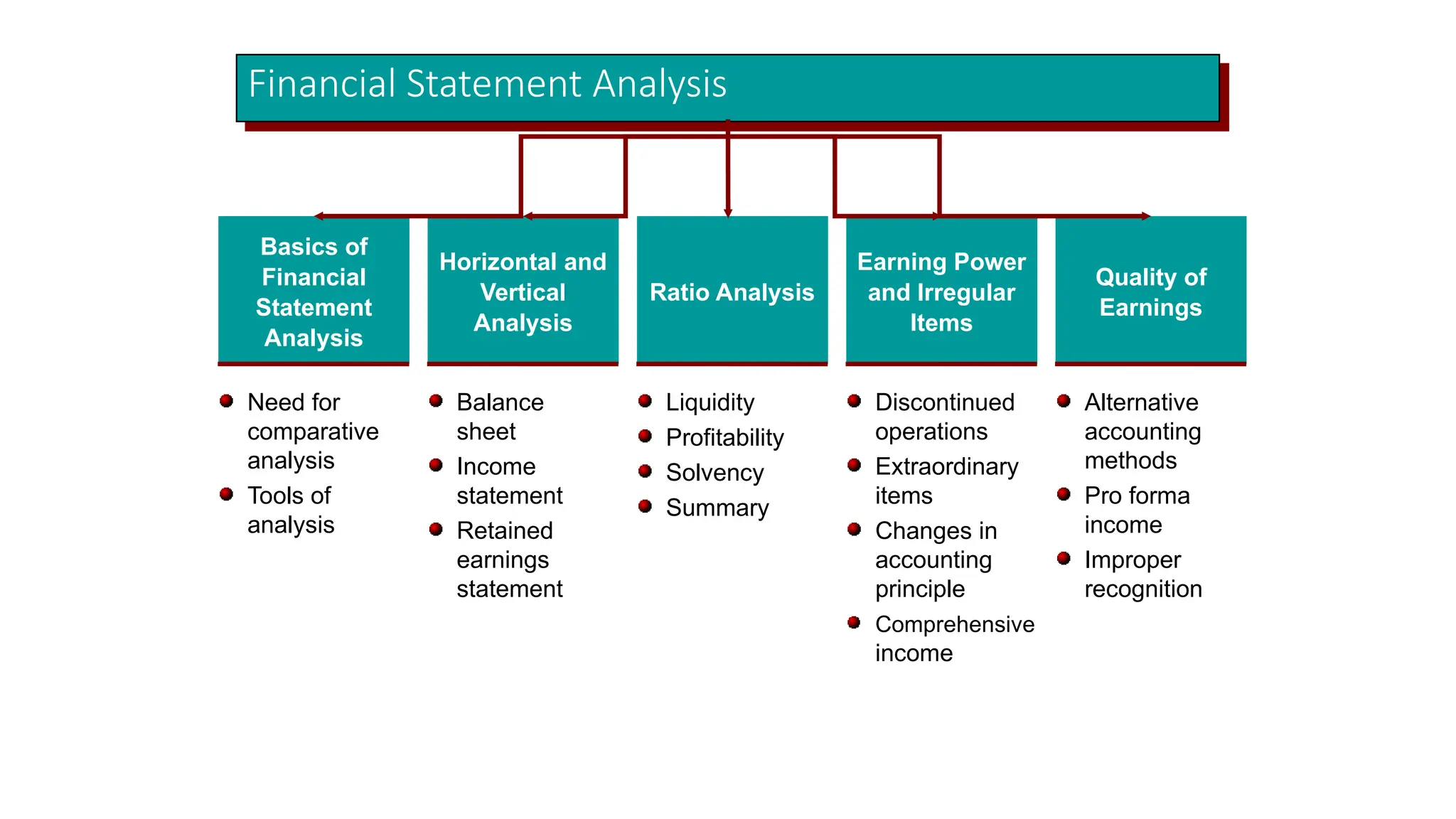

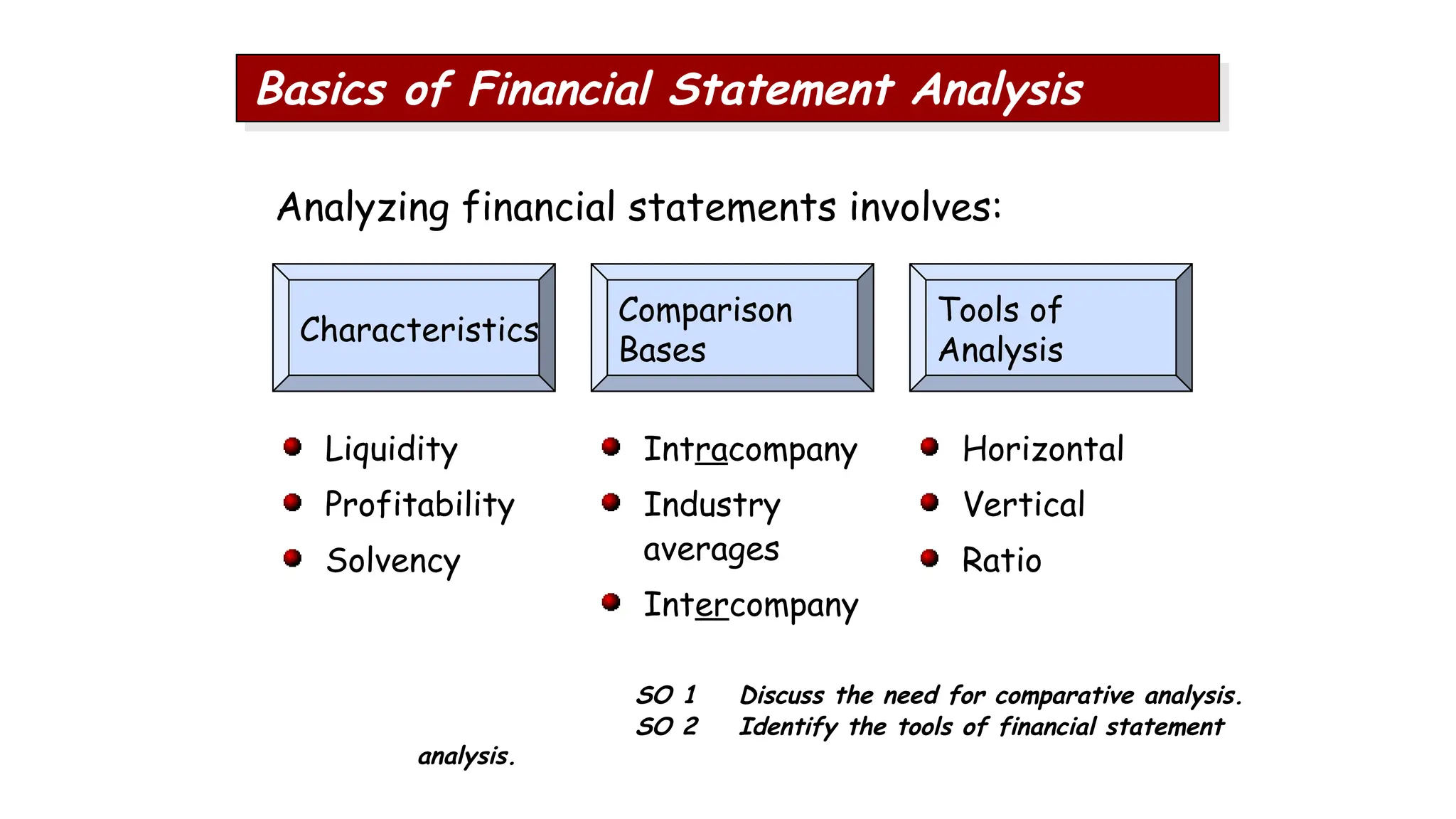

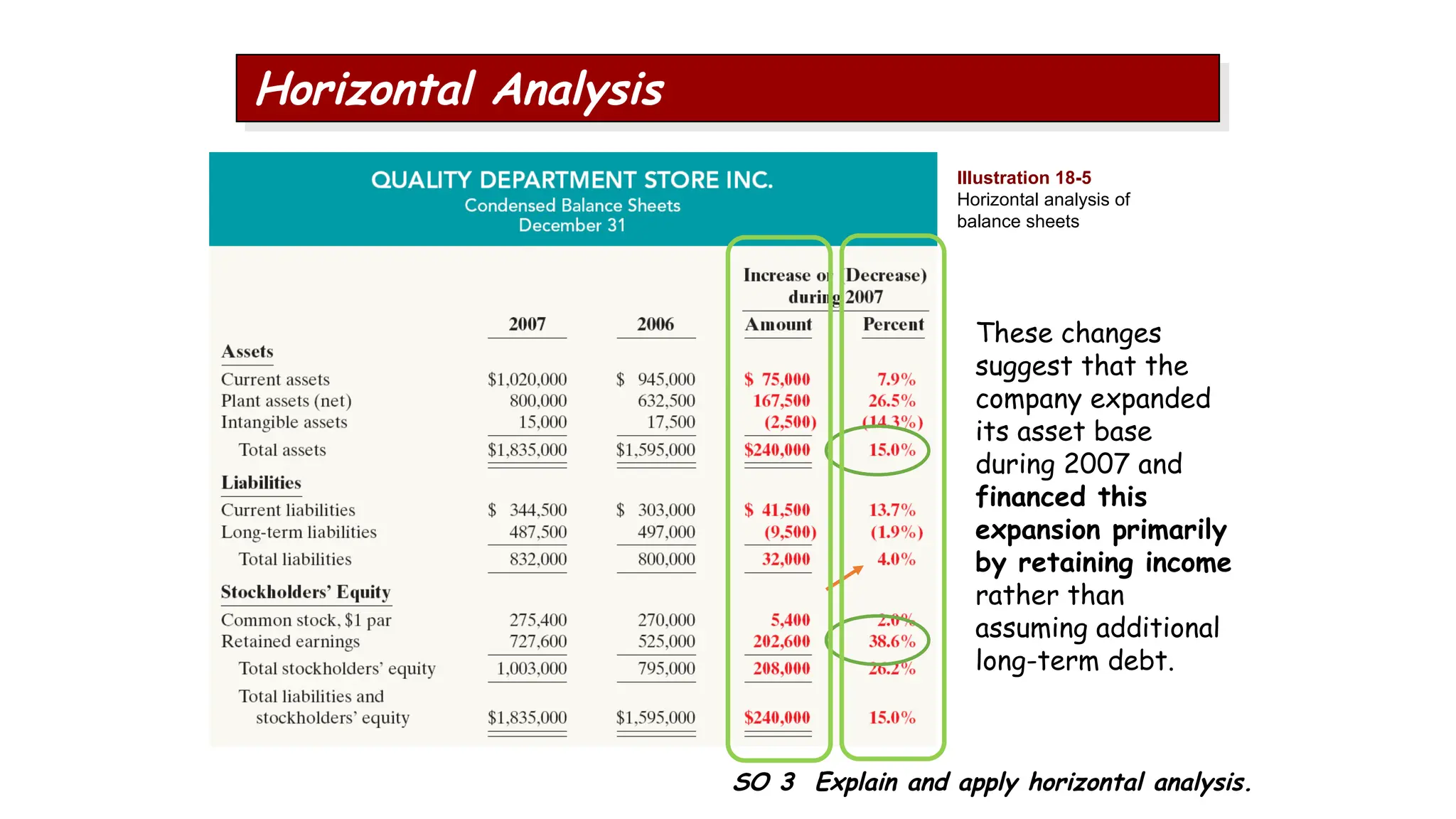

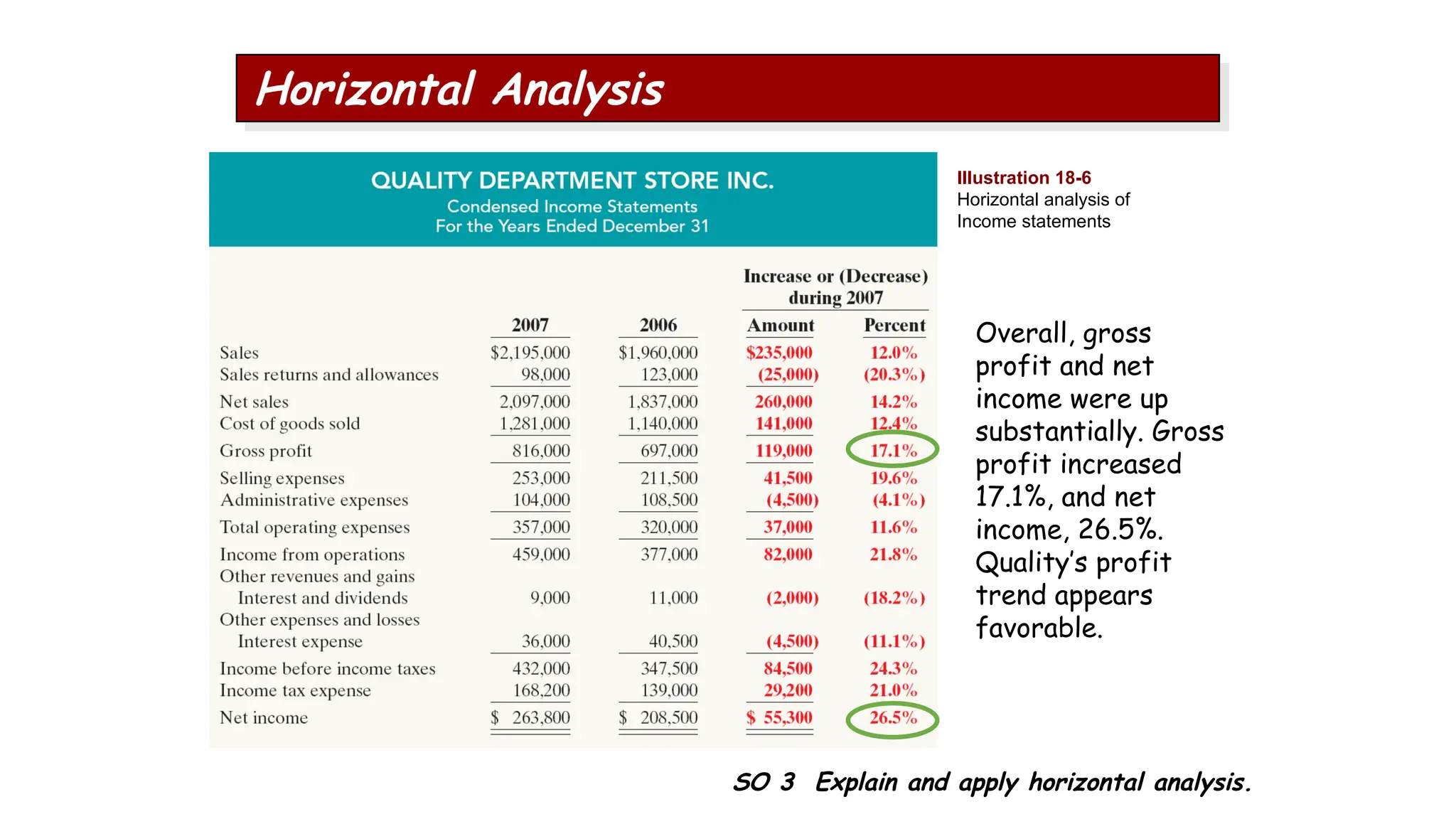

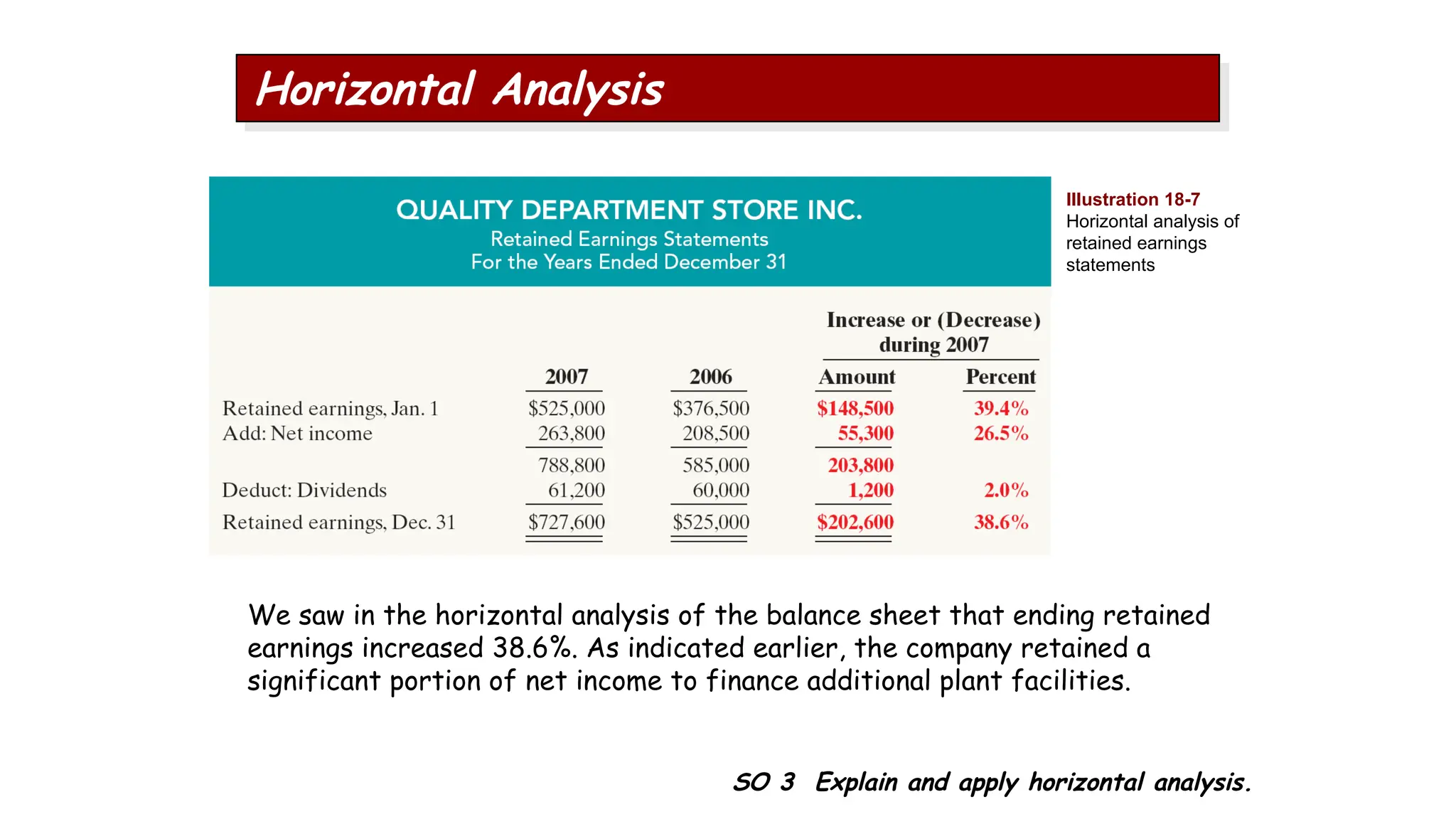

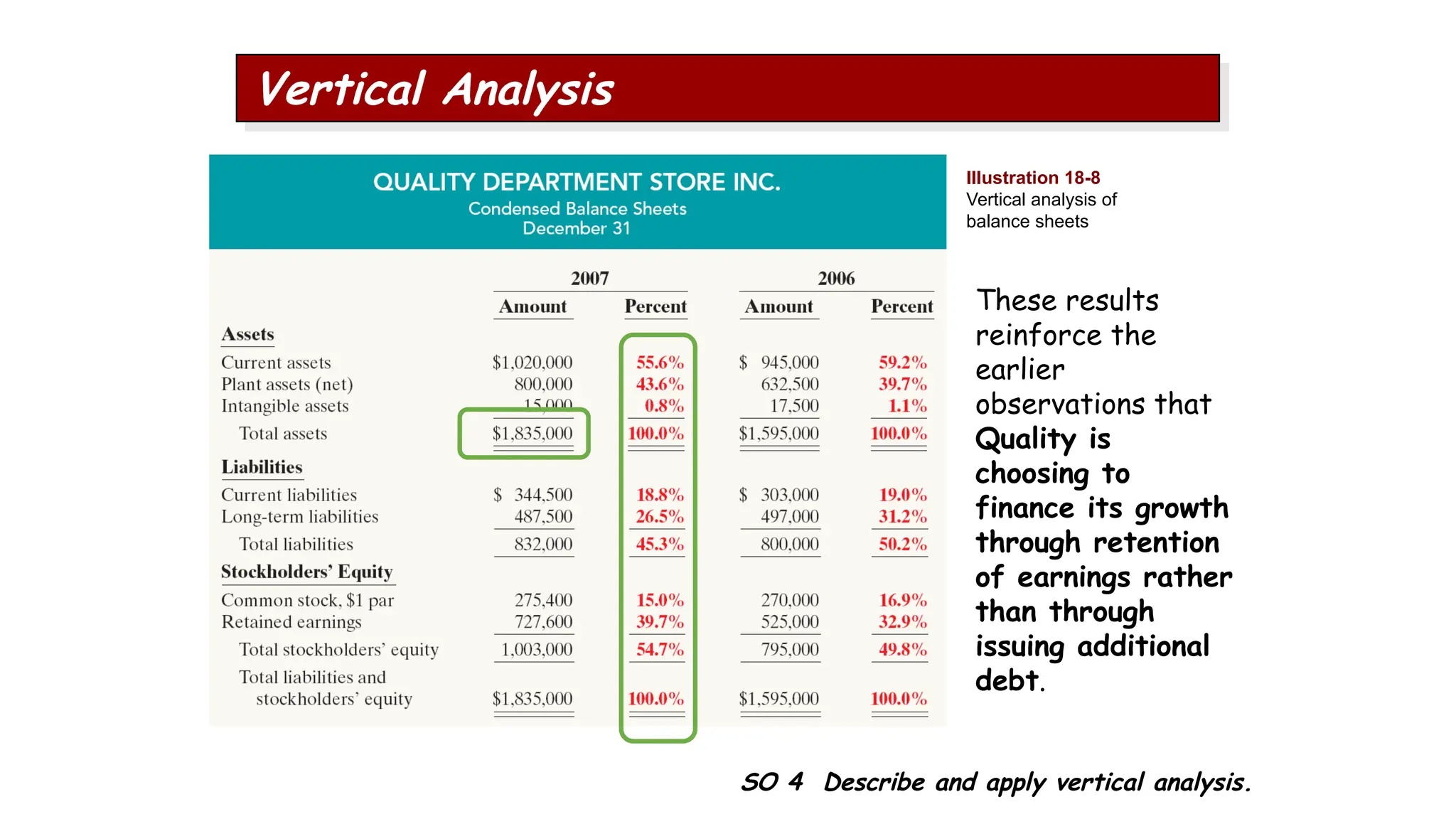

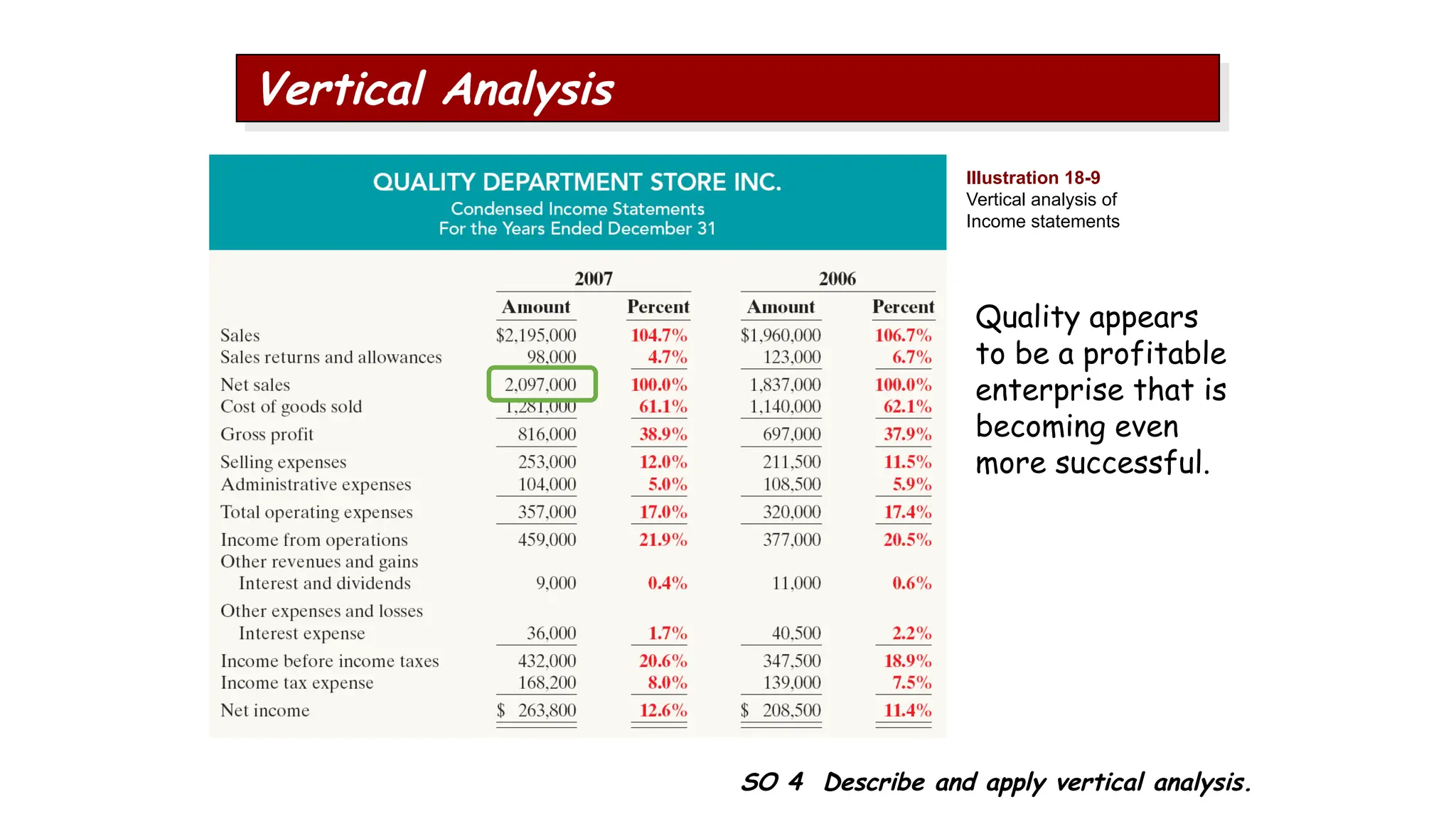

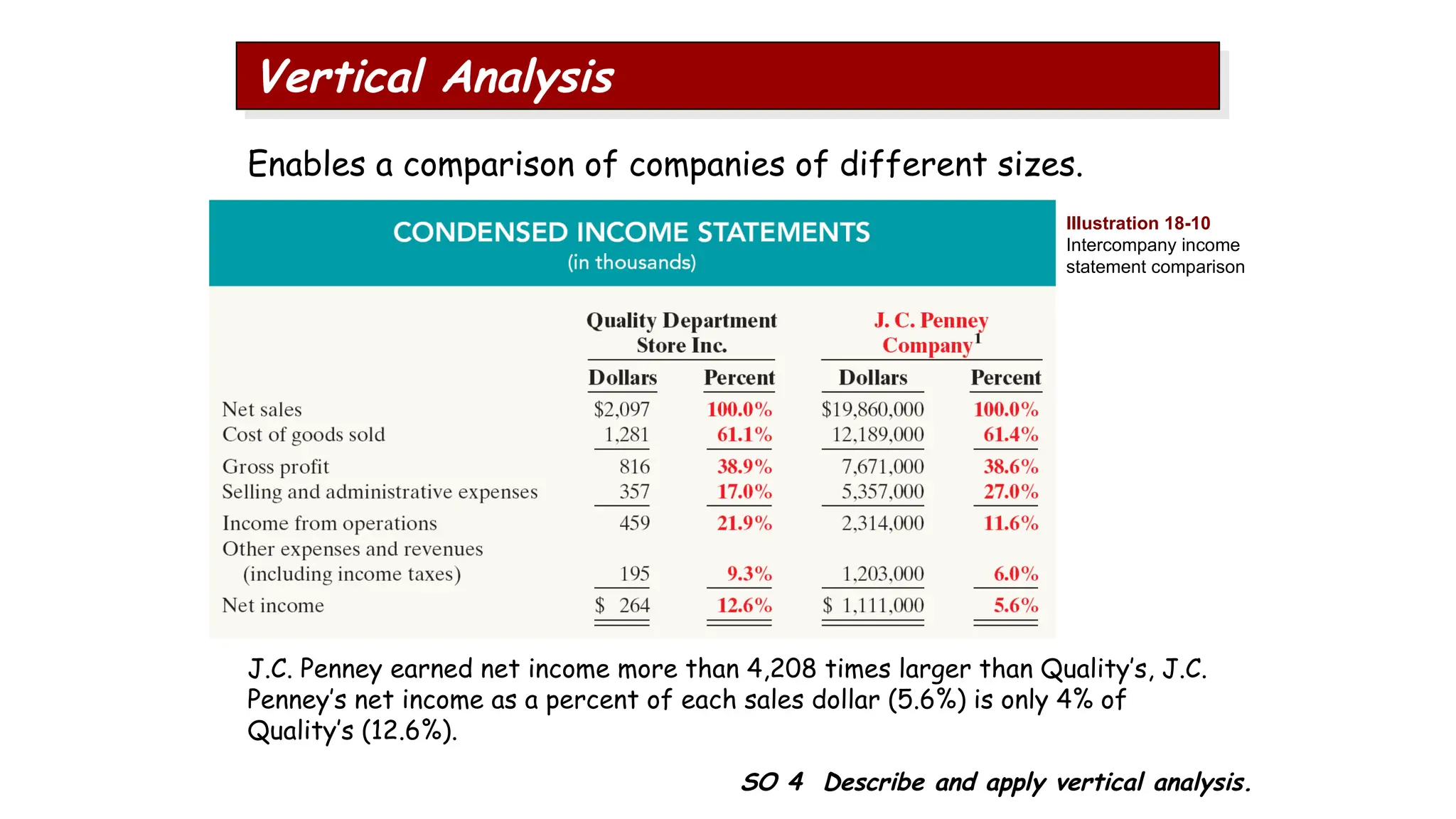

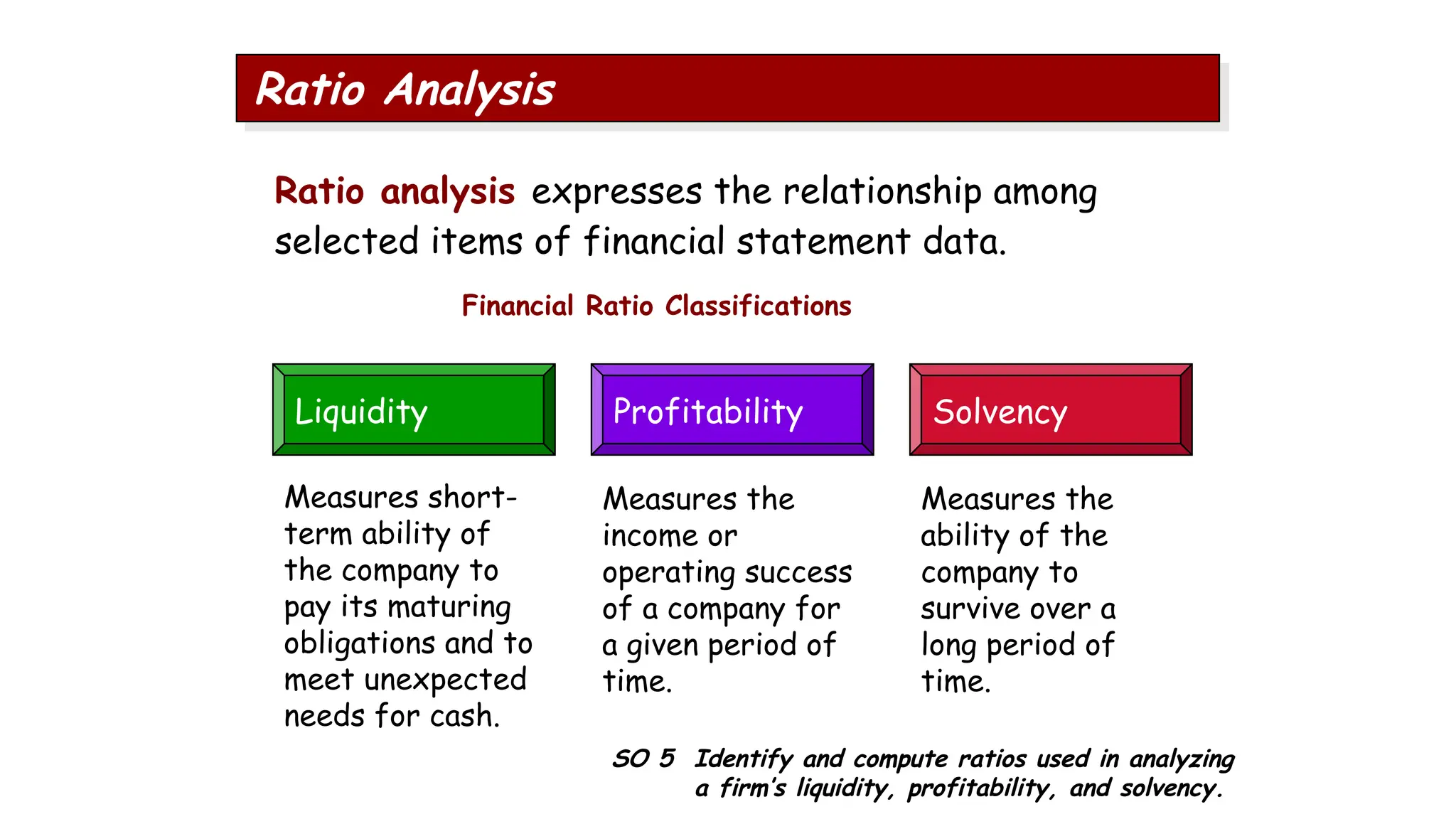

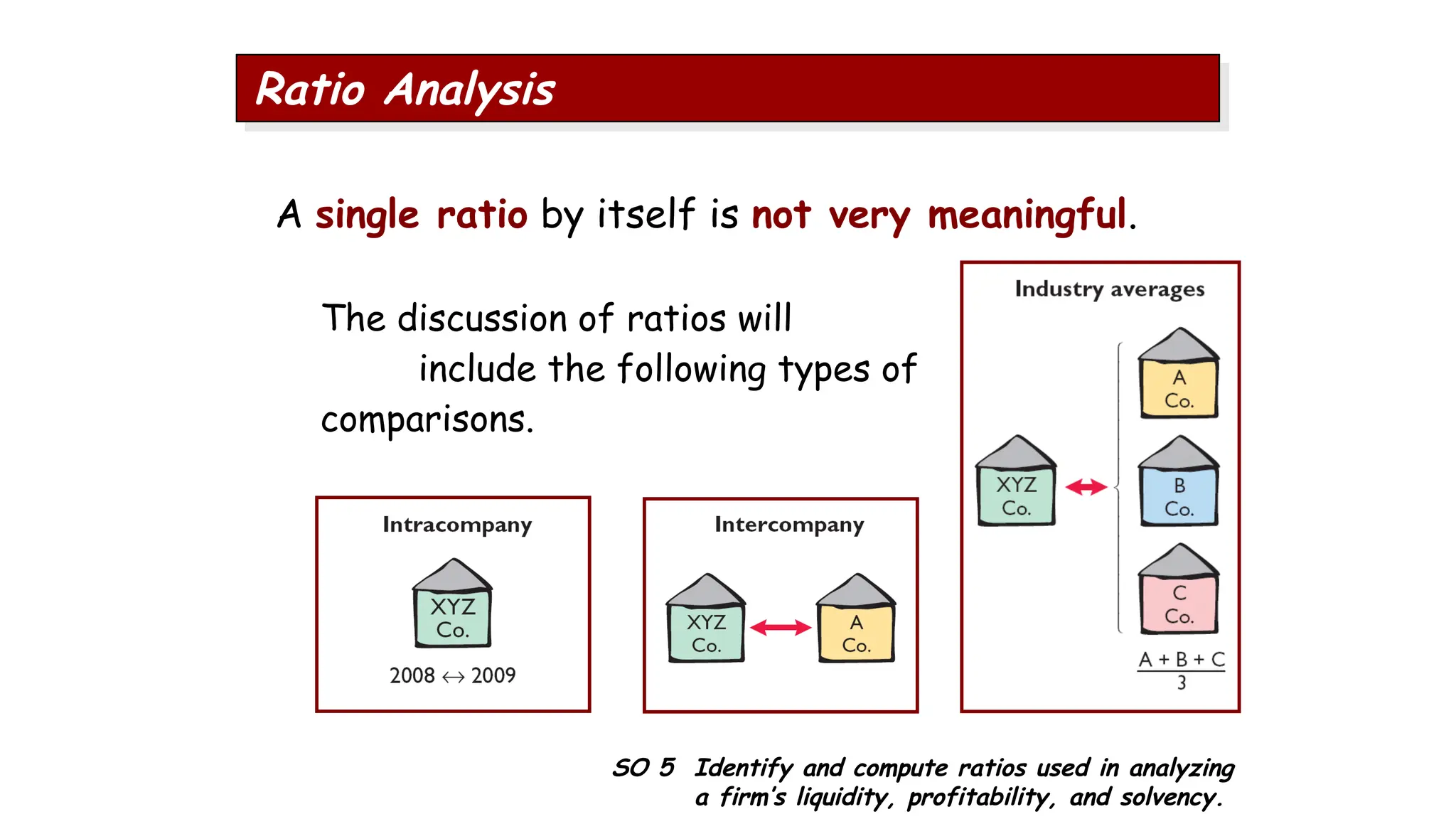

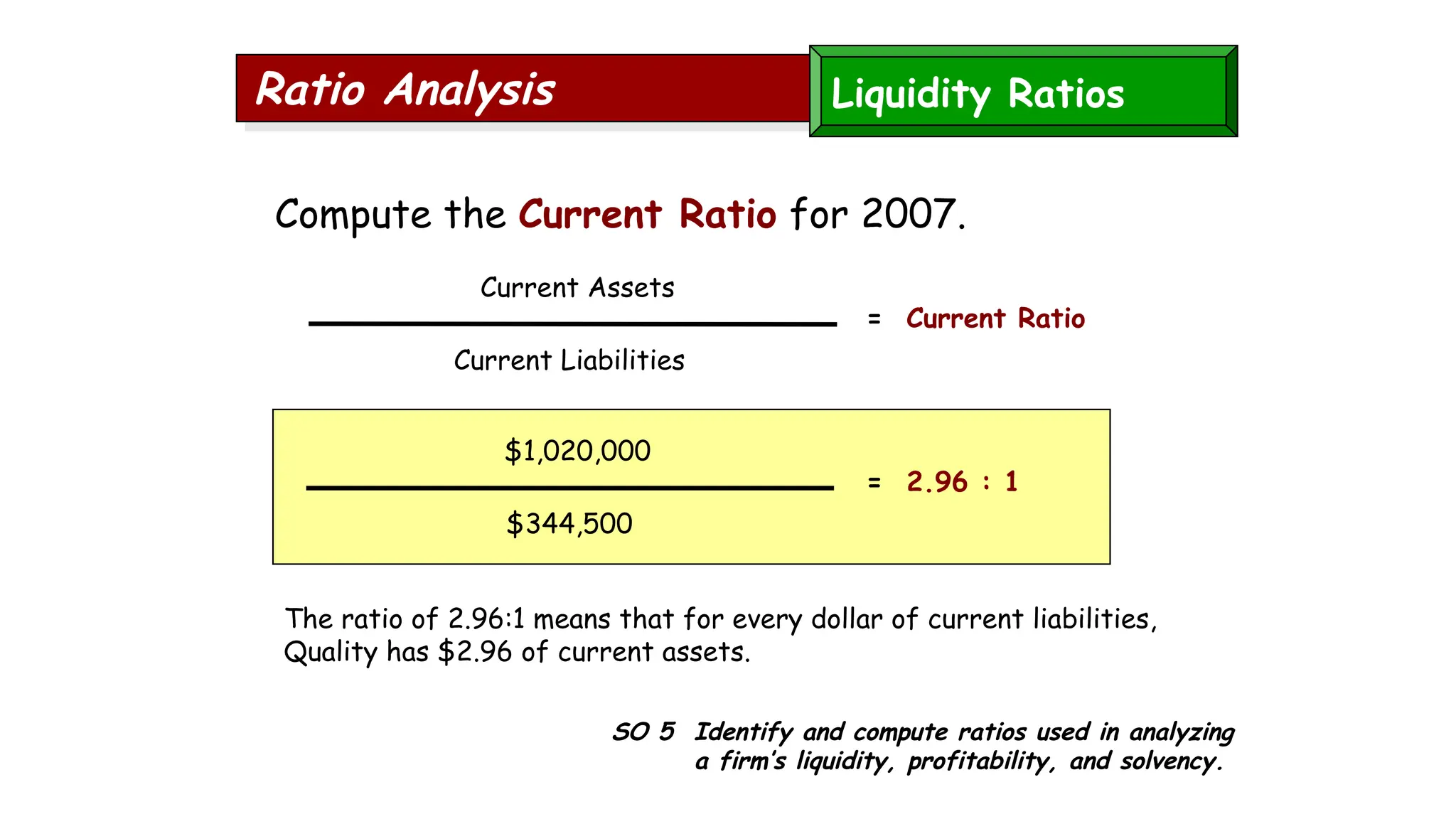

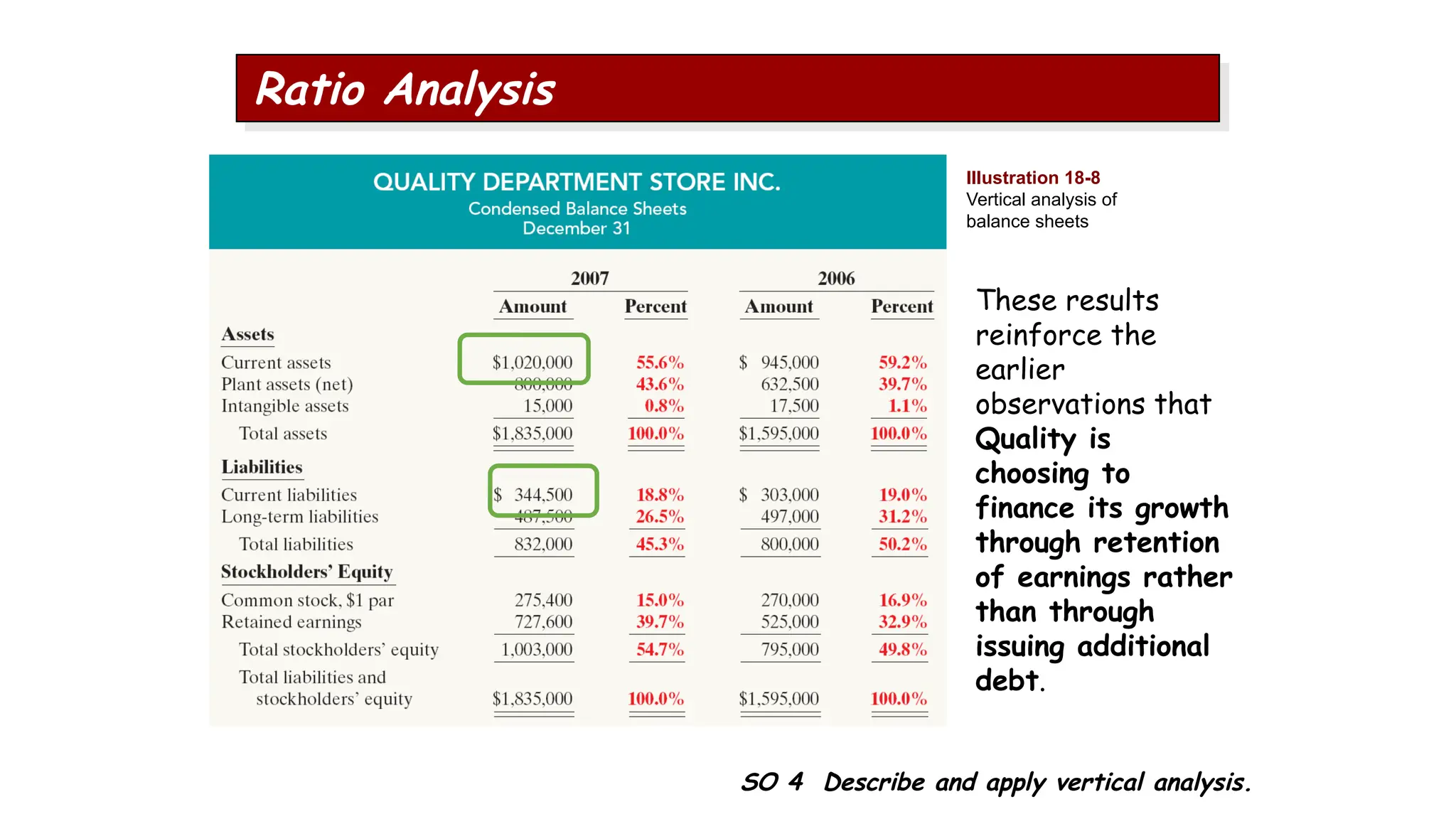

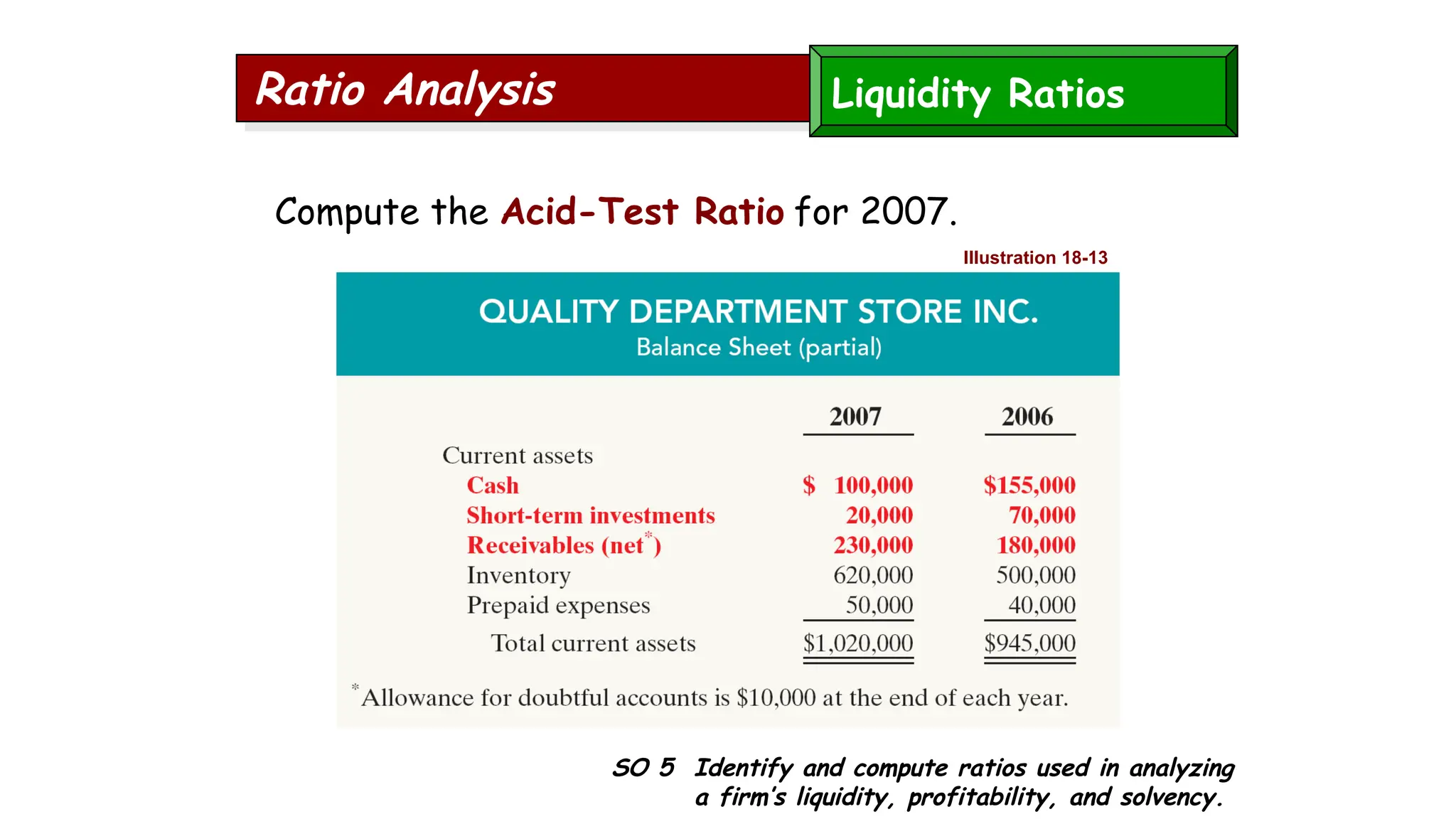

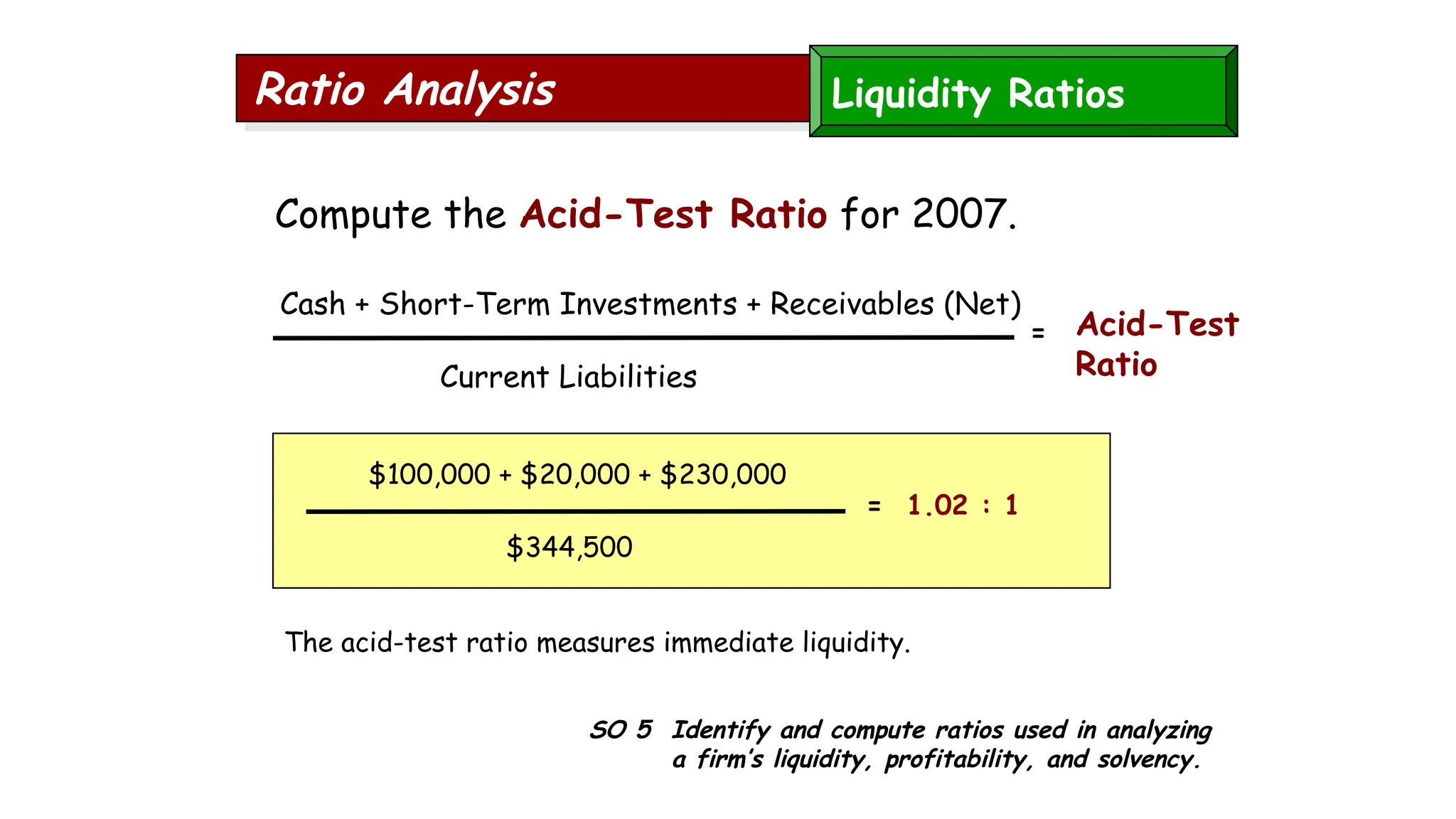

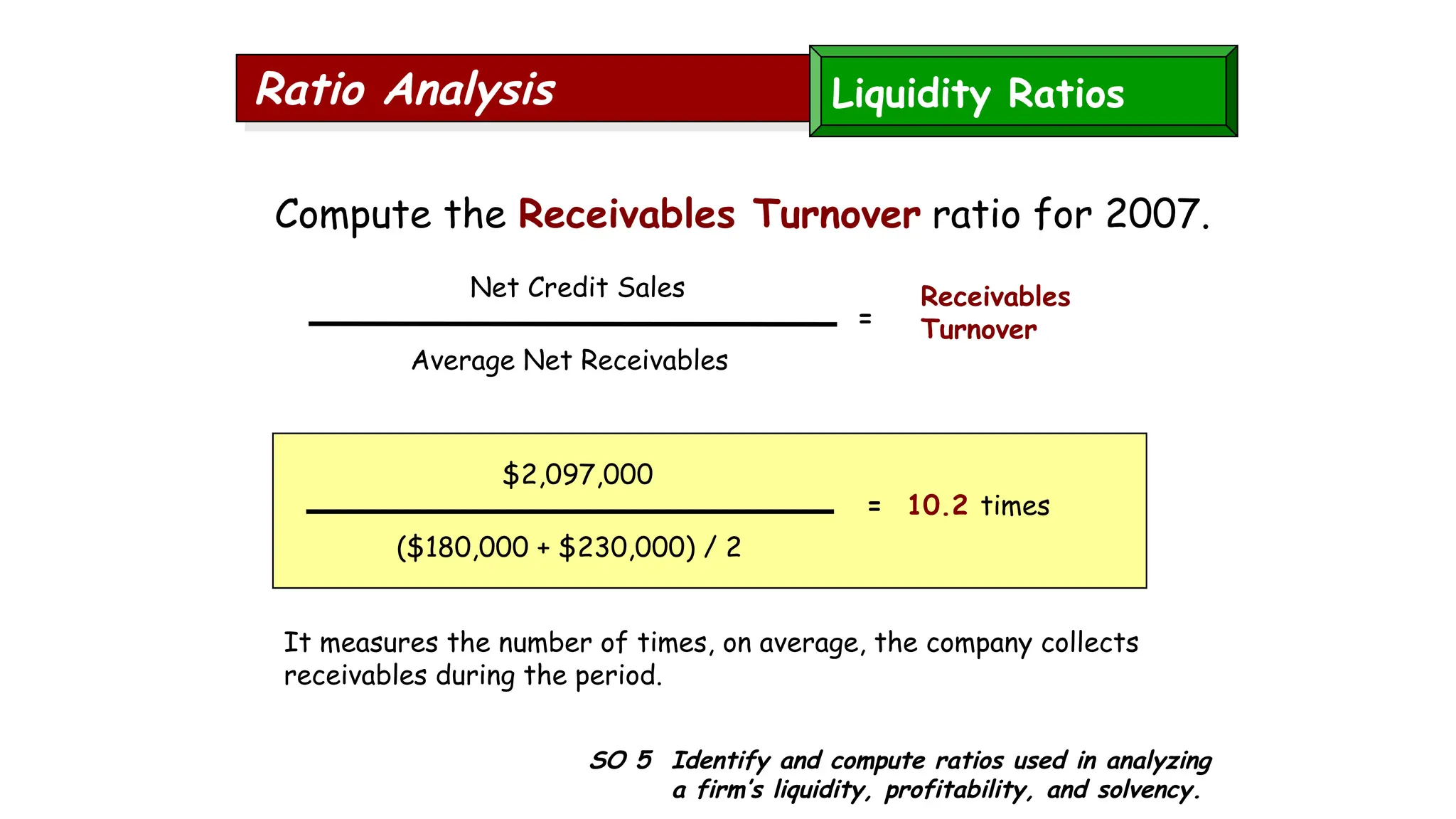

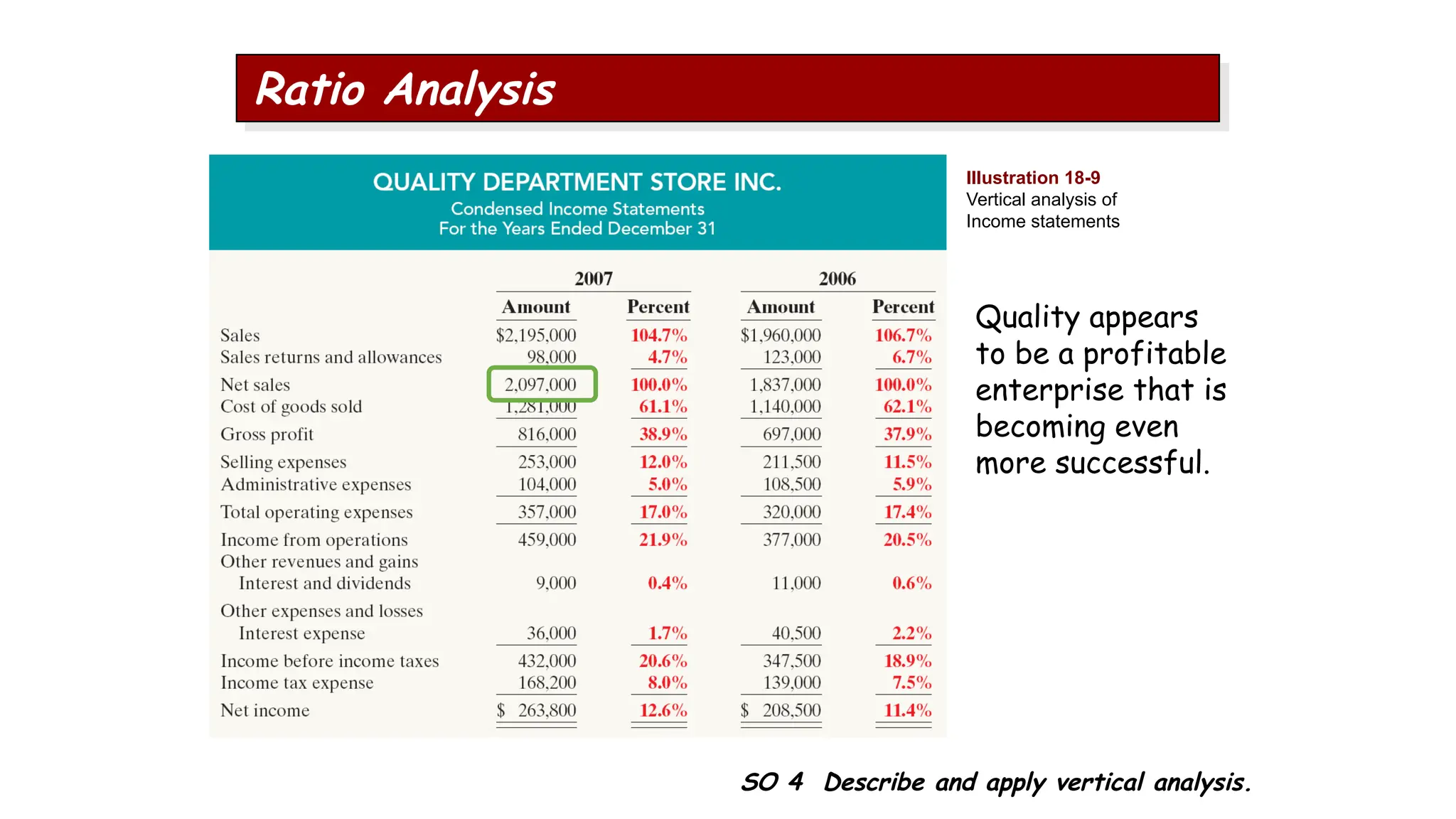

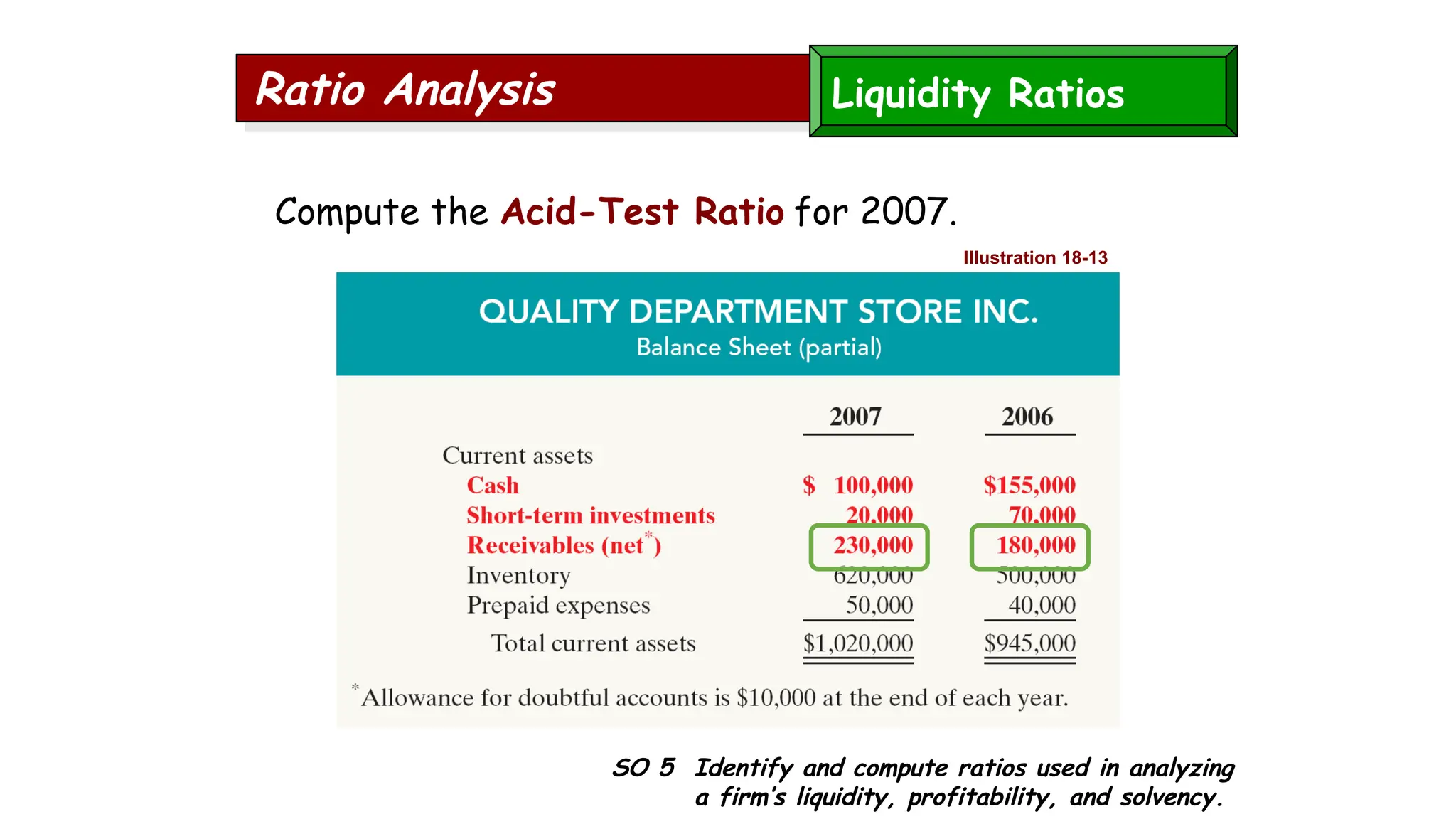

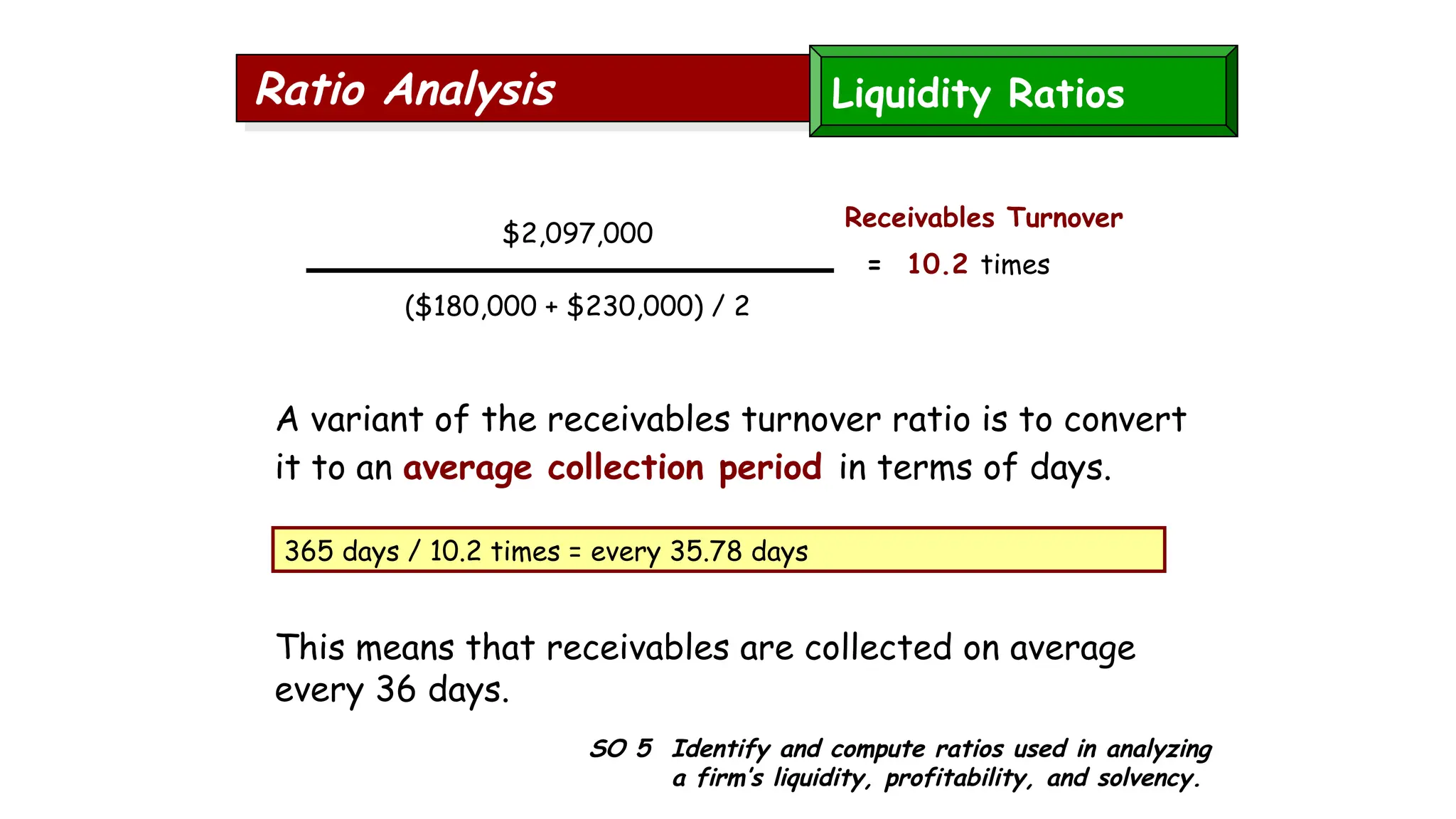

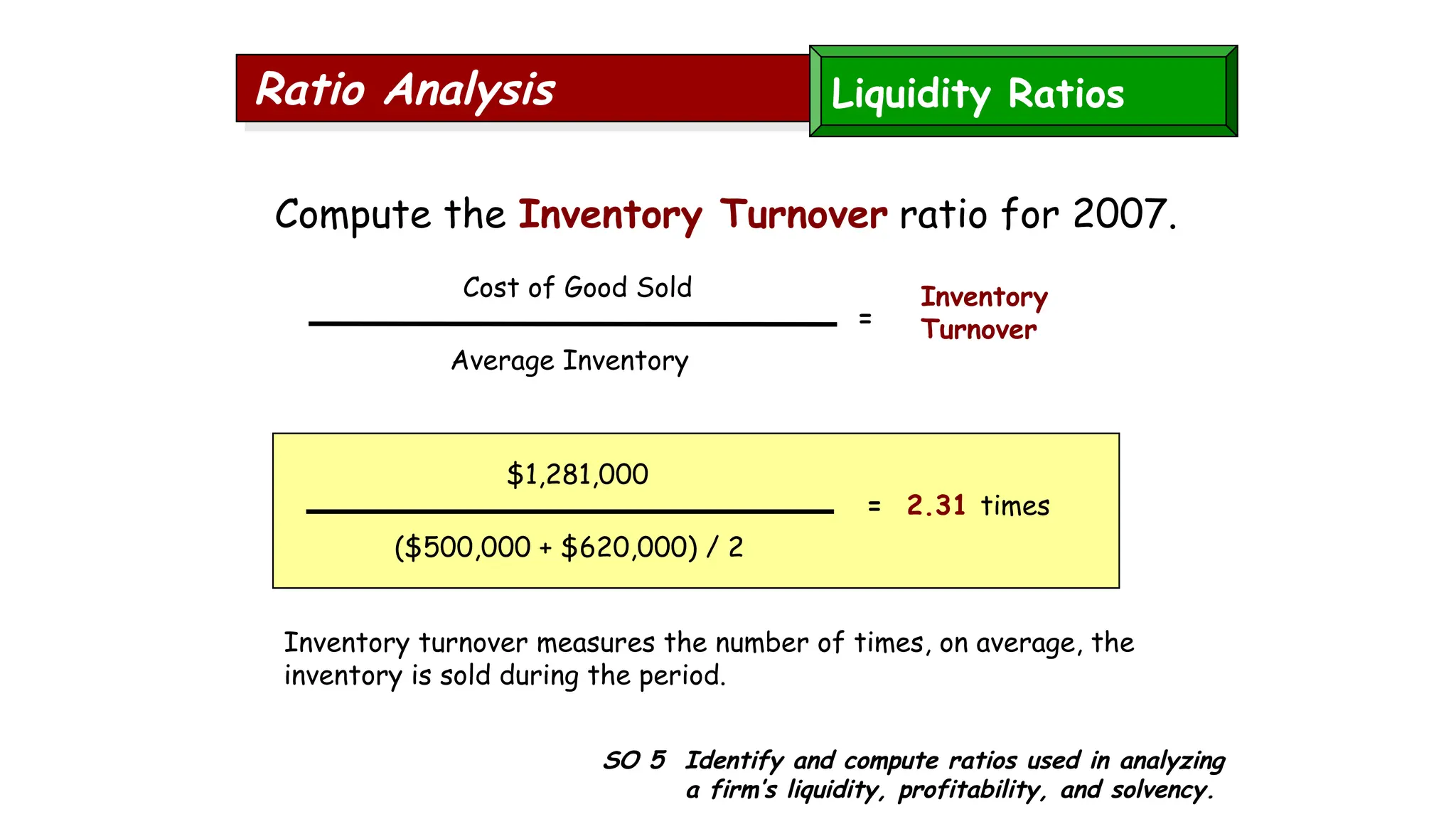

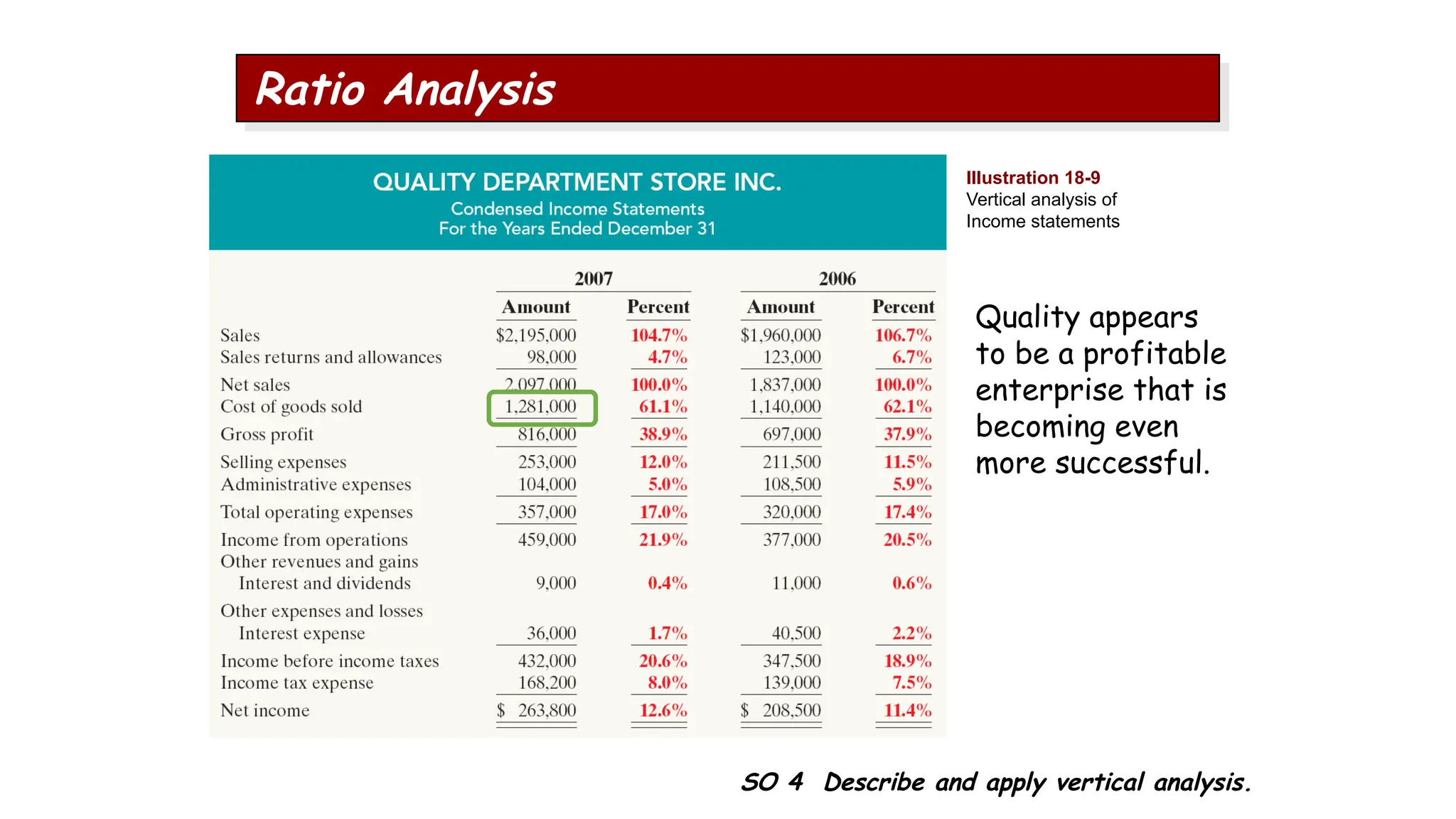

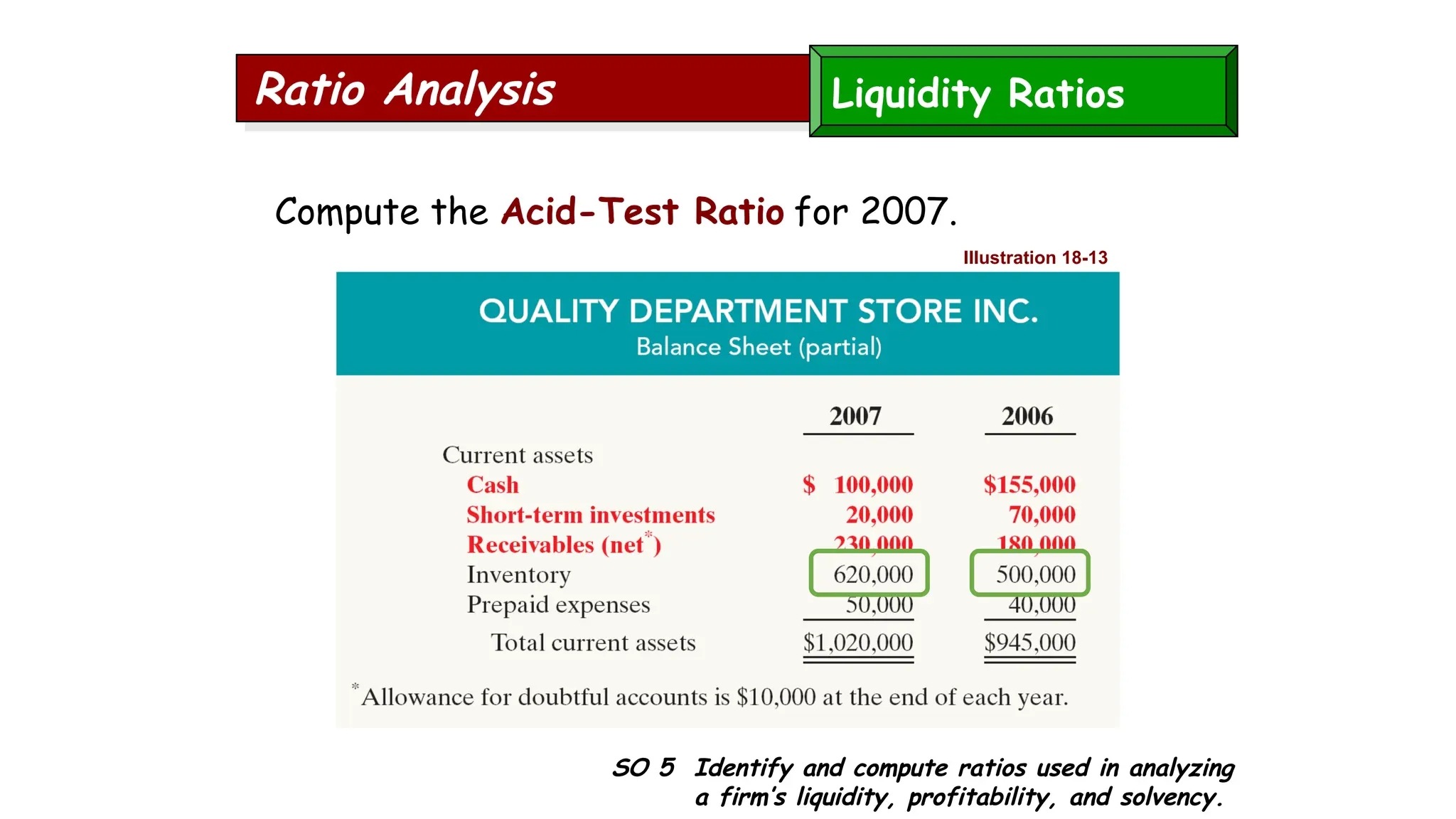

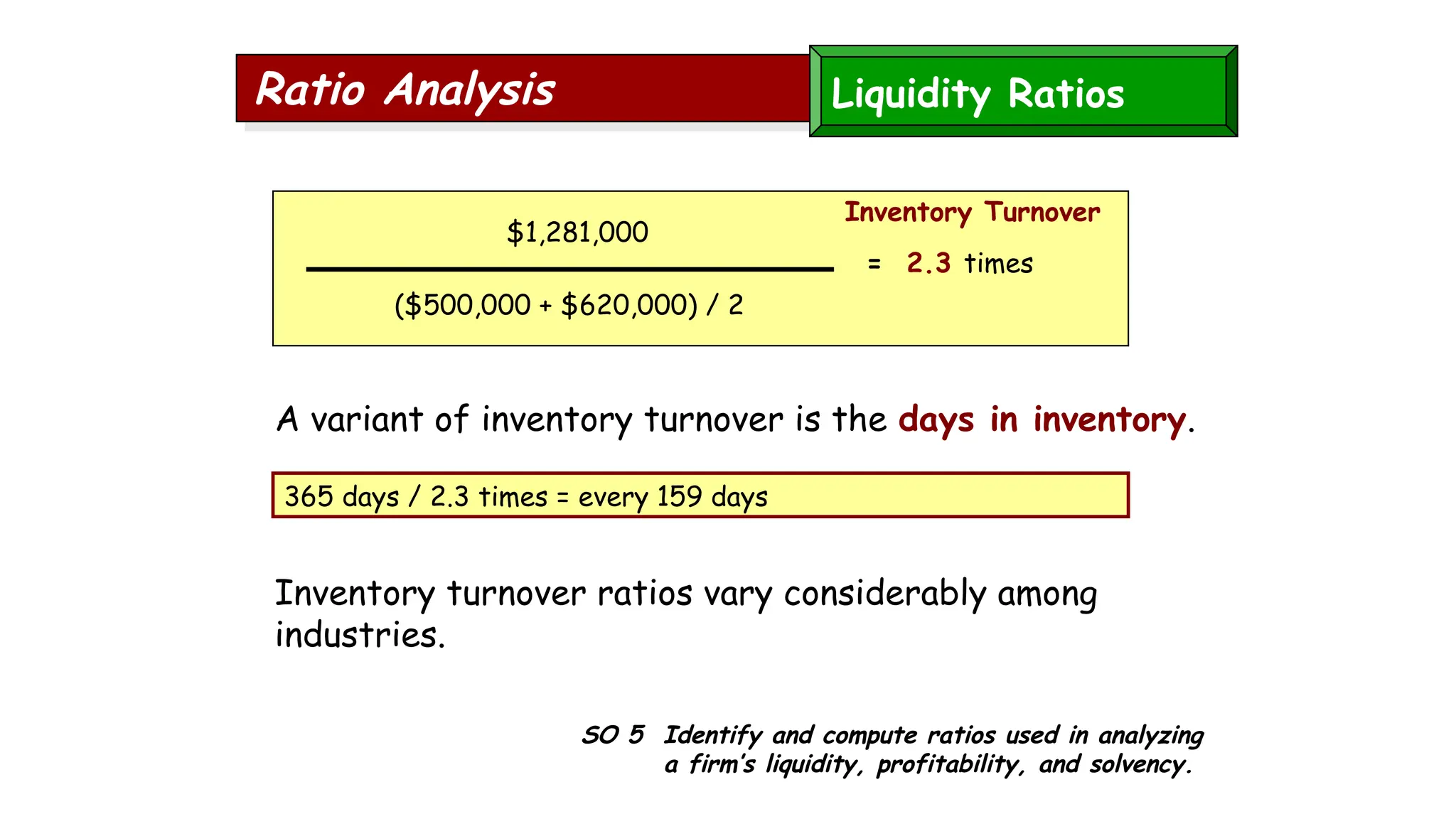

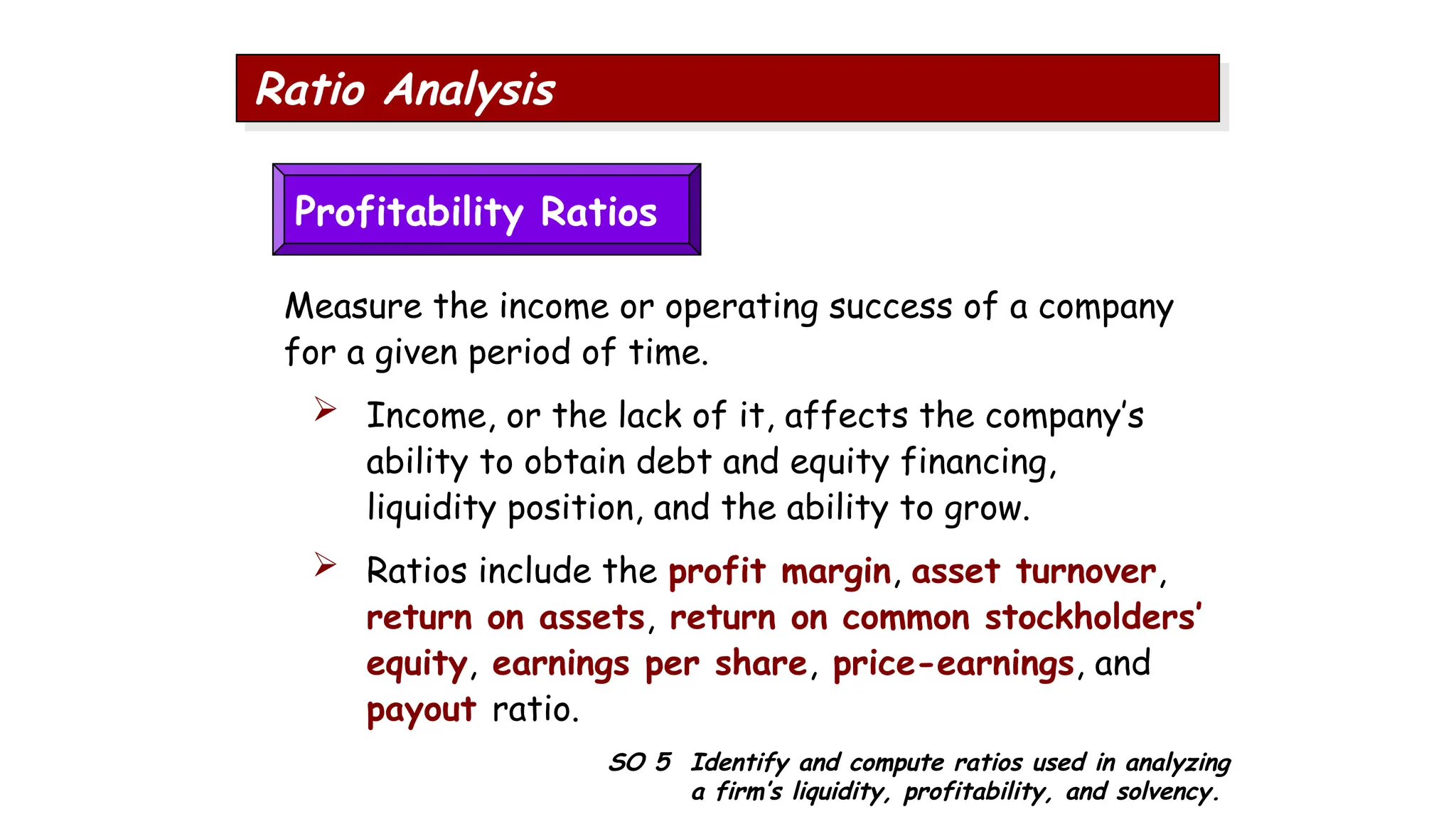

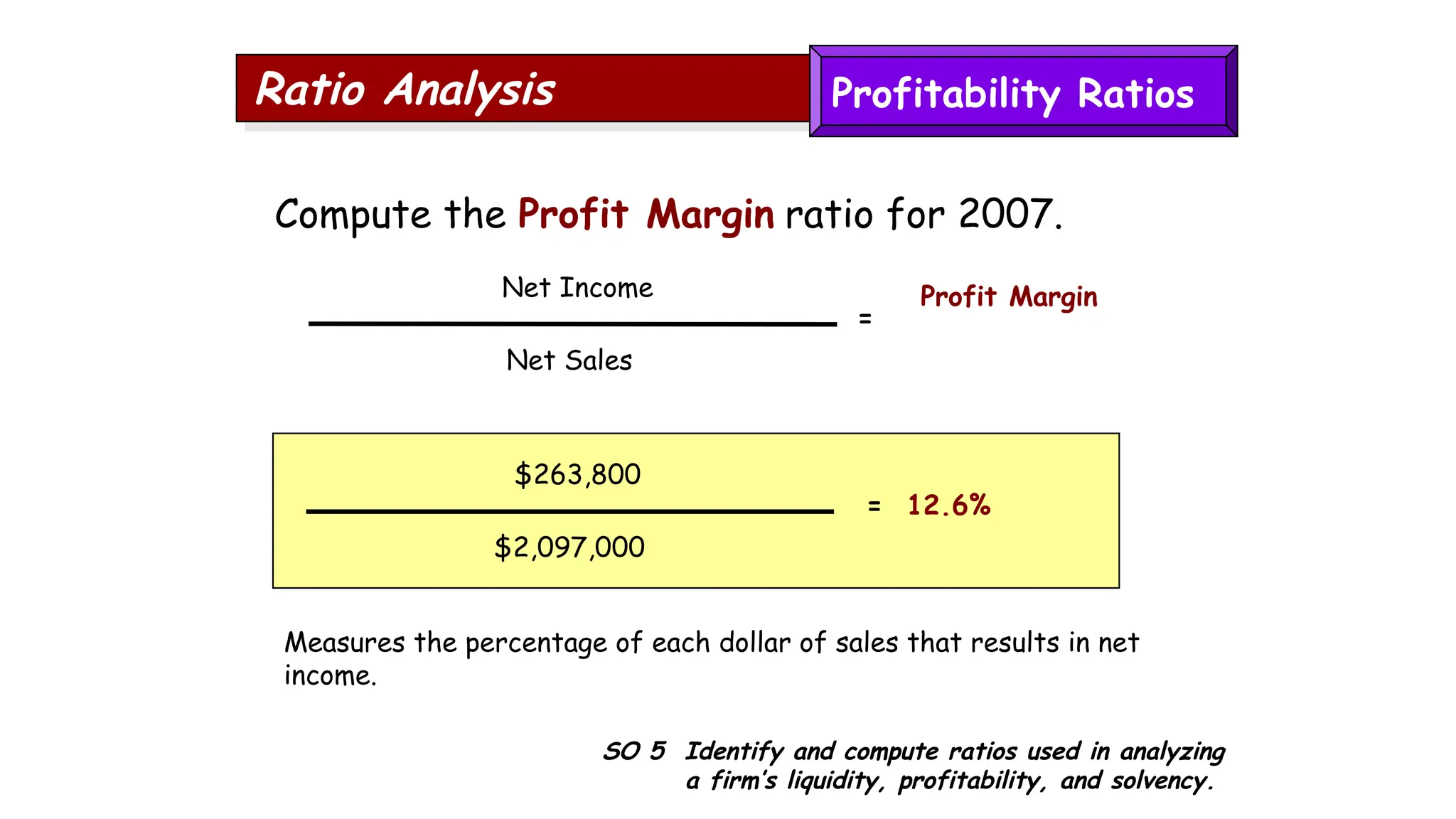

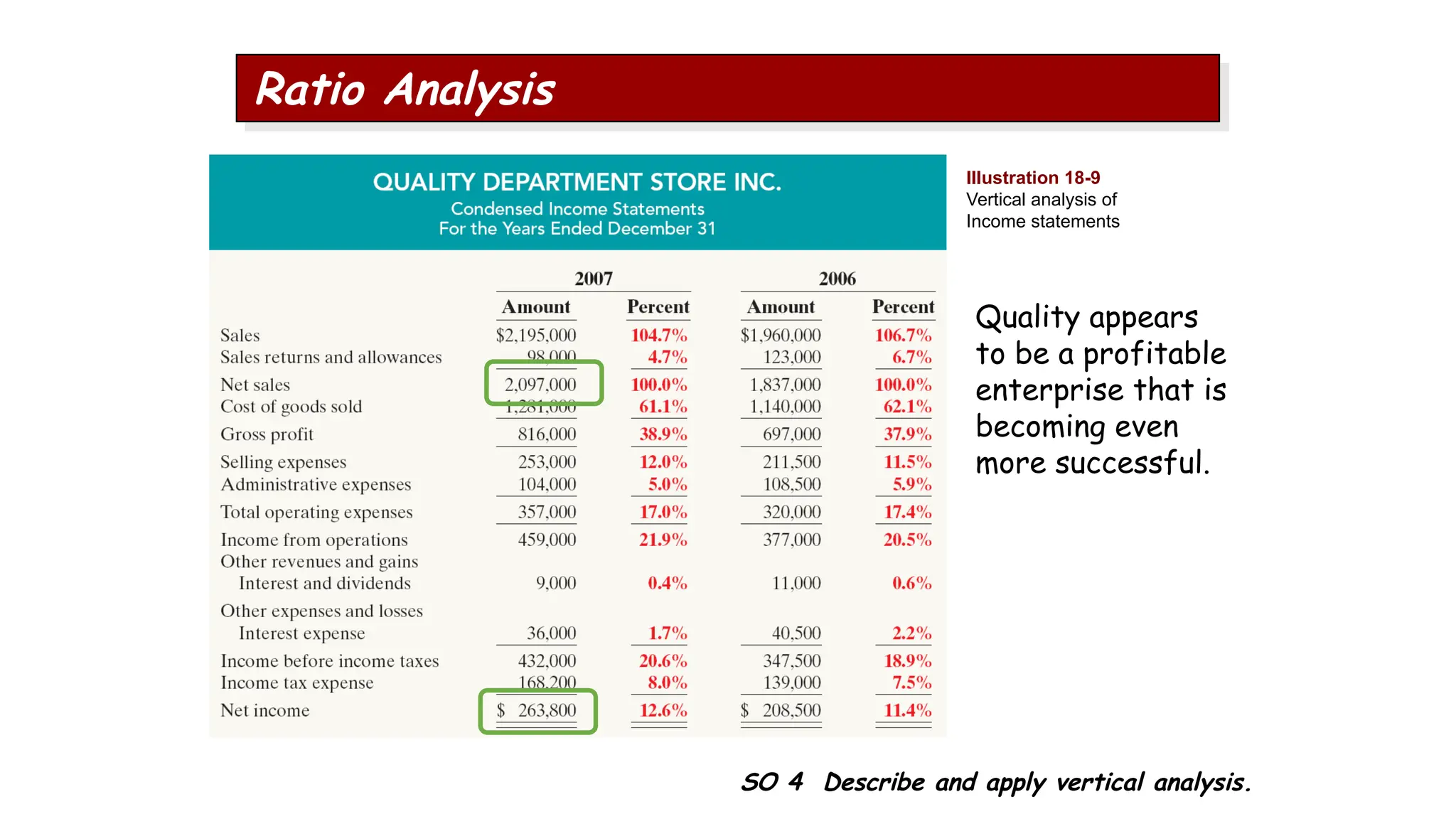

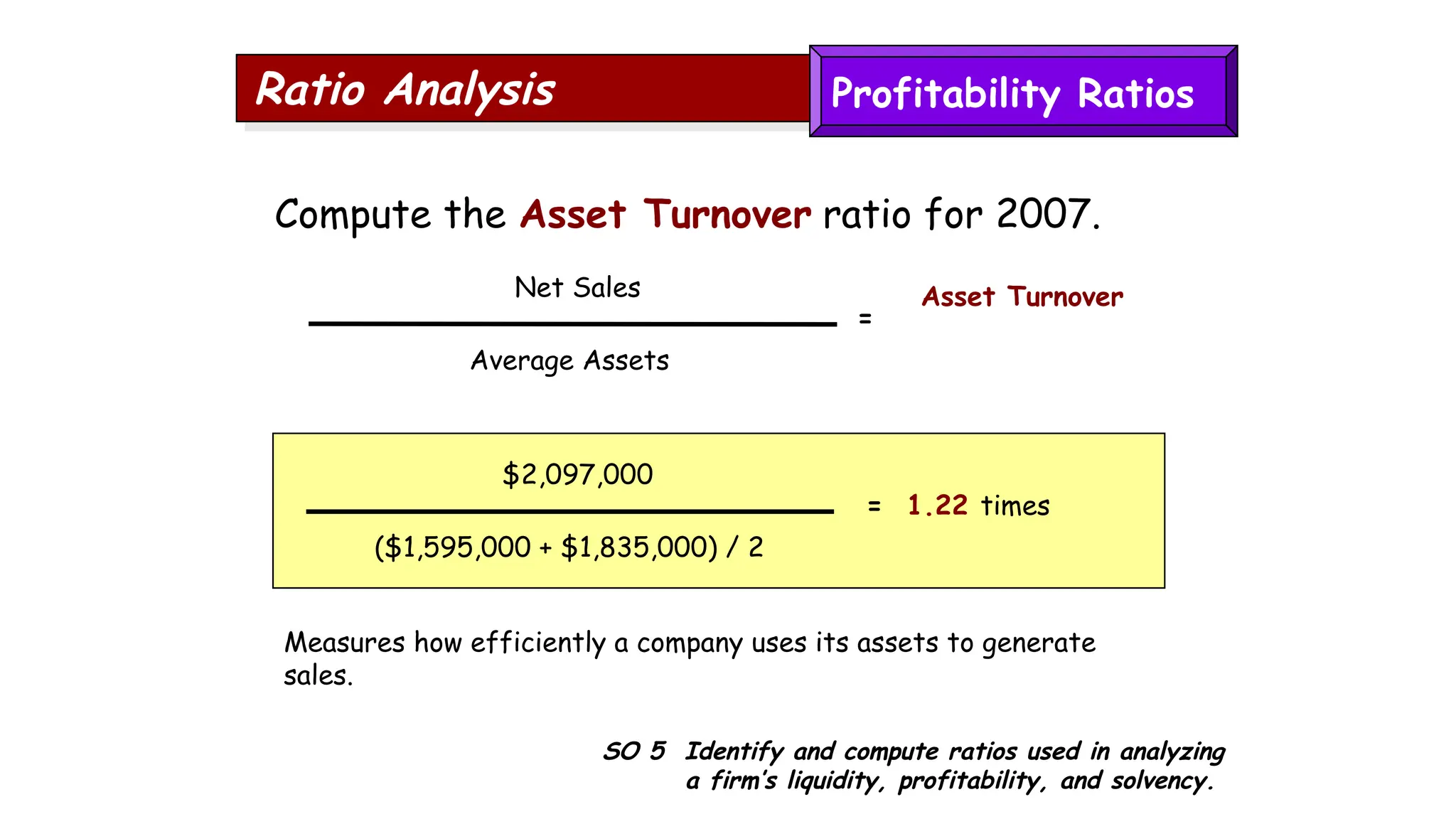

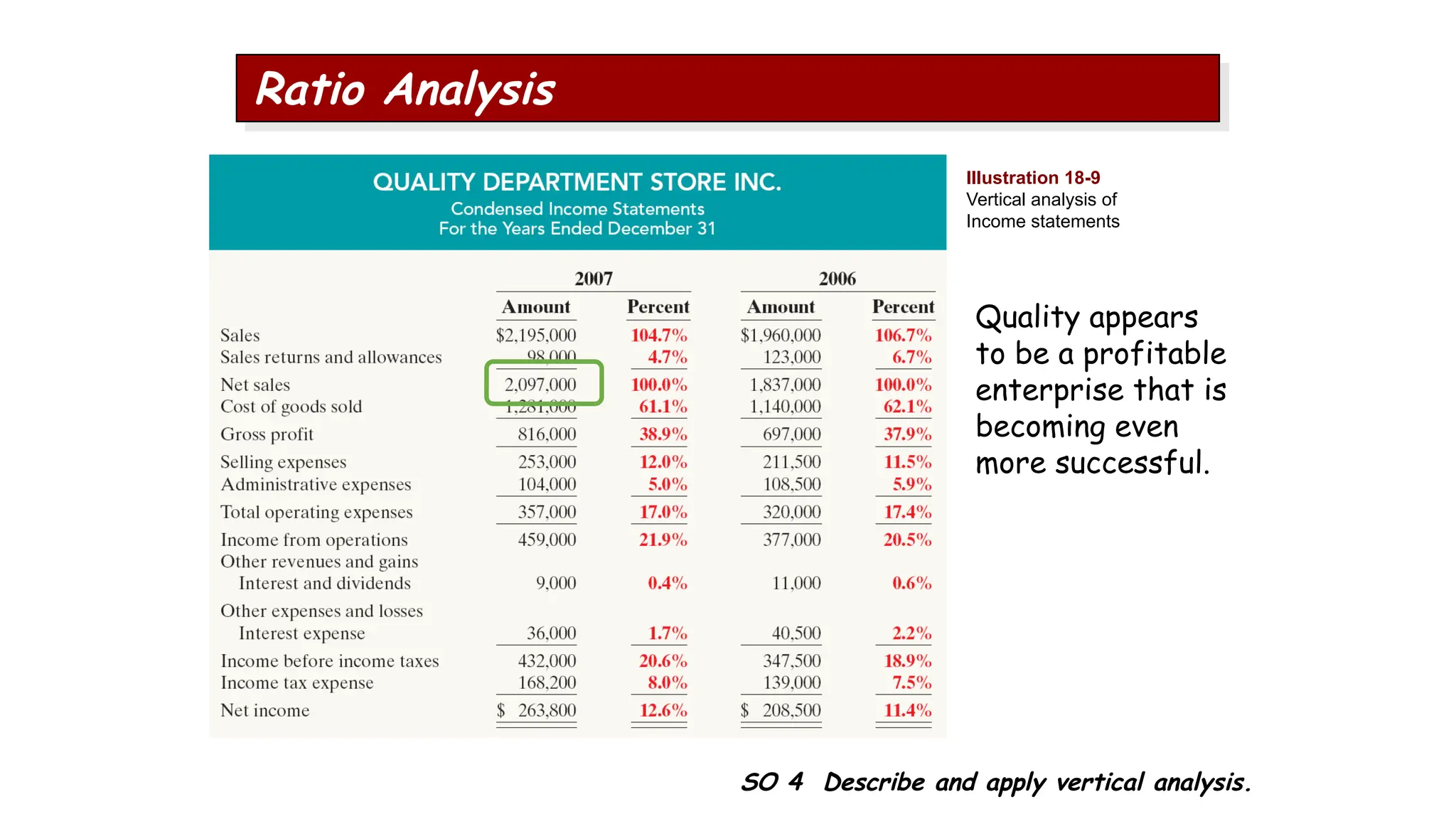

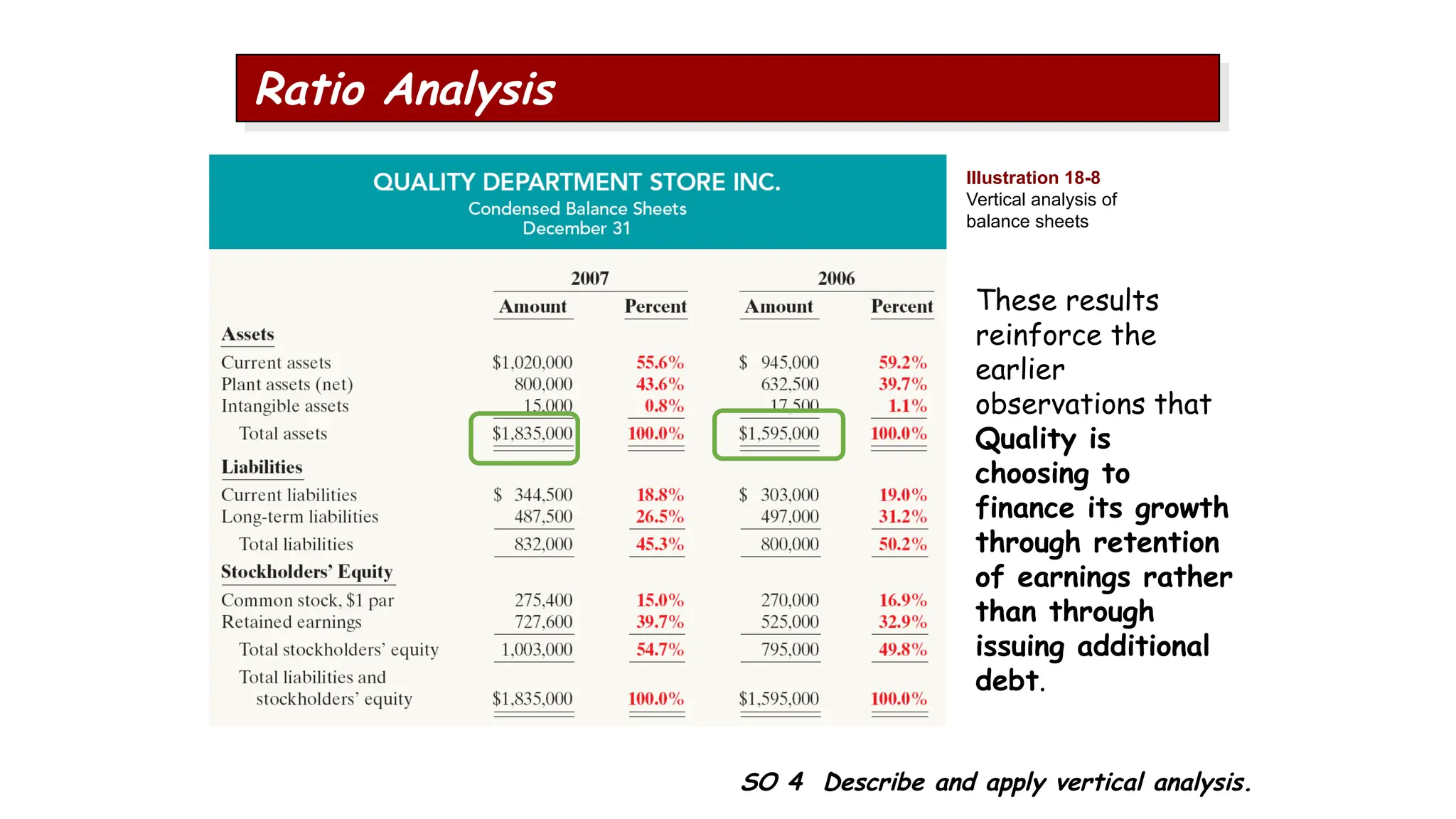

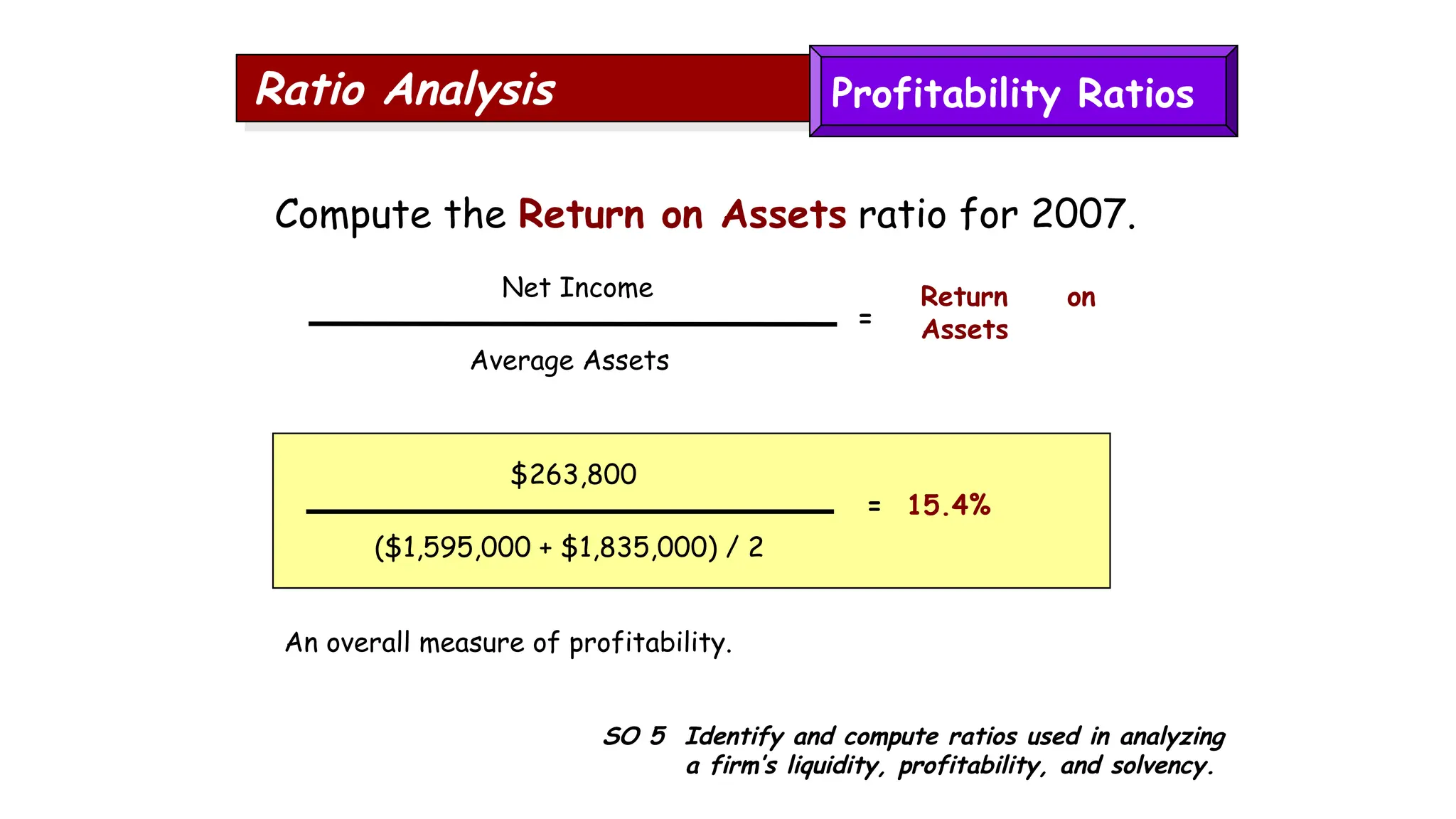

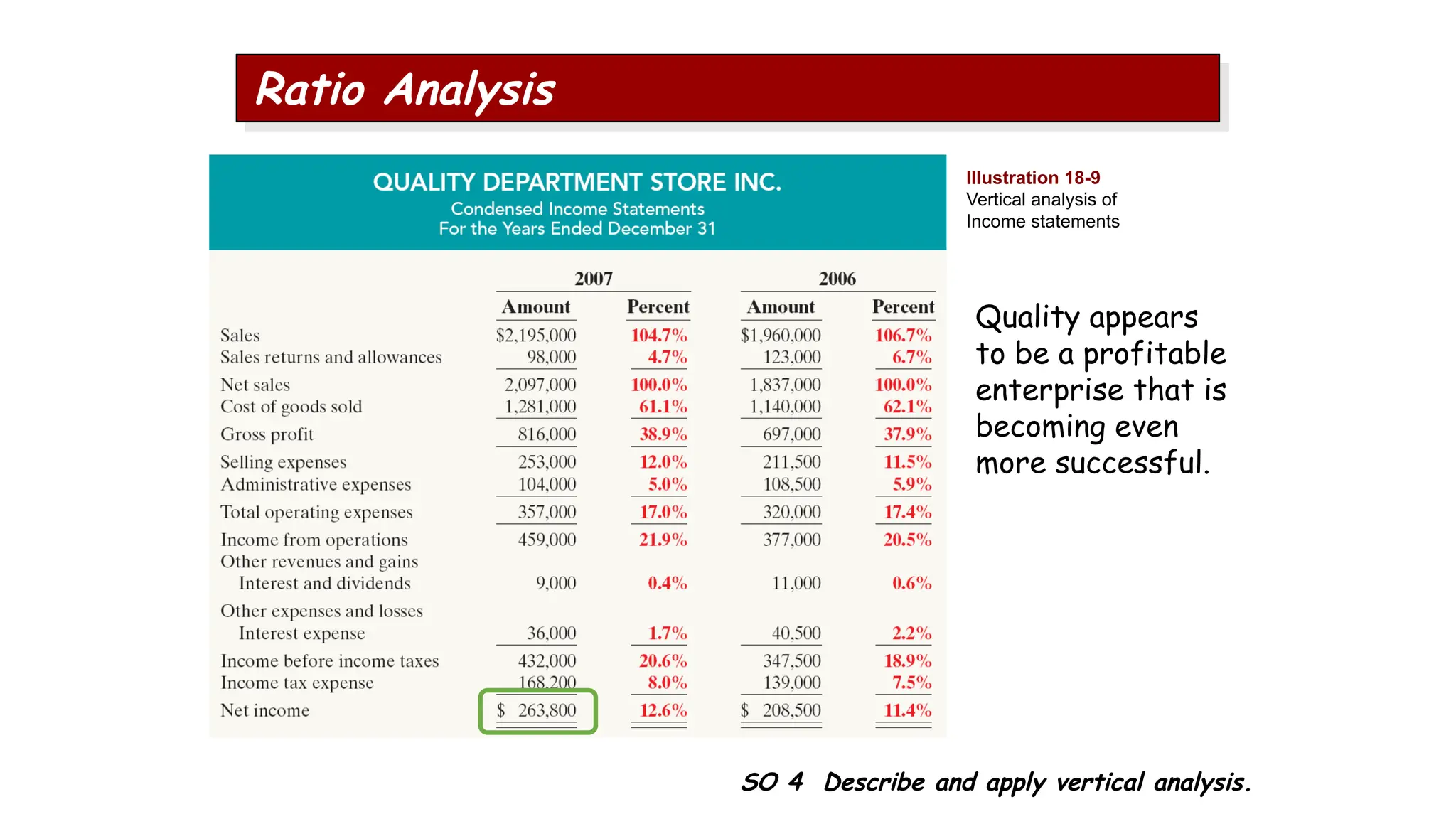

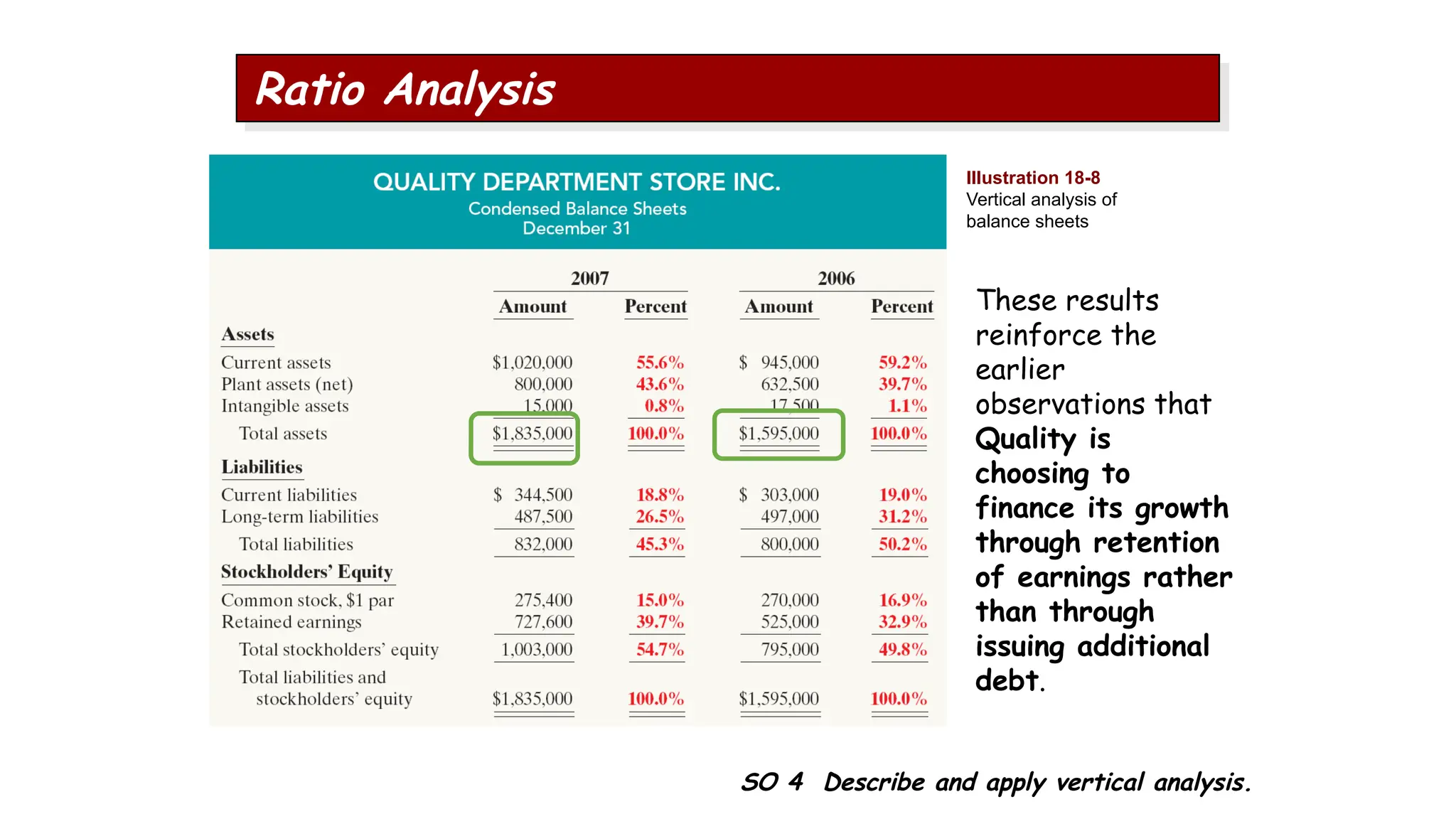

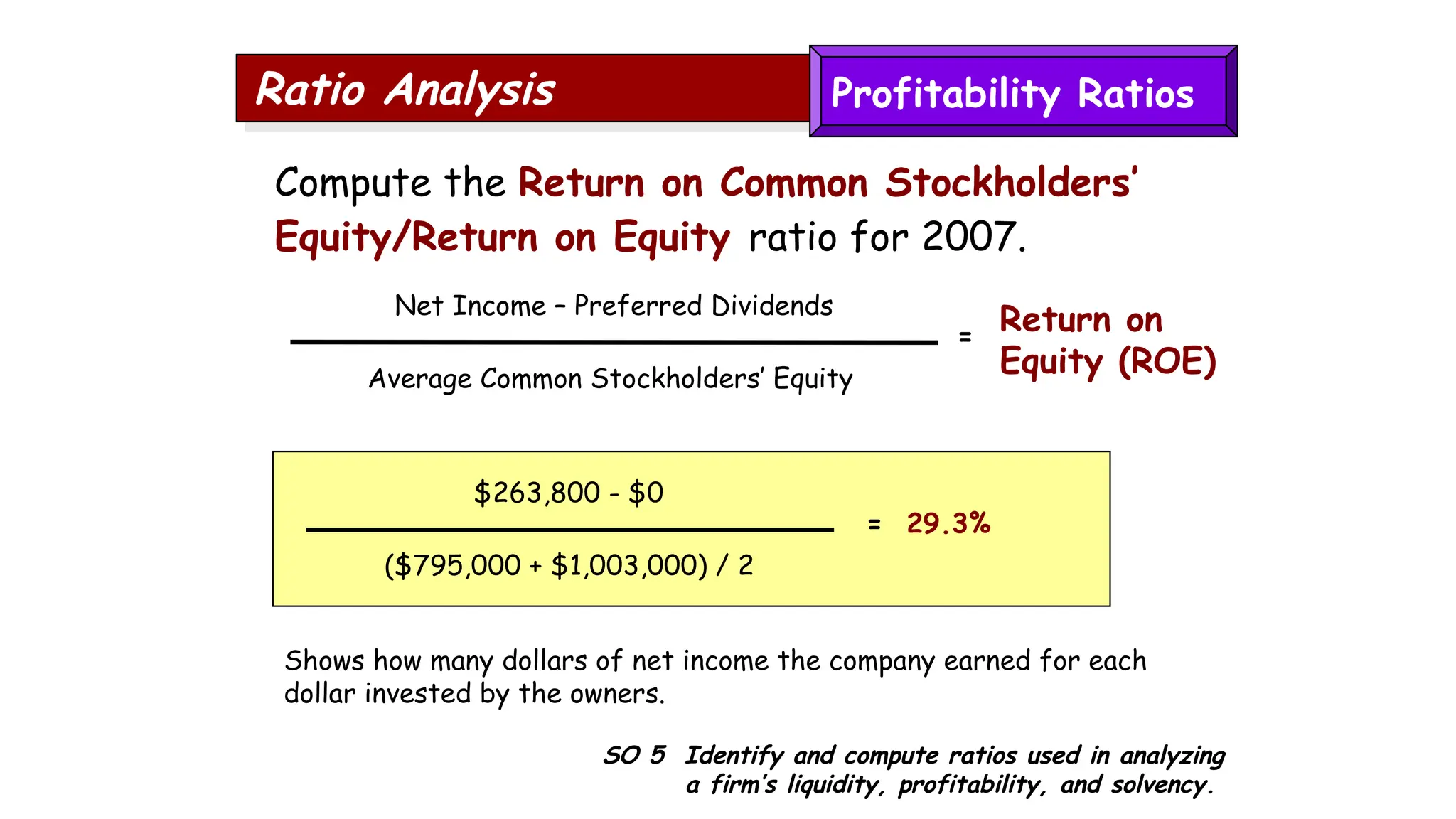

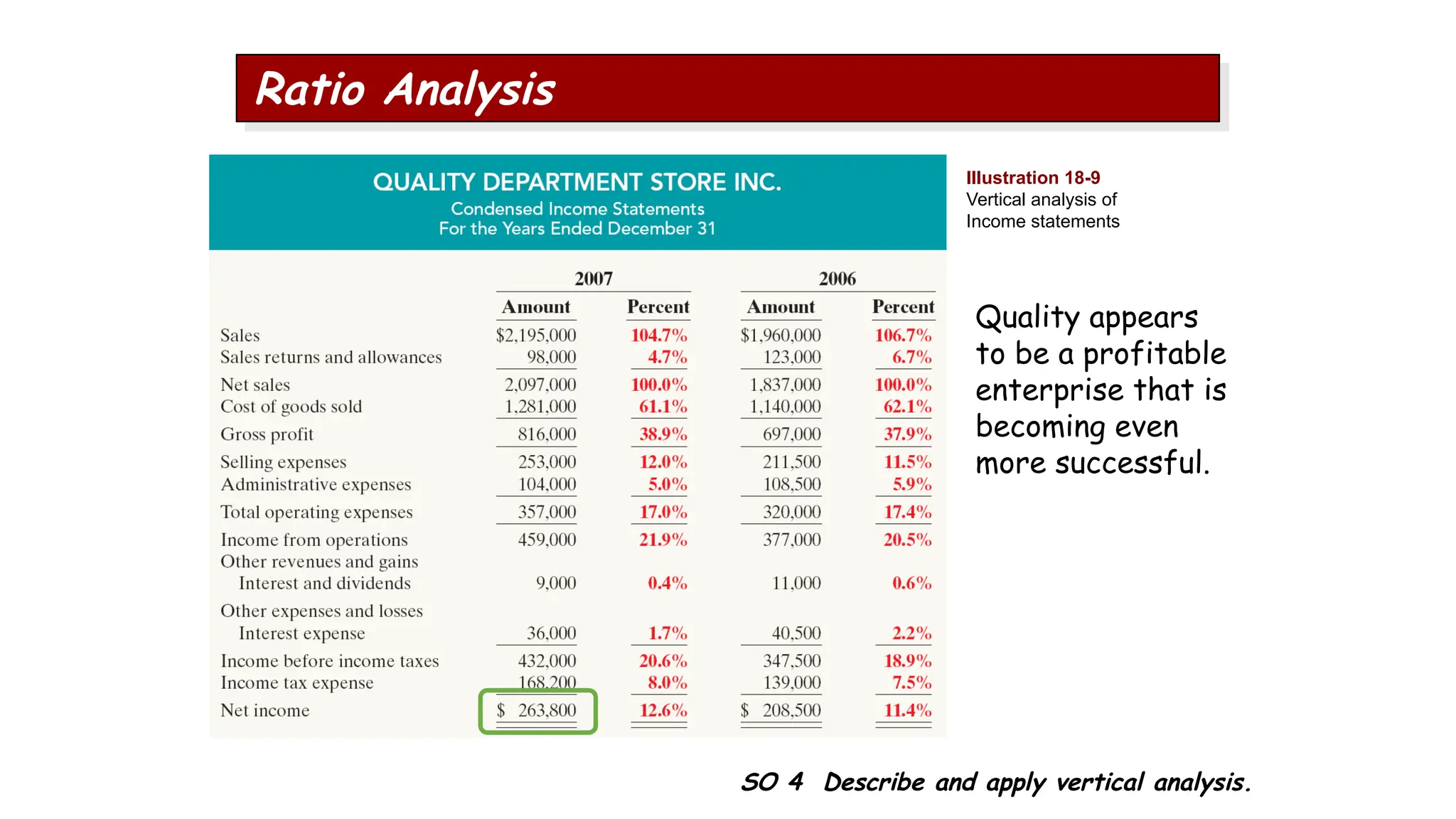

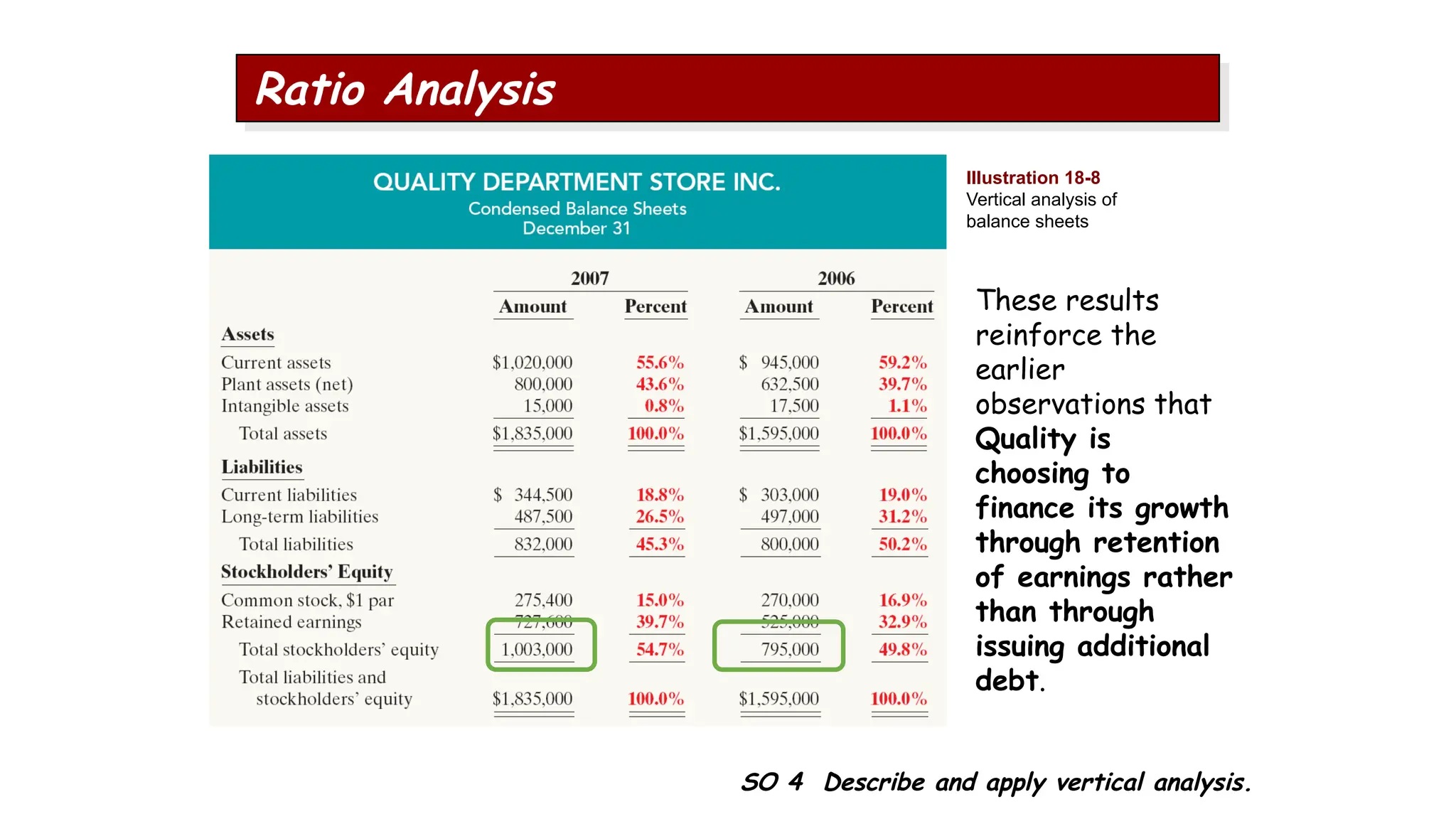

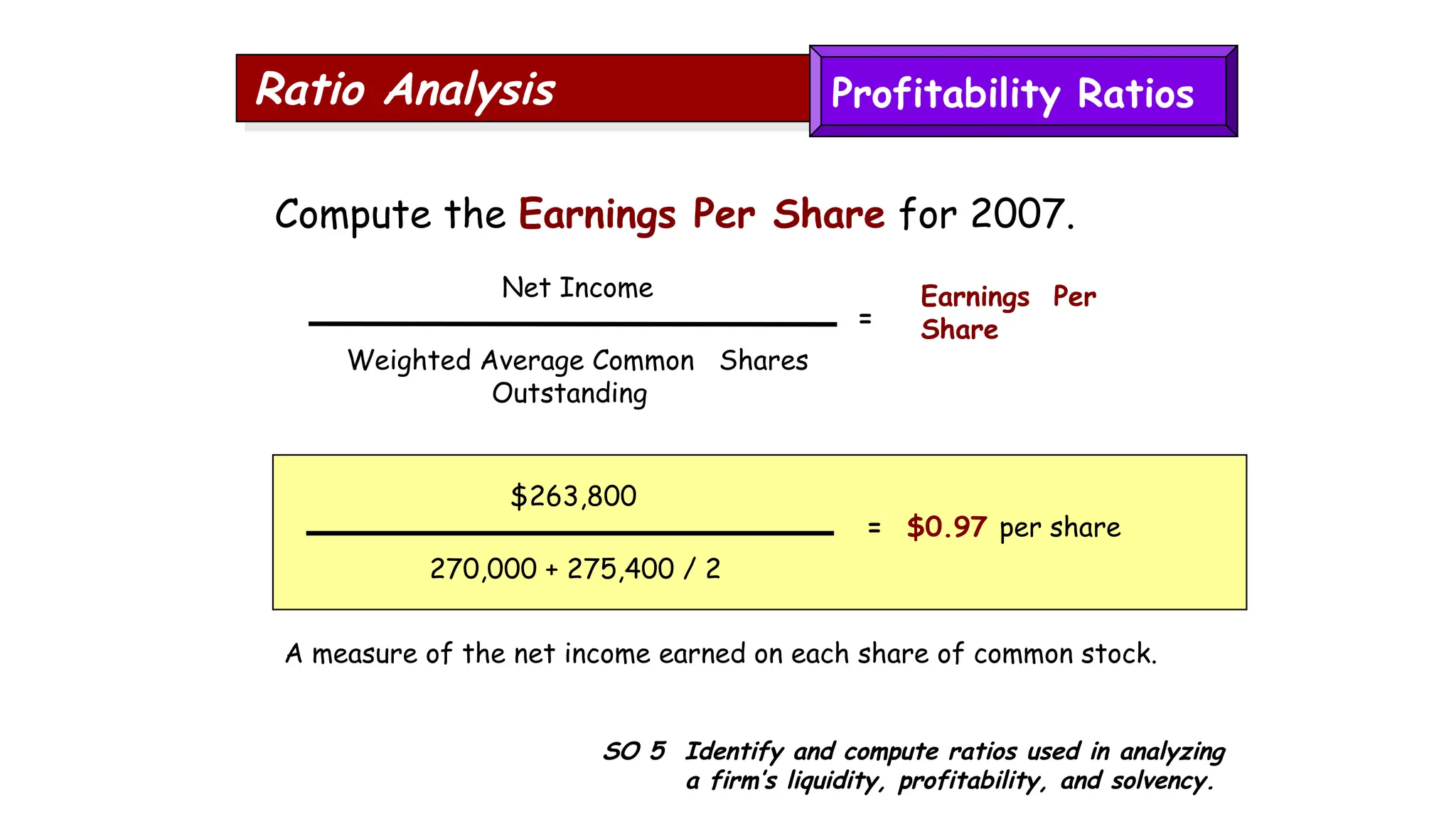

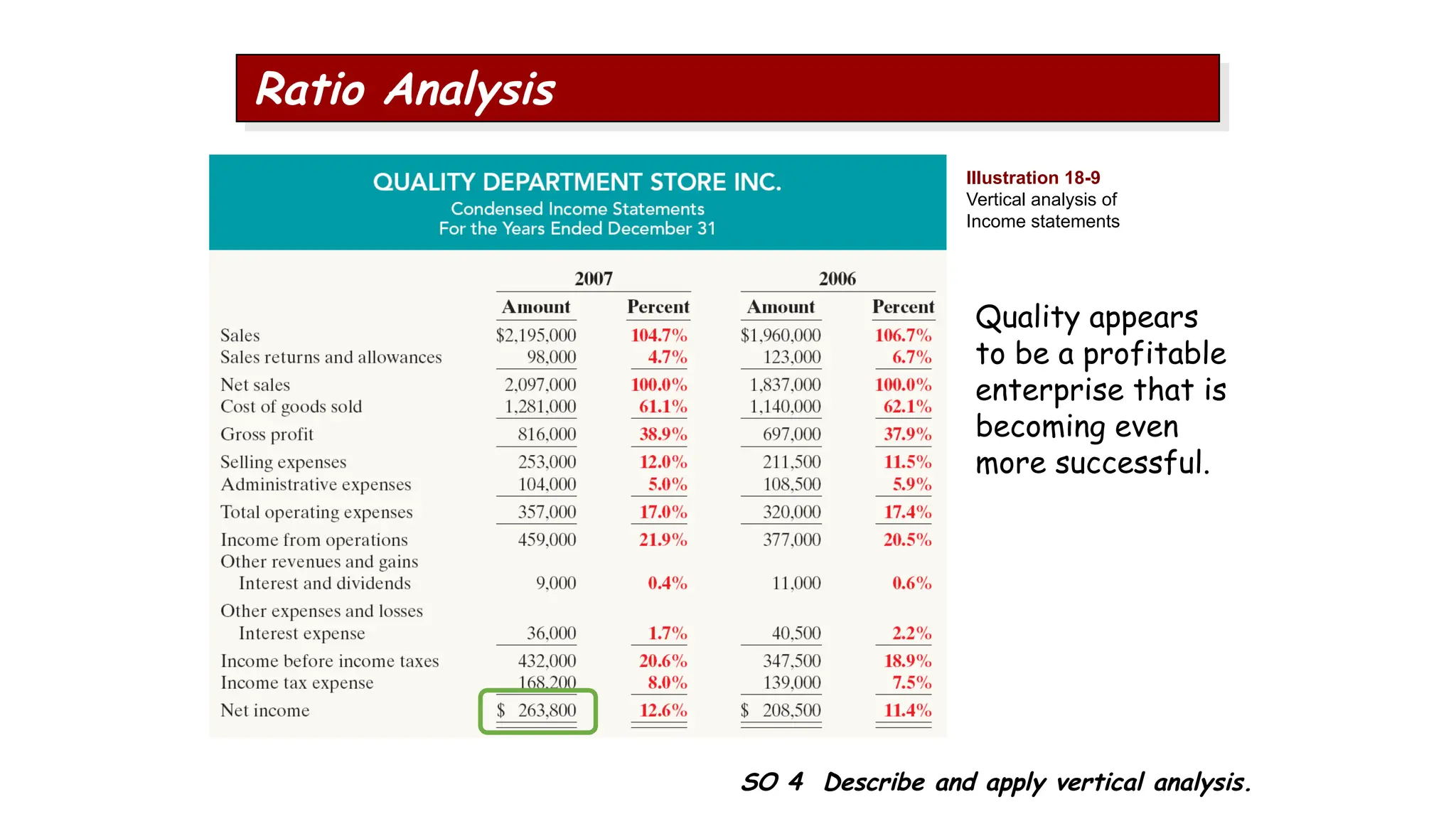

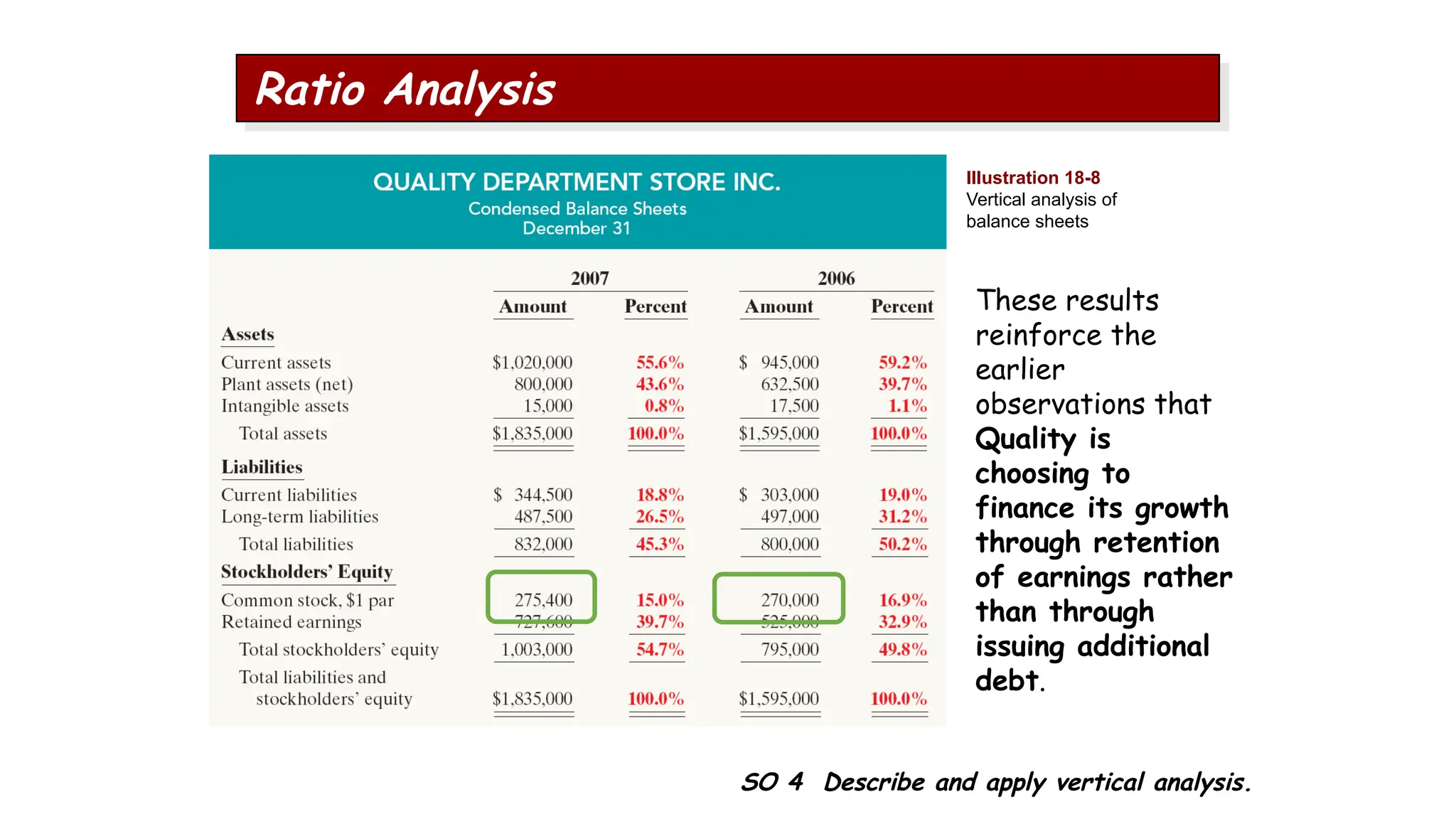

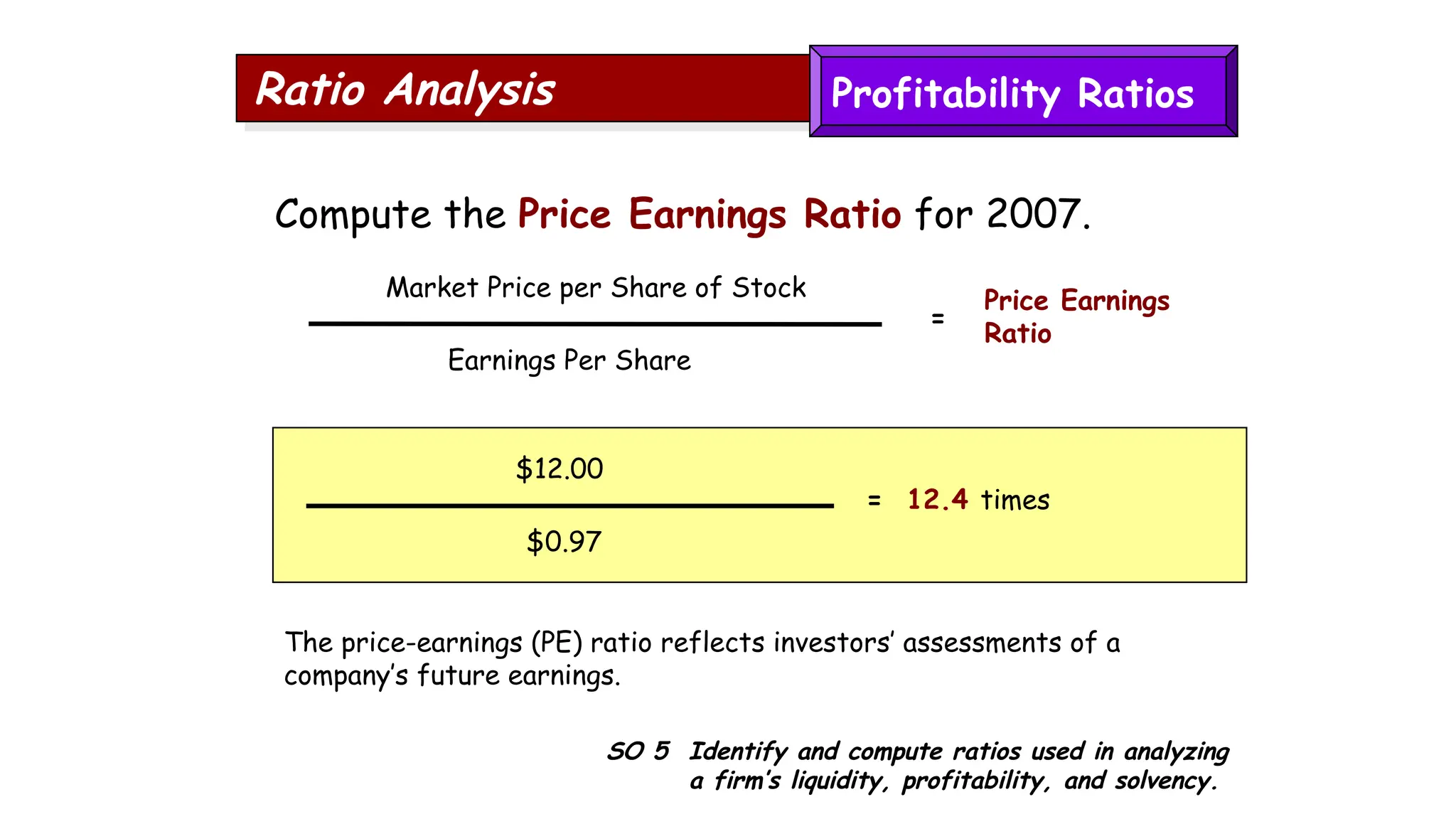

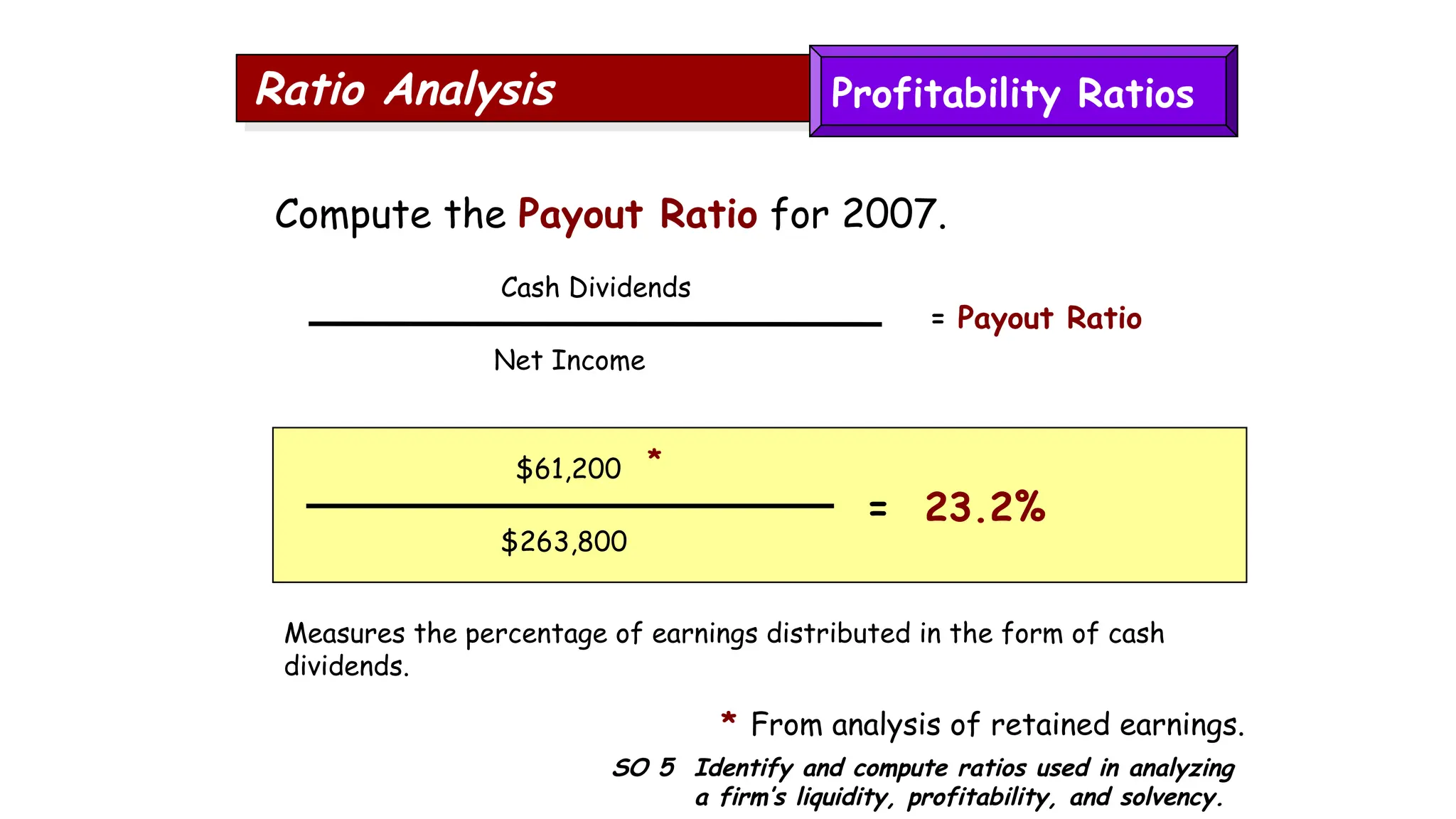

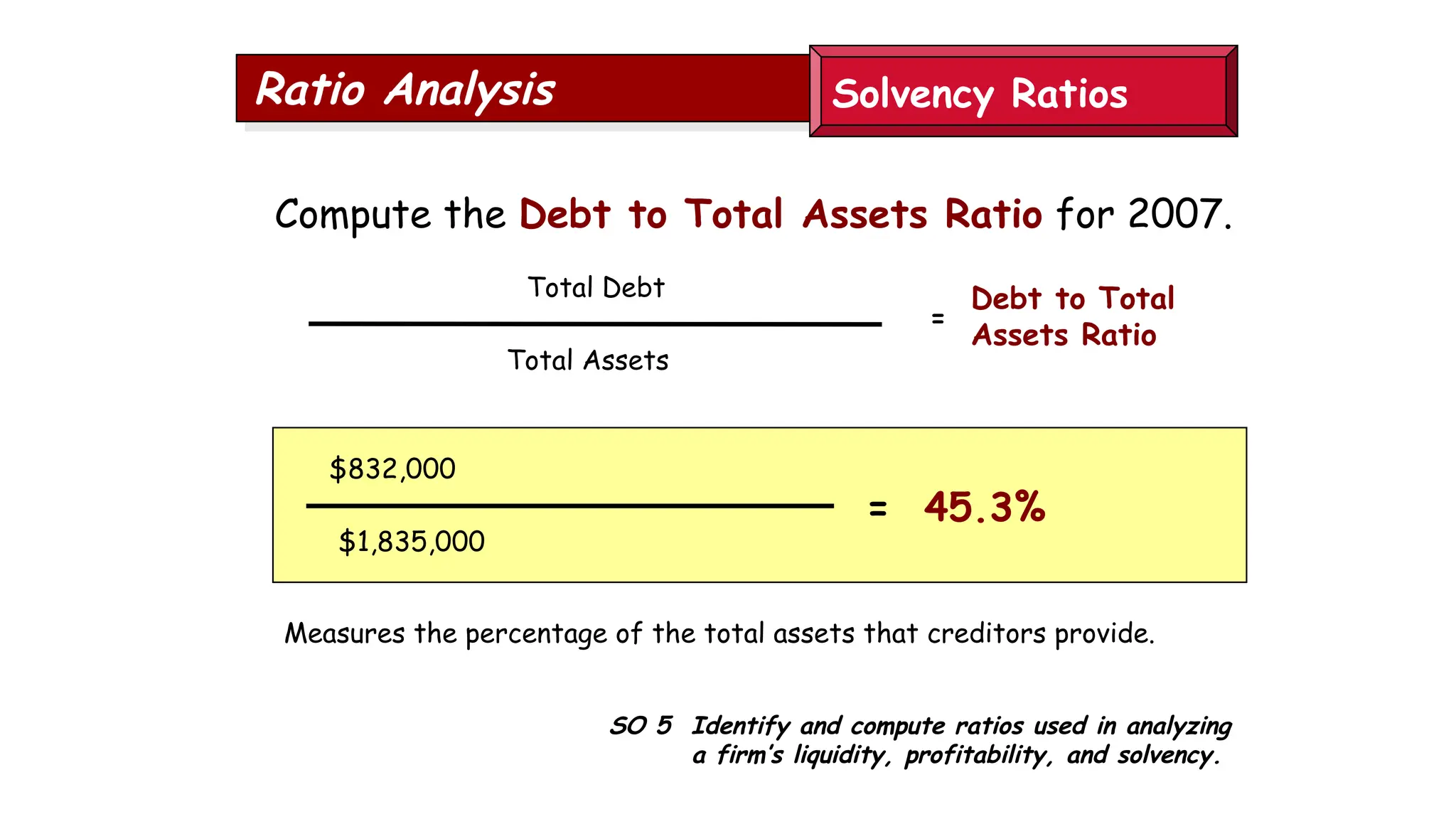

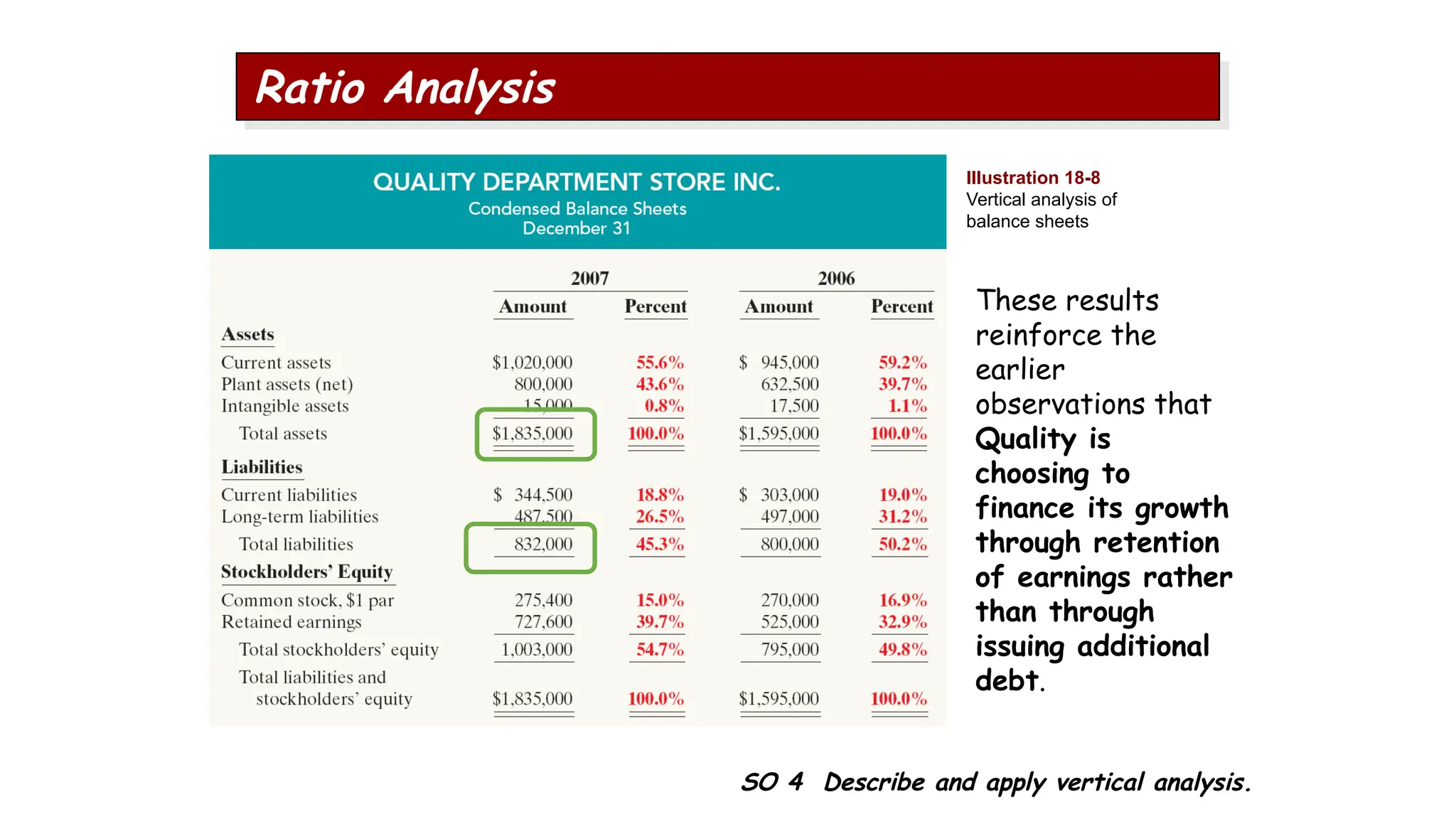

The document outlines the principles and tools of financial statement analysis, emphasizing the importance of comparative, horizontal, and vertical analyses, as well as ratio analysis to assess a firm's liquidity, profitability, and solvency. It explains key concepts such as earning power and the quality of earnings while identifying specific ratios used for evaluation, including the current ratio and profit margin. Additionally, it discusses the advantages and limitations of ratio analysis in providing insights into a company's financial health.