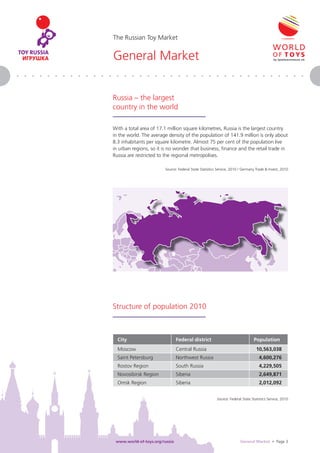

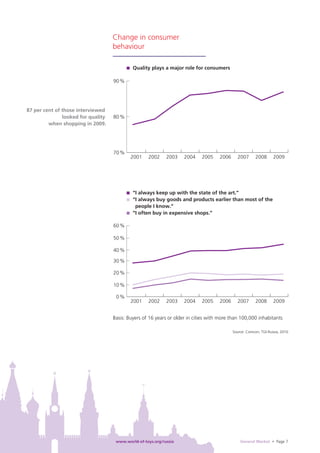

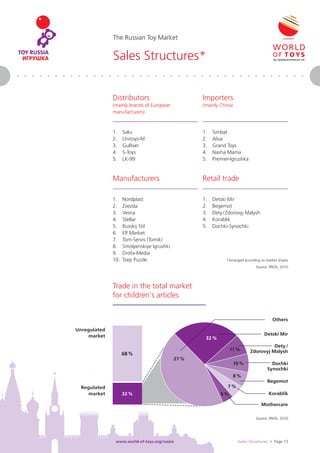

The document provides an overview of the Russian toy market. It discusses Russia's large geographic size and population distribution concentrated in urban areas. It also summarizes key demographic data like rising birth rates and the population structure with many young children, indicating growth potential for the toy industry. Sales of children's toys have increased substantially in recent years. Most toys are purchased in specialist shops, supermarkets, and markets. Safety, educational benefits, and the child's preferences are top priorities for Russian consumers when choosing toys.