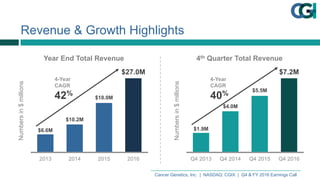

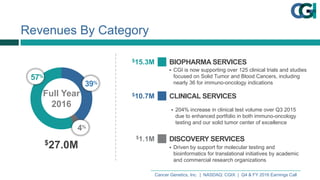

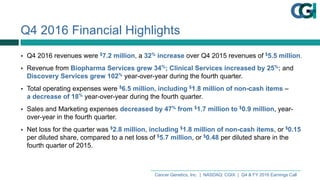

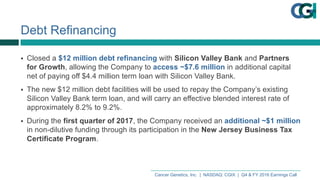

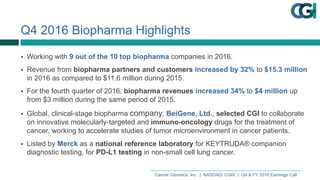

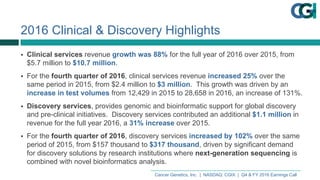

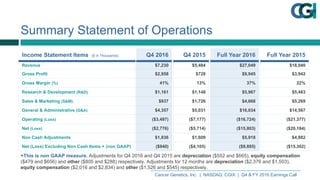

Cancer Genetics reported on its Q4 and full year 2016 earnings. Key highlights included 50% revenue growth in 2016 to $27 million, driven by increases in biopharma, clinical, and discovery services. The company realized operational efficiencies through integration of acquisitions, reducing expenses. However, the company reported a net loss of $15.8 million for 2016. In Q4 2016, revenue increased 32% to $7.2 million while expenses decreased, though the company reported a net loss of $2.8 million. Additionally, Cancer Genetics completed a $12 million debt refinancing to repay existing debt and access additional capital.

![Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 & FY 2016 Earnings Call

2017 Upcoming Milestones

Launch of:

• Hereditary Cancer Testing Panels

• AI engine to improve clinical trial matching

• Development of Network of Genetic Counselors

• Multiple Myeloma NGS Panel [with Mayo Clinic]

• Immuno-Oncology NGS Panel [Biopharma Studies]

1st Half 2017

Launch of:

• Liquid Biopsy for Lung Cancer Profiling

• Liquid Biopsy for Kidney Cancer

• Expand Hereditary Cancer Service Offering

• Further expansion in Asia

• Launch Bioinformatics Center of Excellence in India

2nd Half 2017](https://image.slidesharecdn.com/cgix-q4fy2016earningscall-slides-170327154747/85/Cancer-Genetics-Earnings-Call-16-320.jpg)