Changes in Income Tax and VAT by finance Bill 2075

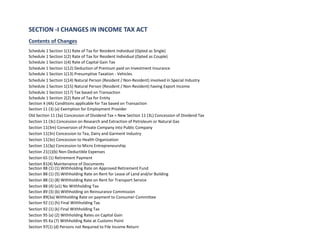

- 1. SECTION -I CHANGES IN INCOME TAX ACT Contents of Changes Schedule 1 Section 1(1) Rate of Tax for Resident Individual (Opted as Single) Schedule 1 Section 1(2) Rate of Tax for Resident Individual (Opted as Couple) Schedule 1 Section 1(4) Rate of Capital Gain Tax Schedule 1 Section 1(12) Deduction of Premium paid on Investment Insurance Schedule 1 Section 1(13) Presumptive Taxation - Vehicles Schedule 1 Section 1(14) Natural Person (Resident / Non-Resident) involved in Special Industry Schedule 1 Section 1(15) Natural Person (Resident / Non-Resident) having Export Income Schedule 1 Section 1(17) Tax based on Transaction Schedule 1 Section 2(2) Rate of Tax for Entity Section 4 (4A) Conditions applicable for Tax based on Transaction Section 11 (3) (a) Exemption for Employment Provider Old Section 11 (3a) Concession of Dividend Tax = New Section 11 (3L) Concession of Dividend Tax Section 11 (3c) Concession on Research and Extraction of Petroleum or Natural Gas Section 11(3m) Conversion of Private Company into Public Company Section 11(3n) Concession to Tea, Dairy and Garment Industry Section 11(3o) Concession to Health Organization Section 11(3p) Concession to Micro Entrepreneurship Section 21(1)(b) Non-Deductible Expenses Section 65 (1) Retirement Payment Section 81(4) Maintenance of Documents Section 88 (1) (1) Withholding Rate on Approved Retirement Fund Section 88 (1) (5) Withholding Rate on Rent for Lease of Land and/or Building Section 88 (1) (8) Withholding Rate on Rent for Transport Service Section 88 (4) (a1) No Withholding Tax Section 89 (3) (b) Withholding on Reinsurance Commission Section 89(3a) Withholding Rate on payment to Consumer Committee Section 92 (1) (h) Final Withholding Tax Section 92 (1) (k) Final Withholding Tax Section 95 (a) (2) Withholding Rates on Capital Gain Section 95 Ka (7) Withholding Rate at Customs Point Section 97(1) (d) Persons not Required to File Income Return

- 2. Changes in Income Tax and VAT Section 97(1) (e) Persons not Required to File Income Return New Section 110 (a) Tax Liability for Joint Venture Section 117 (d) Interest and Penalty for Tax Exempted Entity Section 117 (3) Interest and Penalty for Withholding Agent Section 2 (18) Definition of NBCA Section 2 (32) Definition of Rent SECTION -II CHANGES IN VAT ACT Content of Changes Section 8 (2) Reverse Charging Section 10 (2) compulsory Registration Section 14 (5) Compulsory use of cash machine Section 14 (A) Electronic invoice Section 15(3) Collection of tax by unregistered person Section 18 (1A) Filing of return and payment of tax Section 25 (C) Refund of Re-export Section 29 (1C) Penalty on issue of invoice without transferring goods or services Section 29 (1) (G) (iii) Penalty on electronic invoice Section 29 (2) Subject to 100% Fine on VAT collected on sale. Changes in Schedule - I ***Only for Educational Purpose

- 3. Changes in Income Tax and VAT SECTION -I CHANGES IN INCOME TAX ACT Reference FY 2074/75 FY 2075/76 Schedule 1 Tax shall be imposed at the following rates on the taxable income Tax shall be imposed at the following rates on the taxable income of Section 1(1) of a Resident Natural Person in an Income Year: a Resident Natural Person in an Income Year: Taxable Income Slab Tax Rates Taxable Income Slab Tax Rates (Opted as Single) Up to 3,50,000 1% SST Up to 3,50,000 1% SST Next 1,00,000 15% Next 1,00,000 10% Next 20,50,000 25% Next 200,000 20% Balance (25% + 40% of 25%) = 35% Next 13,50,000 30% Balance (30% + 20% of 30%) = 36% *1% SST shall be levied only on Income from Employment. It is not applicable for income from pension, income from proprietorship *1% SST shall be levied only on Income from Employment. It is not and income from investment. applicable for income from pension, income from proprietorship and income from investment and natural person who contributes to a contributory pension fund. Schedule 1 Tax shall be imposed at the following rates on the taxable income Tax shall be imposed at the following rates on the taxable income of Section 1(2) of a Resident Natural Person in an Income Year: a Resident Natural Person in an Income Year: Taxable Income Slab Tax Rates Taxable Income Slab Tax Rates (Opted as Up to 4,00,000 1% SST Up to 4,00,000 1% SST Couple) Next 1,00,000 15% Next 1,00,000 10% Next 20,00,000 25% Next 200,000 20% Balance (25% + 40% of 25%) = 35% Next 13,00,000 30% Balance (30% + 20% of 30%) = 36% *1% SST shall be levied only on Income from Employment. It is not applicable for income from pension, income from proprietorship *1% SST shall be levied only on Income from Employment. It is not and income from investment. applicable for income from pension, income from proprietorship and income from investment and natural person who contributes to a contributory pension fund. Schedule 1 Tax shall be imposed as follows on the following person subject to Section 1(4) Rate section 1(3) of this Schedule. of Capital Gain (a) Tax shall be imposed at the rate mentioned in sub-section (1) Tax or (2) of this schedule on the higher of the following amounts by treating the Natural person or Couple as having only such taxable income: Tax shall be imposed as follows on the following person subject to section 1(3) of this Schedule. (a) Tax shall be imposed at the rate mentioned in sub-section (1) or (2) of this schedule on the higher of the following amounts by treating the Natural person or Couple as having only such taxable income: ***Only for Educational Purpose

- 4. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 i. The total of individual or couple’s taxable income less the gains; or ii. Rs. 3,50,000 in case of an individual or 4,00,000 in case of couple. (b) The balance of the taxable income is taxed at the rate of 10%, however i. If the ownership of NBCA (land or land and building) is 5 years or more, tax shall be levied at 2.5%, ii. If the ownership of NBCA (land or land and building) is less than 5 years, tax shall be levied at 5%, iii. On the gain on disposal of an interest with any entity (Share) listed in Securities Exchange Board of Nepal, tax shall be levied at 5% Schedule 1 Notwithstanding anything contained elsewhere in this section, if a Section 1(12) Resident Natural Person has investment insurance. Premium paid Deduction of against such investment insurance or Rs.20,000 whichever is lower Premium paid on shall be reduced from the taxable income. Investment Insurance Schedule 1 Notwithstanding anything contained elsewhere in this section, the Section 1(13) following tax shall be collected from the owner of the rented Presumptive vehicle. If the owner is individual, such tax be final. Taxation - Vehicles Tax Vehicles Minibus, Mini-truck, Truck and Bus Rs. 3,000 Car, Jeep, Van, Microbus Rs. 2,400 Three-Wheeler, Auto Rickshaw, Tempo Rs. 1,550 Tractor and Power Tiller Rs. 1,000 i. The total of individual or couple’s taxable income less the gains; or ii. Rs. 3,50,000 in case of an individual or 4,00,000 in case of couple. (b) The balance of the taxable income is taxed at the rate of 10%, however i. If the ownership of NBCA (land or land and building) is 5 years or more, tax shall be levied at 2.5%, iii. If the ownership of NBCA (land or land and building) is less than 5 years, tax shall be levied at 5%, ii. On the gain on disposal of an interest with any entity (Share) listed in Securities Exchange Board of Nepal, tax shall be levied at 7.5%. Notwithstanding anything contained elsewhere in this section, if a Resident Natural Person has investment insurance, Premium paid against such investment insurance or Rs.25,000 whichever is lower shall be reduced from the taxable income. Notwithstanding anything contained elsewhere in this section, the following tax shall be collected from the owner of the rented vehicle through Transportation Management Office at the time of registration or renewal of vehicle. If the owner is individual, such tax be final. Vehicles Tax Car, Jeep, Van, Microbus a. Up to 1,300 cc Rs. 4,000 b. 1,301 to 2,000 cc Rs. 4,500 c. 2,001 to 2,900 cc Rs. 5,000 d. 2,901 to 4,000 cc Rs. 6,000 e. More than 4,000 cc Rs. 7,000 Minibus, Mini-truck, Water Tanker Rs. 6,000 Mini-Tripper Rs. 7,000 Truck, Bus Rs. 8,000 Machinery apparatus like dozer, excavator, Rs. 12,000 loader, roller, crane ***Only for Educational Purpose

- 5. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 Oil tanker, gas bullet, tripper Rs. 12,000 Tractor Rs. 2,000 Power tiller Rs. 1,500 Three-Wheeler, Auto Rickshaw, Tempo Rs. 2,000 Schedule 1 Notwithstanding anything contained elsewhere in this section, if a Section 1(14) natural person is engaged in the operation of a special industry Natural Person mentioned in section 11 of the act throughout the year, tax shall (Resident / Non- be levied by 20% in place of 25% of the taxable income. Resident) involved in Special Industry Schedule 1 Tax shall be levied by 15% in place of 25% of the taxable income Section 1(15) earned by any Natural Person from exports in an Income Year. Natural Person (Resident / Non- Resident) having Export Income Schedule 1 The taxable income of a bank, financial institution or general Section 2(2) Rate insurance business or of an entity carrying on the transaction of of Tax for Entity cigarette, bidi, cigar, chewing tobacco, khaini, gutka, pan masala, liquor, beer or of an entity dealing in petroleum business as per Nepal Petroleum Act, 2040 for an income year shall be taxed at the rate of 30 %. Notwithstanding anything contained elsewhere in this section, if a natural person is engaged in the operation of a special industry mentioned in section 11 of the act throughout the year, tax shall be levied by 20% in place of 30% of the taxable income. If the taxable income earned is from the exports of a natural person in an income year then tax shall be levied as; · a concession of 25 % shall be provided on the income that is otherwise subject to the rate of 20 % (i.e. 15% in place of 20%); and · a concession of 50% shall be provided on the income that is otherwise subject to the rate of 30 % (i.e. 15% in place of 30%) The taxable income of a bank, financial institution or general insurance business or of an entity carrying on the transaction of telecommunication, internet service, money transfer, capital market business, securities business, merchant banking business, commodity future market, securities and commodity brokerage business, cigarette, bidi, cigar, chewing tobacco, khaini, gutka, pan masala, liquor, beer or of an entity dealing in petroleum business as per Nepal Petroleum Act, 2040 for an income year shall be taxed at the rate of 30%. Section 4(4A) The income tax payable by a resident Natural Person under The income tax payable by a resident Natural Person under section Conditions section 3(a) on the basis of turnover in any income year is equal to 3(a) on the basis of turnover in any income year is equal to the applicable for the amount provided in section 1(17) of Schedule 1 who meets amount provided in section 1(17) of Schedule 1 who meets any of any of the following conditions: the following conditions: ***Only for Educational Purpose

- 6. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 Tax based on (a) Taxable income of natural person should be only from Transaction business having source in Nepal (b) Medical tax credit under section 51 not claimed as deduction. (c) Advance income tax under section 93 is not claimed. (d) Annual turnover of business shall be above Rs. 20 lacs but exceeding Rs. 50 lacs. (e) Business shall not be registered in VAT. (f) There is no Income from professional service provided by Doctor, Engineer, Auditor, Legal Practitioner, Sportsman, Artist, Consultant. Section 11 (3) (a) Income derived during an income year by a person from a special Exemption for industry and information technology industry is taxed as follows: Employment · Special industry and information technology industry that Provider provides direct employment throughout the year to 300 or more Nepalese citizens, at 90 percent of tax applicable to the income of that year; · Special industry that provides direct employment throughout the year to 1,200 or more Nepalese citizens, at 80 percent of tax applicable to the income of that year; · Special industry that provides direct employment throughout the year to more than 100 Nepalese citizens including at least 33 percent for women, dalit or disabled, at 80 percent of tax applicable to the income of that year. (a) Taxable income of natural person should be only from business having source in Nepal. (b) Annual turnover of business shall be above Rs. 20 lacs but exceeding Rs. 50 lacs. (c) Business shall not be registered in VAT. (d) There is no Income from professional service provided by Doctor, Engineer, Auditor, Legal Practitioner, Sportsman, Artist, Consultant. (e) Medical tax credit under section 51 not claimed as deduction. (f) Advance income tax under section 93 is not claimed. Income derived during an income year by a person from a special industry and information technology industry is taxed as follows: · If direct employment is provided throughout the year to 100 or more Nepalese citizens, at 90 percent of tax applicable to the income of that year; · If direct employment is provided throughout the year to 300 or more Nepalese citizens, at 80 percent of tax applicable to the income of that year; · If direct employment is provided throughout the year to 500 or more Nepalese citizens, at 75 percent of tax applicable to the income of that year; · If direct employment is provided throughout the year to 1,000 or more Nepalese citizens, at 70 percent of tax applicable to the income of that year; Provided that, if direct employment is provided throughout the year to more than 100 Nepalese citizens including at least 33 % for women, dalit or disabled, additional concession of 10 % on the payable tax shall be provided. Section 11 (3) Special industry, agriculture-based industry and tourism industry Special industry, agriculture-based industry and tourism industry (a1) Exemption that provide direct employment throughout the year to 100 that provide direct employment throughout the year to 100 for Employment Nepalese citizens only, at 70 percent of tax applicable to the Nepalese citizens only, at 70 percent of tax applicable to the Provider income of that year. income of that year. Old Section 11 Concession of 100 % of applicable dividend tax on capitalization of Concession of 100 % of applicable dividend tax on capitalization of (3a) Concession accumulated profit through bonus share by special industry, accumulated profit through bonus share by special industry, of Dividend Tax agriculture-based industry and tourism industry for expansion of agriculture-based industry and tourism industry for expansion of the = the capacity of the industry. capacity of the industry. ***Only for Educational Purpose

- 7. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 New Section 11 (3l) Concession of Dividend Tax Section 11 (3c) In a case, Entity involving research and extraction of petroleum or Concession on natural gas starts commercial production up to Chaitra end 2075, Research and such entity shall exempt from tax for first 7-years and 50% of the Extraction of applicable tax rate in subsequent 3 years. Petroleum or Natural Gas In a case, Entity involving research and extraction of petroleum or natural gas starts commercial production up to Chaitra end 2080, such entity shall exempt from tax for first 7-years and 50% of the applicable tax rate in subsequent 3 years. Section 11(3m) No provision. If a company having paid up capital of 50 crore or more which has Conversion of been operated as a private company is operated after being Private Company converted into a public company, a concession of 10 % of applicable into Public tax shall be provided for 3 years form the date of such conversion Company into the public company. Provided that, no company which is required to be incorporated as a public company under Section 12 of Companies Act, 2063 shall avail the concession under this Sub-section. Section 11(3n) No provision. Concession of 50% on applicable tax shall be provided to an Concession to industry producing and processing domestic tea, a dairy industry Tea, Dairy and transacting dairy products and an industry producing garment on Garment their income derived from selling their products. Industry Section 11(3o) No provision. Concession of 20 % on the applicable tax shall be provided for the Concession to taxable income of health organization operated by community Health organization. Organization Section 11(3p) No provision. Concession of 100% on the applicable tax shall be provided to a Concession to micro entrepreneurship for 5 years from the date of Micro commencement of business or transaction. Entrepreneurship If such micro entrepreneurship is operated by women, a full tax exemption shall be provided for additional 2 years. Section 21(1)(b) Tax to be paid under, and fines and similar other amounts paid to Non-Deductible government any country or local body thereof for having violated Expenses any law or any rule or bye-rule framed under that law. Tax to be paid under, and fines and similar other amounts paid to government any country or local body thereof for having violated any law or any rule or bye-rule framed under that law. Provided that tax paid to provincial government and local bodies shall be allowed to be deducted as expense. ***Only for Educational Purpose

- 8. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 Section 65 (1) For the purposes of calculating retirement payment income of an For the purposes of calculating retirement payment income of an Retirement individual from an interest in an approved retirement fund or from individual from a contributory based interest in an approved Payment retirement payment made by the Government of Nepal, the retirement fund or from retirement payment made by the following provisions shall apply: Government of Nepal, the following provisions shall apply: Section 81(4) The department may allow a Person to keep its record under sub- The department may, after prescribing standards and procedures, Maintenance of section (1) in electronic medium. permit a person to issue invoice through electronic medium Documents and keep its record under sub-section (1) in electronic medium. Section 88 (1) In the case of the retirement payment made by the Government (1) Withholding of Nepal or an approved retirement fund, at the rate of 5 % on the Rate on gain calculated under Section 65(1)(b). Approved Retirement Fund Section 88 (1) Payment of rent having a source in Nepal by a resident person, at (5) Withholding the rate of 10 percent; Rate on Rent for Provided that, tax shall be withheld at the rate of 1.5 percent on Lease of Land payment made to a person carrying out the business of renting and/or Building motor vehicle and registered in VAT in respect of rent of such motor vehicle. In the case of the retirement payment made by the Government of Nepal or contributory based retirement payment made by an approved retirement fund, at the rate of 5 % on the gain calculated under Section 65(1)(b). Payment of rent having a source in Nepal by a resident person, at the rate of 10 percent; Provided that, (a) Tax shall be withheld at the rate of 1.5 percent on payment made to a person carrying out the business of renting motor vehicle and registered in VAT in respect of rent of such motor vehicle. (b) No tax is required to be withheld on the amount derived by natural person in respect of house rent. Section 88 (1) No Provision. Payment of rent in respect of transport service, at the rate of 2.5%. (8) Withholding Rate on Rent for Transport Service Section 88 (4) Payment in respect of an article published in a newspaper and Payment in respect of an article published in a newspaper and (a1) No payment in respect of setting question papers or checking answer payment in respect of setting question papers or checking answer Withholding Tax books books. Section 89 (3) During payment of premium to non-resident insurance company, During payment of premium to non-resident insurance company or (b) Withholding at the rate 1.5 % commission (paid out of premium) to be received from non-resident on Reinsurance insurance company in respect of insurance, at the rate of 1.5 %. Commission ***Only for Educational Purpose

- 9. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 Section 89(3a) No Provision. During payment of amount exceeding Rs. 50 Lakh made for Withholding carrying out work through consumer committee, at the rate 1.5 %. Rate on payment to Consumer Committee Section 92 (1) Meeting allowance, payment in respect of part-time teaching Meeting allowance of up to Rs. 20,000 per meeting, payment in (h) Final respect of part-time teaching, payment in respect of setting Withholding Tax question paper or checking answer books. Section 92 (1) No Provision. Payment in respect of motor vehicle or transport service of a (k) Final natural person other than proprietorship firm. Withholding Tax Section 95 (a) Applicable withholding tax rate for gain on Securities: Applicable withholding tax rate for gain on Securities: (2) Withholding Gain on Share of; Resident Others Gain on Share Resident Resident Entity Others Rates on Capital Listed Resident Entity 5% 10% of; Natural Person Gain Unlisted Resident Entity 10% 15% Listed Shares 7.5% 10% 25% Unlisted Shares 10% 15% 25% Section 95 Ka (7) No Provision. Advance tax at the rate of 5 % on the value determined for the Withholding purpose of customs duty shall be collected at the customs point on Rate at Customs the following goods imported for business purpose: Point · S/he buffalo, he goat, sheep, mountain goat falling under Chapter 1 of customs code · Live, fresh and frozen fish under Chapter 3 of customs code · Fresh flower falling under Chapter 6 of customs code · Fresh vegetable, potato, onion under Chapter 7 of customs code and · Fresh fruit under Chapter 8 of customs code Section 97(1) (d) An individual who is an owner of vehicle and is liable to pay tax An individual natural person other than proprietorship firm, who is Persons not under section 1 (13) 0f schedule 1. an owner of vehicle and is liable to pay tax under section 1 (13) 0f Required to File schedule 1. Income Return ***Only for Educational Purpose

- 10. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 Section 97(1) (e) No Provision. A natural person having income in respect of disposal of NBCA only Persons not who does not want to file a return of income. Required to File Income Return New Section No Provision. The coventurer shall be jointly or severally responsible for the 110 (a) Tax purpose of tax payment of the Joint Venture. Liability for Joint Venture Section 117 (d) If tax exempted entity fails to file annual financial statement If tax exempted entity fails to file annual financial statement within Interest and within Ashoj end of the Fiscal Year, 0.1% p.a. of the annual income Ashoj end of the Fiscal Year, 0.1% p.a. of the annual income Penalty for Tax without any deduction shall be charged. without any deduction shall be charged. Exempted Entity Section 117 (3) Withholding agent who fails to file a statement u/s 90 (1), 1.5% Interest and p.a. of the tax required to be withheld for every month of delay Penalty for treating a part of every month as one month. Withholding Agent Section 2 (18) Non-business chargeable asset (NBCA) means land, building and Definition of interest or security in an entity, other than the following assets: NBCA (1) Business assets, depreciable assets or trading stock (2) A private building of a natural person that has been (a) Owned continuously for 10 years or more (b) Lived in continuously or intermittently for a total period of 10 years or more (3) An interest of a beneficiary in a retirement fund (4) Land, land and building, and private building of a natural person that is disposed of for less than Rs. 30 Lakh (5) An asset that is disposed within three generation otherwise than sales and purchase Explanation: For the purpose of this clause, “private building” means building and land equal to the area covered by the building or 1 ropani land, which is lower. Section 2 (32) Rent means all payments including premium in consideration of Definition of the lease of a tangible property, including house rent. Rent Provided, the term shall not include payments for natural resource. Withholding agent who fails to file a statement u/s 90 (1), 2.5% p.a. of the tax required to be withheld for every month of delay treating a part of every month as one month. Non-business chargeable asset (NBCA) means land, building and interest or security in an entity, other than the following assets: (1) Business assets, depreciable assets or trading stock (2) A private building of a natural person that has been (a) Owned continuously for 10 years or more (b) Lived in continuously or intermittently for a total period of 10 years or more (3) An interest of a beneficiary in a retirement fund (4) Land, land and building, and private building of a natural person that is disposed of for less than Rs. 30 Lakh (5) An asset that is disposed within three generation otherwise than sales and purchase Explanation: For the purpose of this clause, “private building” means building and land equal to the area covered by the building or 1 ropani land, which is lower. Rent means all payments including premium in consideration of the lease of a tangible property, including house rent. Provided, the term shall not include payments for natural resource or an amount derived in respect of house rent by a natural person other than a proprietorship firm. ***Only for Educational Purpose

- 11. Changes in Income Tax and VAT SECTION -II CHANGES IN VAT ACT Reference FY 2074/75 FY 2075/76 Section 8 (2) The recipient whether registered or not, services in Nepal, from a Reverse Charging person who is not registered and is outside of Nepal shall have to assess and collect the tax at the time of payment on the taxable value in accordance with this Act and Rules framed thereunder Section 10 (2) If a person dealing with the good and services become taxable, an compulsory application shall be made to the tax officer, in prescribed format, Registration for registration within 30 days of becoming taxable The recipient whether registered or not, services in Nepal, from a person who is not registered and is outside of Nepal shall have to assess and collect the tax at the time of payment or at the time of receipt of service, on the taxable value in accordance with this Act and Rules framed thereunder. If a person dealing with the good and services become taxable or following transactions has been carried on, an application shall be made to the tax officer, in prescribed format, for registration within 30 days of becoming taxable or commencement of transaction: · Production and transaction of bricks, operation of business relating to liquor distributor, wine shop, software, trekking, rafting, ultra-light flight, paragliding, tourist motorcade crusher, sand mine, slate and stone Business of sanitary, furniture, fixture, furnishing, automobiles, motor parts, electronics, marble, educational consultancy, disco theque, health club, massage therapy, beauty parlor, catering service, party palace business, parking service, drycleaners with machinery and apparatus, restaurant with bar, ice cream industry, color lab, boutique, tailoring business with materials of suiting and shirting, supply of uniform to educational organization or health organization or other entity. Section 14 (5) The department may order taxpayers to give invoice by using a The department may order taxpayers to give invoice by using a Compulsory use cash machine or computer. Other procedures on so giving invoice cash machine or computer. Other procedures on so giving invoice of cash machine by using cash machine or computer shall be as prescribed by the by using cash machine or computer shall be as prescribed by the department. department. Section 14 (a) No provision. 1. A taxpayer may issue electronic invoice with the prior approval Electronic of the department invoice 2. Notwithstanding subsection (1), the department may by publishing a notice, order the taxpayers to compulsorily issue invoice through electronic medium and to link such electronic ***Only for Educational Purpose

- 12. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 medium with the central billing monitoring system of the department. The Department shall prepare and implement work method regarding the security and reliability of software or apparatus from which invoice is issued through electronic medium. Concerned producer, distributor and user shall comply with such work order Section 15 (3) Notwithstanding sub section (1), local government or Nepal Notwithstanding sub section (1), local government, Government of Collection of tax government are shall collect vat on sale of vat attractive goods Nepal or Provincial government shall collect vat on sale of vat by unregistered and services. attractive goods and services. person Section 18 (1A) Notwithstanding sub-section (1), a taxpayer in a district where filing of return there is no IRD may Furnish the amount of tax and tax return to be and payment of paid and submitted by him with the officer of Treasury and tax Account Controller of the same district within fifteen day of month in which he has to submit the tax return. And Such Treasury and Account Controller shall forward the detail of tax return and tax payment so received to the IRD Office within 7 days. Section 25 (c) If any goods are re-exported and payment is received in advance Refund of Re- in Foreign currency, the amount paid for VAT by concerned person export on purchase shall be refunded to him Provided that no facility of tax refund under this section shall be provided in exporting or re exporting any goods on which facility of tax refund under schedule 1 has been claimed. Notwithstanding subsection (1), a taxpayer in a district where there is no IRD or Taxpayers Service Office may Furnish the amount of tax and tax return to be paid and submitted by him with the officer of Treasury and Account Controller of the same district within fifteen day of month in which he has to submit the tax return. And Such Treasury and Account Controller shall forward the detail of tax return and tax payment so received to the IRD Office or Taxpayers Service Office within 7 days. If any goods are re-exported and payment is received in advance in Foreign currency, the amount paid for VAT by concerned person on purchase shall be refunded to him. Provided that no facility of tax refund under this section shall be provided in exporting or re exporting any goods on which facility of tax refund under schedule 1 has been claimed Section 29 (1C) No provision. A seller issues invoice without transferring goods or services, 50% Penalty on issue of issued invoice value. of invoice without transferring goods or services Section 29 (1) (G) No provision. If a person producing, installing or operating software or apparatus (iii) Penalty on for issuing electronic invoice does not comply with the work Electronic method issued by the Department under Section 14KA, shall liable Invoice for Rs. 5,00,000. Section 29 (2) If any person commits any of the following offences, tax officer If any person commits any of the following offences, tax officer may Subject to 100% may impose a fine of 100% of the amount of tax or an impose a fine of 100% of the amount of tax or an imprisonment for imprisonment for up to 6 month or both punishments: up to 6 month or both punishments: ***Only for Educational Purpose

- 13. Changes in Income Tax and VAT Reference FY 2074/75 FY 2075/76 Fine on VAT a) Preparing false account or invoice or other document: collected on Sale b) Evasion of Tax by fraud c) If unregistered person collect vat d)Violating section 23 (c) e) Carrying out transaction by Violating section 30 a) Preparing false account or invoice or other document: b)Evasion of Tax by fraud c) If unregistered person collect vat d) If sale is made after under invoicing. e) Carrying out transaction by Violating section 30 f) Violating section 23 (c) Changes in Schedule - I Where a community school imports a vehicle with 30 or more seating capacity to carry students on recommendation of Education, Science and Technology Ministry, VAT applicable to the extent of one such bus is exempted. A Taxpayer who have not submitted VAT details since a long period are desirous to participate and submit VAT return regularly, no penalty shall be levied on their payment. Vat Refund procedure to the domestic industries producing sugar, cellular mobile phone set, domestic clothes, milk, utensil & circles made from copper & brass, tea, wheat flour, mustard oil, matches have been withdrawn. No VAT shall be charged on Health Services provided by Private Hospitals. ***Only for Educational Purpose