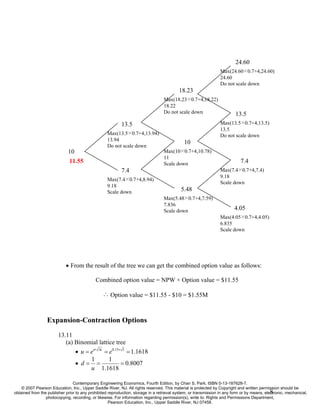

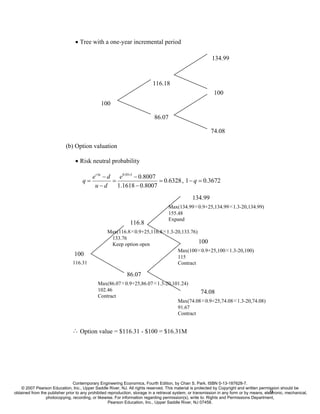

1) The document discusses real-options analysis and financial options valuation. It provides examples of calculating the value of European call options, American call options, and option portfolios using decision trees.

2) Key parameters for valuing a real option to delay investment are defined, such as present value of the project, investment cost, time to expiration, risk-free rate, and volatility. The Black-Scholes model is used to calculate the option value.

3) Parameters for valuing a real option to license a project are defined but the values are not provided.

![• Tree valuation:

Note to instructors: No mention is made about the dividend payment in

determining the option premium in the text. In financial option, any dividend

payment reduces the value of the option. The figures in yellow represent the

adjusted share prices after a 3% dividend payment, i.e., (1 – 0.03)($124.96) =

$121.21. If there is no dividend payment, we just use the original share prices in

determining the option premium.

Keep open 124.96

Keep open 86.35 Do not exercise

59.67 121.21 [0]

83.76

57.88 [0]

40 [ 5.34 ]

[ 12.04 ] Keep open 56.15

Exercise 38.8 Do not exercise

26.81 54.46 [0]

37.64

26.01 [ 10.47 ]

[ 18.99 ]

Exercise 25.23

17.43 Exercise

24.47 [ 20.53 ]

16.91

[ 28.09 ]

11.34

Exercise

11.00 [ 34.00 ]

∴ American option value = $12.04

13.3

Portfolio Premium Payoff at stock price $60

A long call with X = $40 $3 $20 - $3 = $17

A short put with X = $45 $4 $4 – 0 = $4

Two short call with X = $35 $5 ($5 - $25)×2 = ($40)

Two short stock at $40 ($40 - $60)×2 = ($40)

Total ($59)

Contemporary Engineering Economics, Fourth Edition, by Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

2

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.](https://image.slidesharecdn.com/chapter13opcionesfinancieras-130317211933-phpapp01/85/Chapter-13opciones-financieras-2-320.jpg)