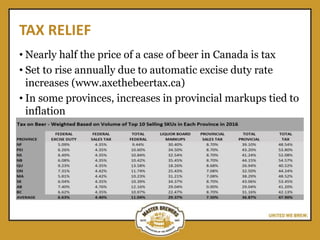

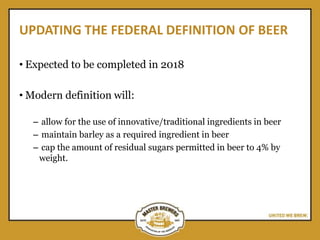

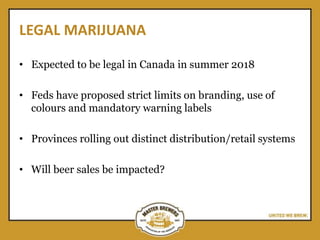

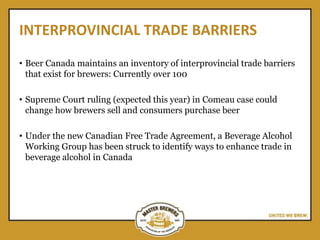

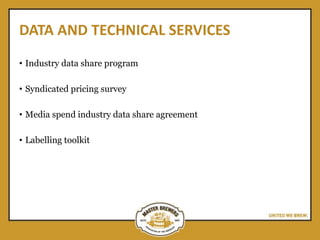

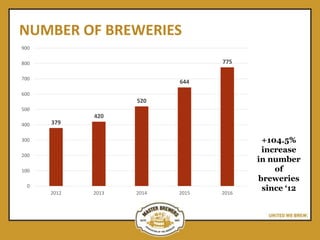

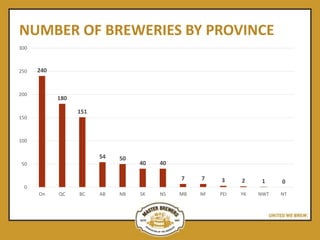

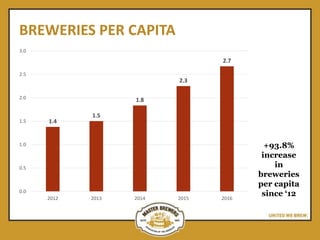

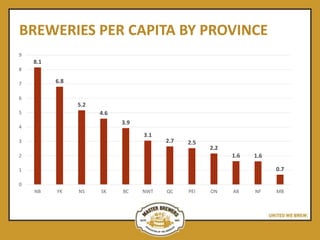

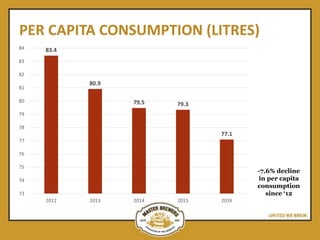

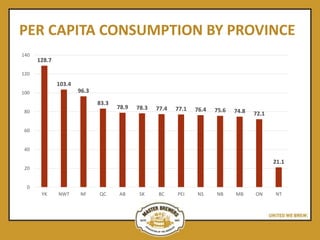

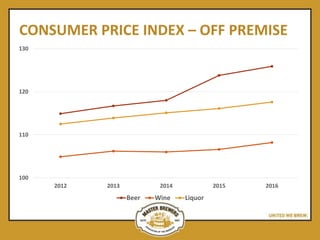

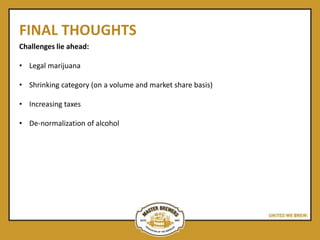

The document provides an overview of the Canadian beer industry. It discusses that the beer industry supports over 149,000 jobs and contributes $13.6 billion annually to the Canadian economy. However, beer sales volumes have declined slightly in recent years. The number of breweries in Canada has greatly increased, with over three-quarters being small breweries producing under 2,000 hectoliters annually. The priorities of Beer Canada include seeking tax relief, updating regulations, preparing for legalized marijuana, and reducing interprovincial trade barriers.