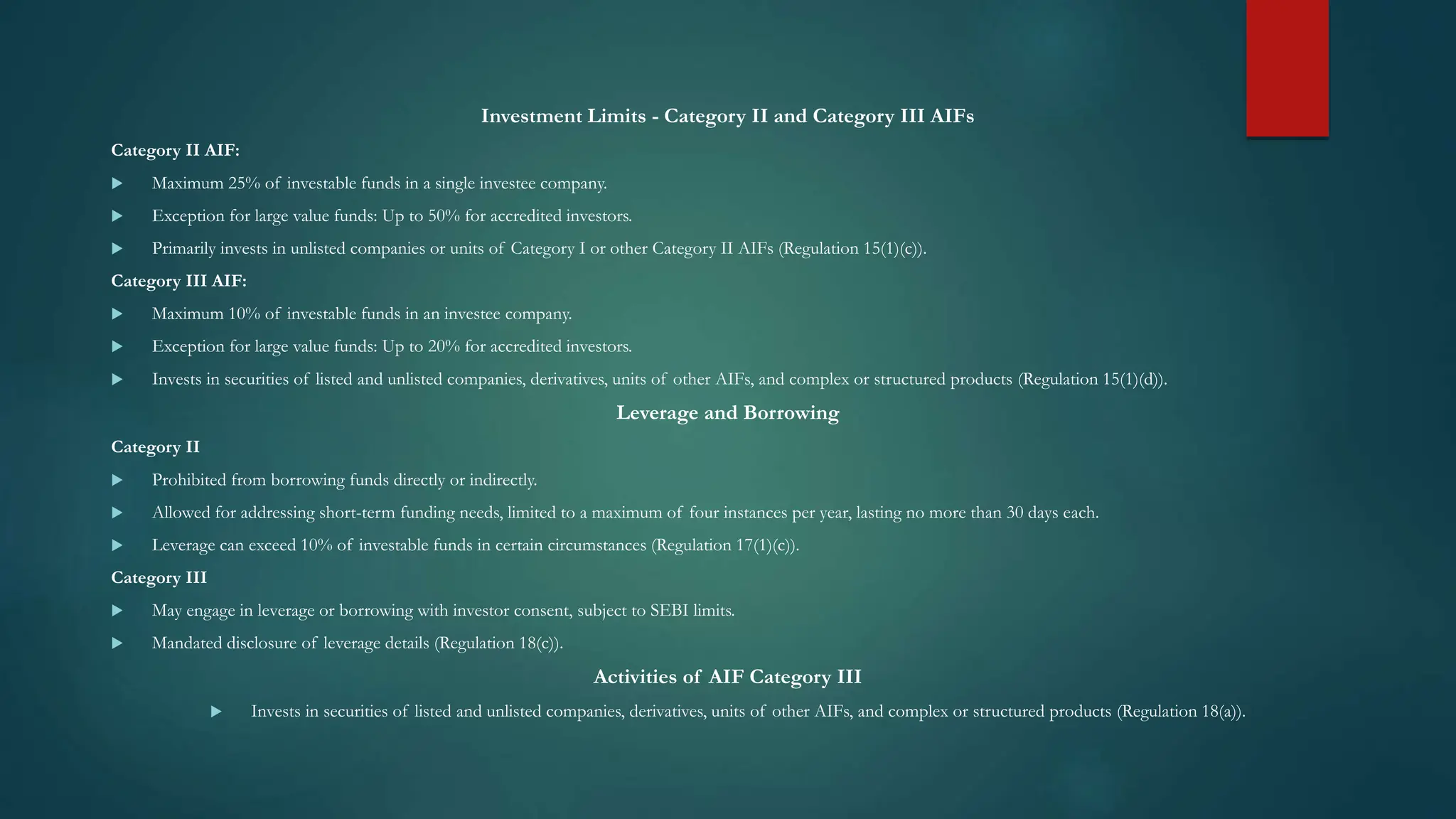

The document outlines the regulations for Category II and Category III Alternative Investment Funds (AIF) in India as defined by SEBI, emphasizing the definition, registration process, fee structure, investment limits, and the distinctive characteristics of each category. It details the roles of the manager and sponsor, types of investment strategies permitted, and stipulations for leverage and borrowing. Additionally, it includes information on valuation requirements and specific investment limitations for each AIF category.

![Category- I Category- II [Regulation

3(4)(b)]

Category- III [Regulation

3(4)(c)]

Angel Funds Real Estate Hedge Funds

Venture Capital Funds Funds of Funds Private Investment in Public

Equity Funds

Infrastructure Funds Debt Fund

Social Venture Funds Private Equity Funds

Types of Alternative Investment Funds](https://image.slidesharecdn.com/categoryiiandcategoryiiiaif-240103041026-b4ec247f/75/Category-II-and-Category-III-AIF-pptx-6-2048.jpg)