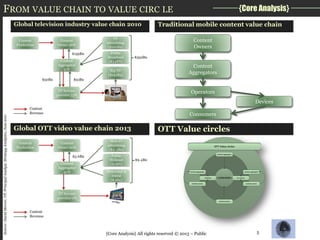

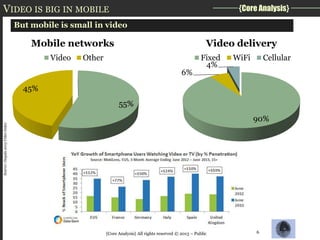

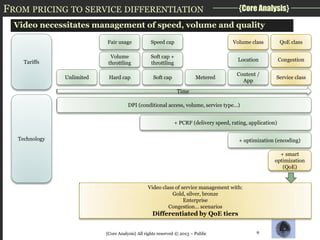

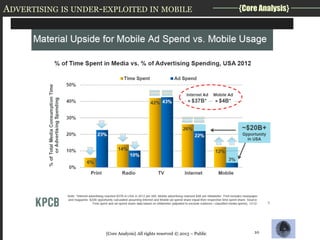

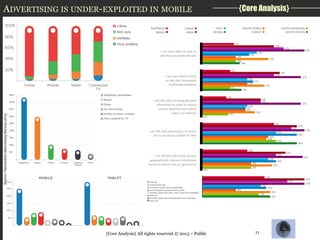

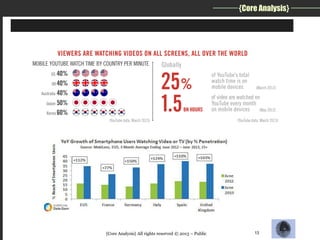

The document provides an overview of Patrick Lopez and his company {Core Analysis}. It discusses their expertise in advising technology companies on over-the-top (OTT) video. Lopez has 15 years of experience in marketing, strategy and product management. {Core Analysis} advises clients on technical and strategic due diligence, market analysis, and business cases. The document also summarizes key trends in the mobile video industry like the growth of OTT disruption and the under-exploitation of mobile advertising. It explores opportunities for network operators to offer differentiated video services through quality of experience tiers and classes of service.