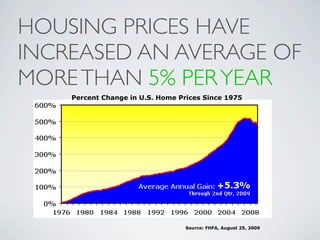

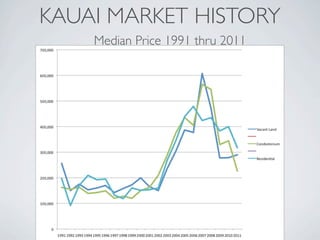

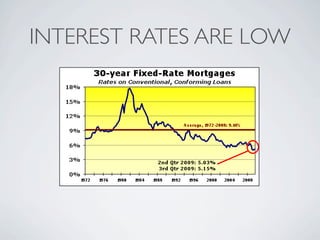

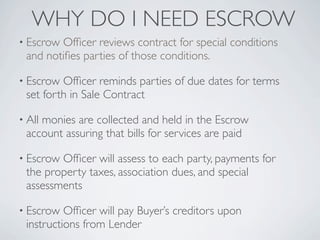

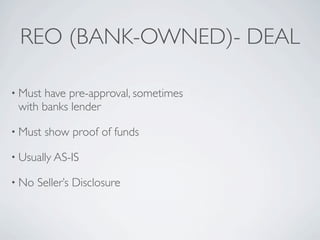

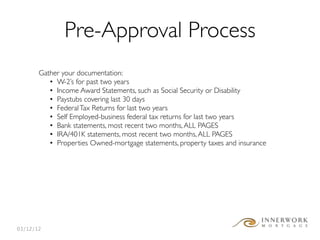

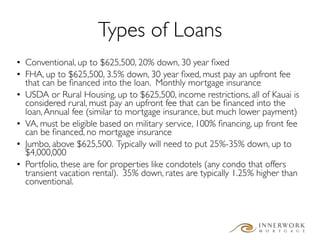

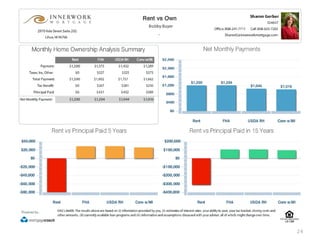

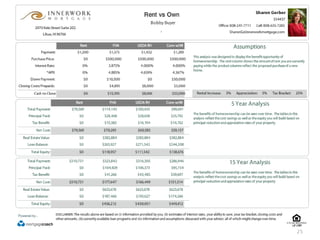

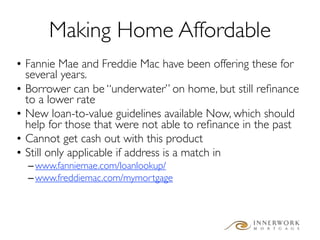

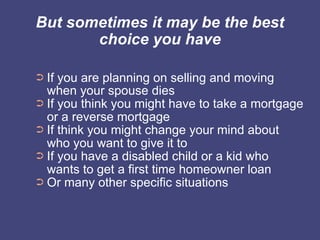

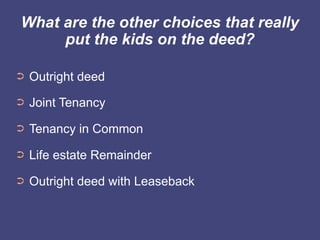

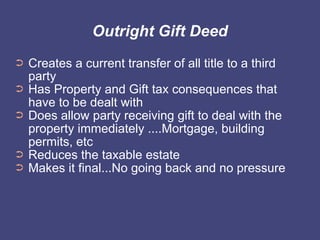

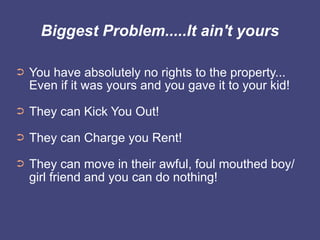

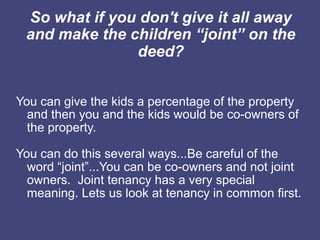

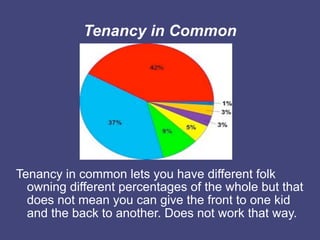

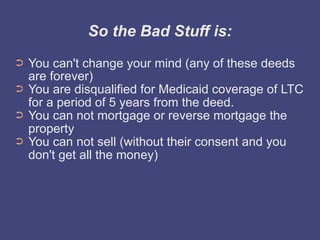

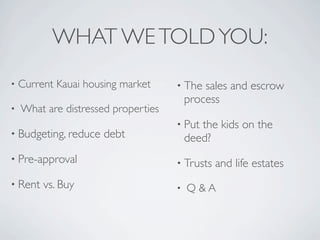

This document serves as a comprehensive guide for prospective homeowners in Kauai, covering topics such as the mortgage insurance process, housing market trends, and the homebuying procedure. It outlines the necessary steps to purchase a property, including team formation, financing options, and navigating escrow, while also emphasizing the importance of pre-approval and budgeting. Additionally, it discusses various real estate options, including distressed properties and legal considerations regarding property deeds for estate planning.