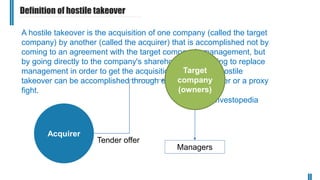

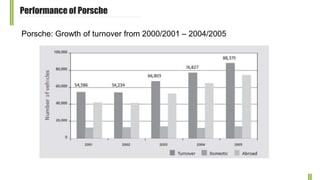

1) Porsche attempted a hostile takeover of Volkswagen by acquiring shares without management approval, reaching 42.6% ownership. However, the financial crisis caused problems as Porsche's debt grew and car sales declined.

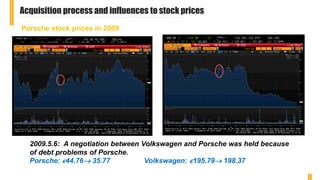

2) Volkswagen eventually negotiated an agreement in 2009 to acquire 49.9% of Porsche to help with its debt issues in exchange for cash and shares.

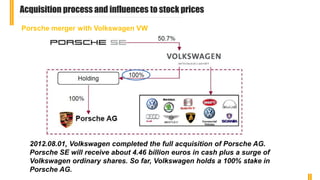

3) By 2012 Volkswagen completed its full acquisition of Porsche, gaining 100% ownership and ending the hostile takeover attempt.