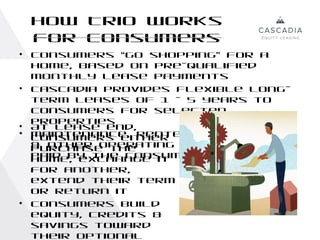

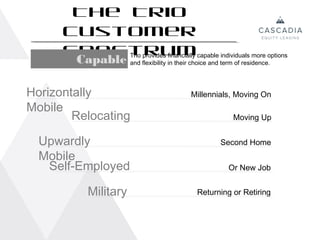

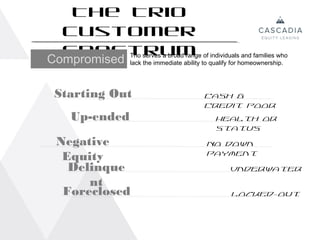

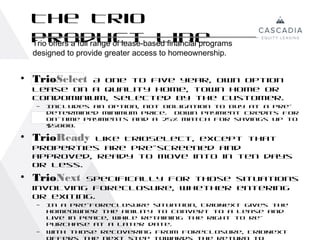

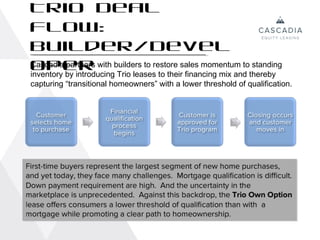

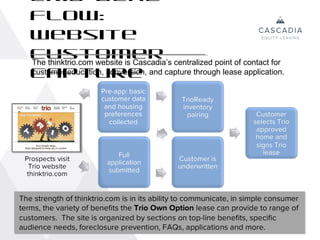

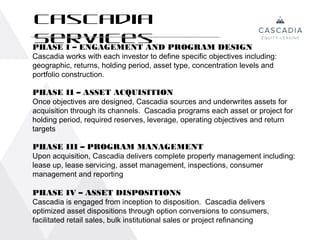

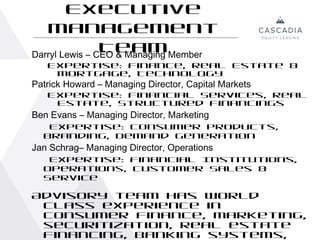

Cascadia Equity Leasing offers innovative home financing solutions through its Trio program, designed to provide flexibility and ease of access to homeownership for individuals and families struggling to qualify for traditional mortgages. Trio allows consumers to lease homes with the option to buy, bridging gaps caused by underqualification and foreclosure, while facilitating a smoother transition to homeownership. The company engages with various stakeholders and provides comprehensive property management services to ensure successful investment strategies in residential real estate.